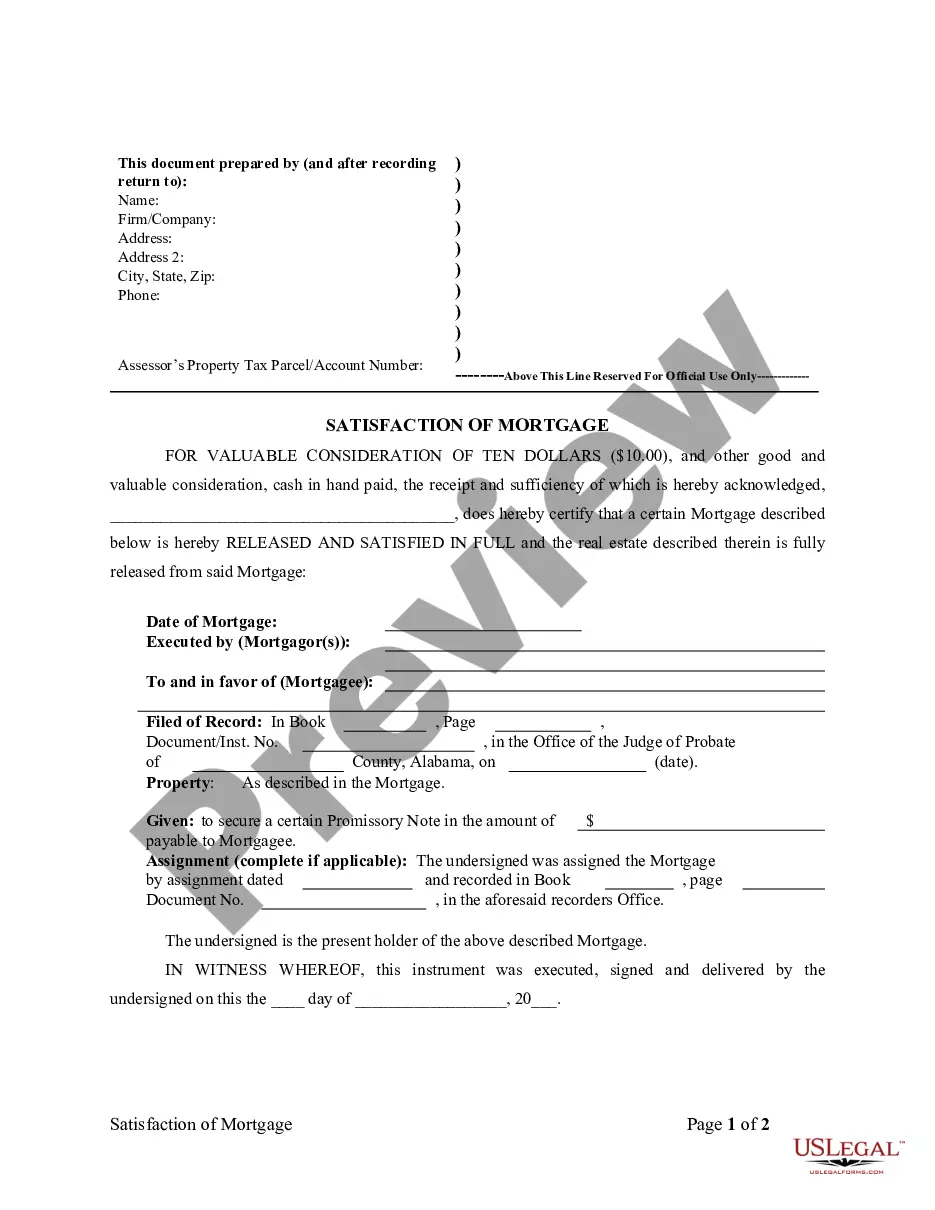

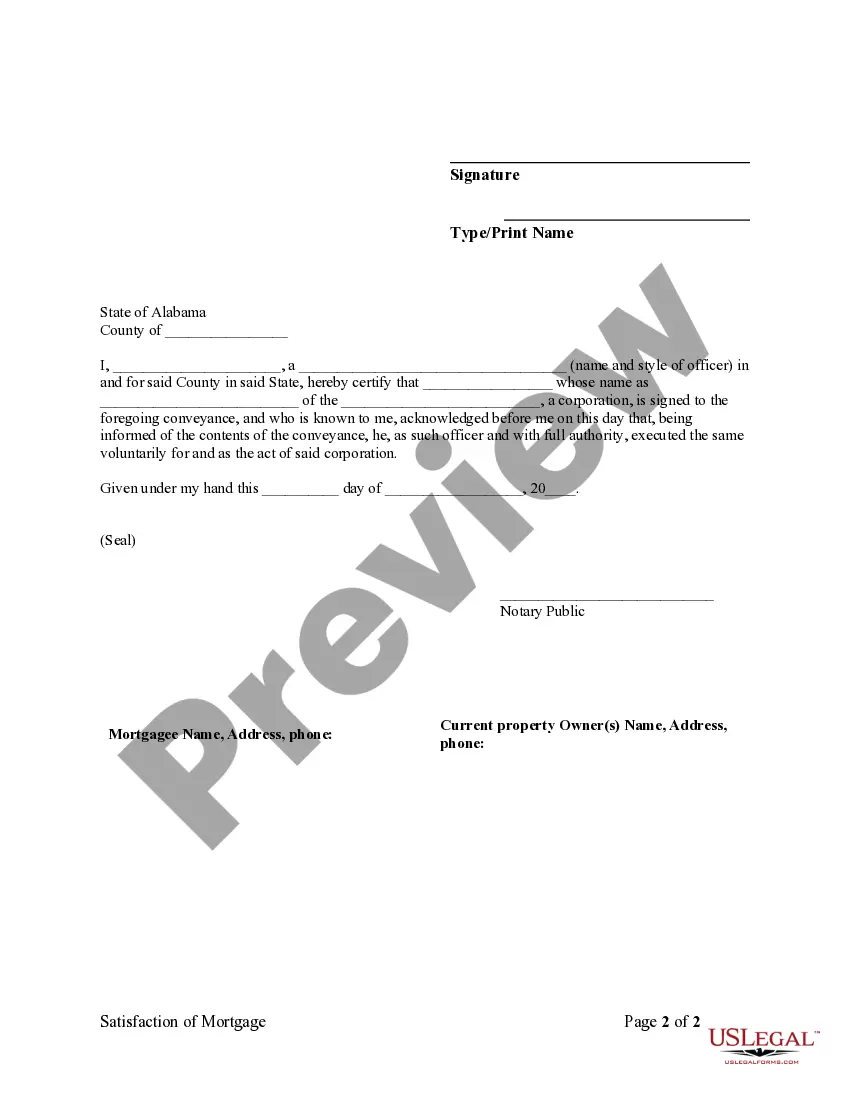

This is a satisfaction or release of a deed of trust or mortgage, for the state of Alabama, by an individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

In Birmingham, Alabama, the Satisfaction, Release or Cancellation of Mortgage by Individual refers to the process by which a homeowner or borrower completes the necessary legal documentation to officially release or cancel their mortgage on a property. This indicates that the mortgage loan has been fully repaid, allowing the homeowner to have clear ownership of the property. The Satisfaction, Release or Cancellation of Mortgage by Individual serves as proof that the borrower has fulfilled their financial obligation to the lender and has met all the terms and conditions of the mortgage agreement. This document is crucial for removing the lien that was placed on the property during the mortgage process. Once the mortgage is released or cancelled, the homeowner can freely sell, refinance, or transfer ownership of the property without any encumbrances. There are various types of Satisfaction, Release or Cancellation of Mortgage by Individual procedures that Birmingham, Alabama homeowners may encounter: 1. Voluntary Satisfaction: This type occurs when the borrower has repaid the mortgage loan in full, either through regular monthly payments or an early payoff. Upon satisfying the debt, the borrower requests a release or cancellation of the mortgage from the lender or the lender's authorized representative. 2. Refinancing: When a homeowner decides to refinance their mortgage with a new lender, the new lender typically takes care of the Satisfaction, Release or Cancellation of Mortgage by Individual. They pay off the existing mortgage, and a new mortgage agreement is established. This process may involve submission of necessary paperwork to show the release of the previous mortgage. 3. Sale of Property: If a homeowner sells their property, the Satisfaction, Release or Cancellation of Mortgage by Individual is typically handled by the closing agent or attorney involved in the property transfer. The proceeds from the sale are used to pay off the outstanding mortgage, and the lender then issues the necessary release or cancellation documentation. Keywords: Birmingham Alabama, Satisfaction, Release, Cancellation, Mortgage, Individual, homeowner, borrower, legal documentation, mortgage loan, repayment, lien, financial obligation, terms and conditions, proof, encumbrances, sell, refinance, transfer ownership, voluntary satisfaction, refinancing, sale of property, closing agent, attorneyIn Birmingham, Alabama, the Satisfaction, Release or Cancellation of Mortgage by Individual refers to the process by which a homeowner or borrower completes the necessary legal documentation to officially release or cancel their mortgage on a property. This indicates that the mortgage loan has been fully repaid, allowing the homeowner to have clear ownership of the property. The Satisfaction, Release or Cancellation of Mortgage by Individual serves as proof that the borrower has fulfilled their financial obligation to the lender and has met all the terms and conditions of the mortgage agreement. This document is crucial for removing the lien that was placed on the property during the mortgage process. Once the mortgage is released or cancelled, the homeowner can freely sell, refinance, or transfer ownership of the property without any encumbrances. There are various types of Satisfaction, Release or Cancellation of Mortgage by Individual procedures that Birmingham, Alabama homeowners may encounter: 1. Voluntary Satisfaction: This type occurs when the borrower has repaid the mortgage loan in full, either through regular monthly payments or an early payoff. Upon satisfying the debt, the borrower requests a release or cancellation of the mortgage from the lender or the lender's authorized representative. 2. Refinancing: When a homeowner decides to refinance their mortgage with a new lender, the new lender typically takes care of the Satisfaction, Release or Cancellation of Mortgage by Individual. They pay off the existing mortgage, and a new mortgage agreement is established. This process may involve submission of necessary paperwork to show the release of the previous mortgage. 3. Sale of Property: If a homeowner sells their property, the Satisfaction, Release or Cancellation of Mortgage by Individual is typically handled by the closing agent or attorney involved in the property transfer. The proceeds from the sale are used to pay off the outstanding mortgage, and the lender then issues the necessary release or cancellation documentation. Keywords: Birmingham Alabama, Satisfaction, Release, Cancellation, Mortgage, Individual, homeowner, borrower, legal documentation, mortgage loan, repayment, lien, financial obligation, terms and conditions, proof, encumbrances, sell, refinance, transfer ownership, voluntary satisfaction, refinancing, sale of property, closing agent, attorney