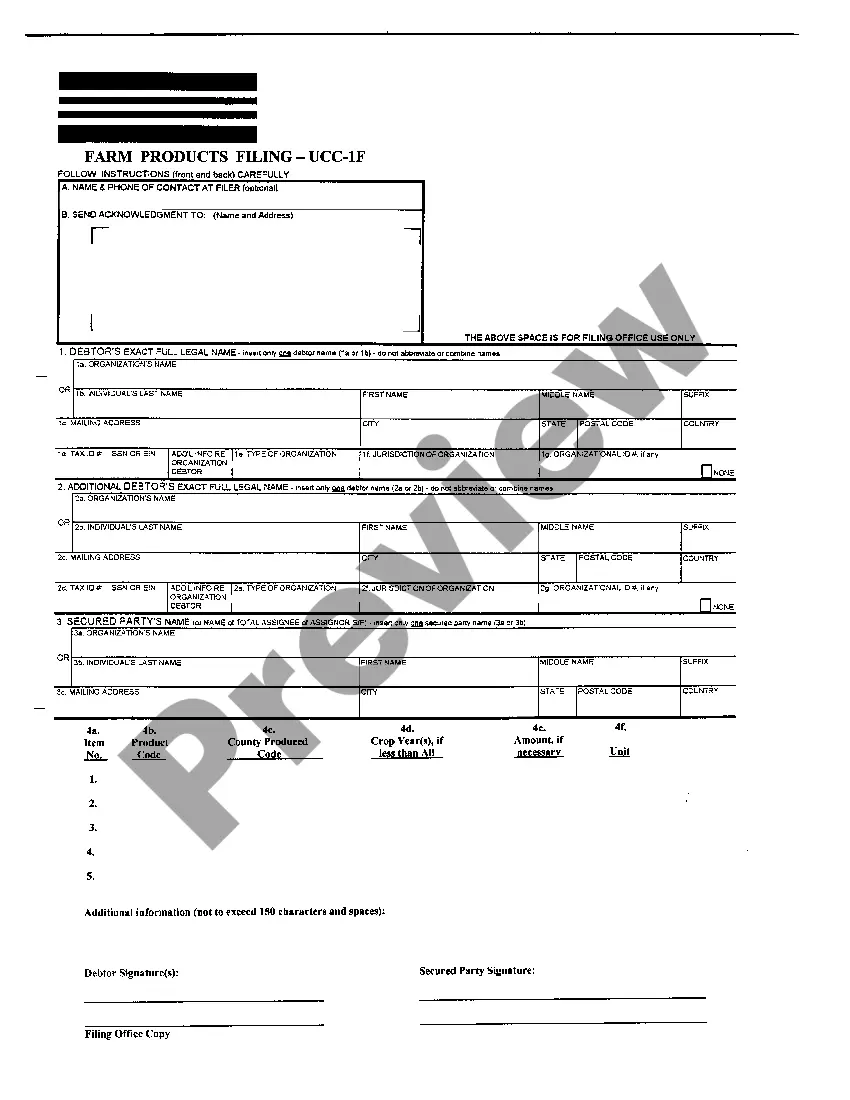

UCC1 - Financing Statement - Alabama - For use after July 1, 2001. This is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Birmingham Alabama UCC1 Financing Statement

Description

How to fill out Alabama UCC1 Financing Statement?

If you are looking for an applicable form template, it’s impossible to discover a more user-friendly service than the US Legal Forms website – likely the most extensive collections on the web.

Here you can locate thousands of form samples for commercial and personal uses by types and states, or key terms.

Utilizing our high-quality search feature, finding the latest Birmingham Alabama UCC1 Financing Statement is as simple as 1-2-3.

Acquire the template. Choose the file format and save it on your device.

Edit the document. Fill out, modify, print, and sign the acquired Birmingham Alabama UCC1 Financing Statement.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Birmingham Alabama UCC1 Financing Statement is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the directions listed below.

- Ensure you have located the form you need. Review its details and use the Preview feature to examine its content. If it doesn’t satisfy your needs, use the Search field at the top of the page to obtain the correct record.

- Confirm your selection. Choose the Buy now option. Then, select your desired pricing plan and provide information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

The Alabama UCC statement request form is essential for filing a UCC1 Financing Statement in Birmingham, Alabama. This form allows creditors to establish their security interests in personal property, thus protecting their rights and interests. By using the right form, you ensure that your financing statement is processed correctly and efficiently. Utilizing the US Legal Forms platform simplifies this process, providing you with easy access to necessary documentation tailored to your needs.

A UCC, or Uniform Commercial Code, in Alabama is a set of laws that governs commercial transactions, including the filing of a UCC1 Financing Statement. This document establishes a secured party's interest in a debtor's assets, allowing for legal claims if the debtor defaults. Understanding the UCC framework helps you protect your financial interests, and platforms like US Legal Forms offer resources to navigate these regulations effectively. Familiarity with UCC filings can be crucial for businesses engaging in credit transactions.

To file a UCC lien in Alabama, you need to complete a UCC1 Financing Statement form, providing details about the debtor and the secured party. Next, you submit the completed form to the appropriate filing office, typically the Secretary of State. This process can also be efficiently managed through platforms like US Legal Forms, which guide you through the requirements. Filing correctly ensures your security interest in the debtor's personal property is recognized.

The Uniform Commercial Code (UCC) was adopted in Alabama in 1966, aiming to standardize and simplify business laws across states. This means that if you are filing a Birmingham Alabama UCC1 Financing Statement, you are participating in a long-established legal framework. Understanding this history can help in recognizing the significance of your filings. They can assist with legal forms and compliance.

A UCC financing statement should be filed in the state's central filing office, usually the Secretary of State’s office. For those in Alabama, this means submitting your Birmingham Alabama UCC1 Financing Statement in Montgomery. Filing correctly safeguards your legal rights regarding your secured transactions. To simplify this process, consider using resources from US Legal Forms.

A UCC fixture filing must be filed in the state where the property is located, similar to other UCC filings. This means that if you are dealing with a fixture in Alabama, you will submit your Birmingham Alabama UCC1 Financing Statement with the Secretary of State's office. It's essential to ensure that all documentation is accurate and complete, which services like US Legal Forms can help streamline.

For a foreign entity, you file a UCC financing statement in the state where it conducts business or owns property. In Alabama, this is done through the Secretary of State's office, specifically through the Birmingham Alabama UCC1 Financing Statement submission. Filing correctly is crucial to protect your security interests. Platforms such as US Legal Forms can provide templates and guidance for your filings.

A UCC lien is filed at the state level, typically with the Secretary of State's office in your state. In Alabama, this means that your Birmingham Alabama UCC1 Financing Statement will be submitted to that office. This centralized filing system ensures that anyone searching for UCC liens can easily access the necessary information. You may also want to consider using services like US Legal Forms to guide you through this process.

You can file a UCC in Alabama at the Secretary of State's office. The office is responsible for maintaining all UCC filings, including the Birmingham Alabama UCC1 Financing Statement. Additionally, you can file online, which streamlines the process. Consider using a reliable platform like US Legal Forms to help manage your filing efficiently.

A FL UCC statement is a financing statement filed under the Uniform Commercial Code in Florida. This document serves to publicly secure a creditor's interest in the debtor's personal property. Just as with the Birmingham Alabama UCC1 Financing Statement, understanding how to file and manage these documents is crucial, and services like US Legal Forms can help guide you through the process.