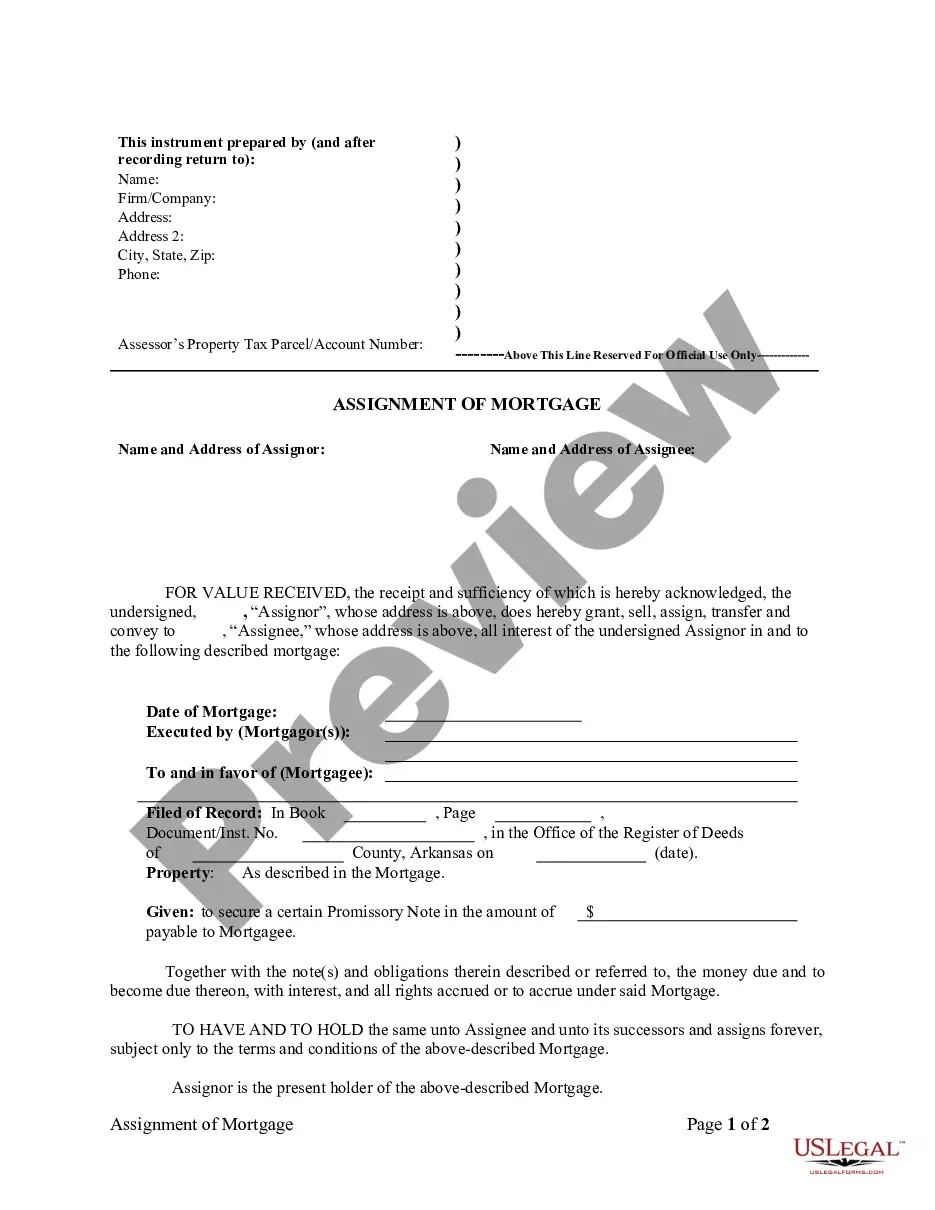

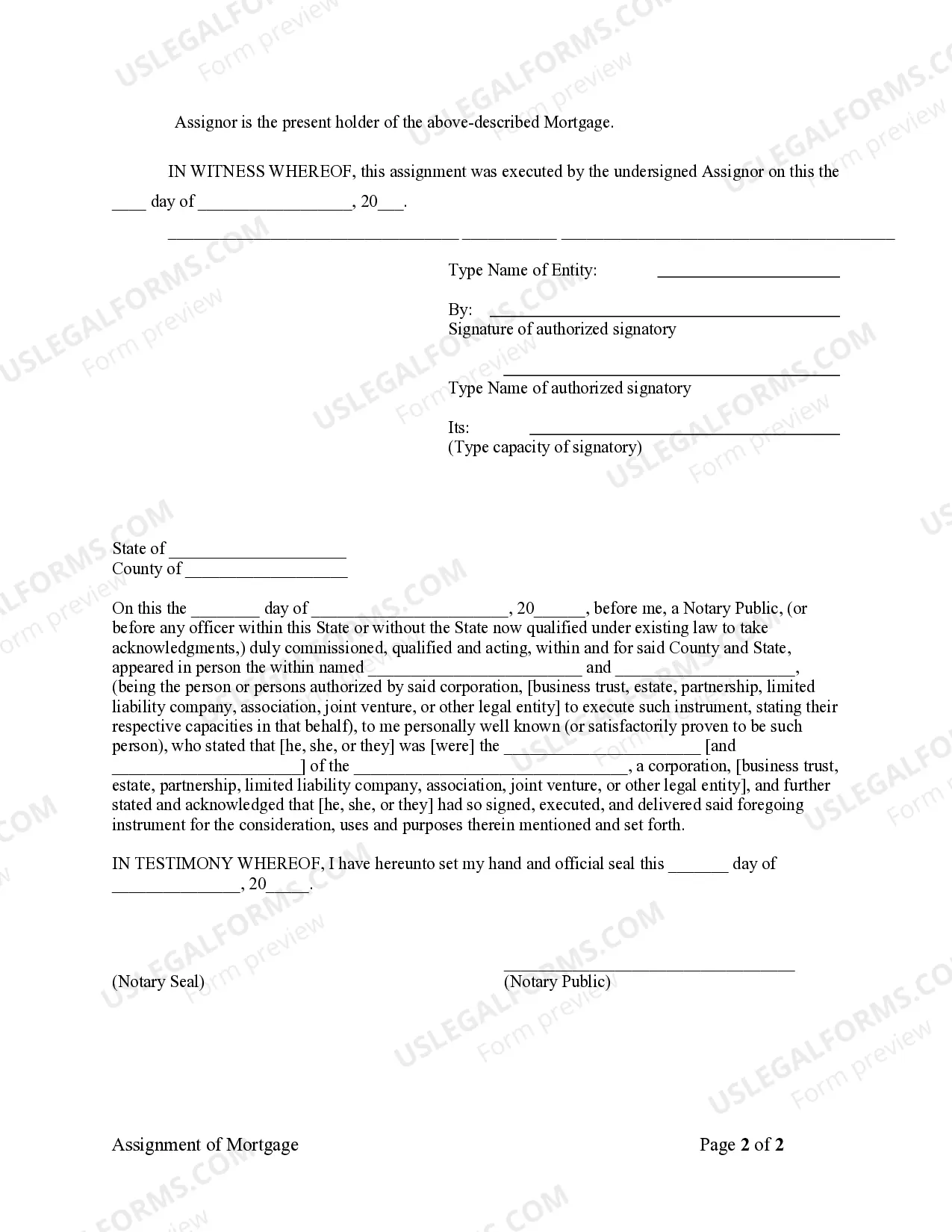

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder is a legal document that transfers the ownership of a mortgage from one corporate mortgage holder to another party within the Little Rock, Arkansas area. This process typically occurs when the original mortgage lender sells its rights to a different entity or company. In this assignment, the original corporate mortgage holder, often a bank or lending institution, becomes the assignor, while the new entity acquiring the mortgage rights becomes the assignee. This document outlines the terms of the assignment, including the mortgage details, property information, and parties involved. The Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder serves as crucial evidence of the transfer of interest in the mortgage. It formalizes the new entity's legal rights and obligations as the new mortgage holder within Little Rock, Arkansas. There are different types of Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder based on the circumstances under which the transfer occurs. Some common types include: 1. Voluntary Assignment: This type occurs when the original corporate mortgage holder willingly transfers its rights and obligations to another entity. This may happen when the original lender wants to free up capital or restructure its loan portfolio. 2. Involuntary Assignment: In rare cases, where the corporate mortgage holder faces bankruptcy, foreclosure, or liquidation, the assignment may happen involuntarily. In such situations, the mortgage rights are assigned as part of legal proceedings or to recover debts. 3. Partial Assignment: Sometimes, a corporate mortgage holder might choose to assign only a portion of the mortgage to another entity. A partial assignment specifies which part of the mortgage is being transferred, preserving the original lender's rights for the remaining portion. 4. Assignment with Recourse: This type of assignment holds the original corporate mortgage holder responsible if the assignee fails to fulfill the obligations associated with the mortgage. It provides legal recourse for the assignee in case of default. 5. Assignment without Recourse: In this type of assignment, the original corporate mortgage holder relinquishes any responsibility or liability for the mortgage after the transfer. The assignee accepts full liability for the mortgage and its obligations. Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder is a vital legal process that ensures transparency, records the transfer, and protects the rights of all parties involved. It ensures a smooth transition of mortgage ownership and allows the new entity to exercise the rights and responsibilities associated with the mortgage within the Little Rock, Arkansas area.Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder is a legal document that transfers the ownership of a mortgage from one corporate mortgage holder to another party within the Little Rock, Arkansas area. This process typically occurs when the original mortgage lender sells its rights to a different entity or company. In this assignment, the original corporate mortgage holder, often a bank or lending institution, becomes the assignor, while the new entity acquiring the mortgage rights becomes the assignee. This document outlines the terms of the assignment, including the mortgage details, property information, and parties involved. The Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder serves as crucial evidence of the transfer of interest in the mortgage. It formalizes the new entity's legal rights and obligations as the new mortgage holder within Little Rock, Arkansas. There are different types of Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder based on the circumstances under which the transfer occurs. Some common types include: 1. Voluntary Assignment: This type occurs when the original corporate mortgage holder willingly transfers its rights and obligations to another entity. This may happen when the original lender wants to free up capital or restructure its loan portfolio. 2. Involuntary Assignment: In rare cases, where the corporate mortgage holder faces bankruptcy, foreclosure, or liquidation, the assignment may happen involuntarily. In such situations, the mortgage rights are assigned as part of legal proceedings or to recover debts. 3. Partial Assignment: Sometimes, a corporate mortgage holder might choose to assign only a portion of the mortgage to another entity. A partial assignment specifies which part of the mortgage is being transferred, preserving the original lender's rights for the remaining portion. 4. Assignment with Recourse: This type of assignment holds the original corporate mortgage holder responsible if the assignee fails to fulfill the obligations associated with the mortgage. It provides legal recourse for the assignee in case of default. 5. Assignment without Recourse: In this type of assignment, the original corporate mortgage holder relinquishes any responsibility or liability for the mortgage after the transfer. The assignee accepts full liability for the mortgage and its obligations. Little Rock Arkansas Assignment of Mortgage by Corporate Mortgage Holder is a vital legal process that ensures transparency, records the transfer, and protects the rights of all parties involved. It ensures a smooth transition of mortgage ownership and allows the new entity to exercise the rights and responsibilities associated with the mortgage within the Little Rock, Arkansas area.