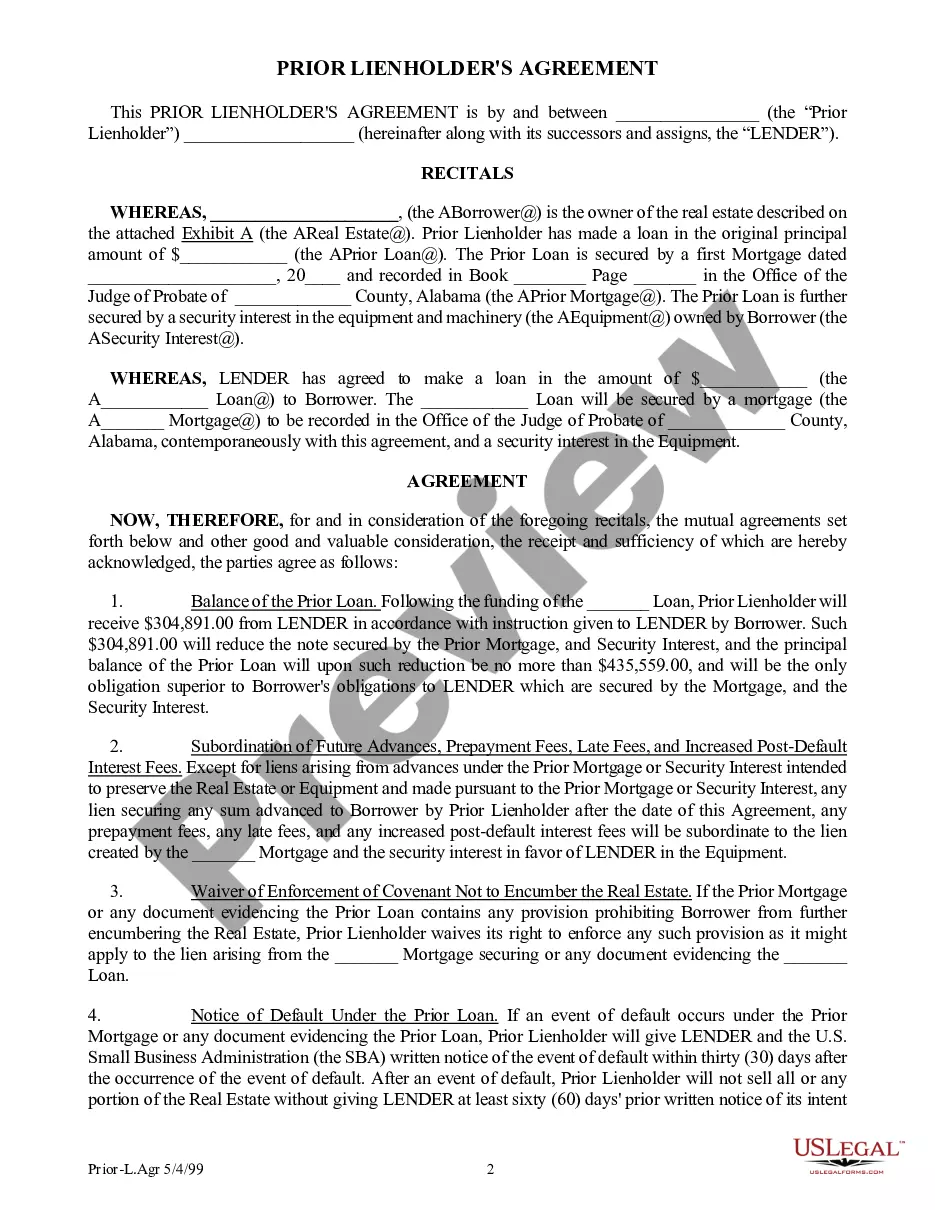

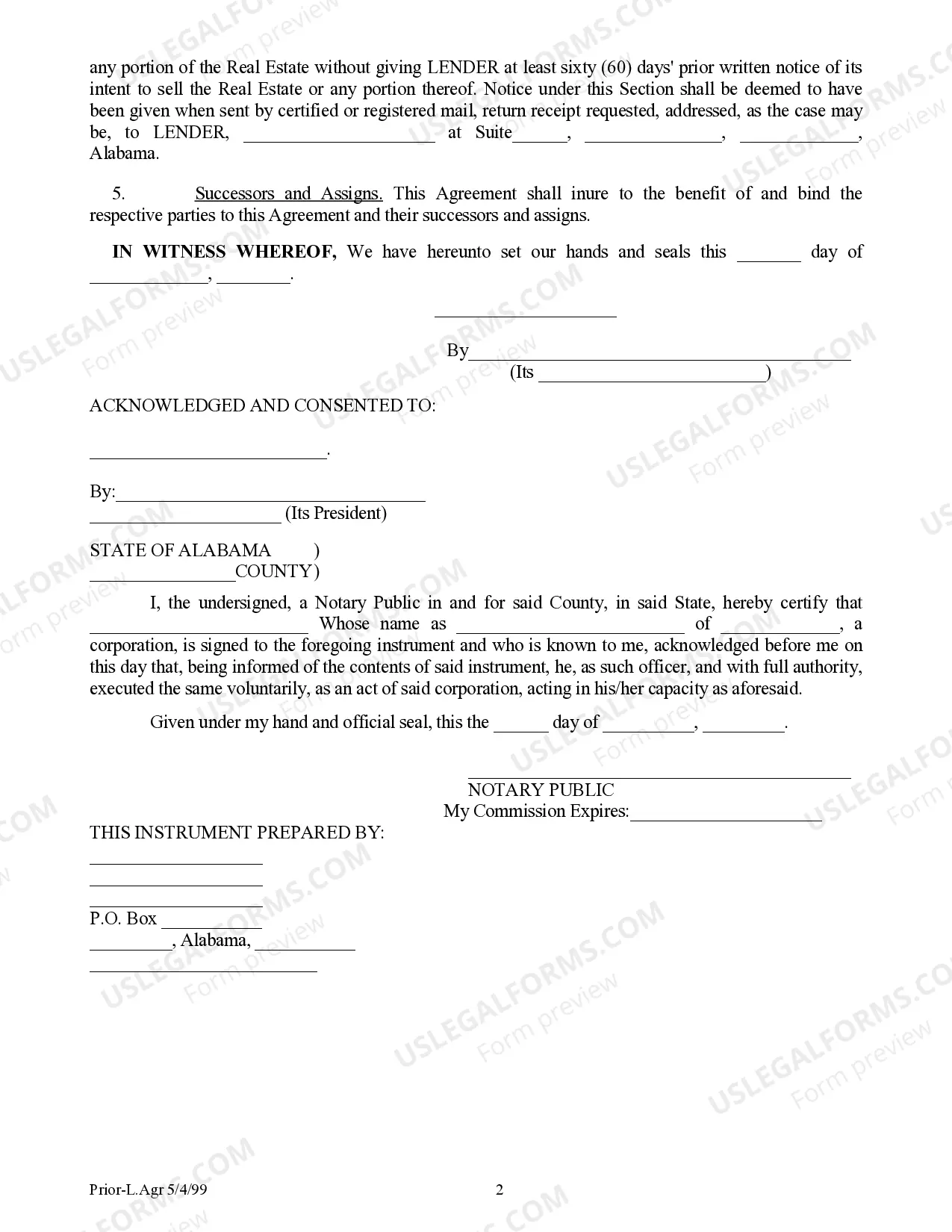

This is a sample form of a prior lienholder's agreement and subordination of interest in real property to another lender. As part of this agreement, the prior lienholder accepts partial payment of his/her/its debt in exchange for allowing the prior lien to become subordinate to the new lien.

Huntsville Alabama Prior Lien holder's Agreement: A Huntsville Alabama Prior Lien holder's Agreement is a legal contract between a prior lien holder and a borrower in a real estate transaction in Huntsville, Alabama. This agreement outlines the rights and responsibilities of the prior lien holder, who holds a pre-existing lien on the property, and the borrower, who is seeking a new loan or mortgage. The purpose of a Prior Lien holder's Agreement is to establish the priority of liens on the property and ensure that the new lender's interest is protected. By entering into this agreement, the prior lien holder agrees to subordinate their lien to the new lien created by the borrower's loan. There are different types of Prior Lien holder's Agreement and subordination in Huntsville, Alabama, depending on the specific circumstances. Some common types include: 1. First Mortgage Subordination Agreement: This type of agreement occurs when the borrower has an existing first mortgage on the property and wishes to obtain a new loan with a different lender. The prior lien holder (holder of the first mortgage) agrees to subordinate their lien to the new mortgage, giving the new lender priority in case of foreclosure or other legal actions. 2. Second Mortgage Subordination Agreement: In this scenario, the borrower has an existing first mortgage and wishes to obtain a second mortgage or home equity loan. The prior lien holder, holding the first mortgage, agrees to subordinate their lien to the new second mortgage, allowing the second lender to have a higher priority in case of default or foreclosure. 3. Subordination Agreement for Construction Loans: This type of agreement is commonly used in real estate development projects in Huntsville, Alabama. The prior lien holder, usually a lender providing financing for land purchase or infrastructure development, agrees to subordinate their lien to a construction loan for the purpose of constructing residential or commercial buildings on the property. In all of these agreements, the subordination clause is crucial. It ensures that the new lender's interest will be protected in the event of default, foreclosure, or any legal action, despite the existence of prior liens. It is important for all parties involved, including the borrower, prior lien holder, and new lender, to carefully review and negotiate the terms of the Prior Lien holder's Agreement to ensure that their interests are adequately represented and protected.