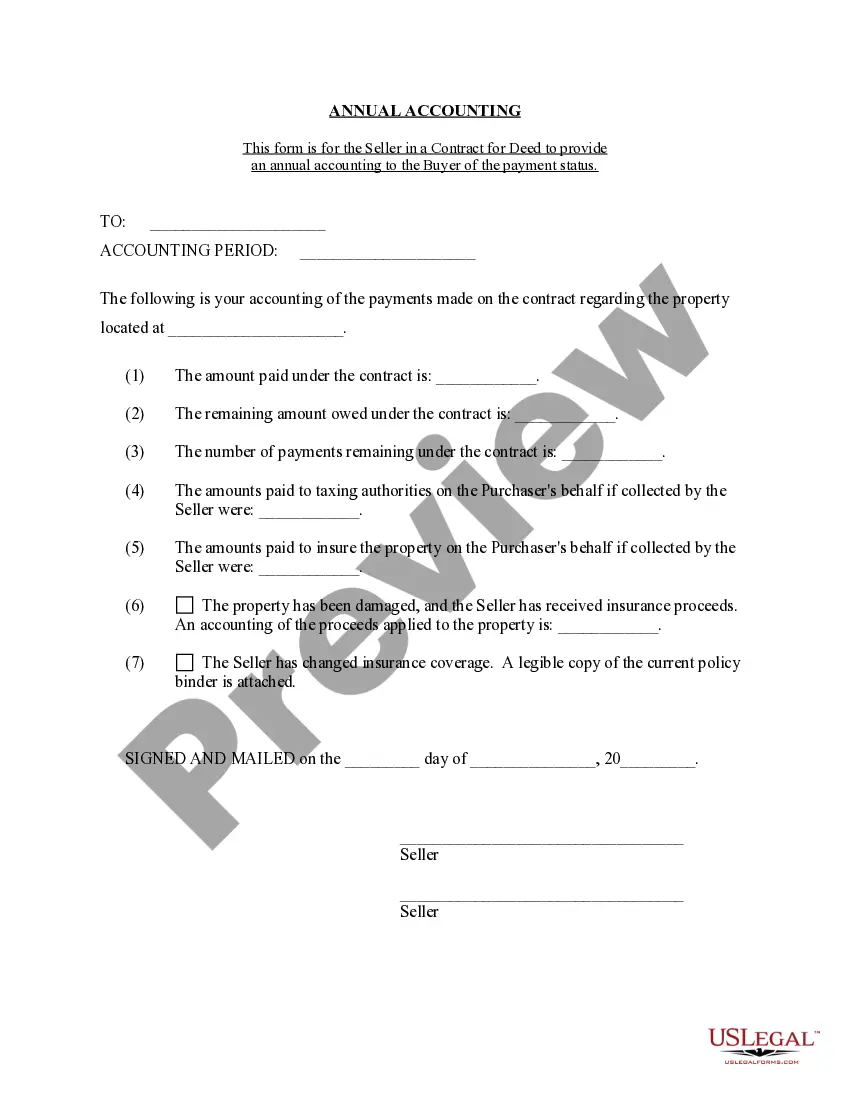

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document provided by the seller in a contract for deed transaction in Little Rock, Arkansas. This statement outlines the financial transactions, income, and expenses related to the property being sold through this type of agreement. It offers a transparent view of the financial status of the contract for deed agreement and helps both parties track and analyze the financial aspects of the transaction. Keywords: Little Rock Arkansas, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, income, expenses, property, agreement, transparent, financial status, parties, track, analyze. Different types of Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement may include: 1. Property-specific Annual Accounting Statement: This type of statement provides a detailed breakdown of the financial activities related to a specific property within the Little Rock, Arkansas area. It includes information such as rental income, property expenses, repairs, and maintenance costs. 2. Portfolio-based Annual Accounting Statement: This statement is designed for sellers who have multiple properties under contract for deed agreements in Little Rock, Arkansas. It provides an overview of the overall financial performance of all properties, consolidating the income and expenses from each property into one comprehensive statement. 3. Tax-optimized Annual Accounting Statement: This type of statement focuses on highlighting the tax benefits and implications of the contract for deed agreement in Little Rock, Arkansas. It includes information on deductible expenses, depreciation, and other tax-related considerations to ensure sellers can maximize their tax advantages. 4. Performance-based Annual Accounting Statement: This statement evaluates the financial performance of the contract for deed agreement in Little Rock, Arkansas over a specific period. It includes key indicators such as return on investment, cash flow analysis, and profit margin to provide a thorough assessment of the agreement's overall success. 5. Compliance-based Annual Accounting Statement: This type of statement ensures adherence to legal and regulatory obligations associated with contract for deed transactions in Little Rock, Arkansas. It includes information on financial reporting requirements, tax compliance, and any other relevant legal obligations sellers must fulfill. Keywords: Little Rock, Arkansas, Contract for Deed, Seller's Annual Accounting Statement, property-specific, portfolio-based, tax-optimized, performance-based, compliance-based, financial activities, income, expenses, rental income, property expenses, repairs, maintenance costs, tax benefits, deductible expenses, tax implications, return on investment, cash flow analysis, profit margin, legal obligations, regulatory compliance.Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document provided by the seller in a contract for deed transaction in Little Rock, Arkansas. This statement outlines the financial transactions, income, and expenses related to the property being sold through this type of agreement. It offers a transparent view of the financial status of the contract for deed agreement and helps both parties track and analyze the financial aspects of the transaction. Keywords: Little Rock Arkansas, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, income, expenses, property, agreement, transparent, financial status, parties, track, analyze. Different types of Little Rock Arkansas Contract for Deed Seller's Annual Accounting Statement may include: 1. Property-specific Annual Accounting Statement: This type of statement provides a detailed breakdown of the financial activities related to a specific property within the Little Rock, Arkansas area. It includes information such as rental income, property expenses, repairs, and maintenance costs. 2. Portfolio-based Annual Accounting Statement: This statement is designed for sellers who have multiple properties under contract for deed agreements in Little Rock, Arkansas. It provides an overview of the overall financial performance of all properties, consolidating the income and expenses from each property into one comprehensive statement. 3. Tax-optimized Annual Accounting Statement: This type of statement focuses on highlighting the tax benefits and implications of the contract for deed agreement in Little Rock, Arkansas. It includes information on deductible expenses, depreciation, and other tax-related considerations to ensure sellers can maximize their tax advantages. 4. Performance-based Annual Accounting Statement: This statement evaluates the financial performance of the contract for deed agreement in Little Rock, Arkansas over a specific period. It includes key indicators such as return on investment, cash flow analysis, and profit margin to provide a thorough assessment of the agreement's overall success. 5. Compliance-based Annual Accounting Statement: This type of statement ensures adherence to legal and regulatory obligations associated with contract for deed transactions in Little Rock, Arkansas. It includes information on financial reporting requirements, tax compliance, and any other relevant legal obligations sellers must fulfill. Keywords: Little Rock, Arkansas, Contract for Deed, Seller's Annual Accounting Statement, property-specific, portfolio-based, tax-optimized, performance-based, compliance-based, financial activities, income, expenses, rental income, property expenses, repairs, maintenance costs, tax benefits, deductible expenses, tax implications, return on investment, cash flow analysis, profit margin, legal obligations, regulatory compliance.