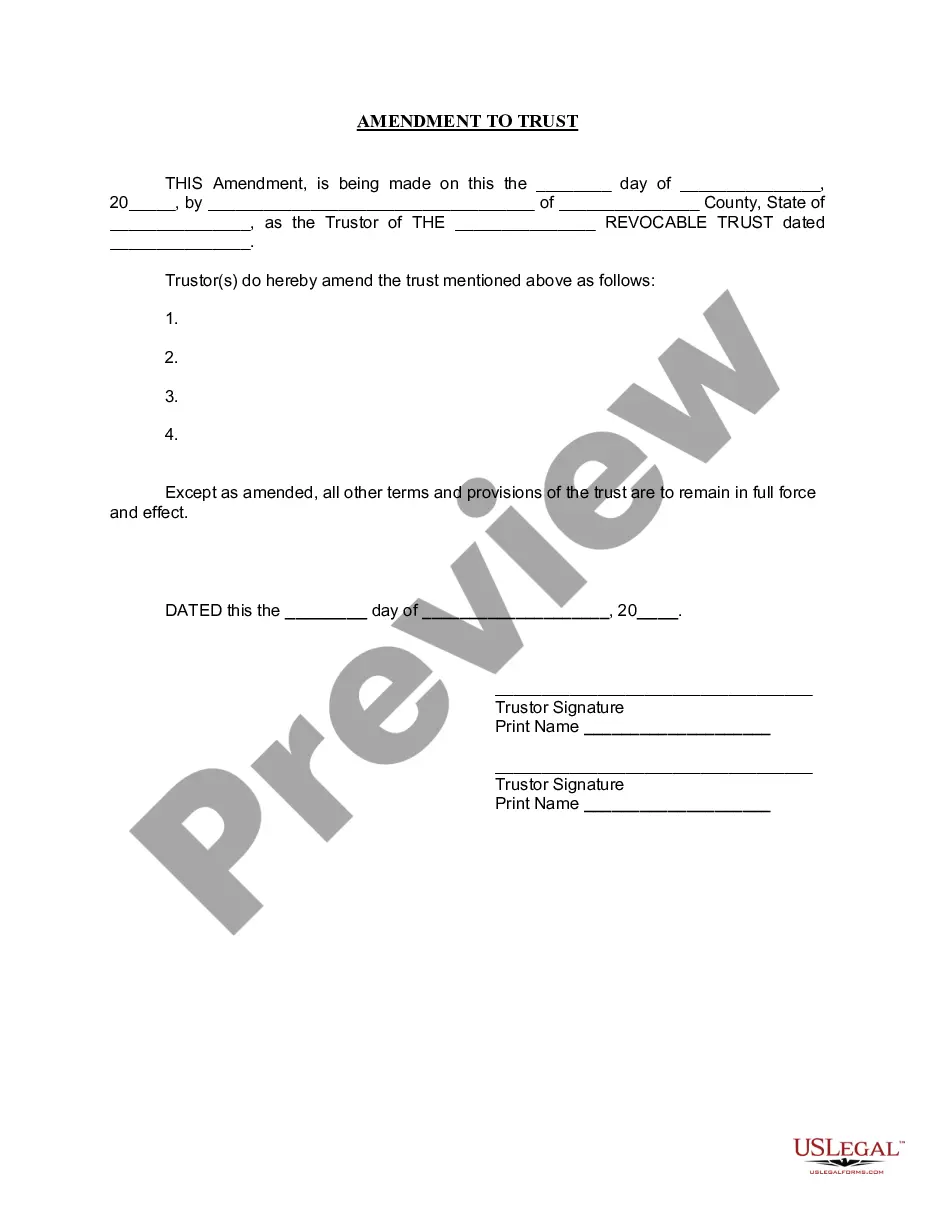

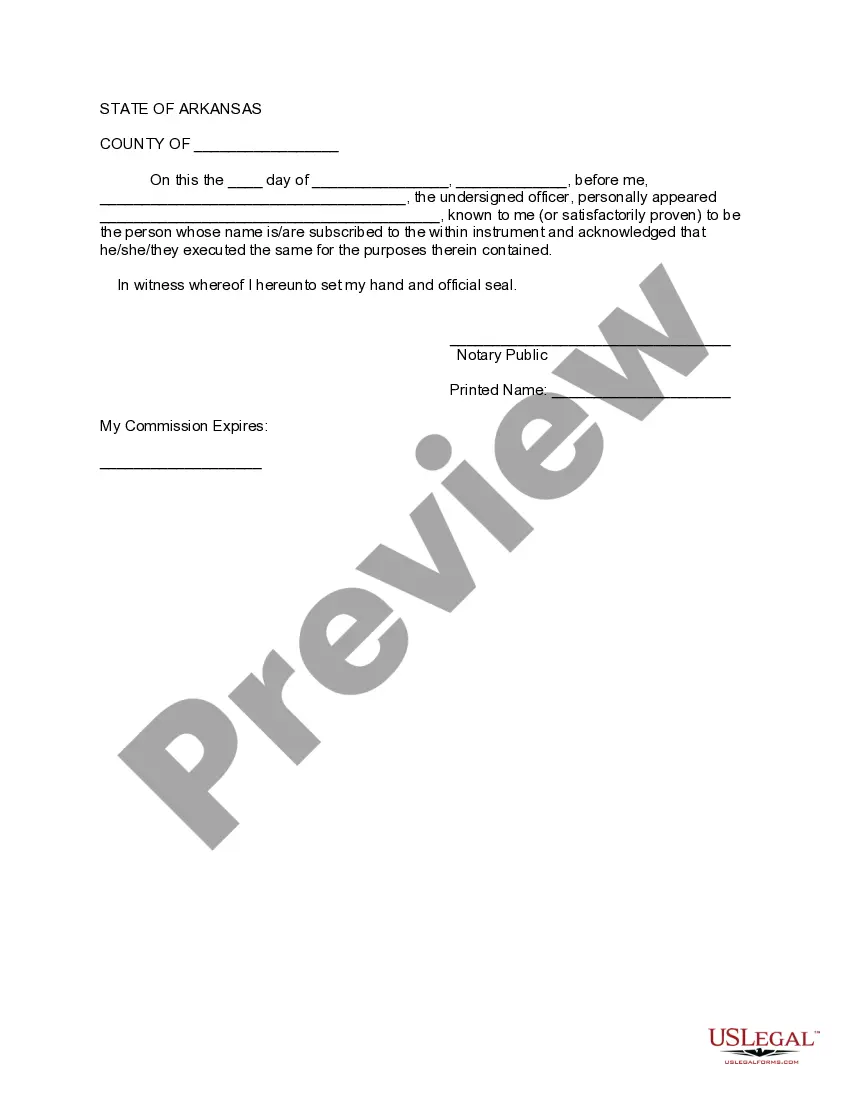

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

A Little Rock Arkansas Amendment to Living Trust is a legal document used for making changes or revisions to an existing living trust in Little Rock, Arkansas. It provides a way for the trust or (person who created the trust) to modify certain provisions or add new instructions to the trust without having to create an entirely new trust document. The amendment is an important tool to ensure that the trust aligns with the trust or's current wishes, addresses any changes in personal or financial circumstances, and reflects any changes in applicable laws in Little Rock, Arkansas. By utilizing a trust amendment, the trust or can easily adjust and update their trust without the need for extensive legal processes. Some common types of Little Rock Arkansas Amendments to Living Trust include: 1. Revocable Living Trust Amendment: This type of amendment enables the trust or to make changes to the trust while maintaining the trust's revocable nature. It allows for modifications such as updating beneficiaries, changing successor trustees, altering distribution instructions, or adding new assets to the trust. 2. Irrevocable Living Trust Amendment: An irrevocable trust, as the name suggests, is more rigid and typically cannot be changed once established. However, under certain circumstances, an irrevocable living trust can be amended if the trust document includes specific provisions or if state laws permit it. This type of amendment requires careful consideration and legal guidance. 3. Asset Specific Amendment: In some cases, a trust or may wish to amend a living trust to include specific assets not previously included. This amendment allows for the inclusion of these assets into the trust, along with any necessary instructions regarding their management, distribution, or disposition. 4. Administrative Amendment: Administrative amendments are typically minor changes to the living trust that do not impact substantial provisions or instructions. They may involve correcting typographical errors, updating contact information of trustees or beneficiaries, or adding additional administrative details. It is crucial to consult with an experienced attorney specializing in estate planning and trust administration in Little Rock, Arkansas, when considering an amendment to a living trust. This ensures that all legal requirements are met, the document accurately reflects the trust or's intentions, and the amendment is valid under Arkansas law.A Little Rock Arkansas Amendment to Living Trust is a legal document used for making changes or revisions to an existing living trust in Little Rock, Arkansas. It provides a way for the trust or (person who created the trust) to modify certain provisions or add new instructions to the trust without having to create an entirely new trust document. The amendment is an important tool to ensure that the trust aligns with the trust or's current wishes, addresses any changes in personal or financial circumstances, and reflects any changes in applicable laws in Little Rock, Arkansas. By utilizing a trust amendment, the trust or can easily adjust and update their trust without the need for extensive legal processes. Some common types of Little Rock Arkansas Amendments to Living Trust include: 1. Revocable Living Trust Amendment: This type of amendment enables the trust or to make changes to the trust while maintaining the trust's revocable nature. It allows for modifications such as updating beneficiaries, changing successor trustees, altering distribution instructions, or adding new assets to the trust. 2. Irrevocable Living Trust Amendment: An irrevocable trust, as the name suggests, is more rigid and typically cannot be changed once established. However, under certain circumstances, an irrevocable living trust can be amended if the trust document includes specific provisions or if state laws permit it. This type of amendment requires careful consideration and legal guidance. 3. Asset Specific Amendment: In some cases, a trust or may wish to amend a living trust to include specific assets not previously included. This amendment allows for the inclusion of these assets into the trust, along with any necessary instructions regarding their management, distribution, or disposition. 4. Administrative Amendment: Administrative amendments are typically minor changes to the living trust that do not impact substantial provisions or instructions. They may involve correcting typographical errors, updating contact information of trustees or beneficiaries, or adding additional administrative details. It is crucial to consult with an experienced attorney specializing in estate planning and trust administration in Little Rock, Arkansas, when considering an amendment to a living trust. This ensures that all legal requirements are met, the document accurately reflects the trust or's intentions, and the amendment is valid under Arkansas law.