This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a trustee on behalf of a trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust

Description

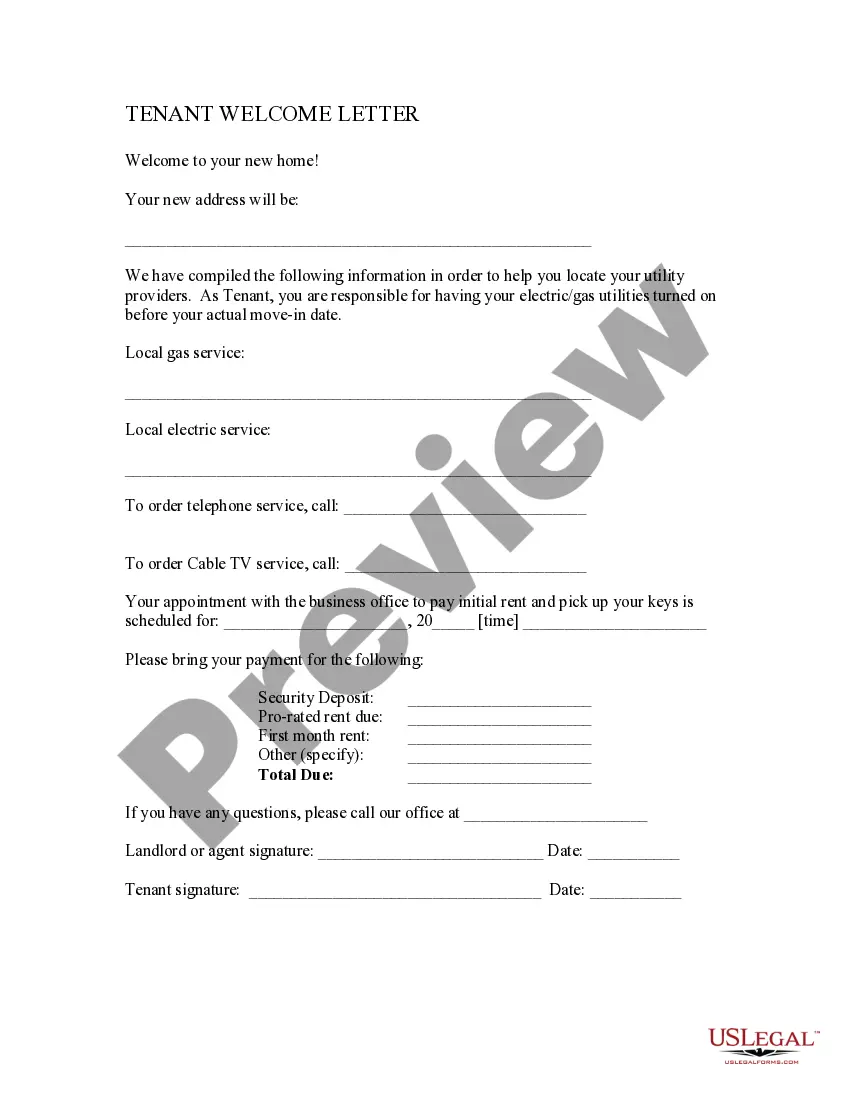

How to fill out Arkansas Quitclaim Deed - Husband And Wife To Trust?

If you are looking for a genuine form template, it’s unfeasible to select a superior platform than the US Legal Forms site – one of the most extensive collections available online.

With this collection, you can discover a vast array of form examples for corporate and personal needs categorized by types and states, or keywords.

With the sophisticated search feature, locating the latest Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Select the format and download it to your device. Edit. Complete, modify, print, and sign the obtained Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust.

- Moreover, the accuracy of each document is confirmed by a team of specialized attorneys who regularly review the templates on our site and revise them in accordance with the latest state and county laws.

- If you are already familiar with our platform and have an account, all you need to obtain the Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions outlined below.

- Ensure you have located the form you require. Review its details and use the Preview option (if available) to examine its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to find the desired document.

- Confirm your choice. Click the Buy now button. Then, choose your desired subscription plan and enter details to set up an account.

Form popularity

FAQ

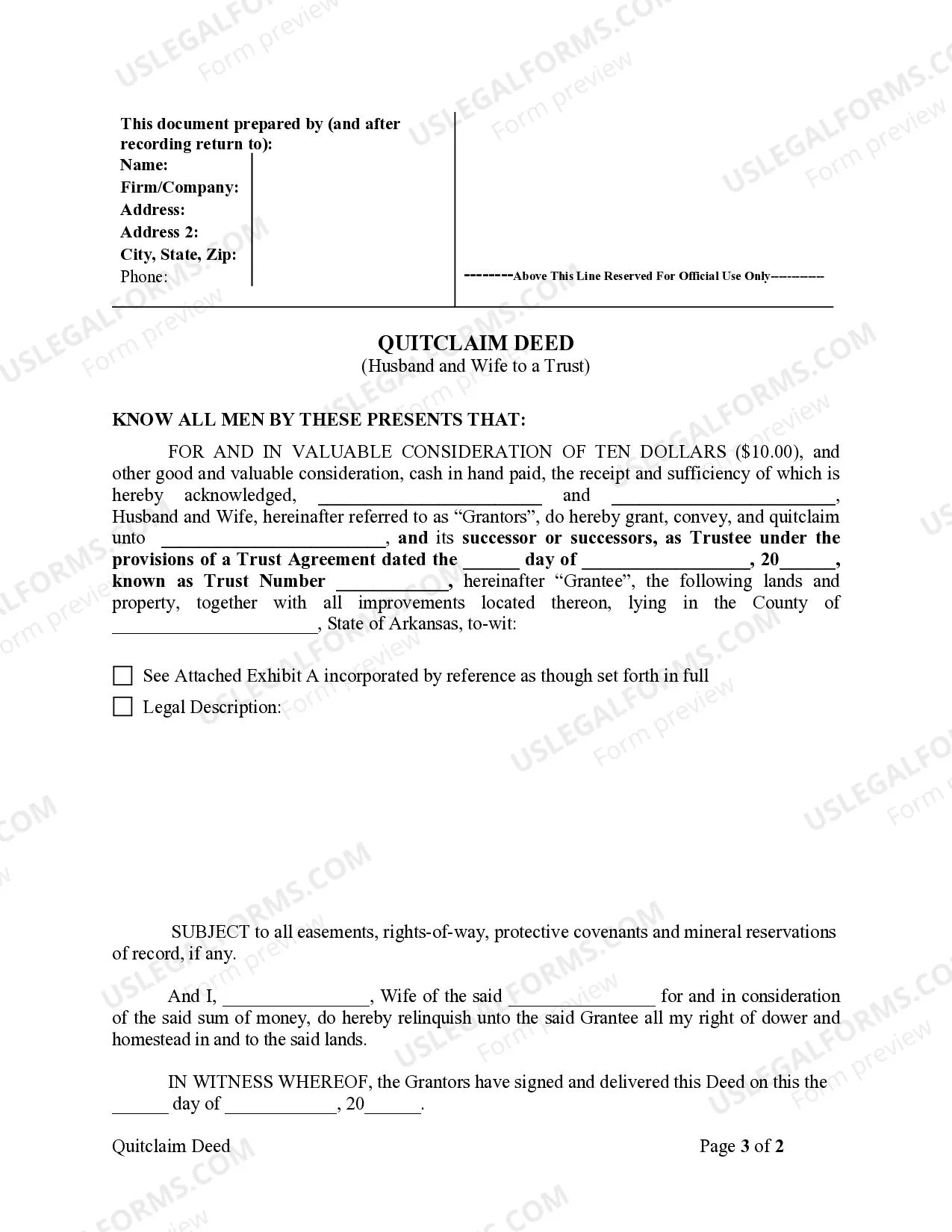

Filling out a quitclaim deed in Arkansas involves several key steps. You need to provide the names and addresses of both parties, describe the property clearly, and ensure that the document includes the correct legal language. You can simplify this process by using platforms like uslegalforms, which offer templates specifically for the Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust.

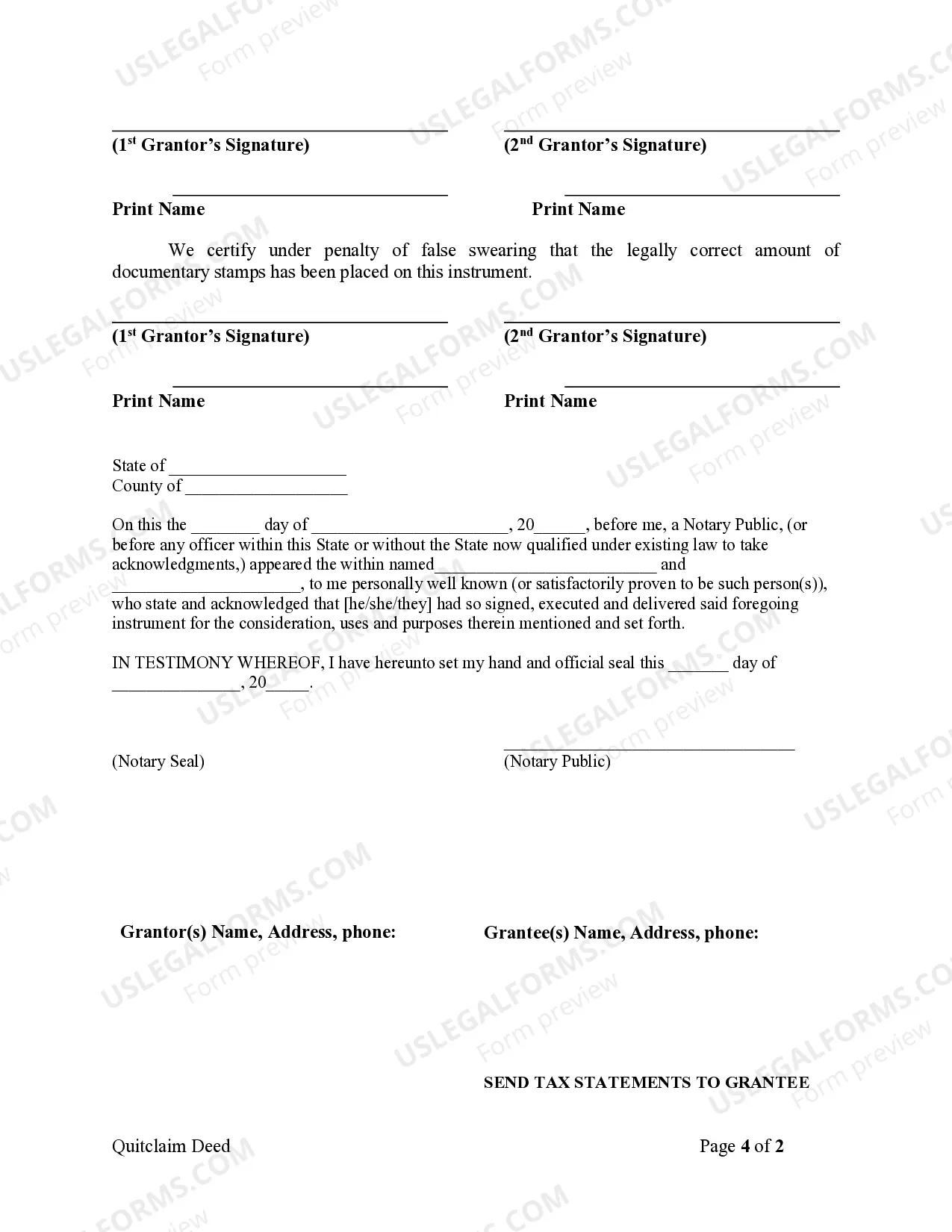

Yes, a quitclaim deed must be notarized in Arkansas to be legally binding. This notarization process adds an essential layer of authenticity and protects the parties involved. If you're handling a Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust, make sure to have it properly executed with a notary.

Quitclaim deeds are often used to transfer property between family members or in divorce settlements. They are straightforward documents that may not guarantee any title protection. The Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust specifically serves to place property into trust, simplifying asset management for couples.

The strongest form of deed is the warranty deed, which offers maximum security to the buyer. This type of deed assures that the seller guarantees good title against any defects that may arise. If you seek more information on how to execute a security-focused deed, consider learning about the Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust.

When considering the Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust, it's essential to understand that a warranty deed typically provides the greatest protection. Warranty deeds guarantee that the seller has clear title to the property and protects buyers from potential future claims. In situations where full protection is needed, buyers often prefer a warranty deed for the assurance it provides.

The most common use of a quitclaim deed is to transfer property ownership without warranty. This method is often employed between family members or in divorce situations, such as a Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust. It allows one spouse to relinquish their interest in the property to a trust or to the other spouse, facilitating a straightforward transfer of ownership. Always ensure that you have the correct documentation to protect all parties involved.

To file a quitclaim deed in Arkansas, begin by obtaining the appropriate form, specifically tailored for a Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust. Fill out the form with accurate details about the property and the parties involved. After that, sign the deed in the presence of a notary public. Finally, submit the completed document to the local county clerk's office for recording.

To create a Little Rock Arkansas Quitclaim Deed - Husband and Wife to Trust, you need to meet specific requirements. First, you must include the names of both spouses and the name of the trust in the deed. Next, ensure you have a legal description of the property being transferred. Lastly, both spouses need to sign the deed in front of a notary public to make it valid.

Yes, quitclaim deeds are legal in Arkansas and widely used for property transfers, especially between family members. They provide a mechanism for the transfer of ownership without guaranteeing clear title. When utilizing a Little Rock Arkansas quitclaim deed, it is important to follow proper legal procedures to validate the deed. Using platforms like US Legal Forms can streamline the creation of a valid quitclaim deed, ensuring compliance with state laws.

To transfer property title to a family member in Arkansas, a quitclaim deed is one of the simplest methods. You’ll need to complete the deed, including the relevant details about the property and the parties involved, and then have it signed and notarized. Following this, you should record the quitclaim deed with the local county clerk’s office. Using a Little Rock Arkansas quitclaim deed is an effective approach to ensure that the transfer is official and recognized.