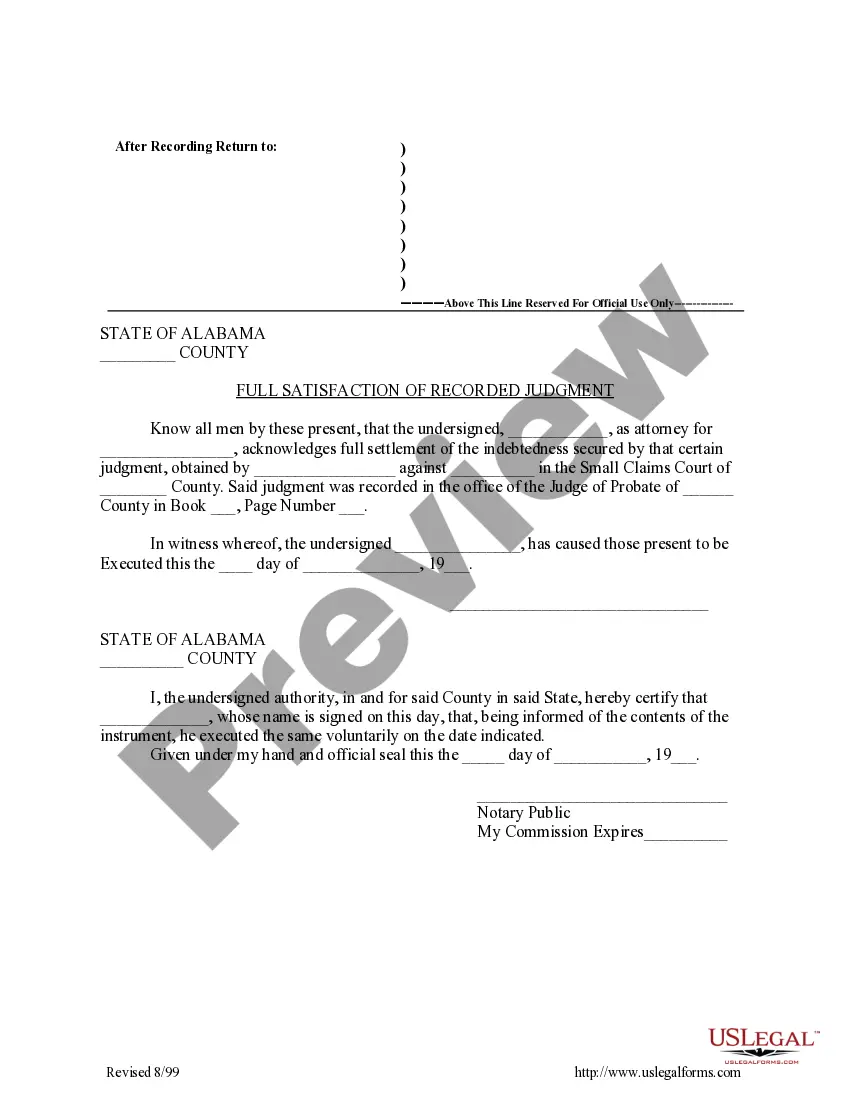

This Full Satisfaction of Recorded Judgment form is to be recorded on the land records to indicate that full satisfaction of recorded judgement has occurred. This satisfaction must be signed before a notary public.

Huntsville Alabama Full Satisfaction of Recorded Judgment refers to a legal process through which a recorded judgment is officially satisfied or paid off in full. In the state of Alabama, when a judgment is entered against a debtor, it becomes a matter of public record and can be recorded in the judgment debtor's county, including Huntsville. The Full Satisfaction of Recorded Judgment process comes into play when the debtor fulfills their obligation by satisfying the judgment's monetary terms. Once this occurs, the debtor can seek to have the judgment officially marked as satisfied and cleared from their record. This process provides closure to both the creditor and debtor, ensuring that the debts have been fully settled and allowing the debtor to have a clean slate regarding the recorded judgment. There aren't different types of Huntsville Alabama Full Satisfaction of Recorded Judgment per se, as the process remains consistent across different types of judgments. However, various types of judgments can be satisfied through this process, including: 1. Money Judgment: This is the most common type of judgment, where a creditor is awarded a specific sum of money by the court. Once the debtor pays the complete amount, he or she can file for Full Satisfaction of the Recorded Judgment. 2. Civil Judgment: Civil judgments cover a broader range of non-monetary matters like property disputes, personal injury claims, contracts, or family law issues. Once the terms of a civil judgment have been satisfied, the debtor can pursue Full Satisfaction of the Recorded Judgment. 3. Small Claims Judgment: Small claims judgments pertain to disputes involving a relatively small amount of money. Once the debtor fulfills their financial obligations, they are eligible to apply for Full Satisfaction of the Recorded Judgment in Huntsville, Alabama. It is important to note that the Full Satisfaction of Recorded Judgment process is crucial for individuals or businesses seeking to maintain a positive credit history. Having a satisfied judgment removed from their record in Huntsville, Alabama can enhance their reputation and credibility when engaging in future financial transactions. To initiate the Full Satisfaction of Recorded Judgment process in Huntsville, Alabama, debtors must file a satisfaction of judgment with the Clerk of the Circuit Court in the county where the judgment was recorded. This document will officially declare the debt as paid in full and request the court to mark the judgment as satisfied and remove it from public record. In conclusion, Huntsville Alabama Full Satisfaction of Recorded Judgment pertains to the process of satisfying a recorded judgment by fulfilling the monetary obligations set by the court. It applies to various types of judgments, including money judgments, civil judgments, and small claims judgments. Seeking Full Satisfaction of the Recorded Judgment provides debtors with the opportunity to clear their credit history and move forward with a clean slate.Huntsville Alabama Full Satisfaction of Recorded Judgment refers to a legal process through which a recorded judgment is officially satisfied or paid off in full. In the state of Alabama, when a judgment is entered against a debtor, it becomes a matter of public record and can be recorded in the judgment debtor's county, including Huntsville. The Full Satisfaction of Recorded Judgment process comes into play when the debtor fulfills their obligation by satisfying the judgment's monetary terms. Once this occurs, the debtor can seek to have the judgment officially marked as satisfied and cleared from their record. This process provides closure to both the creditor and debtor, ensuring that the debts have been fully settled and allowing the debtor to have a clean slate regarding the recorded judgment. There aren't different types of Huntsville Alabama Full Satisfaction of Recorded Judgment per se, as the process remains consistent across different types of judgments. However, various types of judgments can be satisfied through this process, including: 1. Money Judgment: This is the most common type of judgment, where a creditor is awarded a specific sum of money by the court. Once the debtor pays the complete amount, he or she can file for Full Satisfaction of the Recorded Judgment. 2. Civil Judgment: Civil judgments cover a broader range of non-monetary matters like property disputes, personal injury claims, contracts, or family law issues. Once the terms of a civil judgment have been satisfied, the debtor can pursue Full Satisfaction of the Recorded Judgment. 3. Small Claims Judgment: Small claims judgments pertain to disputes involving a relatively small amount of money. Once the debtor fulfills their financial obligations, they are eligible to apply for Full Satisfaction of the Recorded Judgment in Huntsville, Alabama. It is important to note that the Full Satisfaction of Recorded Judgment process is crucial for individuals or businesses seeking to maintain a positive credit history. Having a satisfied judgment removed from their record in Huntsville, Alabama can enhance their reputation and credibility when engaging in future financial transactions. To initiate the Full Satisfaction of Recorded Judgment process in Huntsville, Alabama, debtors must file a satisfaction of judgment with the Clerk of the Circuit Court in the county where the judgment was recorded. This document will officially declare the debt as paid in full and request the court to mark the judgment as satisfied and remove it from public record. In conclusion, Huntsville Alabama Full Satisfaction of Recorded Judgment pertains to the process of satisfying a recorded judgment by fulfilling the monetary obligations set by the court. It applies to various types of judgments, including money judgments, civil judgments, and small claims judgments. Seeking Full Satisfaction of the Recorded Judgment provides debtors with the opportunity to clear their credit history and move forward with a clean slate.