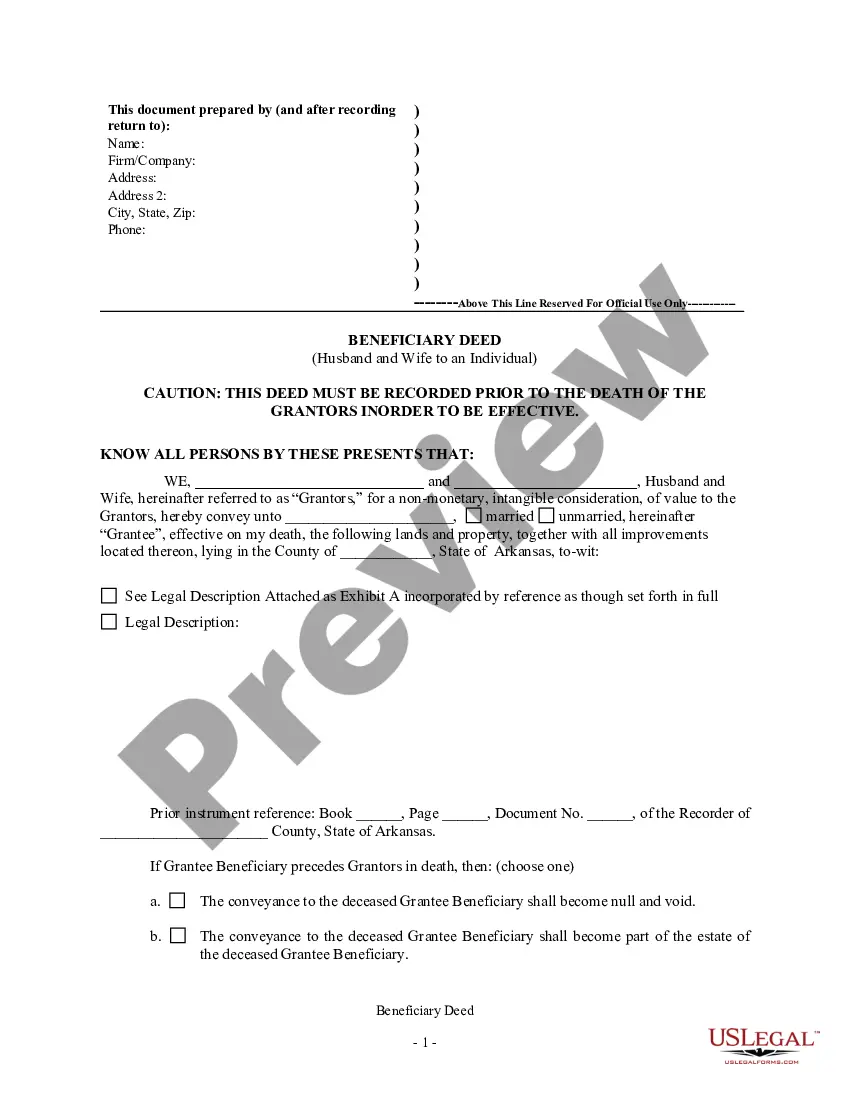

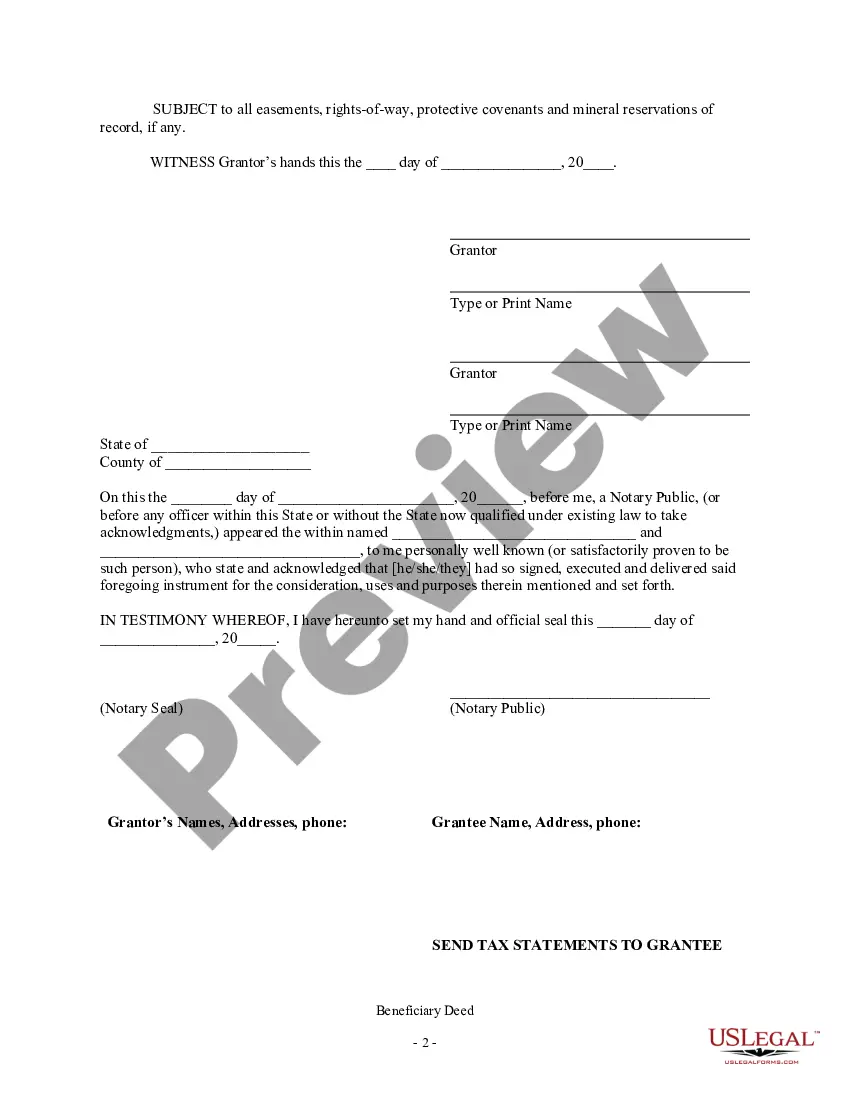

This form is a Transfer on Death Deed, or Beneficiary Deed, where the grantors are husband and wife and the grantee an individual. If grantee fails to survive the grantors their interest goes to their estate or the transfer is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to grantor's deaths. This deed complies with all state statutory laws.

Little Rock Arkansas Transfer on Death Deed, also known as TOD — Beneficiary Deed, is a legal instrument that allows property owners in Little Rock, Arkansas, to designate a specific individual or individuals as the beneficiaries of their real estate upon their death. This type of deed ensures a smooth transfer of ownership outside of probate, avoiding potential complications and costs. The Little Rock Arkansas Transfer on Death Deed is particularly beneficial for married couples who want to ensure the transfer of their property to an individual beneficiary after both spouses pass away. By using this deed, the couple can bypass the probate process and directly convey the property to the designated beneficiary. One type of Little Rock Arkansas Transfer on Death Deed is the Joint Tenancy with Right of Survivorship TOD — Beneficiary Deed for Husband and Wife to Individual. With this deed, the couple as joint tenants can designate a specific individual as the beneficiary, who will gain full ownership of the property upon the death of both spouses. Another type of Little Rock Arkansas Transfer on Death Deed is the Tenants in Common TOD — Beneficiary Deed for Husband and Wife to Individual. This deed allows the couple to hold the property as tenants in common, with each spouse having a defined share. Upon the death of both spouses, the designated beneficiary inherits the deceased spouse's share, while the surviving spouse retains their share. The Little Rock Arkansas Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual is a flexible and efficient estate planning tool that allows couples to designate an individual beneficiary, maintain control over their property during their lifetime, and avoid the probate process for a hassle-free transfer of ownership. It is essential to consult with a qualified attorney to ensure the deed is properly executed and meets the specific requirements of Arkansas state laws.Little Rock Arkansas Transfer on Death Deed, also known as TOD — Beneficiary Deed, is a legal instrument that allows property owners in Little Rock, Arkansas, to designate a specific individual or individuals as the beneficiaries of their real estate upon their death. This type of deed ensures a smooth transfer of ownership outside of probate, avoiding potential complications and costs. The Little Rock Arkansas Transfer on Death Deed is particularly beneficial for married couples who want to ensure the transfer of their property to an individual beneficiary after both spouses pass away. By using this deed, the couple can bypass the probate process and directly convey the property to the designated beneficiary. One type of Little Rock Arkansas Transfer on Death Deed is the Joint Tenancy with Right of Survivorship TOD — Beneficiary Deed for Husband and Wife to Individual. With this deed, the couple as joint tenants can designate a specific individual as the beneficiary, who will gain full ownership of the property upon the death of both spouses. Another type of Little Rock Arkansas Transfer on Death Deed is the Tenants in Common TOD — Beneficiary Deed for Husband and Wife to Individual. This deed allows the couple to hold the property as tenants in common, with each spouse having a defined share. Upon the death of both spouses, the designated beneficiary inherits the deceased spouse's share, while the surviving spouse retains their share. The Little Rock Arkansas Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual is a flexible and efficient estate planning tool that allows couples to designate an individual beneficiary, maintain control over their property during their lifetime, and avoid the probate process for a hassle-free transfer of ownership. It is essential to consult with a qualified attorney to ensure the deed is properly executed and meets the specific requirements of Arkansas state laws.