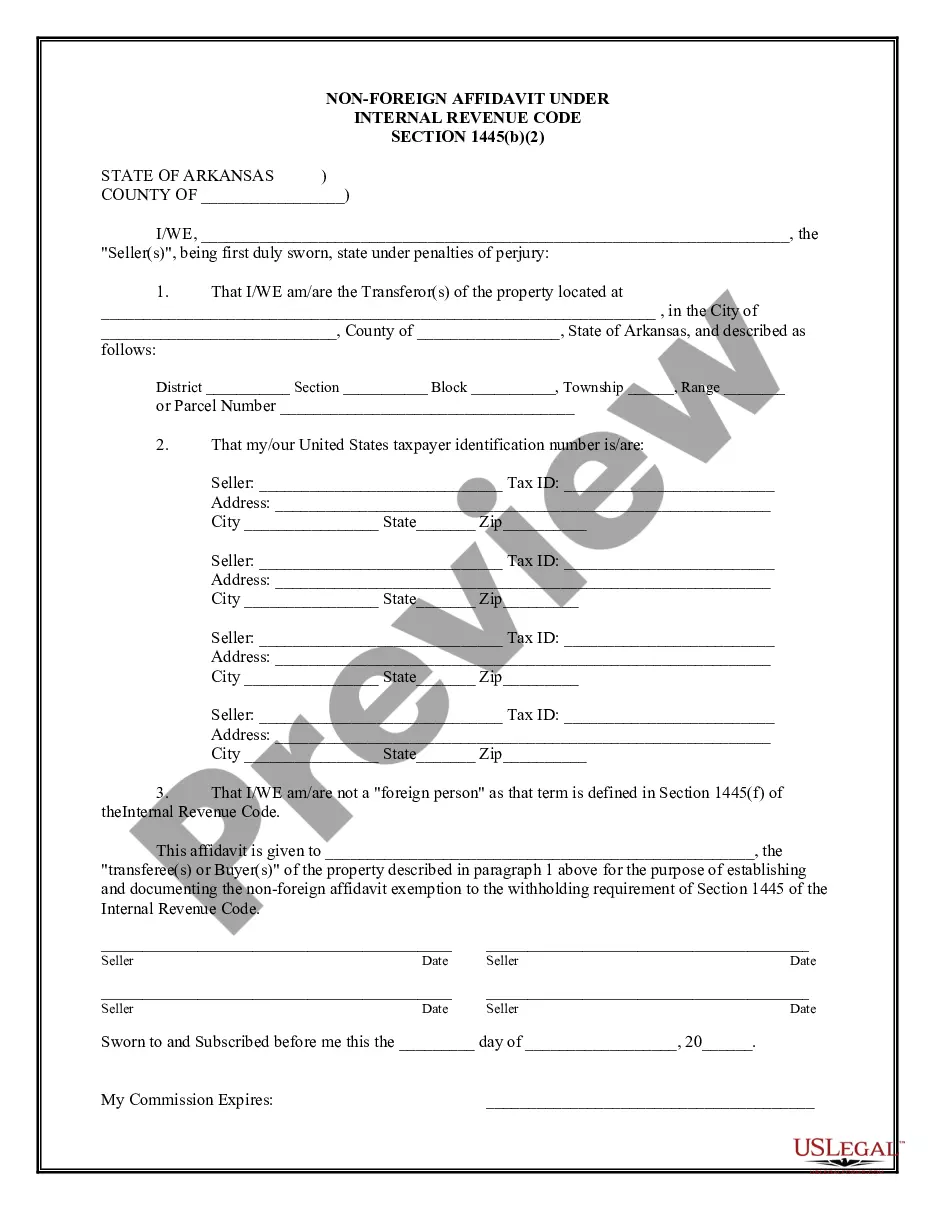

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Little Rock Arkansas Non-Foreign Affidavit Under IRC 1445 is an important document that is used for real estate transactions involving non-resident aliens in Little Rock, Arkansas. It is required by the Internal Revenue Code (IRC) section 1445 to ensure compliance with federal tax laws. This affidavit is specifically used when the seller of a property is a non-resident alien and the buyer is acquiring the property through a withholding agent, such as a title company or escrow agent. The purpose of the Little Rock Arkansas Non-Foreign Affidavit Under IRC 1445 is to confirm the seller's non-foreign status, which means they are not considered a U.S. citizen, lawful permanent resident, or resident of the United States for tax purposes. By providing this affidavit, the seller assures that they have met their tax obligations and are exempt from or subject to a reduced rate of withholding tax on the sale of their property. There are several types of Little Rock Arkansas Non-Foreign Affidavit Under IRC 1445, depending on the specific circumstances of the transaction: 1. Little Rock Arkansas Non-Foreign Affidavit Under IRC 1445 (Withholding Certification): This type of affidavit is used when the seller has obtained a withholding certificate from the IRS, which states that they are exempt from or subject to a reduced rate of withholding tax. 2. Little Rock Arkansas Non-Foreign Affidavit Under IRC 1445 (Non-Foreign Status Confirmation): This type of affidavit is used when the seller does not have a withholding certificate but can confirm their non-foreign status through other means, such as proof of residency or tax returns from their home country. 3. Little Rock Arkansas Non-Foreign Affidavit Under IRC 1445 (Seller's Declaration of Non-Foreign Status): This type of affidavit is used when the seller is unable to provide any official documentation but can declare under penalty of perjury that they are a non-resident alien. It is crucial for the buyer and the withholding agent to obtain the appropriate affidavit based on the seller's circumstances. Failure to comply with the withholding requirements under IRC 1445 could result in legal and financial consequences for all parties involved in the real estate transaction. Overall, the Little Rock Arkansas Non-Foreign Affidavit Under IRC 1445 plays a critical role in ensuring tax compliance and facilitating smooth real estate transactions involving non-resident aliens in Little Rock, Arkansas.