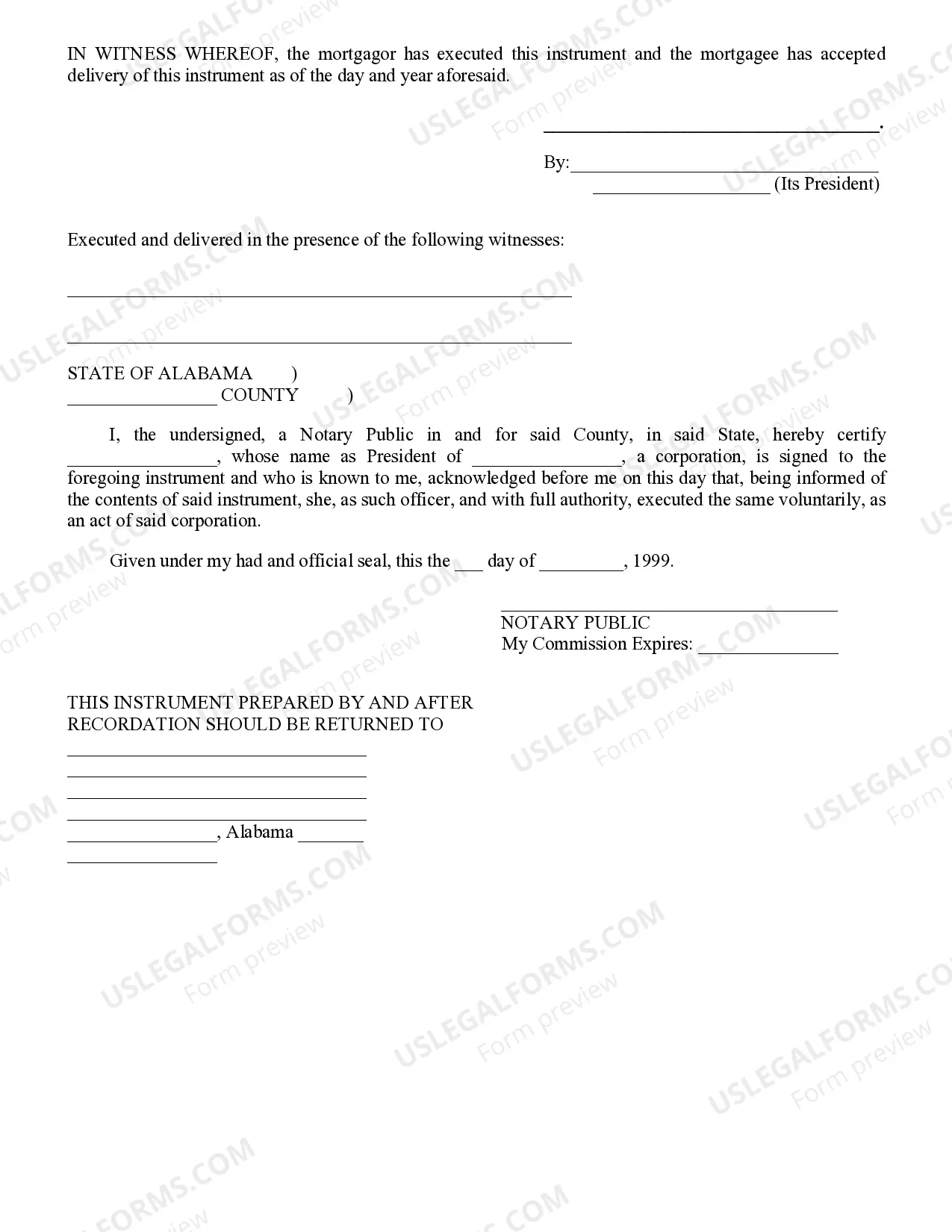

This is a sample mortgage issued to secure a promissory note which was given to secure a loan from the Small Business Association. This mortgage must be witnessed and properly acknowledged before a notary public.

Huntsville Alabama SBA Mortgage — Participation is a financing option offered by the Small Business Administration (SBA) for businesses located in Huntsville, Alabama. This type of mortgage participation allows businesses to secure loans for various purposes, aiding in their growth and development. The SBA Mortgage — Participation program in Huntsville, Alabama, is designed to provide financial assistance to small businesses that may have difficulty obtaining traditional commercial loans. This program encourages local economic growth and promotes entrepreneurship by offering competitive interest rates and flexible repayment terms. There are several types of Huntsville Alabama SBA Mortgage — Participation loans, including: 1. 7(a) Loan Program: This is the most common type of SBA loan and can be used for various purposes, such as working capital, purchasing equipment, or refinancing existing debt. 2. CDC/504 Loan Program: This program is specifically designed to help businesses finance major fixed assets, like real estate or large equipment. It offers long-term, fixed-rate financing, making it easier for businesses to acquire the assets they need to expand or upgrade their facilities. 3. Microloan Program: This program provides small, short-term loans to startups and small businesses in need of capital for startup costs, inventory purchases, or equipment. It is especially beneficial for businesses with limited credit history or those that require smaller loan amounts. 4. Export Loan Programs: These programs aim to support businesses in expanding their international trade activities. They provide financing for export-related purposes, such as working capital, facility expansion, or purchasing inventory or equipment for exporting goods. 5. Disaster Loan Programs: In the event of a natural disaster or declared emergency, the SBA offers low-interest disaster loans to eligible businesses for repairing or replacing damaged property, inventory, or equipment. Huntsville Alabama SBA Mortgage — Participation loans are administered through participating lenders, including banks, credit unions, and other financial institutions. These loans require a thorough application process, including business plans, financial statements, and collateral assessments. By utilizing Huntsville Alabama SBA Mortgage — Participation loans, businesses gain access to capital that may otherwise be unavailable to them. This funding can be instrumental in driving economic growth, job creation, and overall prosperity within the Huntsville business community.Huntsville Alabama SBA Mortgage — Participation is a financing option offered by the Small Business Administration (SBA) for businesses located in Huntsville, Alabama. This type of mortgage participation allows businesses to secure loans for various purposes, aiding in their growth and development. The SBA Mortgage — Participation program in Huntsville, Alabama, is designed to provide financial assistance to small businesses that may have difficulty obtaining traditional commercial loans. This program encourages local economic growth and promotes entrepreneurship by offering competitive interest rates and flexible repayment terms. There are several types of Huntsville Alabama SBA Mortgage — Participation loans, including: 1. 7(a) Loan Program: This is the most common type of SBA loan and can be used for various purposes, such as working capital, purchasing equipment, or refinancing existing debt. 2. CDC/504 Loan Program: This program is specifically designed to help businesses finance major fixed assets, like real estate or large equipment. It offers long-term, fixed-rate financing, making it easier for businesses to acquire the assets they need to expand or upgrade their facilities. 3. Microloan Program: This program provides small, short-term loans to startups and small businesses in need of capital for startup costs, inventory purchases, or equipment. It is especially beneficial for businesses with limited credit history or those that require smaller loan amounts. 4. Export Loan Programs: These programs aim to support businesses in expanding their international trade activities. They provide financing for export-related purposes, such as working capital, facility expansion, or purchasing inventory or equipment for exporting goods. 5. Disaster Loan Programs: In the event of a natural disaster or declared emergency, the SBA offers low-interest disaster loans to eligible businesses for repairing or replacing damaged property, inventory, or equipment. Huntsville Alabama SBA Mortgage — Participation loans are administered through participating lenders, including banks, credit unions, and other financial institutions. These loans require a thorough application process, including business plans, financial statements, and collateral assessments. By utilizing Huntsville Alabama SBA Mortgage — Participation loans, businesses gain access to capital that may otherwise be unavailable to them. This funding can be instrumental in driving economic growth, job creation, and overall prosperity within the Huntsville business community.