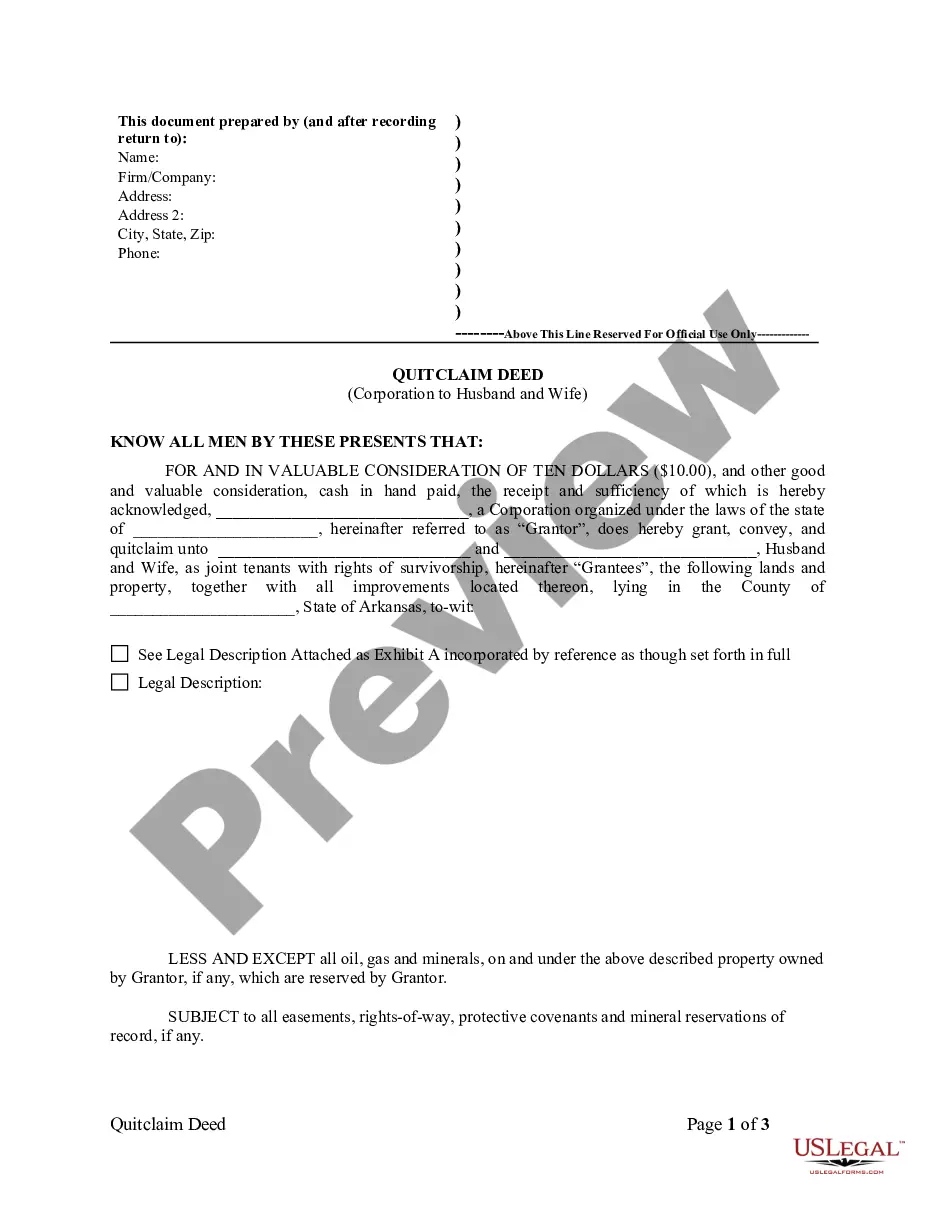

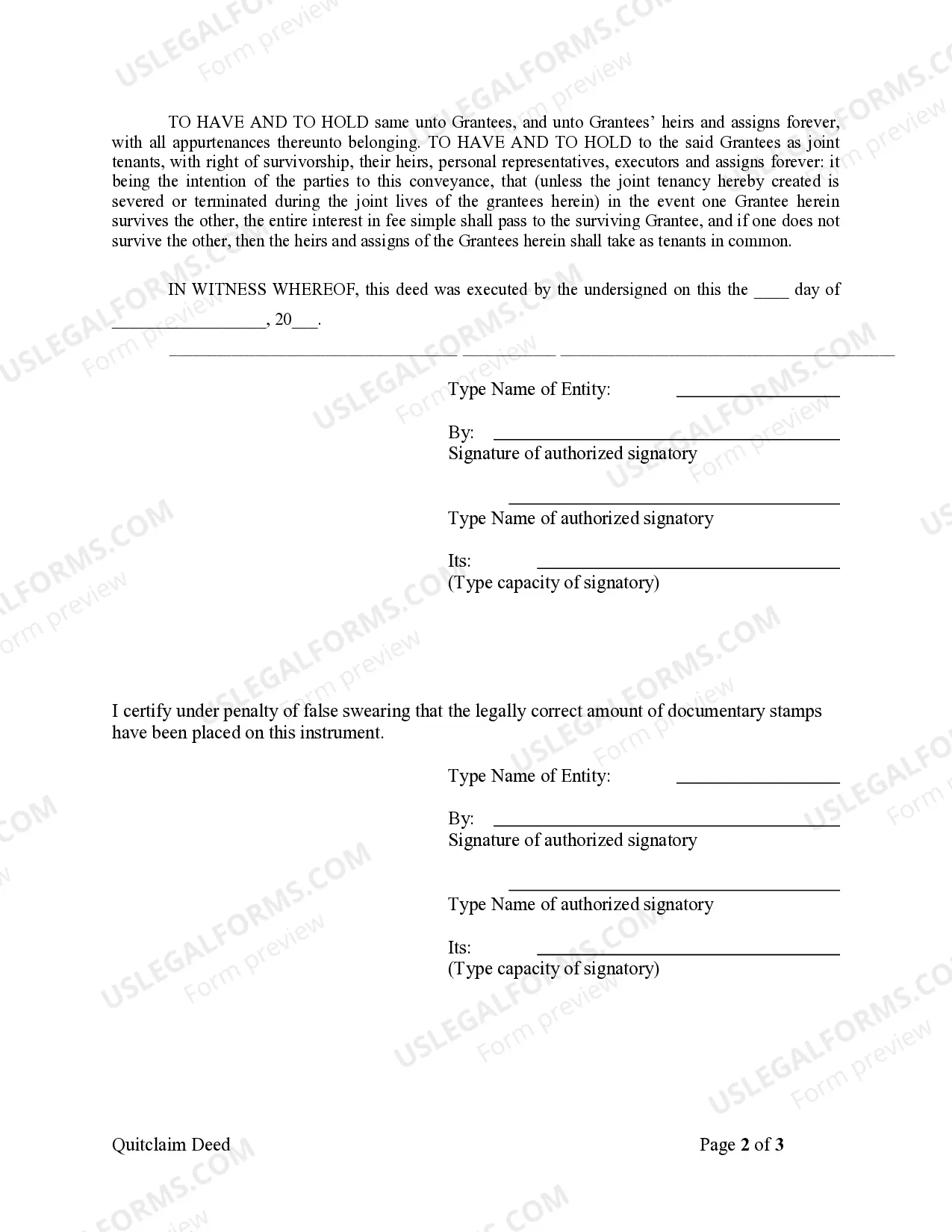

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers the ownership of property from a corporation to a married couple without any warranties of title. This type of deed is often used in situations where the corporation wants to transfer property to the couple without assuming any liability or responsibility for the property's condition or title. The Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife is a legally binding agreement that signifies the corporation's intent to transfer all rights, interests, and ownership of the property to the married couple. By executing this deed, the corporation effectively releases any claim it may have had to the property and transfers it to the husband and wife. There are different variations of the Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife, depending on the specific circumstances and requirements of the parties involved. These may include: 1. General Quitclaim Deed: This type of deed is the most common and straightforward form used to transfer property ownership from a corporation to a husband and wife. 2. Joint Tenancy Quitclaim Deed: This deed creates a joint tenancy between the husband and wife, meaning they both have an equal right to the property and, in the event of the death of one spouse, the surviving spouse automatically inherits the other's share. 3. Tenants in Common Quitclaim Deed: This type of deed allows the husband and wife to hold the property as tenants in common, in which they each have a specific percentage or share of ownership. If one spouse passes away, their share is not automatically transferred to the other spouse but instead can be passed on to heirs as designated in their will. 4. Community Property Quitclaim Deed: In Little Rock, Arkansas, a community property state, this deed allows the husband and wife to hold the property as community property, where each spouse has an undivided and equal interest in the property. Upon the death of one spouse, the property passes to the surviving spouse without the need for probate. When drafting a Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife, it is essential to consult with a qualified real estate attorney to ensure compliance with state laws and to address any specific requirements or concerns. It is also crucial to conduct a thorough title search to minimize any potential issues and to guarantee a clear and marketable title transfer.A Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers the ownership of property from a corporation to a married couple without any warranties of title. This type of deed is often used in situations where the corporation wants to transfer property to the couple without assuming any liability or responsibility for the property's condition or title. The Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife is a legally binding agreement that signifies the corporation's intent to transfer all rights, interests, and ownership of the property to the married couple. By executing this deed, the corporation effectively releases any claim it may have had to the property and transfers it to the husband and wife. There are different variations of the Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife, depending on the specific circumstances and requirements of the parties involved. These may include: 1. General Quitclaim Deed: This type of deed is the most common and straightforward form used to transfer property ownership from a corporation to a husband and wife. 2. Joint Tenancy Quitclaim Deed: This deed creates a joint tenancy between the husband and wife, meaning they both have an equal right to the property and, in the event of the death of one spouse, the surviving spouse automatically inherits the other's share. 3. Tenants in Common Quitclaim Deed: This type of deed allows the husband and wife to hold the property as tenants in common, in which they each have a specific percentage or share of ownership. If one spouse passes away, their share is not automatically transferred to the other spouse but instead can be passed on to heirs as designated in their will. 4. Community Property Quitclaim Deed: In Little Rock, Arkansas, a community property state, this deed allows the husband and wife to hold the property as community property, where each spouse has an undivided and equal interest in the property. Upon the death of one spouse, the property passes to the surviving spouse without the need for probate. When drafting a Little Rock Arkansas Quitclaim Deed from Corporation to Husband and Wife, it is essential to consult with a qualified real estate attorney to ensure compliance with state laws and to address any specific requirements or concerns. It is also crucial to conduct a thorough title search to minimize any potential issues and to guarantee a clear and marketable title transfer.