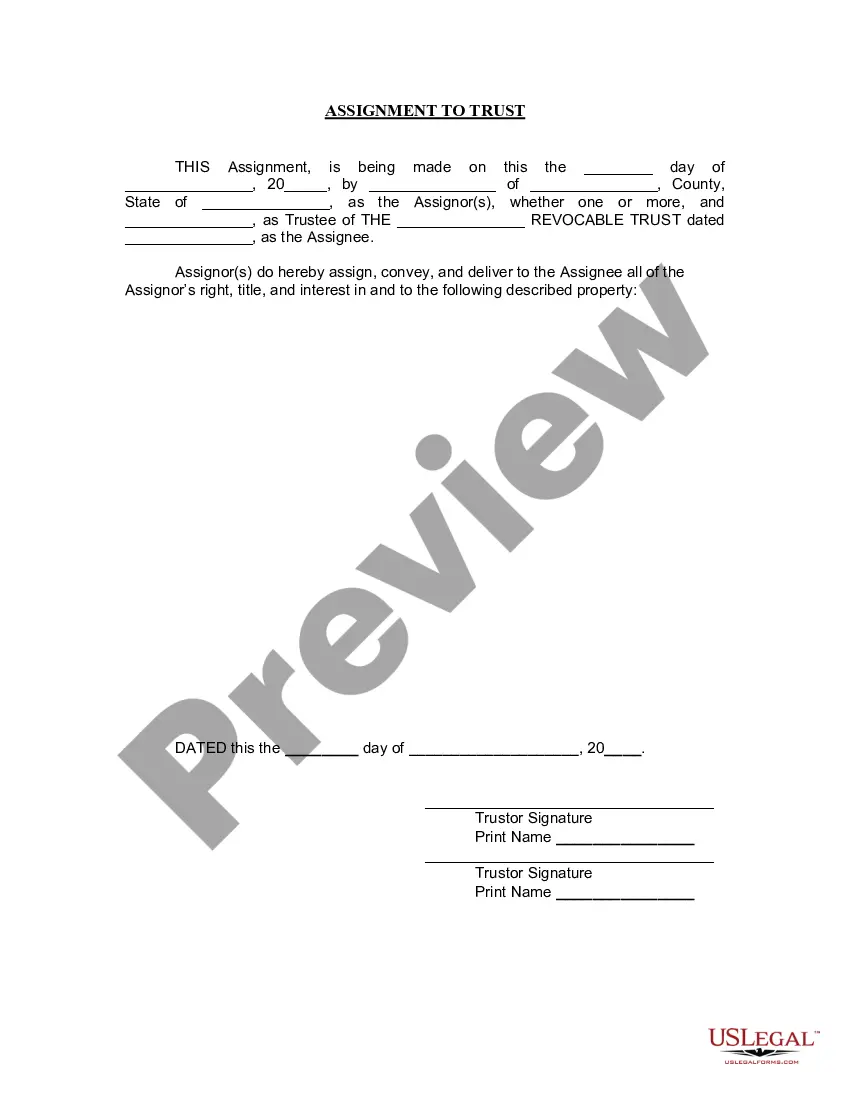

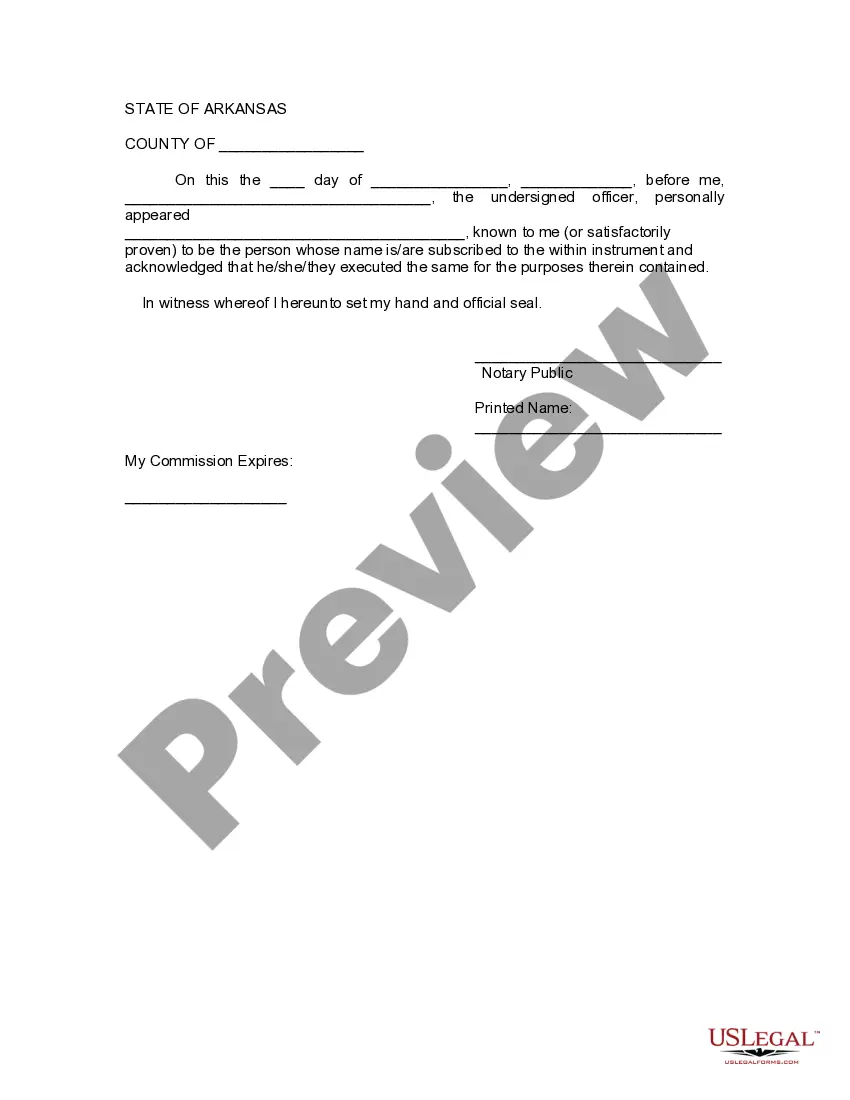

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Little Rock Arkansas Assignment to Living Trust: A Comprehensive Guide on Trust Types and Benefits Introduction: In Little Rock, Arkansas, an Assignment to Living Trust is a widely utilized estate planning tool that provides individuals and families with a secure way to protect their assets and streamline the transfer of property upon death. This detailed description aims to explain the concept of a Little Rock Arkansas Assignment to Living Trust, its different types, and the benefits it offers while incorporating relevant keywords for a comprehensive understanding. 1. What is a Living Trust? A Living Trust, also known as an inter vivos trust, is a legal document that allows an individual (granter) to transfer assets into a trust during their lifetime. The granter names a trustee to manage the assets designated in the trust for the benefit of themselves or others (beneficiaries). 2. Little Rock Arkansas Assignment to Living Trust: In Little Rock, Arkansas, an Assignment to Living Trust involves transferring ownership or assigning assets to a living trust established by an individual. This assignment is crucial as it ensures that the assets assigned are held and managed by the living trust, effectively bypassing the lengthy and costly probate process upon the assignor's death. 3. Types of Living Trusts in Little Rock, Arkansas: a. Revocable Living Trust: A revocable living trust allows the granter to retain control over their assets during their lifetime. The granter can modify or revoke the trust as their circumstances change. Upon the granter's death, assets assigned to the trust are distributed to the beneficiaries as outlined in the trust document. Revocable living trusts are often chosen to avoid probate, maintain privacy, and minimize estate tax burdens. b. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of all beneficiaries. Assets assigned to this trust are considered separate from the granter's estate, thus providing potential tax advantages, creditor protection, and avoiding probate. Irrevocable living trusts are commonly established for Medicaid planning and protecting assets from potential creditors. 4. Benefits of Little Rock Arkansas Assignment to Living Trust: a. Avoidance of Probate: The primary advantage of an Assignment to Living Trust in Little Rock, Arkansas, is avoiding the probate process. Probate can be time-consuming, expensive, and subject to public record, leading to potential conflicts and delays in asset distribution. By assigning assets to a living trust, the transfer of property occurs privately and efficiently, bypassing probate altogether. b. Privacy Protection: As a publicly filed document, a Last Will and Testament is accessible to anyone. In contrast, living trusts offer privacy, ensuring the estate's details, asset allocation, and beneficiaries remain confidential. This confidentiality enhances the granter's privacy while avoiding unwanted attention or potential disputes. c. Incapacity Planning: Living trusts provide a mechanism for managing assets and healthcare decisions if the granter becomes incapacitated or unable to handle their affairs. With an assigned trustee, the trust assets can be seamlessly managed, ensuring the granter's needs are met and their assets are protected. d. Flexibility and Control: For those concerned about maintaining control over their assets during their lifetime, a revocable living trust allows the granter flexibility to modify, amend, or dissolve the trust according to changing circumstances. This control is particularly beneficial when considering changes in personal relationships, financial standing, or the desire to add or remove beneficiaries. Conclusion: In Little Rock, Arkansas, an Assignment to Living Trust is a highly advantageous estate planning tool. With the flexibility to choose between revocable and irrevocable living trusts, individuals can protect their assets, ensure privacy, and streamline the transfer of property upon death, all while maintaining control during their lifetime. By embracing an Assignment to Living Trust, Little Rock, Arkansas residents can have peace of mind knowing their estate is effectively managed and protected, benefiting themselves and their beneficiaries.Little Rock Arkansas Assignment to Living Trust: A Comprehensive Guide on Trust Types and Benefits Introduction: In Little Rock, Arkansas, an Assignment to Living Trust is a widely utilized estate planning tool that provides individuals and families with a secure way to protect their assets and streamline the transfer of property upon death. This detailed description aims to explain the concept of a Little Rock Arkansas Assignment to Living Trust, its different types, and the benefits it offers while incorporating relevant keywords for a comprehensive understanding. 1. What is a Living Trust? A Living Trust, also known as an inter vivos trust, is a legal document that allows an individual (granter) to transfer assets into a trust during their lifetime. The granter names a trustee to manage the assets designated in the trust for the benefit of themselves or others (beneficiaries). 2. Little Rock Arkansas Assignment to Living Trust: In Little Rock, Arkansas, an Assignment to Living Trust involves transferring ownership or assigning assets to a living trust established by an individual. This assignment is crucial as it ensures that the assets assigned are held and managed by the living trust, effectively bypassing the lengthy and costly probate process upon the assignor's death. 3. Types of Living Trusts in Little Rock, Arkansas: a. Revocable Living Trust: A revocable living trust allows the granter to retain control over their assets during their lifetime. The granter can modify or revoke the trust as their circumstances change. Upon the granter's death, assets assigned to the trust are distributed to the beneficiaries as outlined in the trust document. Revocable living trusts are often chosen to avoid probate, maintain privacy, and minimize estate tax burdens. b. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of all beneficiaries. Assets assigned to this trust are considered separate from the granter's estate, thus providing potential tax advantages, creditor protection, and avoiding probate. Irrevocable living trusts are commonly established for Medicaid planning and protecting assets from potential creditors. 4. Benefits of Little Rock Arkansas Assignment to Living Trust: a. Avoidance of Probate: The primary advantage of an Assignment to Living Trust in Little Rock, Arkansas, is avoiding the probate process. Probate can be time-consuming, expensive, and subject to public record, leading to potential conflicts and delays in asset distribution. By assigning assets to a living trust, the transfer of property occurs privately and efficiently, bypassing probate altogether. b. Privacy Protection: As a publicly filed document, a Last Will and Testament is accessible to anyone. In contrast, living trusts offer privacy, ensuring the estate's details, asset allocation, and beneficiaries remain confidential. This confidentiality enhances the granter's privacy while avoiding unwanted attention or potential disputes. c. Incapacity Planning: Living trusts provide a mechanism for managing assets and healthcare decisions if the granter becomes incapacitated or unable to handle their affairs. With an assigned trustee, the trust assets can be seamlessly managed, ensuring the granter's needs are met and their assets are protected. d. Flexibility and Control: For those concerned about maintaining control over their assets during their lifetime, a revocable living trust allows the granter flexibility to modify, amend, or dissolve the trust according to changing circumstances. This control is particularly beneficial when considering changes in personal relationships, financial standing, or the desire to add or remove beneficiaries. Conclusion: In Little Rock, Arkansas, an Assignment to Living Trust is a highly advantageous estate planning tool. With the flexibility to choose between revocable and irrevocable living trusts, individuals can protect their assets, ensure privacy, and streamline the transfer of property upon death, all while maintaining control during their lifetime. By embracing an Assignment to Living Trust, Little Rock, Arkansas residents can have peace of mind knowing their estate is effectively managed and protected, benefiting themselves and their beneficiaries.