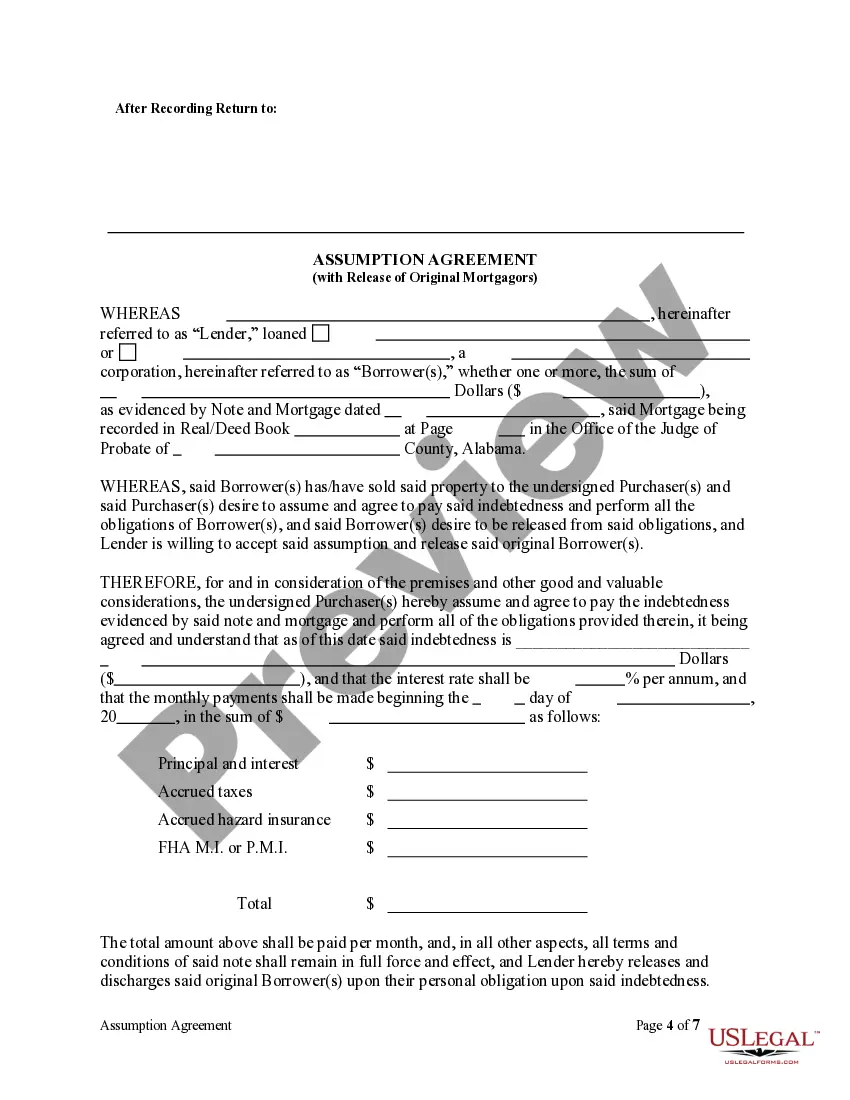

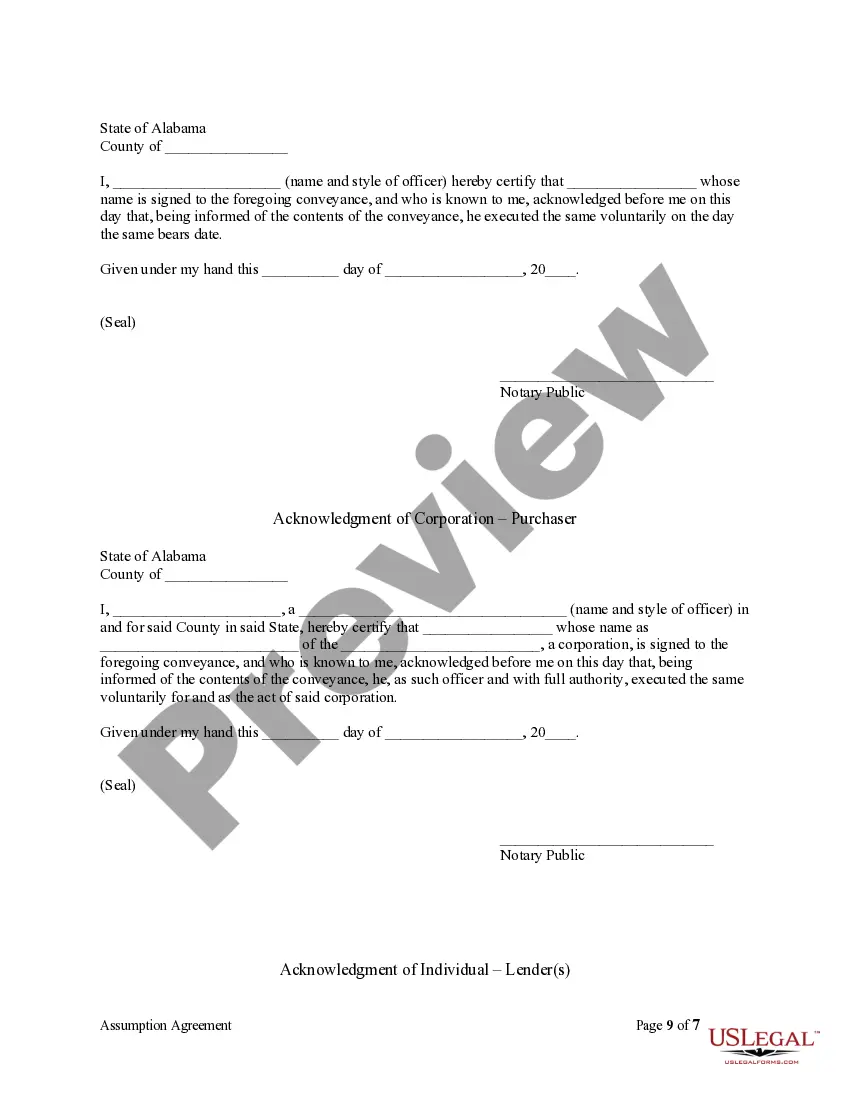

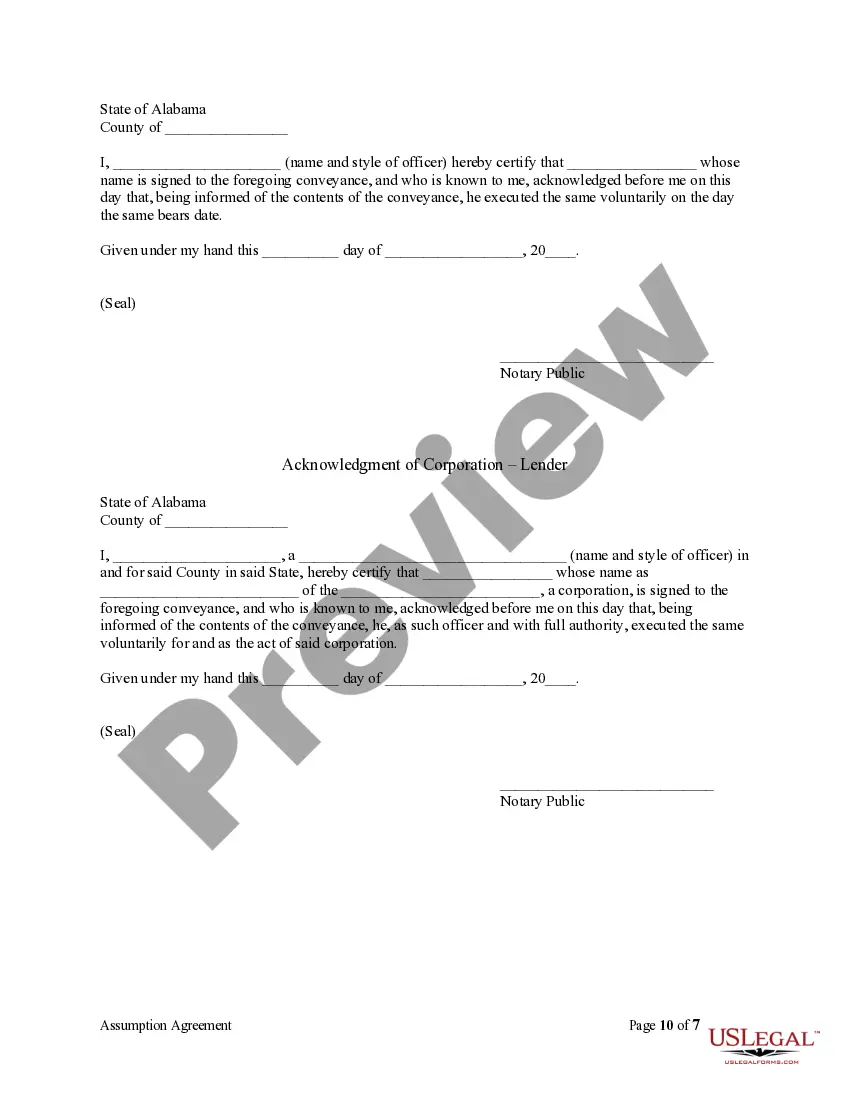

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Alabama Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

If you have previously utilized our service, sign in to your account and acquire the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors on your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continuous access to each document you have purchased: you can locate it in your profile within the My documents section anytime you wish to reuse it. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you’ve identified the correct document. Review the description and utilize the Preview option, if available, to verify if it satisfies your needs. If it does not meet your requirements, use the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and choose a monthly or annual subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors. Choose the file format for your document and save it to your device.

- Finalize your sample. Print it or make use of professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The release of liability for mortgage assumption is a legal provision that frees the original borrower from future obligations once their mortgage is assumed by another party. This release is crucial in agreements like the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, as it protects the original mortgagor from being held responsible for the mortgage payments after the assumption. Understanding this release can significantly impact your financial security in a real estate transaction.

An assumption in a contract is the process by which a new party agrees to take on specific rights and obligations set forth in an existing agreement. This is commonly seen in real estate transactions, such as the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, where a buyer takes over the seller's mortgage obligations. This process helps ensure that agreements remain enforceable and that all parties are aware of their responsibilities.

An assumption of liability agreement is a document that outlines how one party will take on the legal responsibilities and obligations of another. This often occurs in commercial transactions or property agreements, like the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors. Understanding this document can help you navigate property transactions and ensure compliance with existing contracts.

An assumed contract refers to an agreement where one party adopts the rights and obligations of another. This means that the new party steps into the shoes of the original party and is bound by the contract terms. In the specific case of the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, the assumptions made can impact financial liabilities and ownership interests.

An assignment transfer the rights and interests from one party to another, but it does not relieve the original party of obligations. In contrast, an assumption of a contract involves a new party taking on all responsibilities and benefits, effectively replacing the original party. In the context of the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, this distinction is important for understanding liability and terms.

Yes, the assumption of mortgage is legal in the Philippines, but it requires the lender's consent. This practice allows new buyers to take on existing mortgage obligations. If you're navigating similar agreements in the United States, such as the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, understanding local laws is essential. Platforms like USLegalForms can assist you in grasping these intricacies.

The assumption process generally begins with the buyer and seller agreeing that the buyer will take over the mortgage. The lender must then approve this transition, ensuring the buyer meets specific criteria. For those interested in the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, utilizing tools like USLegalForms can provide you with the necessary documentation and guidance throughout the process.

In Canada, the ability to assume a mortgage depends on the terms set by the lender. While some mortgages are assumable, others may require refinancing or approval from the lender. If you're considering a property in Huntsville, Alabama, knowing more about the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors can help clarify how this process works.

An assumption agreement allows one party to take over the responsibilities of a mortgage from another party. This often involves the buyer assuming the existing mortgage obligations from the original borrower. In the context of the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, this agreement helps facilitate smooth property transfers while maintaining the original mortgage terms.

An example of a mortgage assumption occurs when a buyer purchases a property and agrees to take over the seller's existing mortgage payments as part of the deal. In the context of the Huntsville Alabama Assumption Agreement of Mortgage and Release of Original Mortgagors, this allows the buyer to benefit from potentially favorable financing terms that the original mortgagor secured. Ultimately, it can help simplify the transaction and provide a clearer path for all parties in the process.