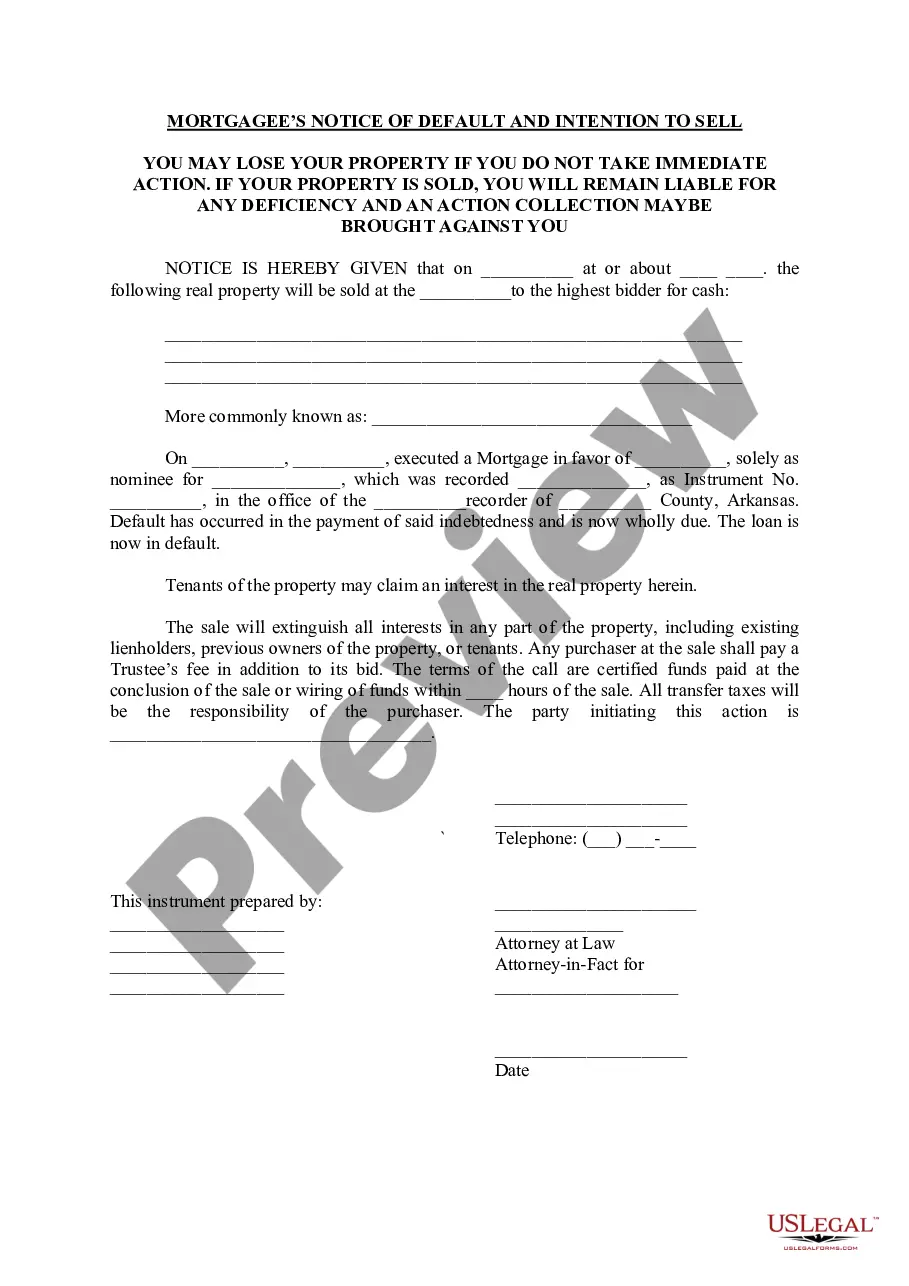

A Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell is a legal document that serves as an official notification to the borrower, also known as the mortgagor, that they are in default on their mortgage loan. It signifies that the homeowner has fallen behind on their mortgage payments and has breached the terms of the loan agreement. This notice serves as a warning to the mortgagor that if they fail to take appropriate actions to resolve the default within a specified period, the lender, also known as the mortgagee, has the right to proceed with the foreclosure process. The purpose of this notice is to inform the borrower about the lender's intention to sell the property in order to recoup the remaining loan balance. The Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell includes essential information such as the borrower's name, property address, loan account details, and the specific arrears amount owed by the borrower. Additionally, the notice typically outlines the steps the borrower can take to remedy the default, such as making immediate payment or contacting the lender to discuss alternative payment arrangements. It is important to note that there may be various types of Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell, depending on the circumstances and stage of the foreclosure process. Some possible variations may include: 1. Notice of Default (Pre-Foreclosure): This type of notice is typically issued when a borrower has missed multiple mortgage payments and has entered into default, but the foreclosure process has not yet commenced. It serves as an initial warning to the borrower, urging them to take corrective actions before formal foreclosure proceedings. 2. Notice of Intent to Accelerate: If the borrower fails to cure the default within the designated timeframe mentioned in the Notice of Default, this notice may be issued. It declares the mortgagee's intention to accelerate the loan, meaning the full loan balance becomes due immediately, rather than being paid over the remaining loan term. 3. Notice of Sale: This notice is usually sent after the borrower has received earlier notifications and failed to address the default. It informs the borrower of the mortgagee's intent to sell the property at a public auction or through other means to recover the outstanding loan balance. 4. Notice of Sheriff Sale: In cases where the foreclosure process advances, this notice is sent to the borrower to inform them of the date, time, and location of the sheriff sale, where the property will be auctioned off to the highest bidder. These variations account for different stages of the foreclosure process and provide borrowers with opportunities to address defaults and potentially save their homes from foreclosure. It is crucial for homeowners facing default to seek professional legal advice and explore available options for debt resolution and loan modification to mitigate potential foreclosure consequences.

Little Rock Arkansas Mortgagee's Notice of Default and Intention to Sell

Category:

State:

Arkansas

City:

Little Rock

Control #:

AR-LR023T

Format:

Word;

Rich Text

Instant download

Description

General default notice used by the Seller to notify the Purchaser of being in default.

A Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell is a legal document that serves as an official notification to the borrower, also known as the mortgagor, that they are in default on their mortgage loan. It signifies that the homeowner has fallen behind on their mortgage payments and has breached the terms of the loan agreement. This notice serves as a warning to the mortgagor that if they fail to take appropriate actions to resolve the default within a specified period, the lender, also known as the mortgagee, has the right to proceed with the foreclosure process. The purpose of this notice is to inform the borrower about the lender's intention to sell the property in order to recoup the remaining loan balance. The Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell includes essential information such as the borrower's name, property address, loan account details, and the specific arrears amount owed by the borrower. Additionally, the notice typically outlines the steps the borrower can take to remedy the default, such as making immediate payment or contacting the lender to discuss alternative payment arrangements. It is important to note that there may be various types of Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell, depending on the circumstances and stage of the foreclosure process. Some possible variations may include: 1. Notice of Default (Pre-Foreclosure): This type of notice is typically issued when a borrower has missed multiple mortgage payments and has entered into default, but the foreclosure process has not yet commenced. It serves as an initial warning to the borrower, urging them to take corrective actions before formal foreclosure proceedings. 2. Notice of Intent to Accelerate: If the borrower fails to cure the default within the designated timeframe mentioned in the Notice of Default, this notice may be issued. It declares the mortgagee's intention to accelerate the loan, meaning the full loan balance becomes due immediately, rather than being paid over the remaining loan term. 3. Notice of Sale: This notice is usually sent after the borrower has received earlier notifications and failed to address the default. It informs the borrower of the mortgagee's intent to sell the property at a public auction or through other means to recover the outstanding loan balance. 4. Notice of Sheriff Sale: In cases where the foreclosure process advances, this notice is sent to the borrower to inform them of the date, time, and location of the sheriff sale, where the property will be auctioned off to the highest bidder. These variations account for different stages of the foreclosure process and provide borrowers with opportunities to address defaults and potentially save their homes from foreclosure. It is crucial for homeowners facing default to seek professional legal advice and explore available options for debt resolution and loan modification to mitigate potential foreclosure consequences.

Free preview

How to fill out Little Rock Arkansas Mortgagee's Notice Of Default And Intention To Sell?

If you’ve already used our service before, log in to your account and download the Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Little Rock Arkansas Mortgagee’s Notice of Default and Intention to Sell. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!