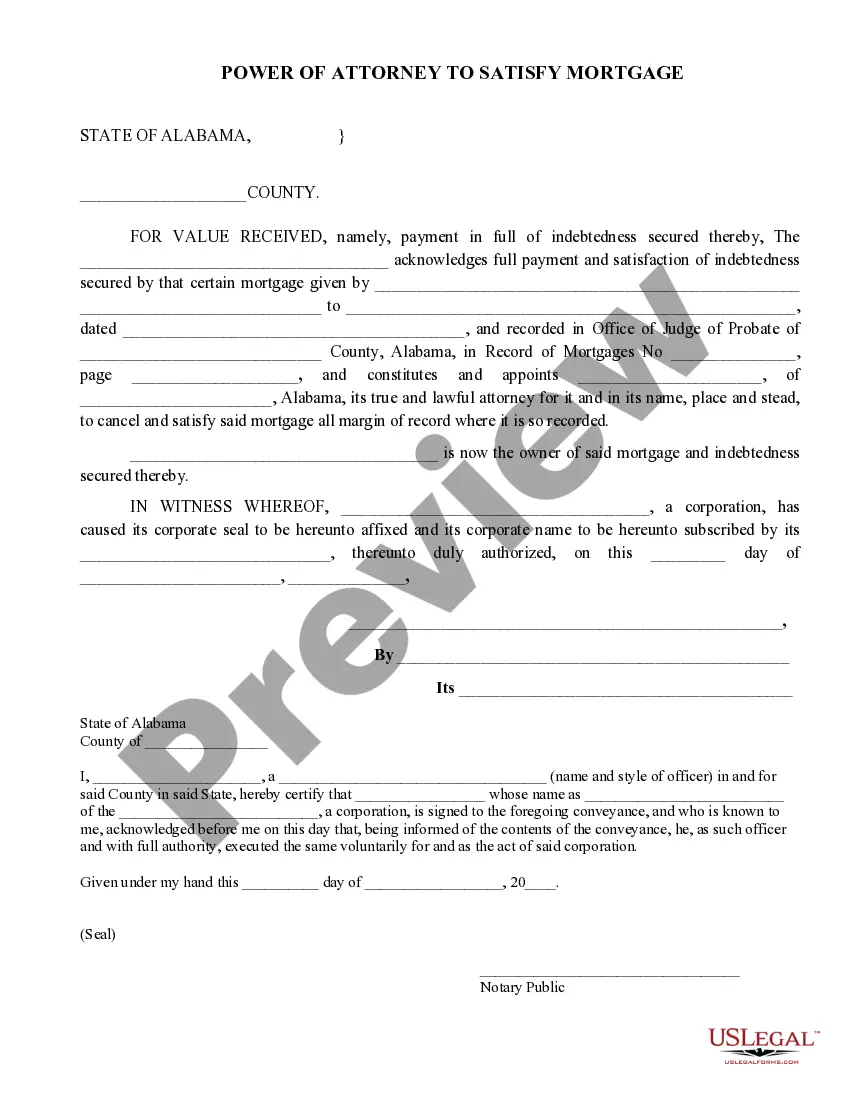

This is a sample of a Power of Attorney to Satisfy Mortgage used to acknowledge that a mortgage obligation has been satisfied and to appoint another to act on behalf of the note holder to cancel and satisfy the mortgage.

Huntsville Alabama Power of Attorney to Satisfy Mortgage is a legal document that grants an individual, known as the attorney-in-fact, the authority to act on behalf of another person in matters related to the satisfaction of a mortgage. This power of attorney is essential when the mortgagor is unable to personally handle the necessary tasks involved in mortgage satisfaction, such as paying off the mortgage, obtaining a release of the lien, or executing necessary documents. With a Huntsville Alabama Power of Attorney to Satisfy Mortgage, the attorney-in-fact becomes empowered to perform all acts necessary to settle the mortgage, ensuring that the loan is paid in full and the lien on the property is released. This legal document provides a convenient solution for individuals who may be physically incapacitated, unavailable, or prefer to delegate these responsibilities to a trusted individual. Some common types of Huntsville Alabama Power of Attorney to Satisfy Mortgage include: 1. Limited Power of Attorney: This type of power of attorney grants specific and restricted powers to the attorney-in-fact. It enables them to complete predetermined tasks related to the mortgage satisfaction, such as signing documents or making payments, but limits their authority beyond these outlined actions. 2. General Power of Attorney: This form of power of attorney provides broad authority to the attorney-in-fact, allowing them to handle a wide range of activities related to the mortgage satisfaction. They may act on behalf of the mortgagor in any transaction or legal matter regarding the mortgage. 3. Durable Power of Attorney: A durable power of attorney remains in effect even if the mortgagor becomes mentally or physically incapacitated. This type of power of attorney ensures that the attorney-in-fact can continue to act on behalf of the mortgagor to satisfy the mortgage obligation, regardless of any future incapacity. When utilizing a Huntsville Alabama Power of Attorney to Satisfy Mortgage, it is crucial to carefully consider the choice of attorney-in-fact. It should be someone trustworthy, competent, and knowledgeable about mortgage satisfaction procedures to effectively handle the necessary tasks. Additionally, it is advisable to consult with an attorney to ensure that the power of attorney document is properly drafted and complies with all applicable laws and regulations. In summary, the Huntsville Alabama Power of Attorney to Satisfy Mortgage is a legal tool that allows an individual to delegate their authority to another person, the attorney-in-fact, to fulfill mortgage-related obligations. Whether it is a limited, general, or durable power of attorney, selecting the right attorney-in-fact is crucial for a smooth and efficient mortgage satisfaction process.Huntsville Alabama Power of Attorney to Satisfy Mortgage is a legal document that grants an individual, known as the attorney-in-fact, the authority to act on behalf of another person in matters related to the satisfaction of a mortgage. This power of attorney is essential when the mortgagor is unable to personally handle the necessary tasks involved in mortgage satisfaction, such as paying off the mortgage, obtaining a release of the lien, or executing necessary documents. With a Huntsville Alabama Power of Attorney to Satisfy Mortgage, the attorney-in-fact becomes empowered to perform all acts necessary to settle the mortgage, ensuring that the loan is paid in full and the lien on the property is released. This legal document provides a convenient solution for individuals who may be physically incapacitated, unavailable, or prefer to delegate these responsibilities to a trusted individual. Some common types of Huntsville Alabama Power of Attorney to Satisfy Mortgage include: 1. Limited Power of Attorney: This type of power of attorney grants specific and restricted powers to the attorney-in-fact. It enables them to complete predetermined tasks related to the mortgage satisfaction, such as signing documents or making payments, but limits their authority beyond these outlined actions. 2. General Power of Attorney: This form of power of attorney provides broad authority to the attorney-in-fact, allowing them to handle a wide range of activities related to the mortgage satisfaction. They may act on behalf of the mortgagor in any transaction or legal matter regarding the mortgage. 3. Durable Power of Attorney: A durable power of attorney remains in effect even if the mortgagor becomes mentally or physically incapacitated. This type of power of attorney ensures that the attorney-in-fact can continue to act on behalf of the mortgagor to satisfy the mortgage obligation, regardless of any future incapacity. When utilizing a Huntsville Alabama Power of Attorney to Satisfy Mortgage, it is crucial to carefully consider the choice of attorney-in-fact. It should be someone trustworthy, competent, and knowledgeable about mortgage satisfaction procedures to effectively handle the necessary tasks. Additionally, it is advisable to consult with an attorney to ensure that the power of attorney document is properly drafted and complies with all applicable laws and regulations. In summary, the Huntsville Alabama Power of Attorney to Satisfy Mortgage is a legal tool that allows an individual to delegate their authority to another person, the attorney-in-fact, to fulfill mortgage-related obligations. Whether it is a limited, general, or durable power of attorney, selecting the right attorney-in-fact is crucial for a smooth and efficient mortgage satisfaction process.