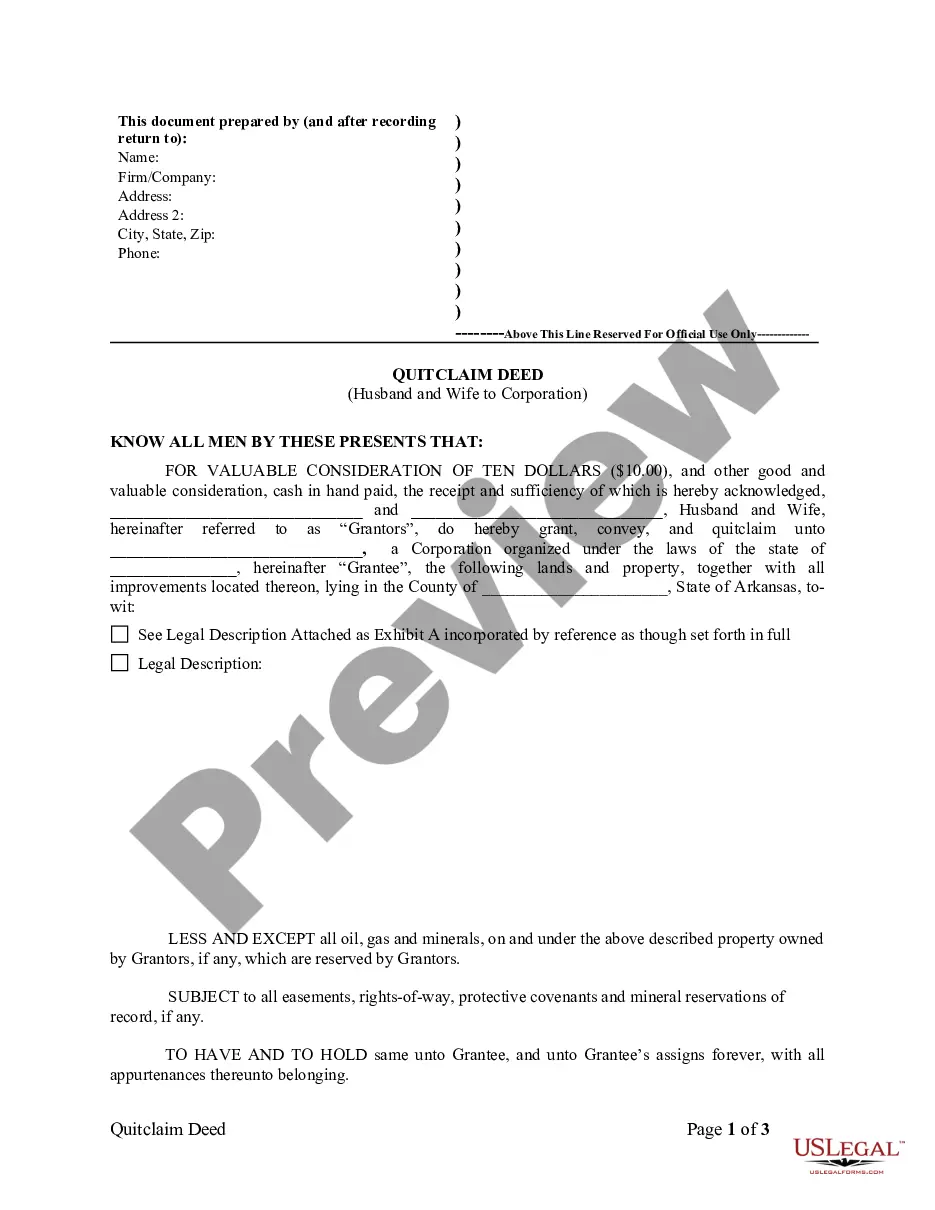

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that facilitates the transfer of property ownership from a married couple to a corporation in Little Rock, Arkansas. This type of deed enables the husband and wife to relinquish any rights or claims they have on the property, thus vesting the corporation with sole ownership. When preparing this deed, certain keywords are essential to understand the specific aspects and variations of the Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation. These keywords include: 1. Little Rock, Arkansas: This indicates the specific jurisdiction in which the quitclaim deed is being executed and where the property is located. 2. Quitclaim Deed: A legal instrument used to transfer any interest or claim that the granter (husband and wife) holds on the property to the grantee (corporation). It does not provide any guarantees or warranties regarding the property's title. 3. Husband and Wife: Refers to the married couple who currently holds ownership of the property and intends to transfer it to the corporation. 4. Corporation: Represents the entity or business that will assume ownership of the property upon the completion of the quitclaim deed. 5. Property: The real estate asset, which could include land, buildings, or any other structures situated within Little Rock, Arkansas, that the husband and wife wish to transfer to the corporation's ownership. 6. Sole Ownership: Indicates that the corporation will become the sole owner of the property, free from any current or future claims by the husband and wife. Different Types of Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation: 1. General Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed where the transfer of property ownership occurs without any specific limitations or conditions. 2. Little Rock Arkansas Quitclaim Deed with Consideration from Husband and Wife to Corporation: This type of deed involves a monetary consideration or payment made by the corporation to the husband and wife in exchange for the transfer of property ownership. 3. Little Rock Arkansas Quitclaim Deed with Restrictions from Husband and Wife to Corporation: In certain cases, the husband and wife may impose specific restrictions or conditions on the grantee corporation, such as land-use restrictions or limitations on future transfers of ownership. Note: It is crucial to consult with a qualified attorney or real estate professional while preparing any legal document, including a quitclaim deed, to ensure compliance with the relevant laws and regulations in Little Rock, Arkansas.A Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that facilitates the transfer of property ownership from a married couple to a corporation in Little Rock, Arkansas. This type of deed enables the husband and wife to relinquish any rights or claims they have on the property, thus vesting the corporation with sole ownership. When preparing this deed, certain keywords are essential to understand the specific aspects and variations of the Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation. These keywords include: 1. Little Rock, Arkansas: This indicates the specific jurisdiction in which the quitclaim deed is being executed and where the property is located. 2. Quitclaim Deed: A legal instrument used to transfer any interest or claim that the granter (husband and wife) holds on the property to the grantee (corporation). It does not provide any guarantees or warranties regarding the property's title. 3. Husband and Wife: Refers to the married couple who currently holds ownership of the property and intends to transfer it to the corporation. 4. Corporation: Represents the entity or business that will assume ownership of the property upon the completion of the quitclaim deed. 5. Property: The real estate asset, which could include land, buildings, or any other structures situated within Little Rock, Arkansas, that the husband and wife wish to transfer to the corporation's ownership. 6. Sole Ownership: Indicates that the corporation will become the sole owner of the property, free from any current or future claims by the husband and wife. Different Types of Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation: 1. General Little Rock Arkansas Quitclaim Deed from Husband and Wife to Corporation: This is the most common type of quitclaim deed where the transfer of property ownership occurs without any specific limitations or conditions. 2. Little Rock Arkansas Quitclaim Deed with Consideration from Husband and Wife to Corporation: This type of deed involves a monetary consideration or payment made by the corporation to the husband and wife in exchange for the transfer of property ownership. 3. Little Rock Arkansas Quitclaim Deed with Restrictions from Husband and Wife to Corporation: In certain cases, the husband and wife may impose specific restrictions or conditions on the grantee corporation, such as land-use restrictions or limitations on future transfers of ownership. Note: It is crucial to consult with a qualified attorney or real estate professional while preparing any legal document, including a quitclaim deed, to ensure compliance with the relevant laws and regulations in Little Rock, Arkansas.