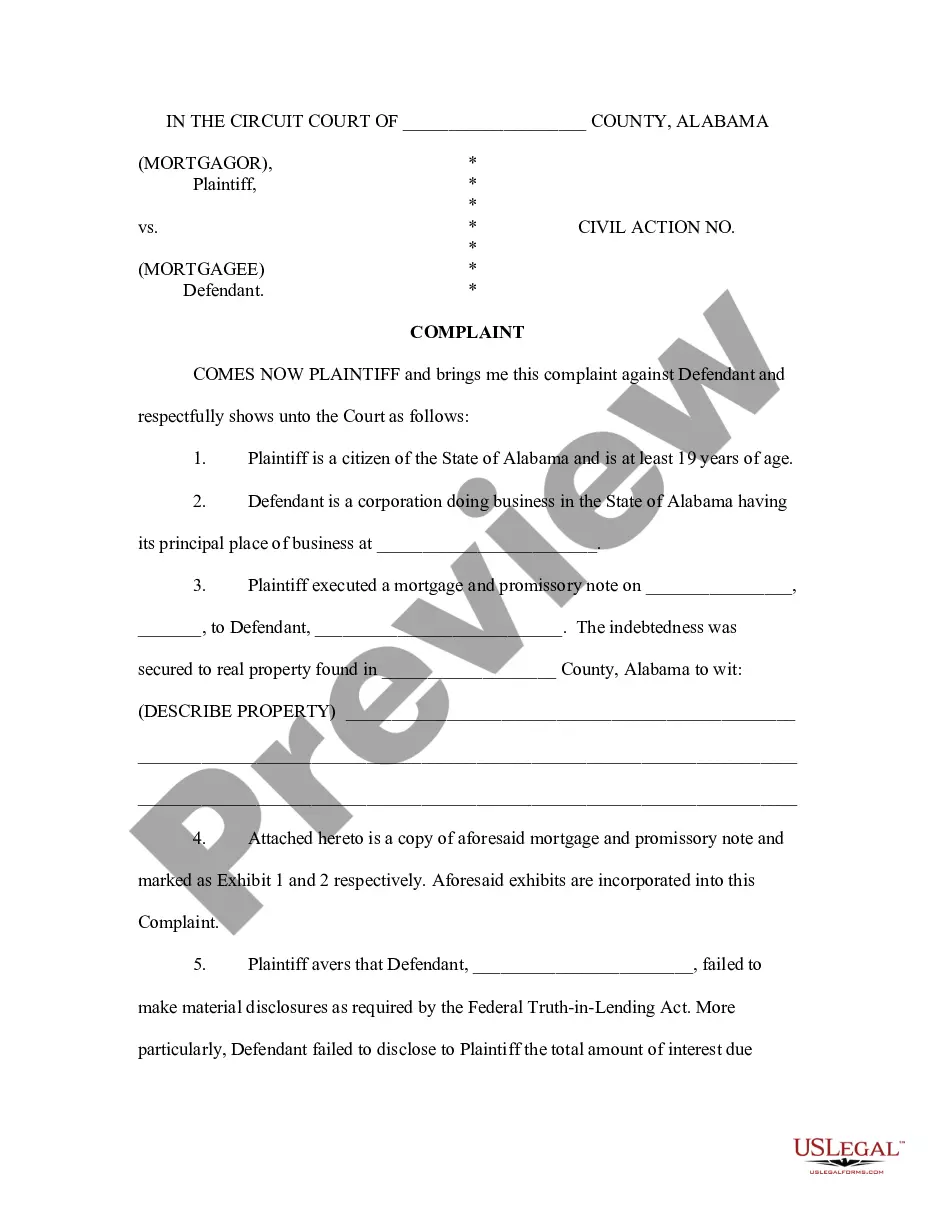

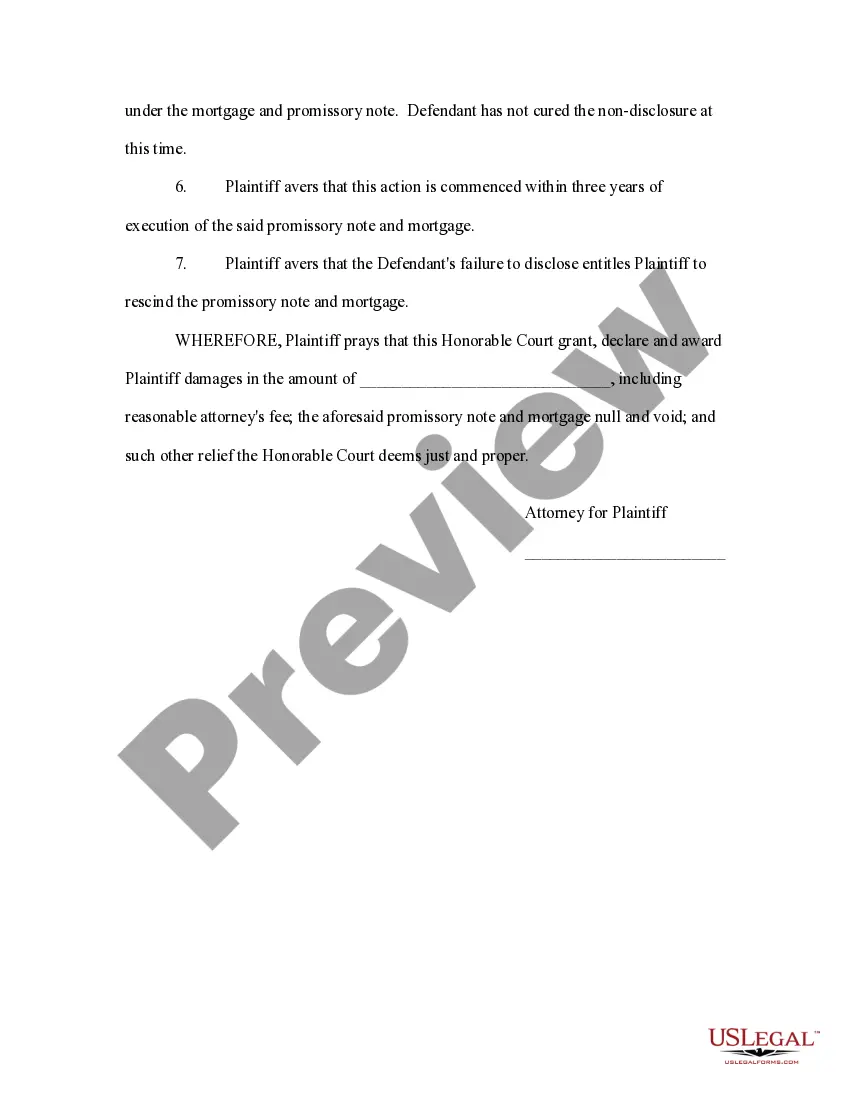

This sample complaint filed in the Circuit Court alleges violations of the Federal Truth-in-Lending Act. Specifically it alleges that certain material disclosures were not made to the plaintiff and seeks to have the promissory note declared null and void.

The Huntsville Alabama Complaint — Federal Truth-in-Lending Act is a legal proceeding that deals with violations or discrepancies related to the Federal Truth-in-Lending Act (TILL) within the Huntsville, Alabama jurisdiction. The TILL is a federal law designed to protect consumers in credit transactions by ensuring transparency and accurate disclosure of terms and conditions. It mandates lenders to clearly disclose the costs, fees, and terms of credit, aiming to prevent misleading or deceptive practices. In Huntsville, Alabama, if individuals feel that their rights under the TILL have been violated, they can file a complaint to address their concerns and seek appropriate remedies. Common types of Huntsville Alabama Complaints related to the Federal Truth-in-Lending Act may include: 1. Misleading Advertising: This complaint may arise when a creditor or lender engages in deceptive advertising practices that provide inaccurate or misleading information about credit terms, interest rates, or fees. 2. Failure to Disclose Essential Information: Creditors or lenders are required to provide borrowers with necessary details concerning annual percentage rates (APR), finance charges, payment terms, and any other costs associated with the credit. If a lender fails to disclose such essential information, a complaint can be filed. 3. Hidden or Undisclosed Charges: This type of complaint arises when lenders impose hidden fees or undisclosed charges that were not adequately explained to the borrower at the time of the credit agreement. These charges may result in higher costs or unexpected expenses for the borrower. 4. Predatory Lending Practices: Predatory lending refers to unethical practices in the lending industry, such as charging excessively high-interest rates, engaging in loan flipping (repeated refinancing without benefiting the borrower), or coercing borrowers into unfair or unaffordable loan terms. If borrowers in Huntsville, Alabama face such practices, they can file a complaint based on the Federal Truth-in-Lending Act. To file a Huntsville Alabama Complaint regarding any of these issues or other violations of the Federal Truth-in-Lending Act, individuals should gather documentation, such as credit agreements, billing statements, and any other relevant records. They can then contact the appropriate regulatory authorities or seek legal advice to initiate the complaint process. It is important to note that this content is for informational purposes only and does not constitute legal advice. Individuals facing potential TILL violations should consult with legal professionals or relevant authorities in Huntsville, Alabama, for accurate guidance based on their specific circumstances.