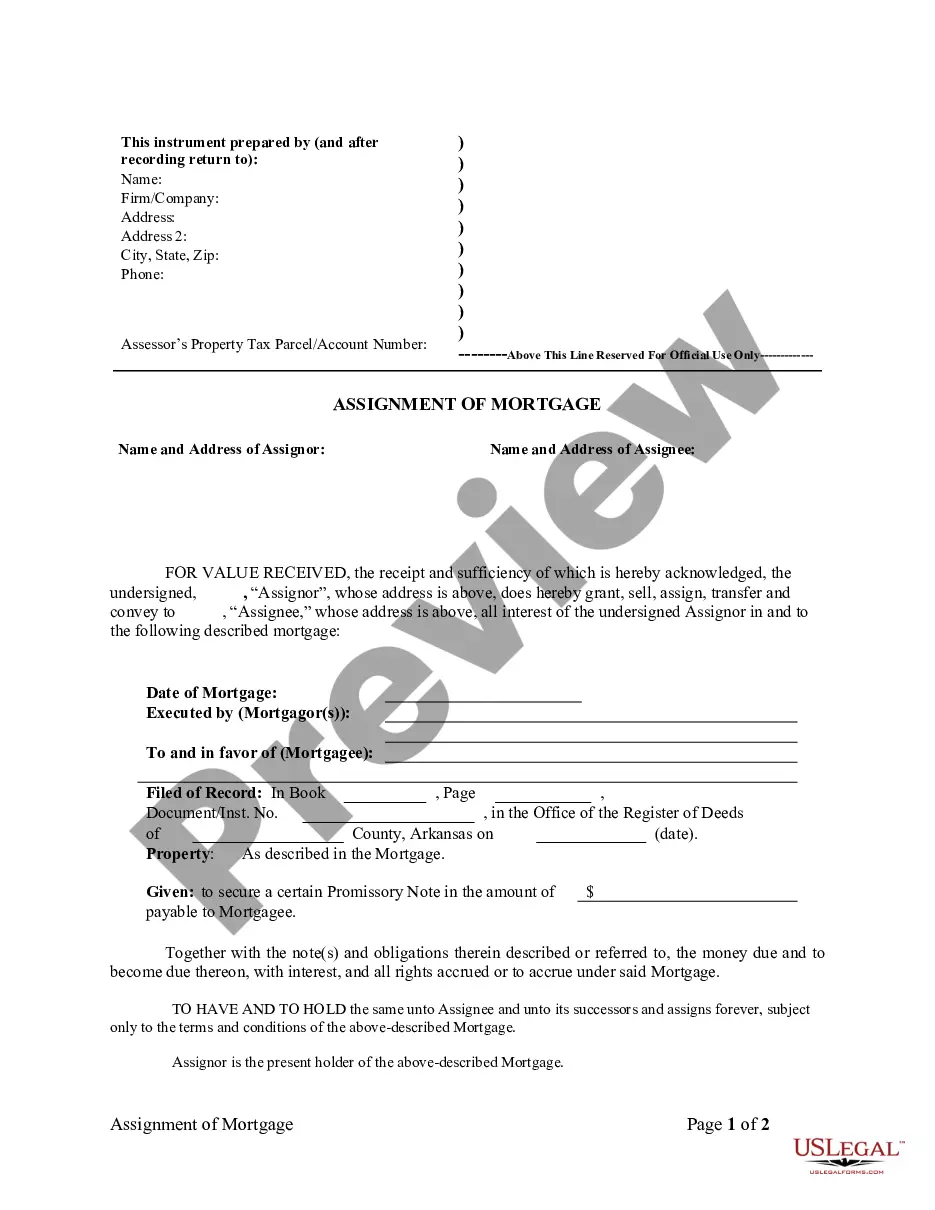

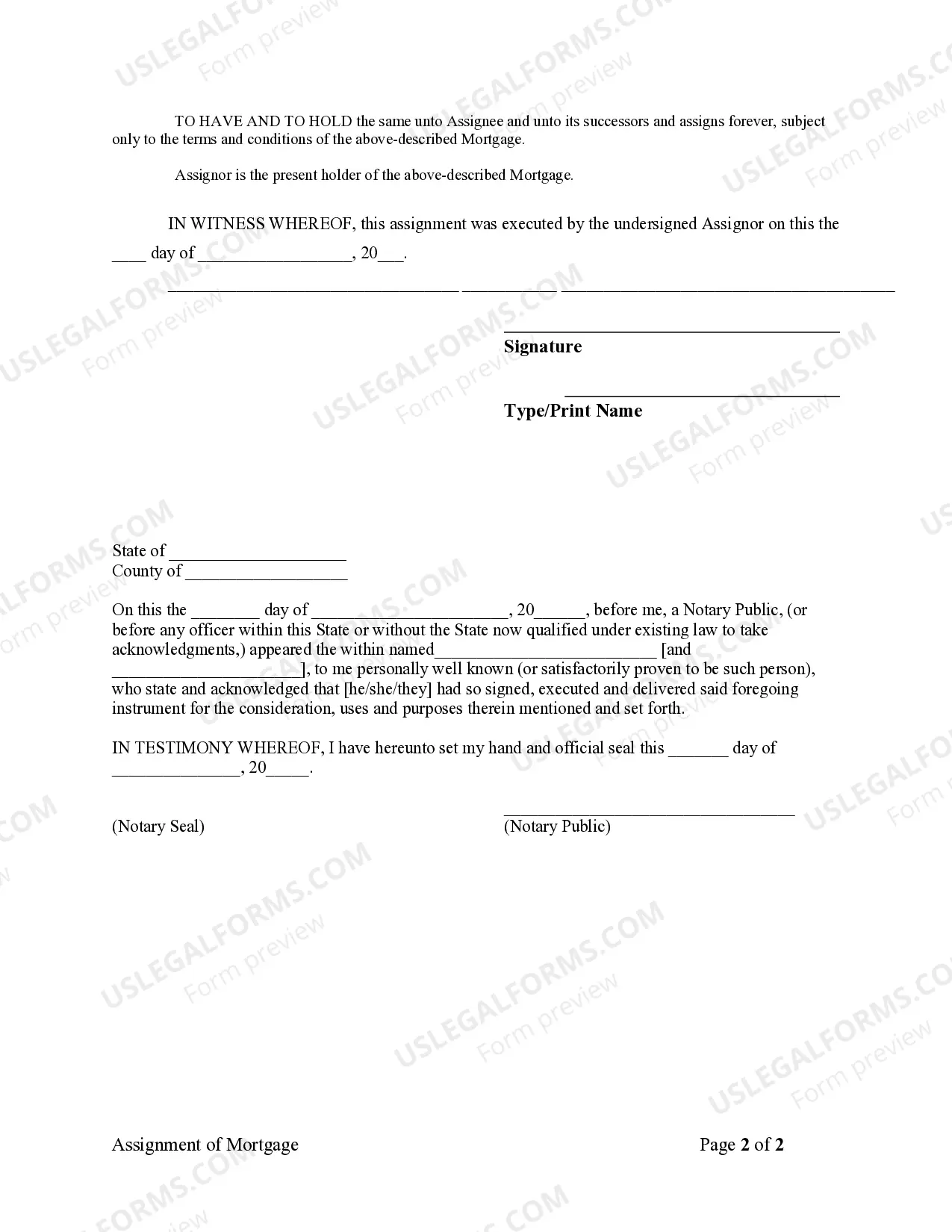

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder is a legal document that involves the transfer of a mortgage from one individual mortgage holder to another in Little Rock, Arkansas. The assignment typically occurs when the original mortgage holder wants to transfer their rights and interests in the mortgage to another party. The Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder is beneficial for both the transferring and receiving parties. The original mortgage holder may want to assign the mortgage due to various reasons such as financial constraints, investment opportunities, or personal circumstances. By assigning the mortgage, they can transfer their obligations, responsibilities, and rights to the new mortgage holder. The assignment of mortgage process in Little Rock, Arkansas, involves several essential steps. Firstly, the original mortgage holder and the assignee need to enter into a legally binding agreement, laying out the terms and conditions of the assignment. This agreement outlines the transfer of the mortgage and any associated rights, interests, or claims. At this stage, it is crucial to ensure that the agreement complies with Arkansas state laws. Once the agreement is in place, it is necessary to file the Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder with the appropriate county recorder's office. This step is crucial as it creates a public record of the assignment, ensuring that it is binding on all parties involved and any subsequent purchasers or interested parties. There are a few different types of Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder: 1. Assignment of Mortgage with Full Recourse: This type of assignment holds the original mortgage holder liable for the repayment of the mortgage if the assignee fails to fulfill their obligations. 2. Assignment of Mortgage without Recourse: With this type of assignment, the assignee becomes solely responsible for fulfilling the terms of the mortgage, and the original mortgage holder is released from any further liability. 3. Assignment of Mortgage with Assumption: In this case, the assignee takes over the mortgage, assuming all the original mortgage holder's obligations and liabilities. It is important to note that the specific terms, conditions, and types of Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder can vary depending on the agreement reached between the parties involved. Therefore, seeking legal advice during the assignment process is recommended to ensure compliance with Arkansas state laws and the protection of both parties' interests.Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder is a legal document that involves the transfer of a mortgage from one individual mortgage holder to another in Little Rock, Arkansas. The assignment typically occurs when the original mortgage holder wants to transfer their rights and interests in the mortgage to another party. The Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder is beneficial for both the transferring and receiving parties. The original mortgage holder may want to assign the mortgage due to various reasons such as financial constraints, investment opportunities, or personal circumstances. By assigning the mortgage, they can transfer their obligations, responsibilities, and rights to the new mortgage holder. The assignment of mortgage process in Little Rock, Arkansas, involves several essential steps. Firstly, the original mortgage holder and the assignee need to enter into a legally binding agreement, laying out the terms and conditions of the assignment. This agreement outlines the transfer of the mortgage and any associated rights, interests, or claims. At this stage, it is crucial to ensure that the agreement complies with Arkansas state laws. Once the agreement is in place, it is necessary to file the Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder with the appropriate county recorder's office. This step is crucial as it creates a public record of the assignment, ensuring that it is binding on all parties involved and any subsequent purchasers or interested parties. There are a few different types of Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder: 1. Assignment of Mortgage with Full Recourse: This type of assignment holds the original mortgage holder liable for the repayment of the mortgage if the assignee fails to fulfill their obligations. 2. Assignment of Mortgage without Recourse: With this type of assignment, the assignee becomes solely responsible for fulfilling the terms of the mortgage, and the original mortgage holder is released from any further liability. 3. Assignment of Mortgage with Assumption: In this case, the assignee takes over the mortgage, assuming all the original mortgage holder's obligations and liabilities. It is important to note that the specific terms, conditions, and types of Little Rock Arkansas Assignment of Mortgage by Individual Mortgage Holder can vary depending on the agreement reached between the parties involved. Therefore, seeking legal advice during the assignment process is recommended to ensure compliance with Arkansas state laws and the protection of both parties' interests.