The Little Rock Arkansas Department of the Treasury — Internal Revenue Service is a government agency responsible for administering and enforcing federal tax laws within the state of Arkansas. As a part of the Department of the Treasury, this office plays a crucial role in collecting taxes and ensuring compliance to maintain the financial stability of the nation. The main function of the Little Rock Arkansas Department of the Treasury — Internal Revenue Service is to collect income taxes from individuals and businesses in Arkansas. This includes processing tax returns, conducting audits, and ensuring that taxpayers accurately report their income and deductions. The agency also works to educate and assist taxpayers in understanding their tax obligations and offer guidance on how to efficiently comply with tax laws. In addition to income taxes, the Little Rock Arkansas Department of the Treasury — Internal Revenue Service also oversees other tax areas such as estate taxes, gift taxes, and excise taxes. They collaborate with other government agencies to combat tax fraud and financial crimes, investigating cases of tax evasion and taking appropriate legal action when necessary. The Little Rock Arkansas Department of the Treasury — Internal Revenue Service provides various services to taxpayers, including taxpayer assistance centers where individuals can seek support in filing their taxes, addressing tax-related issues, and resolving disputes. Additionally, the office offers online resources, such as tax forms and publications, to facilitate the easy filing of taxes and access to essential tax-related information. It is important to note that the Little Rock Arkansas Department of the Treasury — Internal Revenue Service is just one of many IRS offices throughout the United States. Each state has its own IRS office to cater to the specific tax needs of its residents. This structure ensures efficient tax administration and allows the IRS to provide personalized services to taxpayers nationwide. In conclusion, the Little Rock Arkansas Department of the Treasury — Internal Revenue Service is an essential government agency responsible for upholding federal tax laws, ensuring compliance, and collecting taxes within the state of Arkansas. By providing educational resources, taxpayer assistance, and conducting audits, this office contributes to the nation's financial stability while ensuring a fair tax system for all.

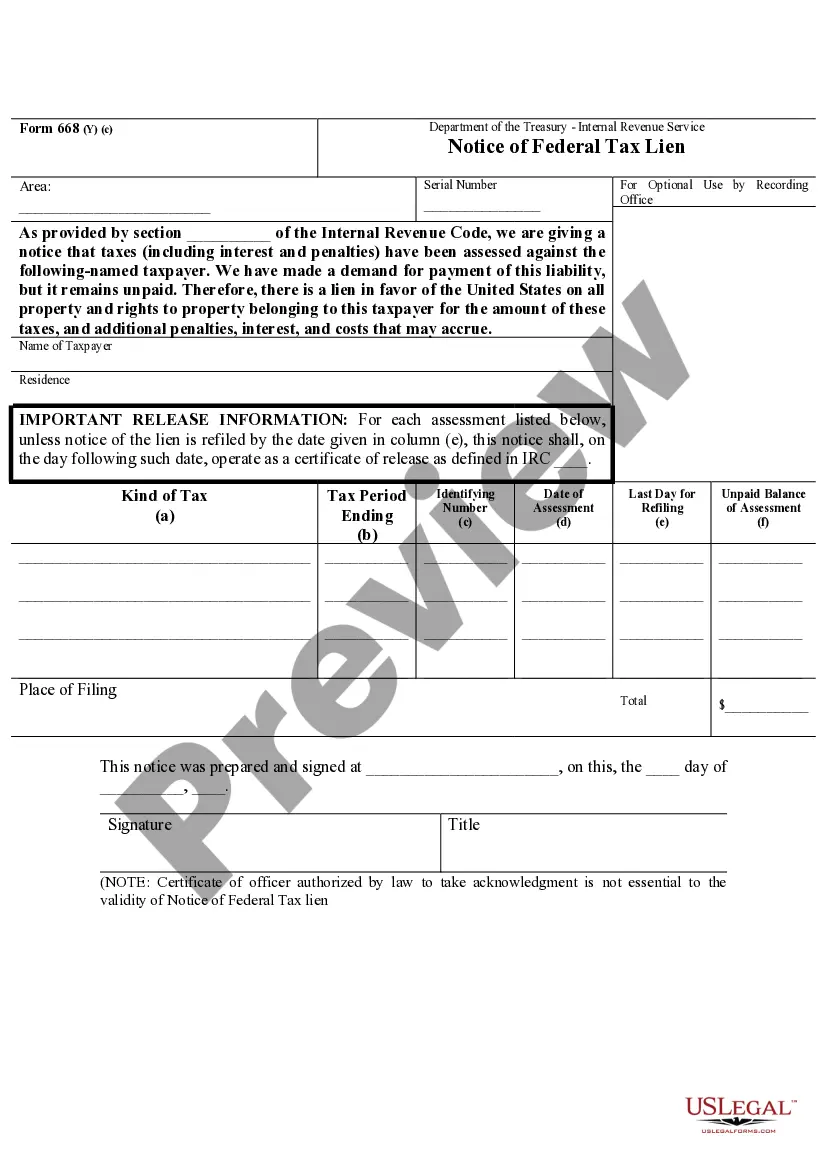

Little Rock Arkansas Department of the Treasury -Internal Revenue Service Notice of Federal Tax Lien

Description

How to fill out Little Rock Arkansas Department Of The Treasury -Internal Revenue Service Notice Of Federal Tax Lien?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Little Rock Arkansas Department of the Treasury -Internal Revenue Service? US Legal Forms is your go-to option.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of separate state and area.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Little Rock Arkansas Department of the Treasury -Internal Revenue Service conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is good for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Little Rock Arkansas Department of the Treasury -Internal Revenue Service in any available format. You can return to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online for good.