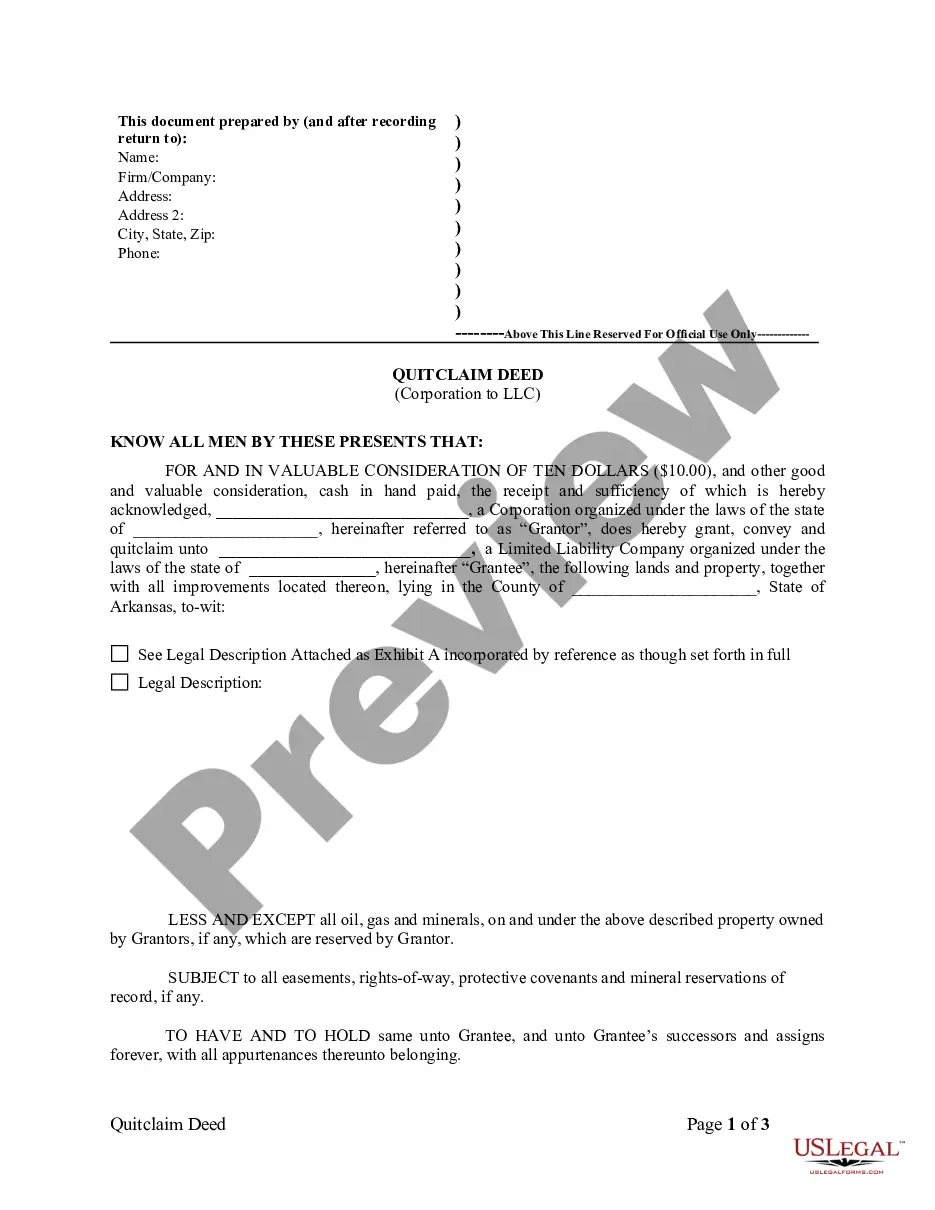

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Little Rock Arkansas Quitclaim Deed from Corporation to LLC is a legal document that allows a corporation in the city of Little Rock, Arkansas to transfer ownership of a property to a limited liability company (LLC) without making any warranties or guarantees regarding the property's title. A quitclaim deed is commonly used when transferring ownership between related entities, such as a corporation and an LLC. This type of deed effectively transfers any interest the corporation holds in the property to the LLC, ensuring a smooth transition of ownership. There are different variations of a Little Rock Arkansas Quitclaim Deed from Corporation to LLC, each serving different purposes. These include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used in Little Rock, Arkansas. It transfers ownership of the property from the corporation to the LLC, relinquishing any claim or interest the corporation may have had. 2. Corporate Conversion Quitclaim Deed: This type of quitclaim deed is used when a corporation is converting into an LLC and wishes to transfer ownership of the property into the newly formed LLC. It is a crucial document in the conversion process. 3. LLC Formation Quitclaim Deed: In situations where a corporation decides to dissolve and form an LLC, this deed is used to transfer the property's ownership to the newly formed LLC. It is an essential step in the transition from corporation to LLC. The Little Rock Arkansas Quitclaim Deed from Corporation to LLC includes important details such as the legal names of the corporation and LLC, the property description, and the effective date of the transfer. Furthermore, it signifies that the corporation is willingly relinquishing any interest it may hold in the property and is transferring it to the LLC. It is highly recommended consulting an attorney or a real estate professional specializing in Little Rock, Arkansas real estate law to ensure the accurate preparation and execution of this legal document.