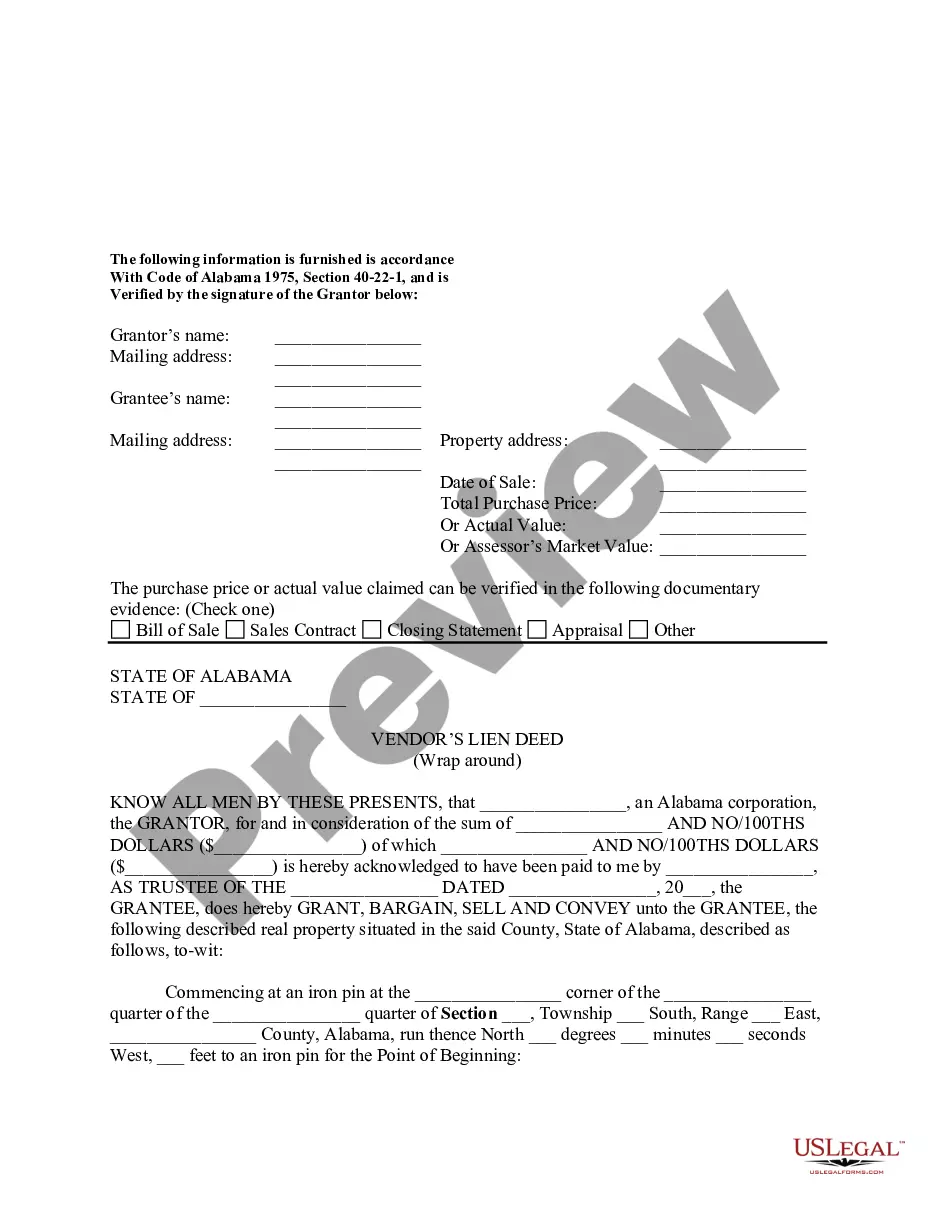

Huntsville Alabama Vendor's Lien Deed

Description

How to fill out Alabama Vendor's Lien Deed?

Are you seeking a reliable and budget-friendly supplier of legal forms to obtain the Huntsville Alabama Vendor's Lien Deed? US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish rules for living with your partner or a collection of documents to facilitate your divorce process in court, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business purposes. All templates we offer are not generic and are tailored based on the regulations of specific states and counties.

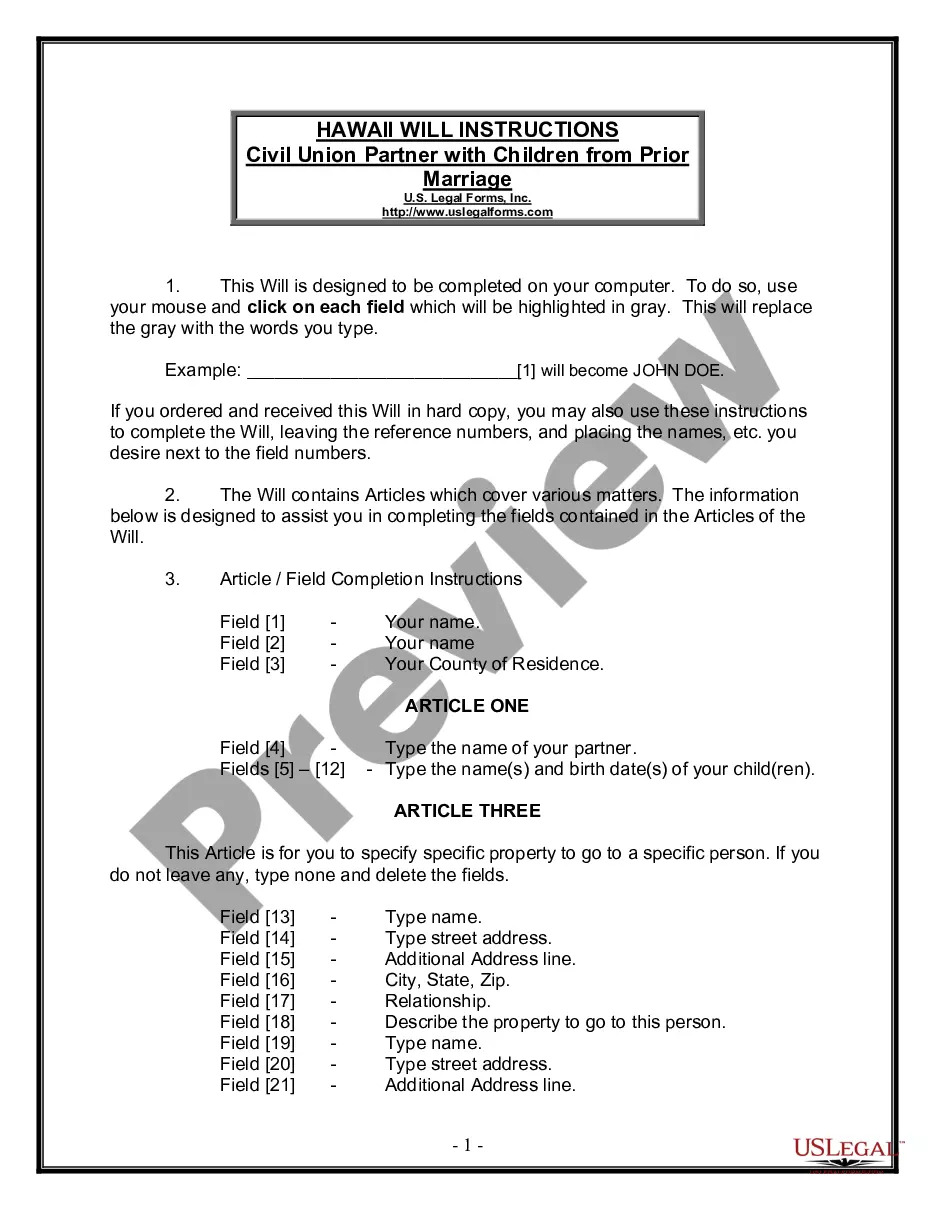

To access the document, you must Log In to your account, find the desired form, and click the Download button next to it. Please remember that you can retrieve your previously purchased form templates at any time in the My documents section.

Is this your first visit to our website? No problem. You can easily create an account, but before doing so, make sure to follow these steps.

Now you can set up your account. Then select the subscription option and continue to payment. Once your payment is processed, download the Huntsville Alabama Vendor's Lien Deed in any available format. You can return to the site whenever you need and download the document at no additional cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your valuable time searching for legal paperwork online once and for all.

- Verify that the Huntsville Alabama Vendor's Lien Deed complies with your state and local laws.

- Examine the details of the form (if available) to understand who and what the document is designed for.

- Begin the search again if the form does not suit your legal needs.

Form popularity

FAQ

To obtain a copy of a deed or document from a deeds registry, you must: Go to any deeds office (deeds registries may not give out information acting on a letter or a telephone call). Go to the information desk, where an official will help you complete a prescribed form and explain the procedure.

You can do this through a transfer of equity. This is where a share of equity is transferred to one or multiple people, but the original owner stays on the title deeds. You'll need a Conveyancing Solicitor to complete the legal requirements for you in a transfer of equity.

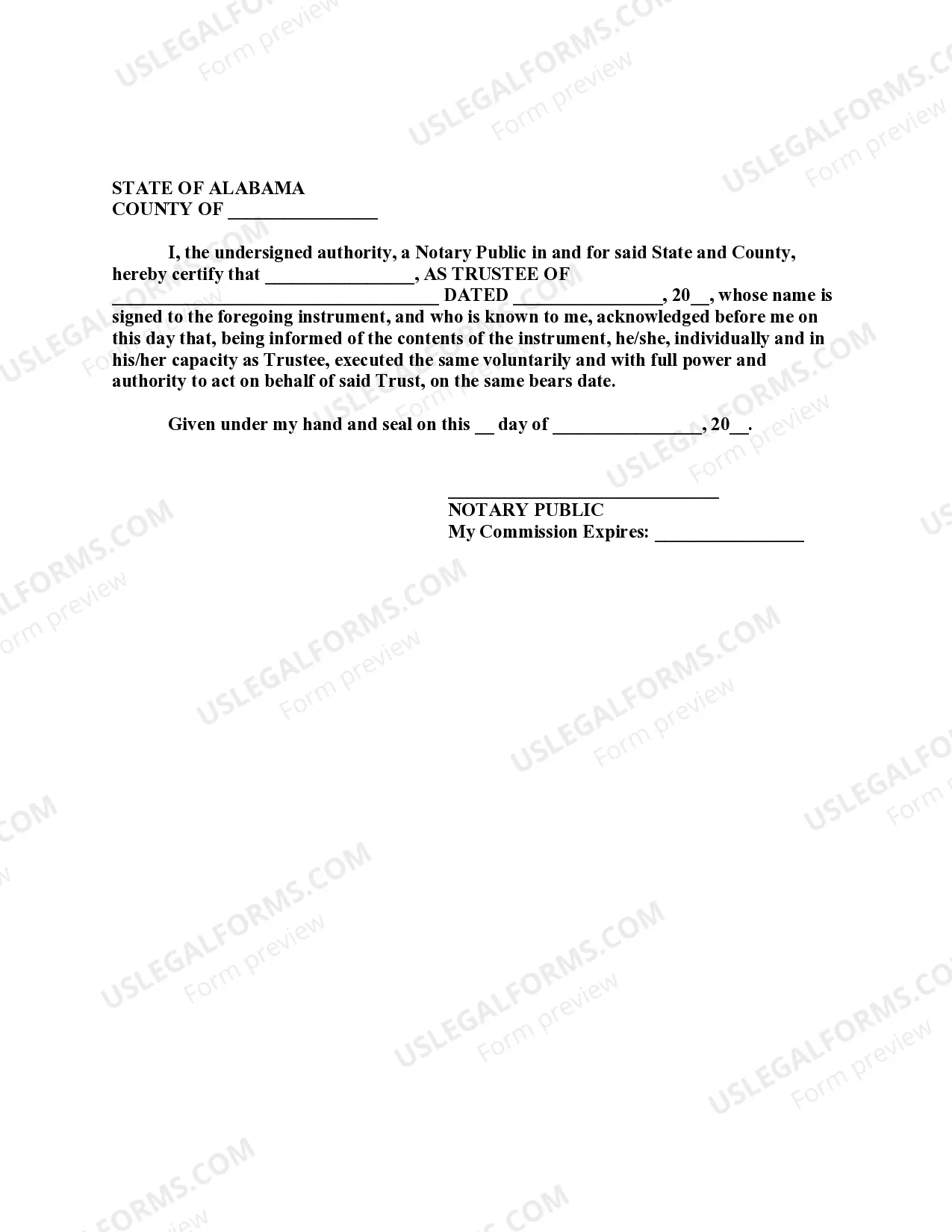

How to Transfer Alabama Real Estate Find the most recent deed to the property.Create the new deed.Sign and notarize the deed.Record the signed, notarized original deed with the Office of the Judge of Probate.

In the state of Alabama, you can obtain your property title by visiting the courthouse in which your land is located. These courthouses contain all of the relevant Alabama deeds and records related to the property in question.

The Alabama statutory warranty deed is a document that offers a limited title warranty to the Grantee (buyer) that the property has no undisclosed encumbrances. It also guarantees that the Grantors heirs will not claim any encumbrances against the Grantee, his heirs, or assigns.

Attorney Involvement All legal documents must be drafted by an attorney licensed to practice in the State of Alabama.

You just need to ensure that when you buy a property, your solicitor gives you a copy of the 'registered title' ideally within a month of completion, though some new leases may take a couple of months.

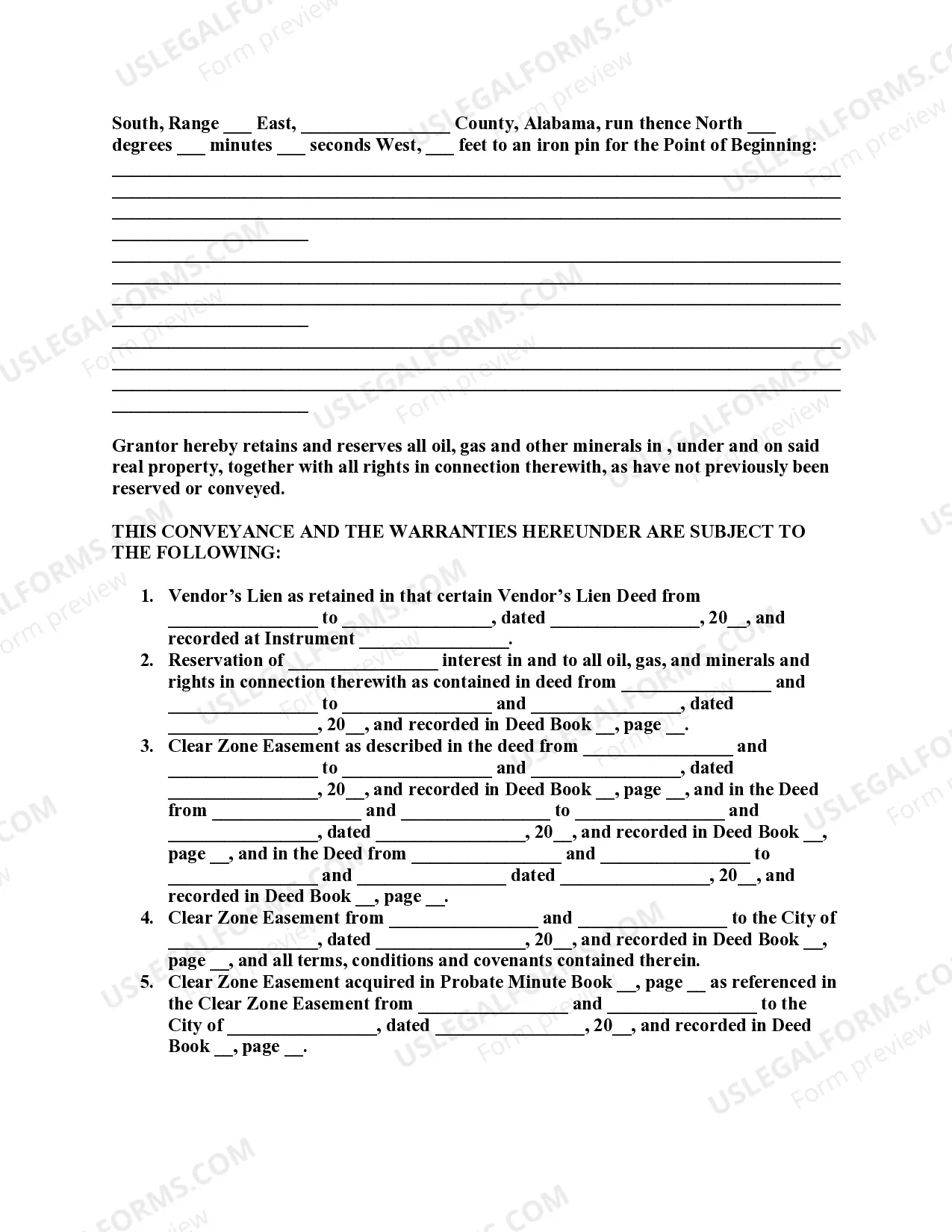

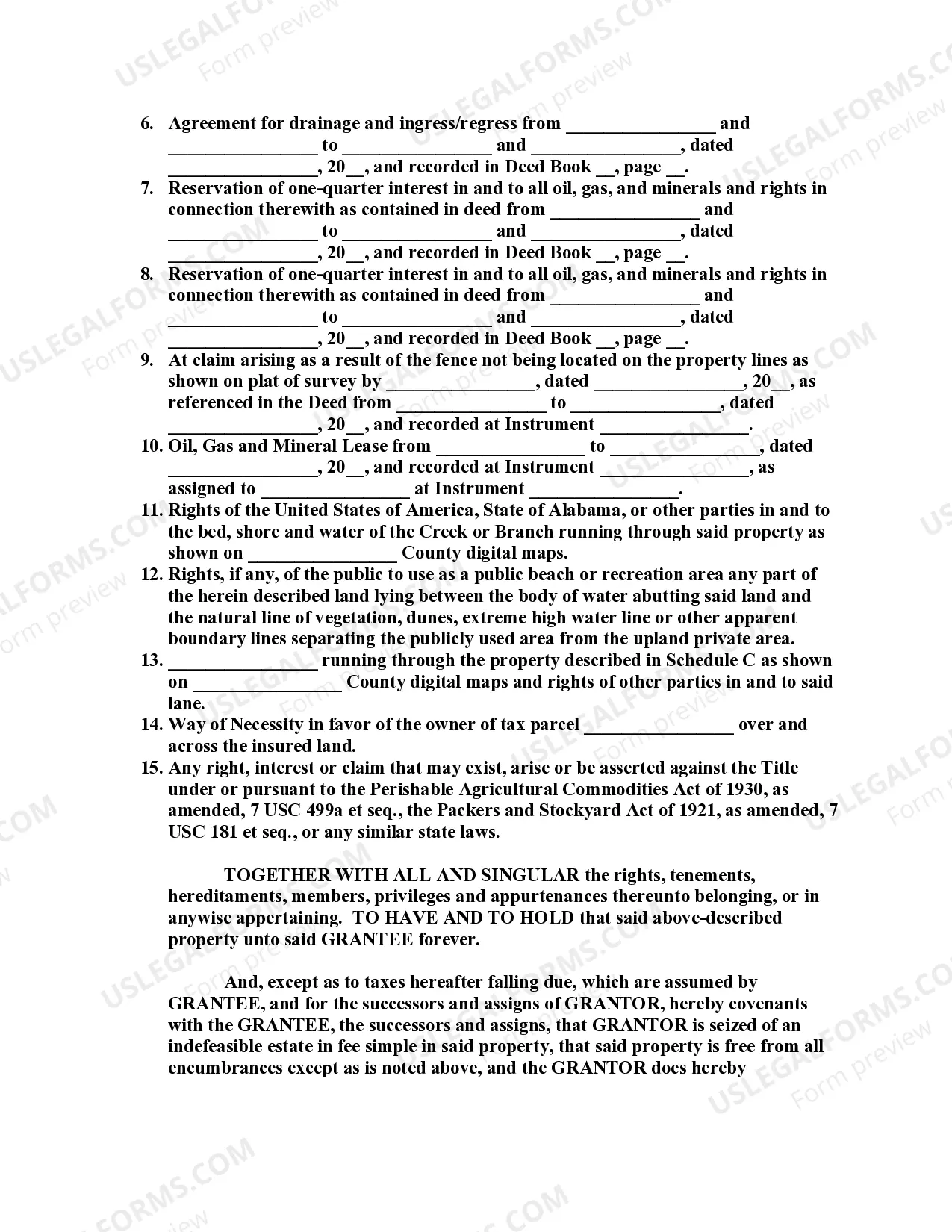

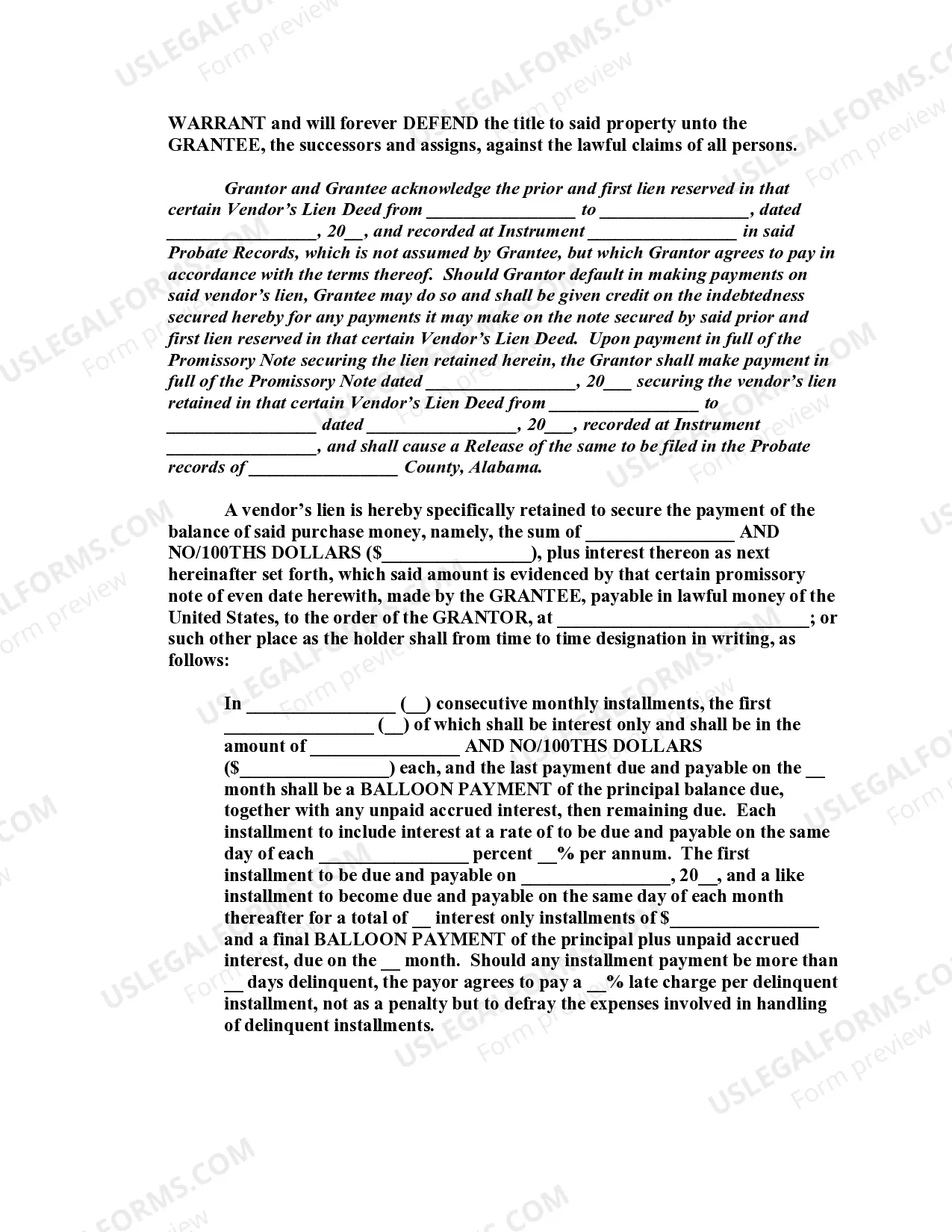

A vendor's lien is the right of a seller to repossess the property sold until the buyer makes all payments for the full purchase price. The property is the collateral given as security to the seller for the purchase price. It is sometimes used in connection with a purchase money mortgage on real estate.

Of all these, property deeds are the most popular type of property record. In Alabama, interested persons can obtain property records from their local probate office's records and recording or land records department. Alternatively, they may query their local revenue commissioner's office for property tax records.

Deeds are usually recorded by the property owner, real estate agent, or closing attorney in the Mobile County Probate Court records department. If your deed was recorded, you may purchase a copy. For more information you can call the records department of the Mobile County Probate Court at 251-574-6000.