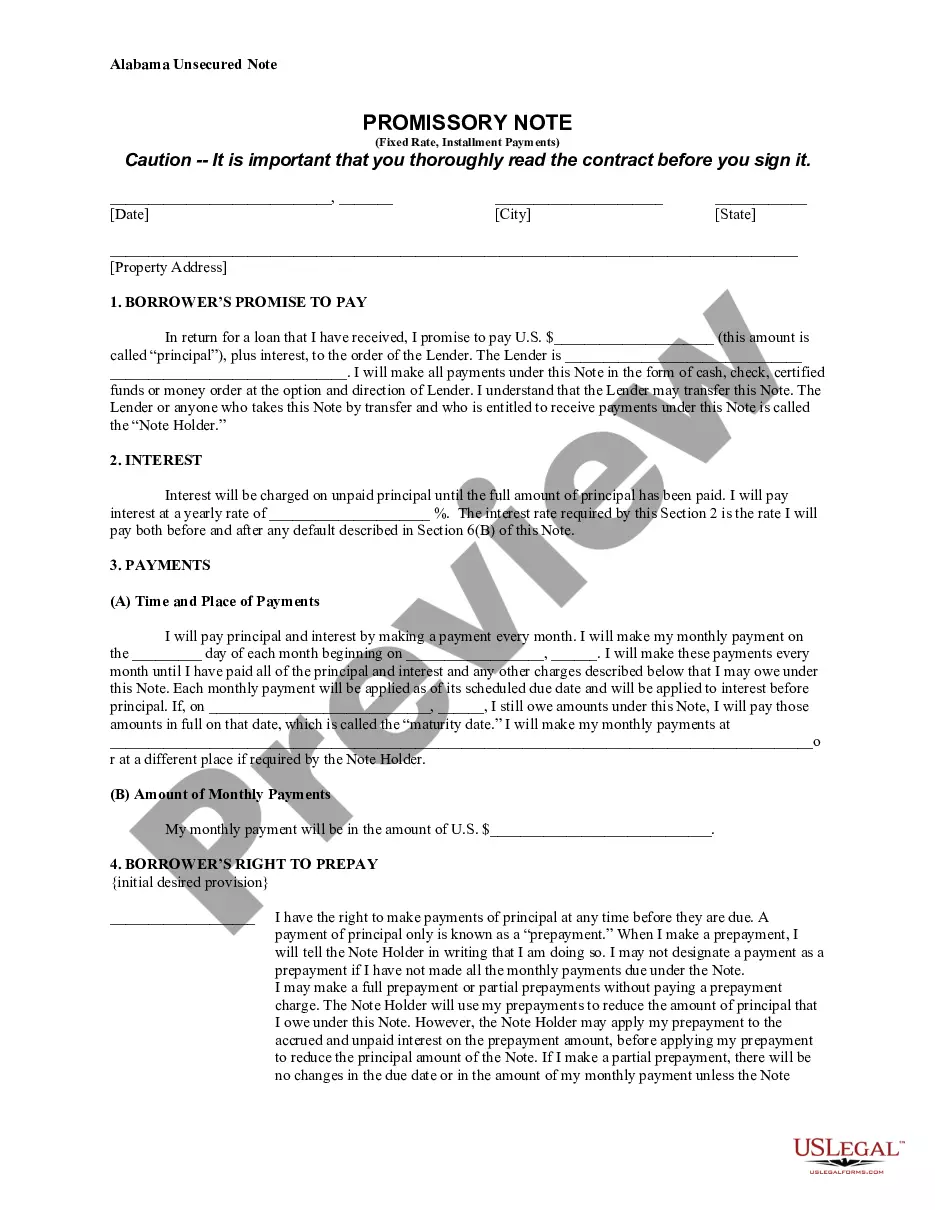

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

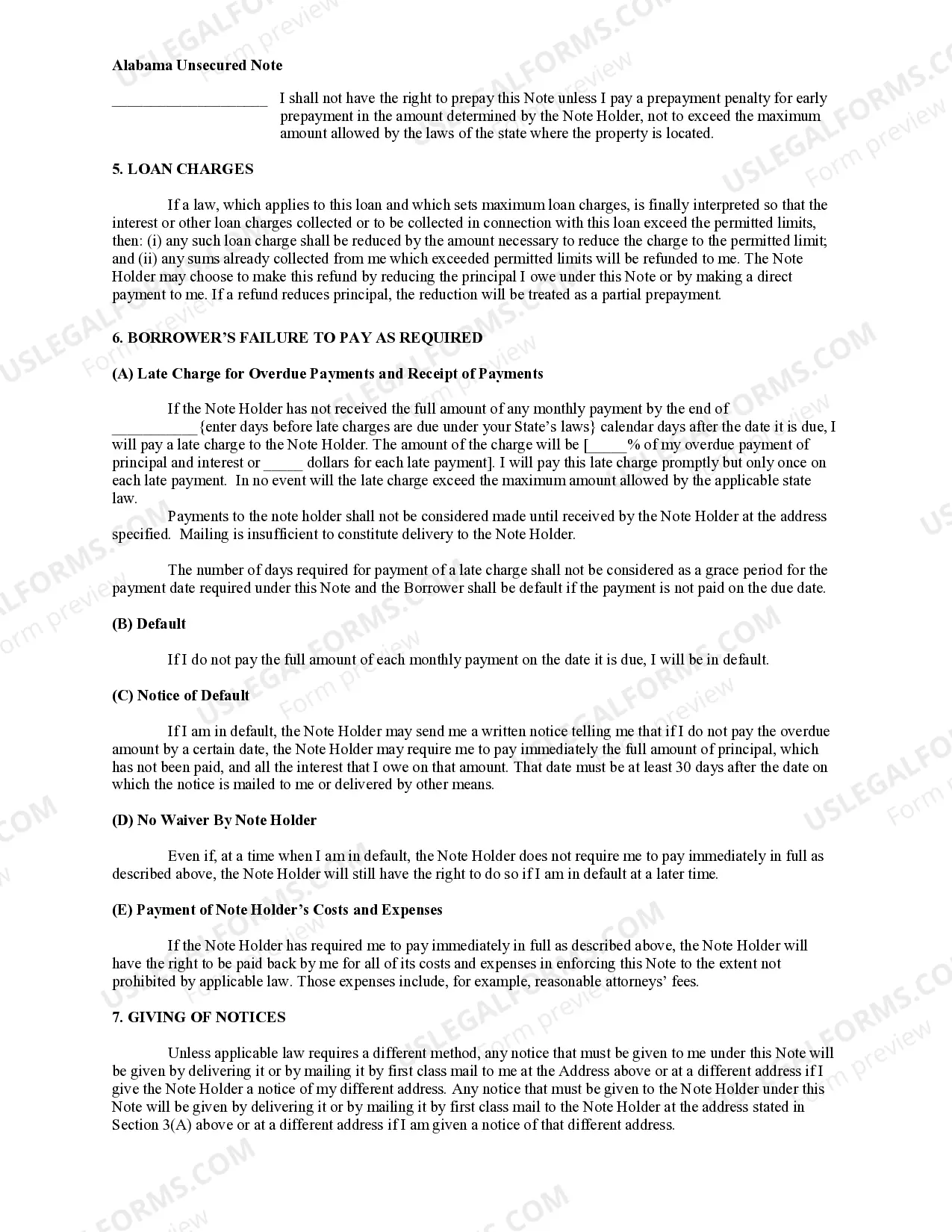

A Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document commonly used in financial transactions within the Huntsville, Alabama area. This promissory note serves as an agreement between a borrower and a lender, outlining the terms and conditions of a loan. Keywords: Huntsville Alabama, Unsecured, Installment Payment, Promissory Note, Fixed Rate The Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate is designed for loans that are not backed by collateral. Unlike secured loans, such as a mortgage or a car loan, this note does not require the borrower to provide any assets as security for the loan. However, because of its unsecured nature, this type of promissory note typically carries higher interest rates to compensate for the increased risk for the lender. The note establishes the repayment framework for the loan, specifying the repayment schedule, interest rate, and any additional fees or charges. The borrower agrees to make regular installment payments over a set period, often monthly, until the loan is fully repaid. The fixed rate refers to the fact that the interest rate remains constant throughout the loan term, providing predictable monthly payments for the borrower. Different types of Huntsville Alabama Unsecured Installment Payment Promissory Notes for Fixed Rate may include variations in loan amounts, loan purposes, and repayment terms. Some common examples include personal loans, student loans, business loans, and medical loans. Each type of loan may have specific requirements and conditions unique to its purpose and the lender's criteria. When entering into a Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, both parties should carefully review all terms and conditions before signing. It is advisable to consult with legal professionals to ensure all obligations and rights are clearly understood and protected. In conclusion, the Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial document in loan transactions within Huntsville, Alabama, allowing borrowers to secure funds without providing collateral. By clearly outlining the repayment terms, including the fixed interest rate and installments, this promissory note establishes a clear agreement and fosters trust between both parties involved in the financial transaction.A Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document commonly used in financial transactions within the Huntsville, Alabama area. This promissory note serves as an agreement between a borrower and a lender, outlining the terms and conditions of a loan. Keywords: Huntsville Alabama, Unsecured, Installment Payment, Promissory Note, Fixed Rate The Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate is designed for loans that are not backed by collateral. Unlike secured loans, such as a mortgage or a car loan, this note does not require the borrower to provide any assets as security for the loan. However, because of its unsecured nature, this type of promissory note typically carries higher interest rates to compensate for the increased risk for the lender. The note establishes the repayment framework for the loan, specifying the repayment schedule, interest rate, and any additional fees or charges. The borrower agrees to make regular installment payments over a set period, often monthly, until the loan is fully repaid. The fixed rate refers to the fact that the interest rate remains constant throughout the loan term, providing predictable monthly payments for the borrower. Different types of Huntsville Alabama Unsecured Installment Payment Promissory Notes for Fixed Rate may include variations in loan amounts, loan purposes, and repayment terms. Some common examples include personal loans, student loans, business loans, and medical loans. Each type of loan may have specific requirements and conditions unique to its purpose and the lender's criteria. When entering into a Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, both parties should carefully review all terms and conditions before signing. It is advisable to consult with legal professionals to ensure all obligations and rights are clearly understood and protected. In conclusion, the Huntsville Alabama Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial document in loan transactions within Huntsville, Alabama, allowing borrowers to secure funds without providing collateral. By clearly outlining the repayment terms, including the fixed interest rate and installments, this promissory note establishes a clear agreement and fosters trust between both parties involved in the financial transaction.