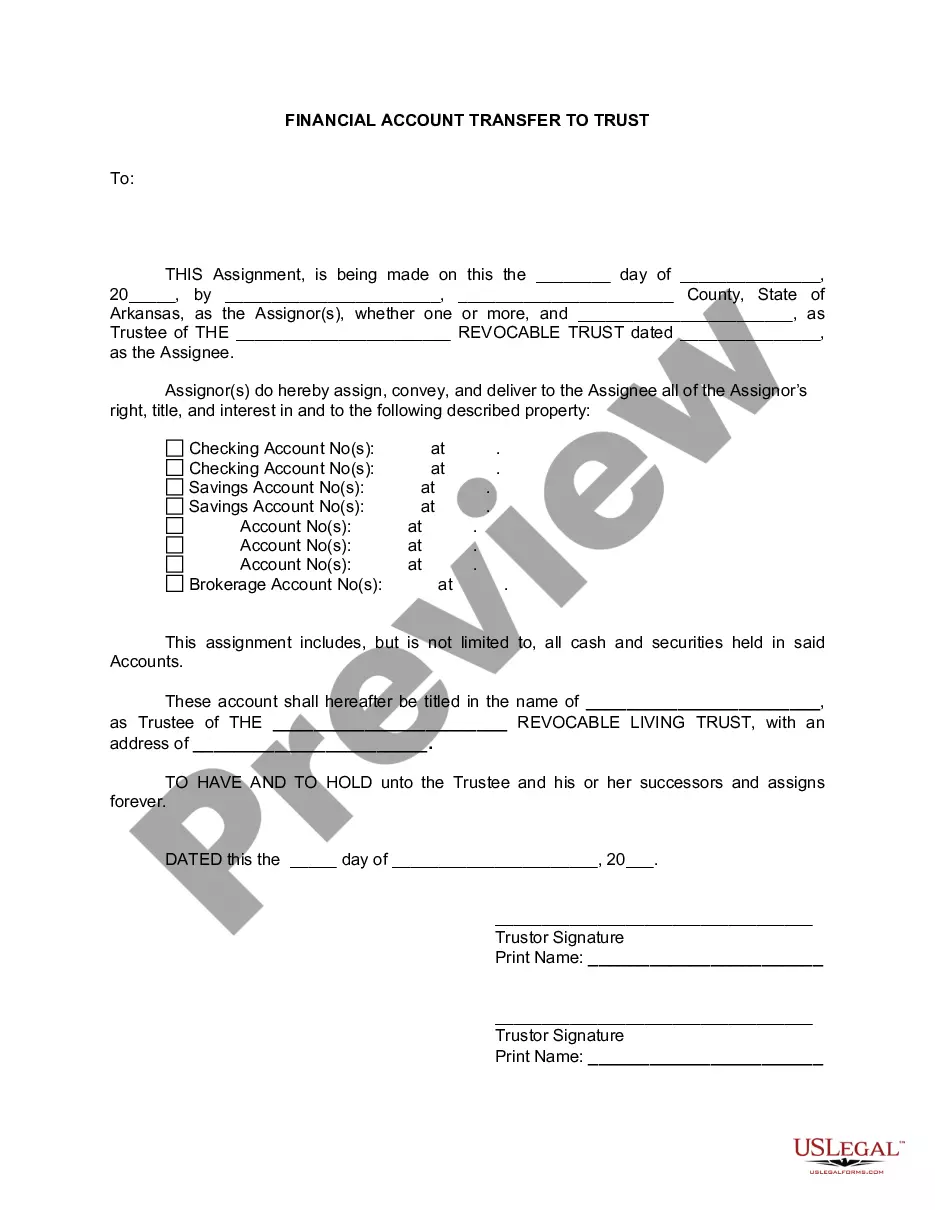

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Little Rock Arkansas Financial Account Transfer to Living Trust: A Comprehensive Overview Keywords: Little Rock Arkansas, financial account transfer, living trust, estate planning, probate, testamentary trust, revocable living trust, irrevocable living trust, trust administration. Introduction: Transferring financial accounts to a living trust in Little Rock, Arkansas is a crucial aspect of estate planning. By taking this step, individuals can ensure the smooth transfer of their financial assets to their beneficiaries while avoiding probate. This detailed description will explore the concept and process of Little Rock Arkansas Financial Account Transfer to Living Trust, discussing different types of living trusts and their crucial features. 1. Understanding Financial Account Transfer to a Living Trust: Transferring financial accounts to a living trust involves re-titling assets held in an individual's name into the name of the trust. This action helps to establish the trust as the legal owner of the assets, allowing for efficient management and distribution upon the individual's incapacity or death. 2. Benefits of Transferring Financial Accounts to a Living Trust: 2.1. Avoidance of Probate: Probate can be a lengthy and costly process, and transferring accounts to a living trust bypasses probate, ensuring a quicker distribution of assets. 2.2. Privacy: Unlike the public nature of probate, a living trust maintains confidentiality as it does not involve court proceedings. This can be especially desirable for those who wish to keep their financial matters private. 2.3. Incapacity Planning: A living trust also protects and manages assets in the event of incapacitation, ensuring a designated trustee can step in to handle financial matters. 3. Little Rock Arkansas Financial Account Transfers: Types of Living Trusts: 3.1. Revocable Living Trust: One of the most common types, a revocable living trust allows individuals to maintain control over their assets during their lifetime and make amendments or revoke the trust if necessary. 3.2. Testamentary Trust: This type of trust is established under a will and only comes into effect upon the individual's death. It enables the transfer of financial accounts to a trust for the benefit of named beneficiaries and may also address specific requirements laid out in the individual's will. 3.3. Irrevocable Living Trust: Unlike a revocable trust, once established, an irrevocable living trust cannot be altered or revoked without the consent of the beneficiaries. This trust type provides added asset protection and potential tax advantages, making it suitable for specific estate planning goals. 4. The Process of Financial Account Transfer to a Living Trust in Little Rock Arkansas: 4.1. Establishing the Living Trust: Engaging an attorney experienced in estate planning, individuals can create a living trust document that outlines their wishes and designates a trustee. 4.2. Re-titling Financial Accounts: After establishing the living trust, individuals need to transfer ownership of their financial accounts, such as bank accounts, investments, and retirement funds, to the trust by re-titling them or designating the trust as the beneficiary. 4.3. Updating Beneficiary Designations: It's essential to review and update beneficiary designations on life insurance policies and any other assets that pass outside the trust to align them with the estate plan. 4.4. Seek Professional Assistance: Given the complexities of the process, it is advisable to seek the guidance of an attorney or financial advisor well-versed in trust administration to ensure compliance with legal requirements. Conclusion: A Little Rock Arkansas Financial Account Transfer to a Living Trust is a prudent step towards effective estate planning, allowing individuals to retain control of their financial accounts during their lifetime while ensuring smooth asset management and distribution upon their passing. Understanding the different types of living trusts and seeking appropriate professional guidance can facilitate a well-structured financial account transfer process.Little Rock Arkansas Financial Account Transfer to Living Trust: A Comprehensive Overview Keywords: Little Rock Arkansas, financial account transfer, living trust, estate planning, probate, testamentary trust, revocable living trust, irrevocable living trust, trust administration. Introduction: Transferring financial accounts to a living trust in Little Rock, Arkansas is a crucial aspect of estate planning. By taking this step, individuals can ensure the smooth transfer of their financial assets to their beneficiaries while avoiding probate. This detailed description will explore the concept and process of Little Rock Arkansas Financial Account Transfer to Living Trust, discussing different types of living trusts and their crucial features. 1. Understanding Financial Account Transfer to a Living Trust: Transferring financial accounts to a living trust involves re-titling assets held in an individual's name into the name of the trust. This action helps to establish the trust as the legal owner of the assets, allowing for efficient management and distribution upon the individual's incapacity or death. 2. Benefits of Transferring Financial Accounts to a Living Trust: 2.1. Avoidance of Probate: Probate can be a lengthy and costly process, and transferring accounts to a living trust bypasses probate, ensuring a quicker distribution of assets. 2.2. Privacy: Unlike the public nature of probate, a living trust maintains confidentiality as it does not involve court proceedings. This can be especially desirable for those who wish to keep their financial matters private. 2.3. Incapacity Planning: A living trust also protects and manages assets in the event of incapacitation, ensuring a designated trustee can step in to handle financial matters. 3. Little Rock Arkansas Financial Account Transfers: Types of Living Trusts: 3.1. Revocable Living Trust: One of the most common types, a revocable living trust allows individuals to maintain control over their assets during their lifetime and make amendments or revoke the trust if necessary. 3.2. Testamentary Trust: This type of trust is established under a will and only comes into effect upon the individual's death. It enables the transfer of financial accounts to a trust for the benefit of named beneficiaries and may also address specific requirements laid out in the individual's will. 3.3. Irrevocable Living Trust: Unlike a revocable trust, once established, an irrevocable living trust cannot be altered or revoked without the consent of the beneficiaries. This trust type provides added asset protection and potential tax advantages, making it suitable for specific estate planning goals. 4. The Process of Financial Account Transfer to a Living Trust in Little Rock Arkansas: 4.1. Establishing the Living Trust: Engaging an attorney experienced in estate planning, individuals can create a living trust document that outlines their wishes and designates a trustee. 4.2. Re-titling Financial Accounts: After establishing the living trust, individuals need to transfer ownership of their financial accounts, such as bank accounts, investments, and retirement funds, to the trust by re-titling them or designating the trust as the beneficiary. 4.3. Updating Beneficiary Designations: It's essential to review and update beneficiary designations on life insurance policies and any other assets that pass outside the trust to align them with the estate plan. 4.4. Seek Professional Assistance: Given the complexities of the process, it is advisable to seek the guidance of an attorney or financial advisor well-versed in trust administration to ensure compliance with legal requirements. Conclusion: A Little Rock Arkansas Financial Account Transfer to a Living Trust is a prudent step towards effective estate planning, allowing individuals to retain control of their financial accounts during their lifetime while ensuring smooth asset management and distribution upon their passing. Understanding the different types of living trusts and seeking appropriate professional guidance can facilitate a well-structured financial account transfer process.