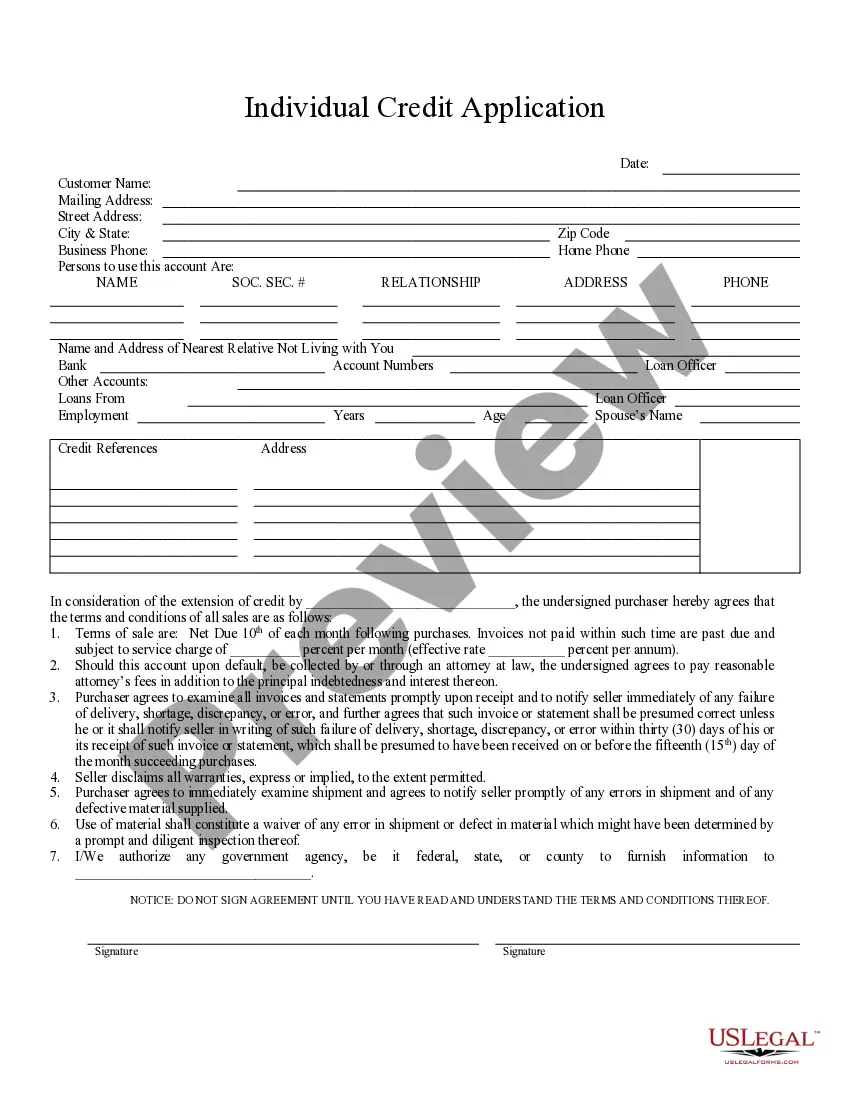

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Little Rock Arkansas Individual Credit Application is a financial document that individuals in Little Rock, Arkansas can use when applying for credit or loans from various financial institutions and lenders. This application helps gather crucial information to assess an individual's creditworthiness and eligibility for obtaining credit. The Little Rock Arkansas Individual Credit Application typically requires applicants to provide their personal details, including full name, address, contact information, Social Security number, and date of birth. This information helps lenders verify the applicant's identity and establish their residency in Little Rock. Furthermore, the application may require applicants to disclose their employment information, such as current and previous employers, job title, length of employment, and monthly income. This allows lenders to assess the applicant's financial stability and ability to repay the credit. Applicants may also need to provide information regarding their financial obligations, including existing loans, mortgages, credit card debt, and other outstanding financial liabilities. This assists lenders in evaluating the applicant's existing financial commitments and their capacity to take on additional credit. Additionally, the Little Rock Arkansas Individual Credit Application may inquire about an applicant's banking details. This may include the name of their bank, account number, and length of the banking relationship. These details help lenders understand the applicant's financial history, banking activity, and overall financial discipline. It is important to note that there might be different types of Little Rock Arkansas Individual Credit Applications available, depending on the specific financial institution or lender. These variations could include applications for personal loans, mortgages, credit cards, auto loans, or other types of credit products available to individuals in Little Rock, Arkansas. Using keywords to further enhance the content: Little Rock Arkansas, individual credit application, financial document, creditworthiness, eligibility, loans, lenders, personal details, full name, address, contact information, Social Security number, date of birth, identity verification, residency, employment information, current employer, previous employers, job title, length of employment, monthly income, financial stability, repayment capability, financial obligations, existing loans, mortgages, credit card debt, outstanding liabilities, financial commitments, banking details, bank name, account number, banking relationship, financial history, banking activity, contracts, personal loans, mortgages, credit cards, auto loans, credit products.