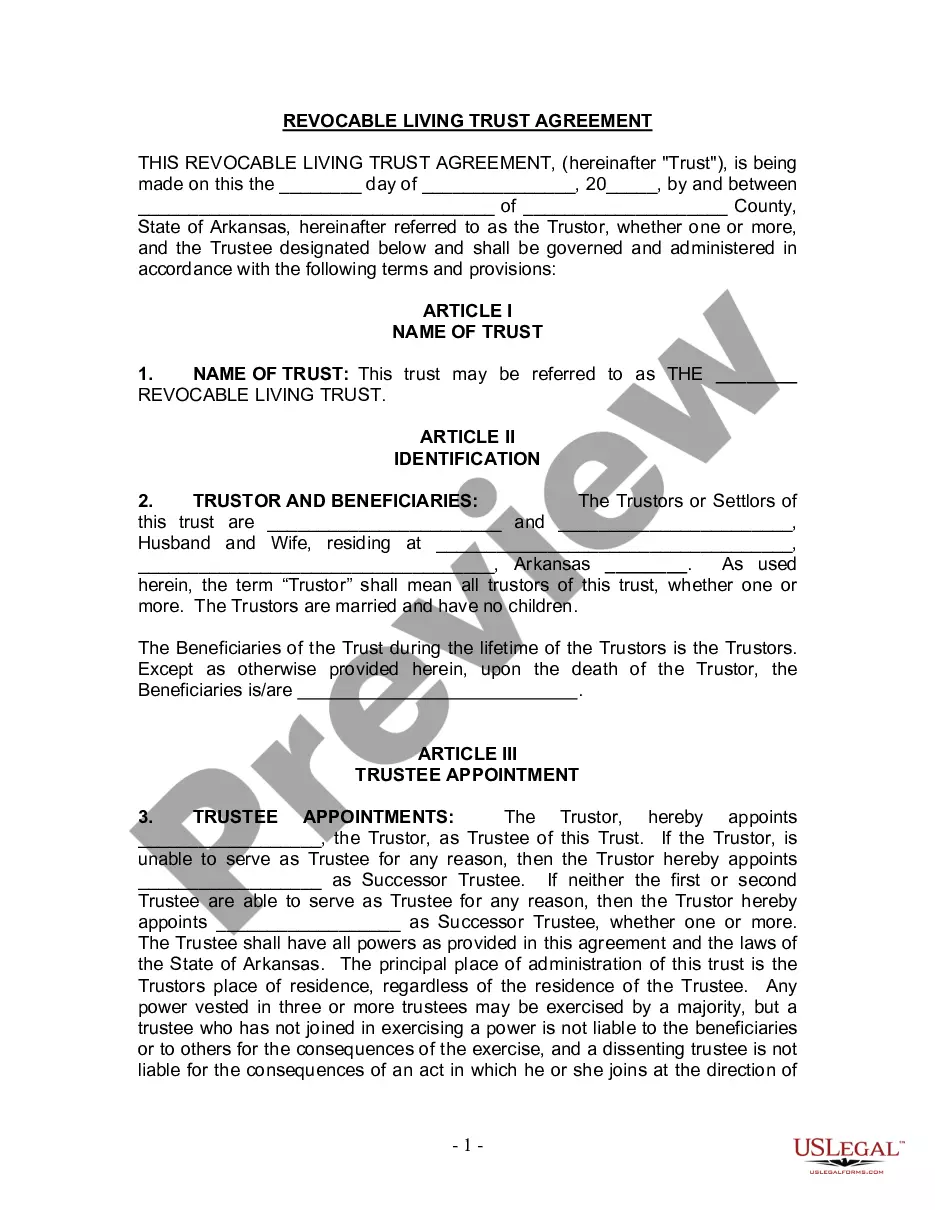

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Little Rock Arkansas Living Trust for Husband and Wife with No Children

Description

How to fill out Arkansas Living Trust For Husband And Wife With No Children?

Take advantage of the US Legal Forms and obtain immediate access to any template you desire.

Our beneficial website, which offers a vast array of templates, simplifies the process of locating and acquiring nearly any document sample you need.

You can save, complete, and sign the Little Rock Arkansas Living Trust for Spouses with No Offspring in just a few minutes instead of spending hours online searching for a suitable template.

Utilizing our catalog is an excellent method to enhance the security of your form submissions. Our knowledgeable attorneys routinely review all documents to ensure that the forms are applicable for a specific state and adhere to new laws and regulations.

If you have not yet created an account, follow the steps below.

Open the page with the document you require. Verify that it is the correct form: check its title and description, and use the Preview feature if it’s available. If not, utilize the Search field to find the suitable one.

- How can you obtain the Little Rock Arkansas Living Trust for Husband and Wife with No Children.

- If you are already subscribed, simply Log In to your account. The Download button will be visible on all the templates you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

To avoid probate in Arkansas, consider establishing a revocable living trust, gifting assets, and designating beneficiaries for financial accounts. Implementing these strategies ensures that your assets transfer directly to your loved ones without the need for court proceedings. A Little Rock Arkansas Living Trust for Husband and Wife with No Children can effectively streamline this process, allowing you to focus on what truly matters in life.

Yes, a properly funded trust can avoid probate in Arkansas. By placing your assets into a revocable living trust, you eliminate the need for probate court involvement after your death. This enables your spouse to gain access to the assets quickly and without unnecessary legal delays, making a Little Rock Arkansas Living Trust for Husband and Wife with No Children a wise choice.

In Arkansas, there is no minimum estate value for probate, but estates valued at less than $100,000 may qualify for a simplified process. This can lead to a faster resolution, but it still involves some level of legal oversight. Establishing a Little Rock Arkansas Living Trust for Husband and Wife with No Children can help you avoid even this simplified probate path, ensuring a swift transition of assets.

The best type of trust to avoid probate in Arkansas is a revocable living trust. This trust allows you to maintain control over your assets during your lifetime, while also facilitating a smooth transfer to your spouse upon your passing. By setting up a Little Rock Arkansas Living Trust for Husband and Wife with No Children, you can effectively minimize the complexities of probate and ensure your wishes are met.

In Arkansas, certain assets are exempt from probate, including life insurance policies with a named beneficiary, retirement accounts, and assets held in a joint ownership arrangement. These exemptions significantly simplify the estate settlement process. A Little Rock Arkansas Living Trust for Husband and Wife with No Children can help ensure that your assets bypass probate, providing you and your spouse with peace of mind.

After a spouse passes away, the trust typically becomes irrevocable, and the assets are managed according to the trust's terms. The surviving spouse generally continues to receive benefits from the trust while following the outlined instructions. This process highlights the importance of a well-structured Little Rock Arkansas Living Trust for Husband and Wife with No Children, which can provide clarity and ease during a challenging time.

A spousal trust is designed to benefit a spouse by providing financial security and control over trust assets. This type of trust can help manage funds and provide for the surviving spouse's needs without the complications of probate. For couples creating a Little Rock Arkansas Living Trust for Husband and Wife with No Children, a spousal trust simplifies estate management during a period of grief.

The term 'surviving spouse' refers to the partner who remains alive after the death of their spouse. This individual inherits the deceased spouse's assets and may be responsible for managing the estate. Understanding this concept is vital for anyone considering a Little Rock Arkansas Living Trust for Husband and Wife with No Children, as it impacts how assets are handled after one spouse's death.

A survivor's trust protects assets for the surviving spouse after one partner passes away. This trust allows the surviving spouse to manage and use the assets without facing unnecessary legal complications. In the context of a Little Rock Arkansas Living Trust for Husband and Wife with No Children, it ensures that the surviving spouse retains control over their shared estate.

Setting up a trust like the Little Rock Arkansas Living Trust for Husband and Wife with No Children can come with various pitfalls. One significant issue is improperly funded trusts, which occur when assets are not transferred into the trust. Additionally, individuals may overlook tax implications or fail to consider how changes in family dynamics can affect the trust’s relevance. It's essential to work with a reliable platform like uslegalforms to navigate these challenges effectively.