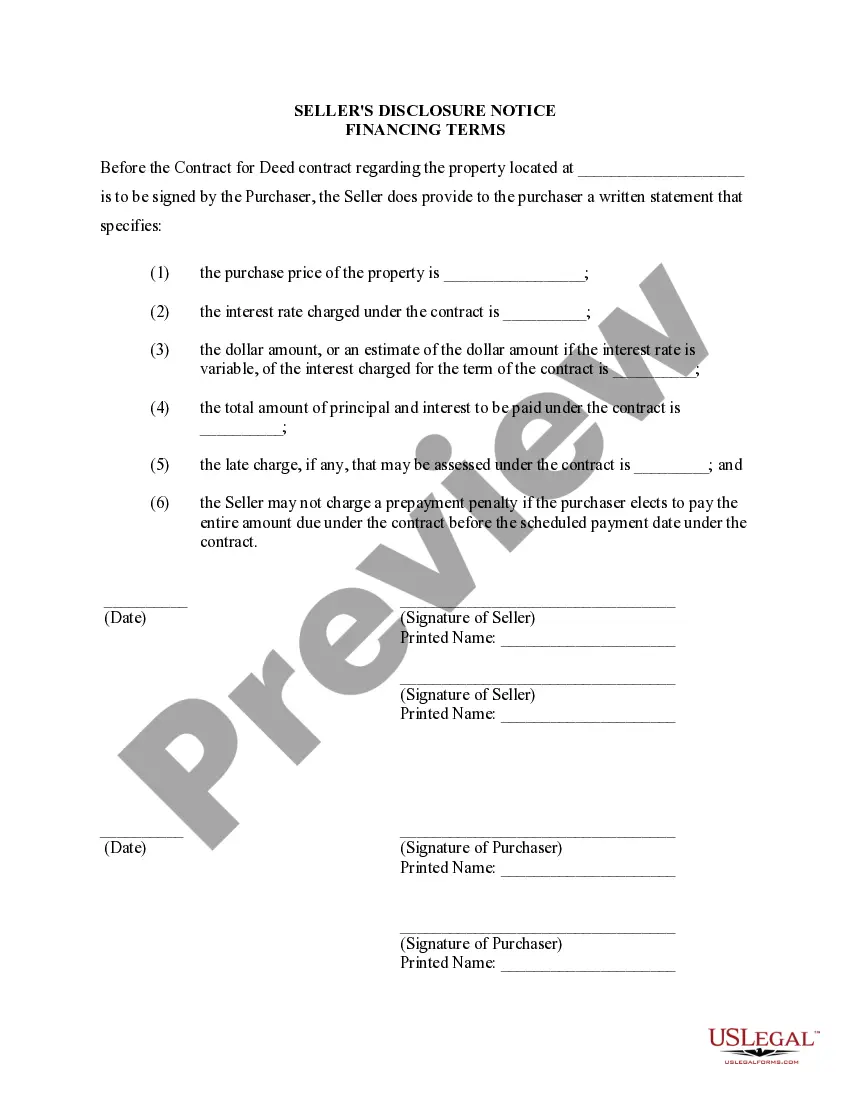

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Little Rock Arkansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract When engaging in a real estate transaction in Little Rock, Arkansas, it is essential for sellers to provide a Seller's Disclosure of Financing Terms for Residential Property when the agreement involves a Contract or Agreement for Deed, also known as a Land Contract. This disclosure document outlines the financing terms associated with the sale, ensuring transparency and legal compliance. The Little Rock Arkansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed must include specific details relevant to the financing arrangements. These details will vary depending on the specific terms negotiated between the buyer and seller. However, some of the most common elements that should be included in the disclosure are: 1. Purchase Price: Clearly state the agreed-upon purchase price for the property covered by the Contract or Agreement for Deed. This sets the foundation for the financing terms and obligations. 2. Down Payment: Specify the amount of down payment required from the buyer. This can be a fixed amount or a percentage of the purchase price, agreed upon in the terms of the contract. 3. Interest Rate: Clearly indicate the interest rate that will be applied to the unpaid balance of the purchase price. This rate may be fixed or adjustable, depending on the terms of the contract. 4. Installment Payments: Detail the installment payment plan, including the frequency, due dates, and amount of each payment that the buyer is obligated to make. This section should also clarify whether additional charges or fees will be imposed for late or missed payments. 5. Length of Contract/Repayment Period: Specify the duration of the Contract or Agreement for Deed, indicating when the buyer is expected to fully repay the balance owed. This is important information for both parties to understand the timeline of the transaction. 6. Late Payment Penalties: Outline any penalties or fees that may be imposed on the buyer in the event of late or missed payments. These penalties should be reasonable and should comply with any applicable state or local laws. 7. Property Tax and Insurance Responsibilities: Clearly state who is responsible for paying property taxes and insurance premiums during the course of the Contract or Agreement for Deed. This ensures that both parties understand their financial obligations. It is important to note that the specific details and language of the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may vary based on the preferences of the buyer and seller, as well as any applicable state or local laws. However, the document should always strive to provide comprehensive and accurate information relating to the financing terms of the transaction. Different types of Little Rock Arkansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include variations in the specific terms mentioned above. For example, the interest rate may be adjustable rather than fixed, or the repayment period may be extended in specific cases. It is crucial for sellers to consult with legal professionals and understand the specific requirements and options available to them when drafting the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed in Little Rock, Arkansas.Little Rock Arkansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract When engaging in a real estate transaction in Little Rock, Arkansas, it is essential for sellers to provide a Seller's Disclosure of Financing Terms for Residential Property when the agreement involves a Contract or Agreement for Deed, also known as a Land Contract. This disclosure document outlines the financing terms associated with the sale, ensuring transparency and legal compliance. The Little Rock Arkansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed must include specific details relevant to the financing arrangements. These details will vary depending on the specific terms negotiated between the buyer and seller. However, some of the most common elements that should be included in the disclosure are: 1. Purchase Price: Clearly state the agreed-upon purchase price for the property covered by the Contract or Agreement for Deed. This sets the foundation for the financing terms and obligations. 2. Down Payment: Specify the amount of down payment required from the buyer. This can be a fixed amount or a percentage of the purchase price, agreed upon in the terms of the contract. 3. Interest Rate: Clearly indicate the interest rate that will be applied to the unpaid balance of the purchase price. This rate may be fixed or adjustable, depending on the terms of the contract. 4. Installment Payments: Detail the installment payment plan, including the frequency, due dates, and amount of each payment that the buyer is obligated to make. This section should also clarify whether additional charges or fees will be imposed for late or missed payments. 5. Length of Contract/Repayment Period: Specify the duration of the Contract or Agreement for Deed, indicating when the buyer is expected to fully repay the balance owed. This is important information for both parties to understand the timeline of the transaction. 6. Late Payment Penalties: Outline any penalties or fees that may be imposed on the buyer in the event of late or missed payments. These penalties should be reasonable and should comply with any applicable state or local laws. 7. Property Tax and Insurance Responsibilities: Clearly state who is responsible for paying property taxes and insurance premiums during the course of the Contract or Agreement for Deed. This ensures that both parties understand their financial obligations. It is important to note that the specific details and language of the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may vary based on the preferences of the buyer and seller, as well as any applicable state or local laws. However, the document should always strive to provide comprehensive and accurate information relating to the financing terms of the transaction. Different types of Little Rock Arkansas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include variations in the specific terms mentioned above. For example, the interest rate may be adjustable rather than fixed, or the repayment period may be extended in specific cases. It is crucial for sellers to consult with legal professionals and understand the specific requirements and options available to them when drafting the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed in Little Rock, Arkansas.