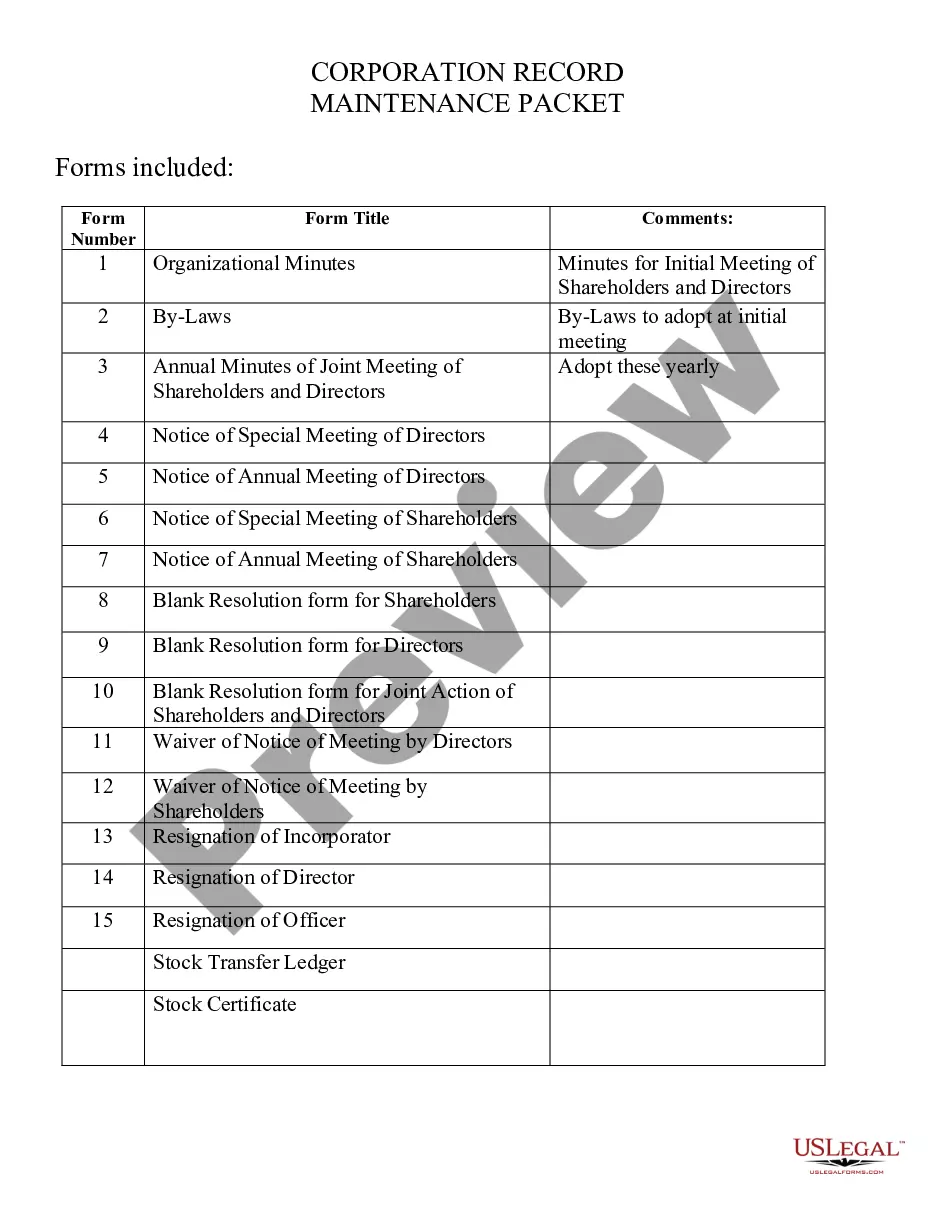

This corporation formation package of forms contains a pre-incorporation agreement for the formers of a corporation to sign, agreeing on how the corporation will be operated, who will be elected as officers and directors, salaries and many other corporate matters.

The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters.

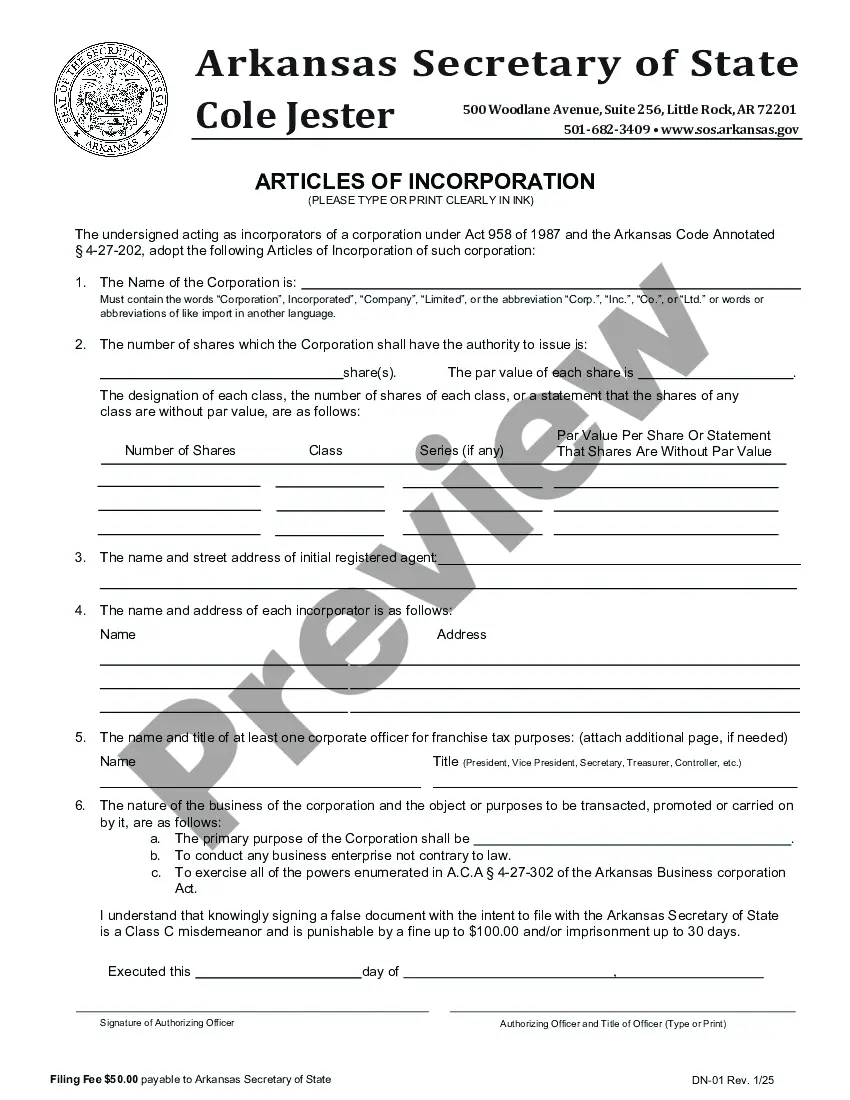

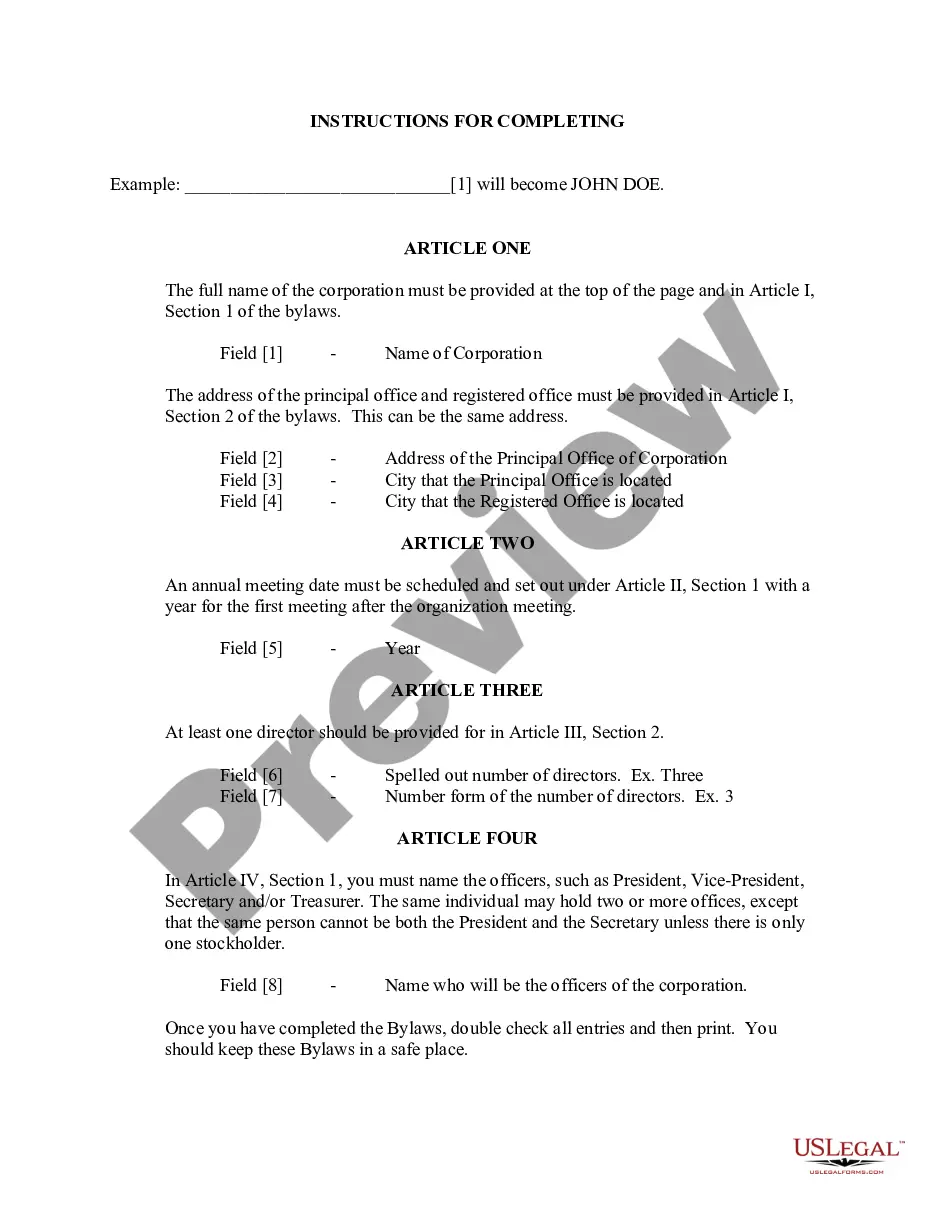

Little Rock Arkansas Pre-Incorporation Agreement: A Little Rock Arkansas Pre-Incorporation Agreement is a legal document that outlines the initial arrangements and obligations among individuals who wish to form a corporation in Little Rock, Arkansas. This agreement is typically entered into before the incorporation process takes place and serves as a precursor to the formal Articles of Incorporation. It ensures that all parties involved have a clear understanding of their roles, responsibilities, and rights during the pre-incorporation stage. Keywords: Little Rock Arkansas, Pre-Incorporation Agreement, legal document, corporation, obligations, arrangements, Articles of Incorporation, roles, responsibilities, rights. Different types of Little Rock Arkansas Pre-Incorporation Agreements may include: 1. Standard Little Rock Arkansas Pre-Incorporation Agreement: This is a general agreement template that covers the basic requirements and provisions commonly associated with the pre-incorporation stage. It provides a framework for the future corporation's formation, management, and distribution of shares. 2. Industry-Specific Little Rock Arkansas Pre-Incorporation Agreement: Some businesses may require tailored agreements that address industry-specific regulations, compliance needs, or unique operational aspects. For example, a technology startup may include provisions related to intellectual property ownership and development in their pre-incorporation agreement. Little Rock Arkansas Shareholders Agreement: A Little Rock Arkansas Shareholders Agreement is a legally binding contract that outlines the rights, obligations, and procedures governing the relationship among shareholders of a corporation in Little Rock, Arkansas. This agreement protects the interests of shareholders and establishes a framework for decision-making, share transfers, dispute resolution, and other important matters. Keywords: Little Rock Arkansas, Shareholders Agreement, legally binding, rights, obligations, procedures, relationship, shareholder, decision-making, share transfers, dispute resolution. Different types of Little Rock Arkansas Shareholders Agreements may include: 1. Basic Little Rock Arkansas Shareholders Agreement: This agreement typically covers the essential rights and obligations of shareholders, such as voting rights, share transfer restrictions, and processes for resolving disputes. It serves as a foundation for shareholders' interactions within the corporation. 2. Vesting Agreement: A Vesting Agreement outlines the terms and conditions under which a shareholder can acquire ownership of shares over a predetermined period. It is commonly used when founders or key employees receive shares as part of their compensation, ensuring that they remain committed to the company's long-term success. Little Rock Arkansas Confidentiality Agreement: A Little Rock Arkansas Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that establishes a confidential relationship between parties involved in a business transaction or partnership in Little Rock, Arkansas. This agreement aims to protect sensitive information, trade secrets, and proprietary knowledge from being disclosed or misused by the recipient. Keywords: Little Rock Arkansas, Confidentiality Agreement, Non-Disclosure Agreement, legal contract, confidential relationship, sensitive information, trade secrets, proprietary knowledge, disclosure, misuse. Different types of Little Rock Arkansas Confidentiality Agreements may include: 1. Mutual Confidentiality Agreement: This agreement is used when both parties need to share confidential information with each other. It ensures that both parties agree to keep information confidential and outlines the terms and restrictions related to the use, disclosure, and return of the shared information. 2. One-Way Confidentiality Agreement: This agreement is utilized when only one party discloses confidential information, such as during negotiations or discussions with potential investors or business partners. The recipient of the information is bound by the agreement's terms to maintain strict confidentiality and not disclose or use the shared information for any unauthorized purposes. In conclusion, Little Rock Arkansas Pre-Incorporation Agreements, Shareholders Agreements, and Confidentiality Agreements are essential legal documents that outline various aspects of business formation, shareholder relationships, and confidential information protection. These agreements provide a clear framework for parties involved, ensuring smooth operations, rights protection, and confidential information security.Little Rock Arkansas Pre-Incorporation Agreement: A Little Rock Arkansas Pre-Incorporation Agreement is a legal document that outlines the initial arrangements and obligations among individuals who wish to form a corporation in Little Rock, Arkansas. This agreement is typically entered into before the incorporation process takes place and serves as a precursor to the formal Articles of Incorporation. It ensures that all parties involved have a clear understanding of their roles, responsibilities, and rights during the pre-incorporation stage. Keywords: Little Rock Arkansas, Pre-Incorporation Agreement, legal document, corporation, obligations, arrangements, Articles of Incorporation, roles, responsibilities, rights. Different types of Little Rock Arkansas Pre-Incorporation Agreements may include: 1. Standard Little Rock Arkansas Pre-Incorporation Agreement: This is a general agreement template that covers the basic requirements and provisions commonly associated with the pre-incorporation stage. It provides a framework for the future corporation's formation, management, and distribution of shares. 2. Industry-Specific Little Rock Arkansas Pre-Incorporation Agreement: Some businesses may require tailored agreements that address industry-specific regulations, compliance needs, or unique operational aspects. For example, a technology startup may include provisions related to intellectual property ownership and development in their pre-incorporation agreement. Little Rock Arkansas Shareholders Agreement: A Little Rock Arkansas Shareholders Agreement is a legally binding contract that outlines the rights, obligations, and procedures governing the relationship among shareholders of a corporation in Little Rock, Arkansas. This agreement protects the interests of shareholders and establishes a framework for decision-making, share transfers, dispute resolution, and other important matters. Keywords: Little Rock Arkansas, Shareholders Agreement, legally binding, rights, obligations, procedures, relationship, shareholder, decision-making, share transfers, dispute resolution. Different types of Little Rock Arkansas Shareholders Agreements may include: 1. Basic Little Rock Arkansas Shareholders Agreement: This agreement typically covers the essential rights and obligations of shareholders, such as voting rights, share transfer restrictions, and processes for resolving disputes. It serves as a foundation for shareholders' interactions within the corporation. 2. Vesting Agreement: A Vesting Agreement outlines the terms and conditions under which a shareholder can acquire ownership of shares over a predetermined period. It is commonly used when founders or key employees receive shares as part of their compensation, ensuring that they remain committed to the company's long-term success. Little Rock Arkansas Confidentiality Agreement: A Little Rock Arkansas Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that establishes a confidential relationship between parties involved in a business transaction or partnership in Little Rock, Arkansas. This agreement aims to protect sensitive information, trade secrets, and proprietary knowledge from being disclosed or misused by the recipient. Keywords: Little Rock Arkansas, Confidentiality Agreement, Non-Disclosure Agreement, legal contract, confidential relationship, sensitive information, trade secrets, proprietary knowledge, disclosure, misuse. Different types of Little Rock Arkansas Confidentiality Agreements may include: 1. Mutual Confidentiality Agreement: This agreement is used when both parties need to share confidential information with each other. It ensures that both parties agree to keep information confidential and outlines the terms and restrictions related to the use, disclosure, and return of the shared information. 2. One-Way Confidentiality Agreement: This agreement is utilized when only one party discloses confidential information, such as during negotiations or discussions with potential investors or business partners. The recipient of the information is bound by the agreement's terms to maintain strict confidentiality and not disclose or use the shared information for any unauthorized purposes. In conclusion, Little Rock Arkansas Pre-Incorporation Agreements, Shareholders Agreements, and Confidentiality Agreements are essential legal documents that outline various aspects of business formation, shareholder relationships, and confidential information protection. These agreements provide a clear framework for parties involved, ensuring smooth operations, rights protection, and confidential information security.