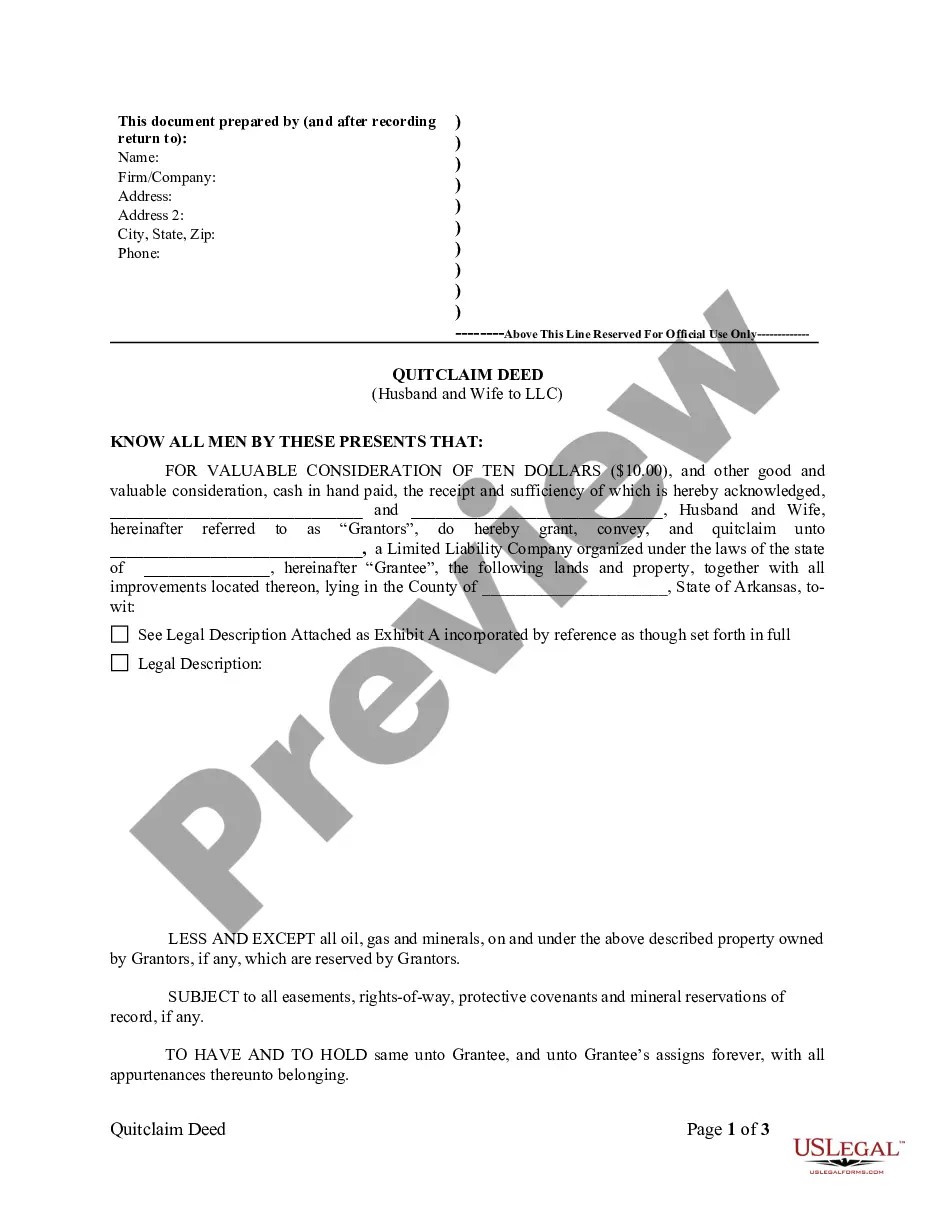

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

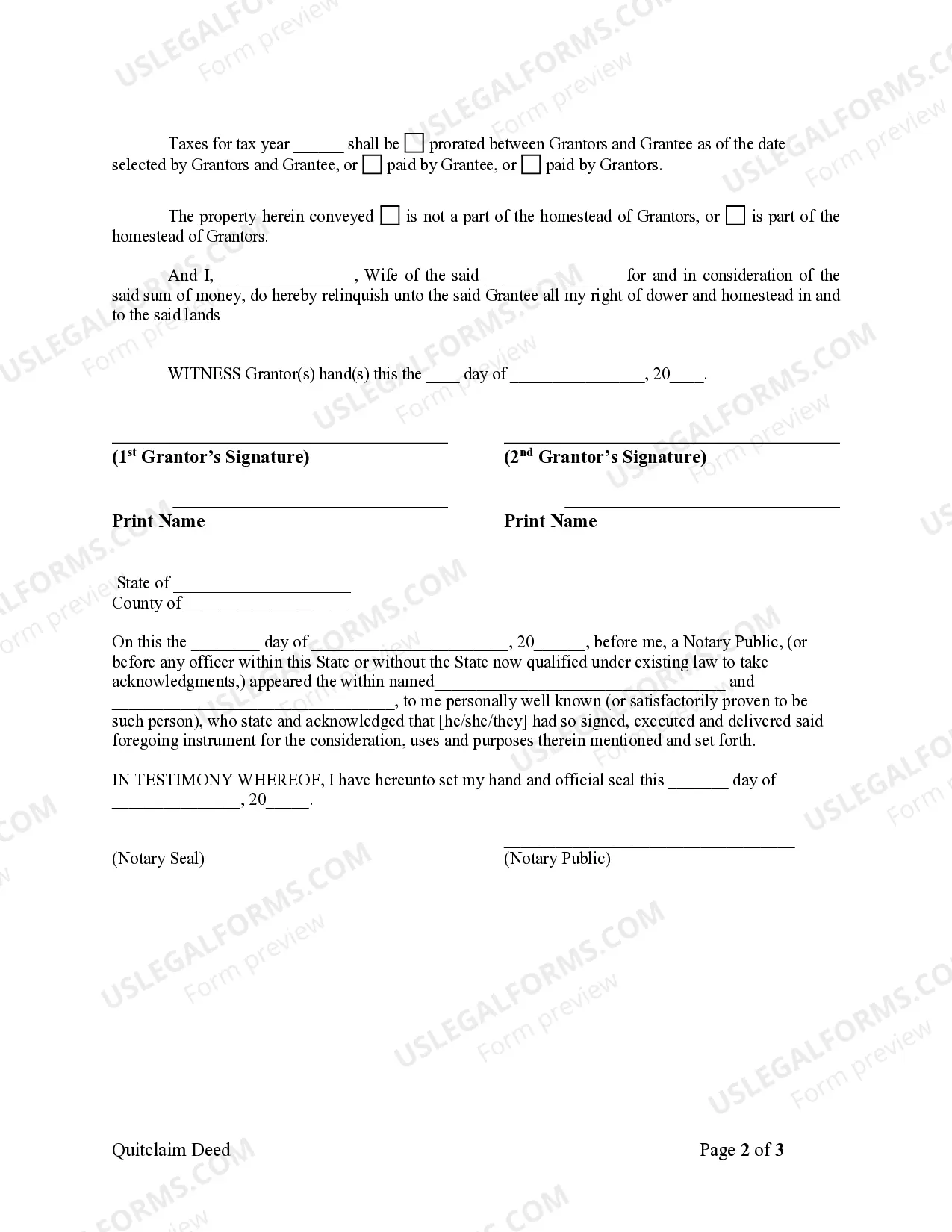

A Little Rock Arkansas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers property ownership rights from a married couple to their Limited Liability Company (LLC). This type of deed is commonly used when a married couple wishes to transfer ownership of a property they own jointly to their LLC. By executing a quitclaim deed, the couple is effectively releasing their ownership interests in the property and transferring them to the LLC. There are two main types of Little Rock Arkansas Quitclaim Deeds from Husband and Wife to LLC: 1. Little Rock Arkansas Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when the property is owned by the couple as joint tenants. Joint tenancy ensures that both spouses have an equal share in the property and, upon the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share. Transferring ownership to the LLC through a quitclaim deed can be advantageous for asset protection, business purposes, or estate planning. 2. Little Rock Arkansas Tenancy in Common Quitclaim Deed from Husband and Wife to LLC: In this scenario, the property is owned by the couple as tenants in common. Unlike joint tenancy, tenants in common can hold unequal ownership interests, and there is no automatic right of survivorship. By executing a quitclaim deed, the couple can transfer their respective shares in the property to their LLC. This can be beneficial for asset protection, separation of personal and business assets, or tax planning purposes. In both types of Little Rock Arkansas Quitclaim Deeds from Husband and Wife to LLC, it is important to follow legal procedures and consult with an attorney to ensure the proper execution and recording of the deed. The terms of the transfer, including any considerations or conditions, should be clearly outlined in the deed to prevent any future disputes or misunderstandings. By utilizing a Little Rock Arkansas Quitclaim Deed from Husband and Wife to LLC, married couples can effectively and legally transfer property ownership to their LLC for various purposes such as business ventures, asset protection, estate planning, or tax planning. Consult an attorney familiar with Arkansas real estate laws to determine the most suitable type of deed for your specific circumstances.A Little Rock Arkansas Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers property ownership rights from a married couple to their Limited Liability Company (LLC). This type of deed is commonly used when a married couple wishes to transfer ownership of a property they own jointly to their LLC. By executing a quitclaim deed, the couple is effectively releasing their ownership interests in the property and transferring them to the LLC. There are two main types of Little Rock Arkansas Quitclaim Deeds from Husband and Wife to LLC: 1. Little Rock Arkansas Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when the property is owned by the couple as joint tenants. Joint tenancy ensures that both spouses have an equal share in the property and, upon the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share. Transferring ownership to the LLC through a quitclaim deed can be advantageous for asset protection, business purposes, or estate planning. 2. Little Rock Arkansas Tenancy in Common Quitclaim Deed from Husband and Wife to LLC: In this scenario, the property is owned by the couple as tenants in common. Unlike joint tenancy, tenants in common can hold unequal ownership interests, and there is no automatic right of survivorship. By executing a quitclaim deed, the couple can transfer their respective shares in the property to their LLC. This can be beneficial for asset protection, separation of personal and business assets, or tax planning purposes. In both types of Little Rock Arkansas Quitclaim Deeds from Husband and Wife to LLC, it is important to follow legal procedures and consult with an attorney to ensure the proper execution and recording of the deed. The terms of the transfer, including any considerations or conditions, should be clearly outlined in the deed to prevent any future disputes or misunderstandings. By utilizing a Little Rock Arkansas Quitclaim Deed from Husband and Wife to LLC, married couples can effectively and legally transfer property ownership to their LLC for various purposes such as business ventures, asset protection, estate planning, or tax planning. Consult an attorney familiar with Arkansas real estate laws to determine the most suitable type of deed for your specific circumstances.