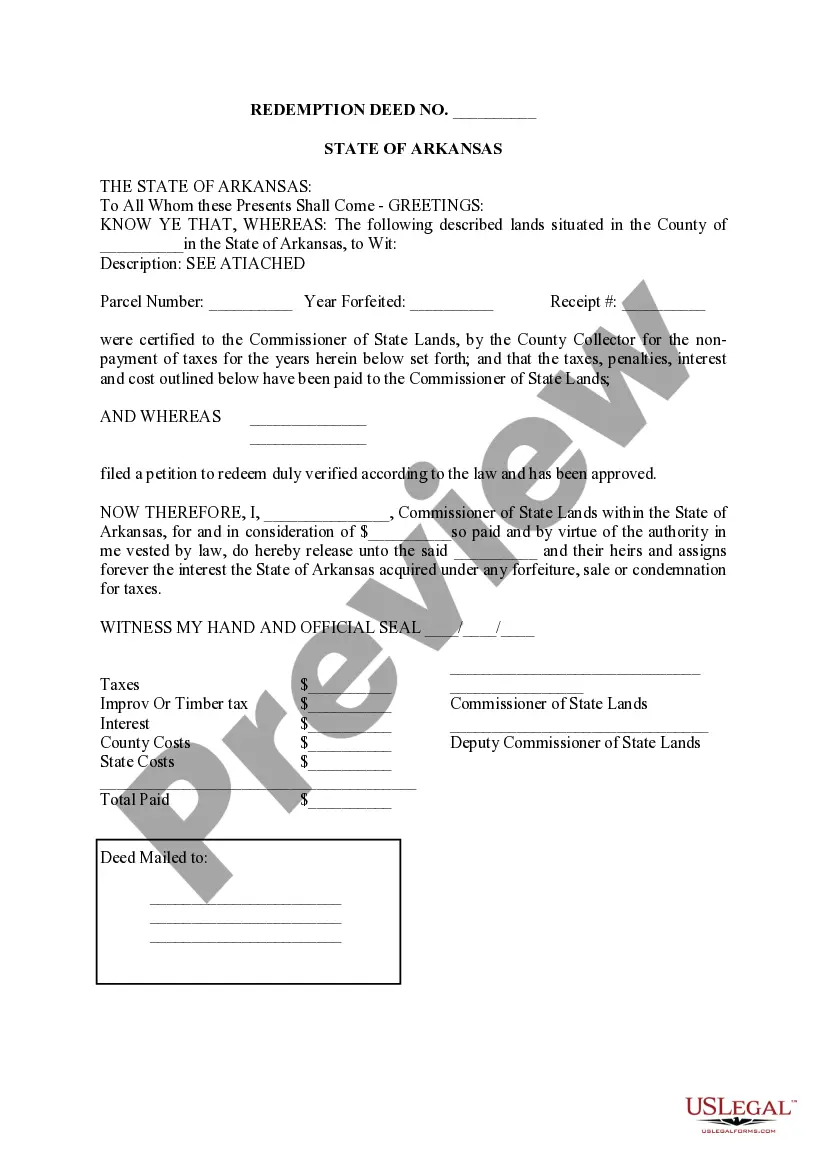

A Little Rock Arkansas Redemption Deed refers to a legal document that provides the opportunity for property owners in Little Rock, Arkansas to redeem their property after a tax sale. When a property owner fails to pay their property taxes, the local government may hold a tax sale, in which the property is auctioned off to the highest bidder. However, to protect property owners from losing their property permanently, the Little Rock Arkansas Redemption Deed allows them to redeem their property by paying the delinquent taxes, penalties, and interest within a specified timeframe. The Little Rock Arkansas Redemption Deed serves as proof of the property owner's right to redeem their property and reclaim ownership. It contains essential information such as the property's legal description, the name of the delinquent taxpayer, the amount of taxes owed, and the redemption period. It also includes details about the tax sale, such as the date, time, and location of the auction. In addition to the general Little Rock Arkansas Redemption Deed, there may be different types or variations of redemption deeds available. Some of these may include: 1. Residential Redemption Deed: Specifically designed for residential properties, this type of redemption deed applies to homeowners who want to redeem their houses after a tax sale. It provides the necessary guidelines and procedures for residential property redemption. 2. Commercial Redemption Deed: Similar to the residential redemption deed, the commercial redemption deed caters to property owners who wish to redeem their commercial or business property. It may include specific requirements and regulations applicable to commercial properties. 3. Agricultural Redemption Deed: This redemption deed variant caters to owners of agricultural land, farms, or rural properties who want to exercise their right to redemption following a tax sale. It addresses the unique considerations associated with agricultural property. It is important for property owners in Little Rock, Arkansas, to consult with legal professionals or the local tax assessor's office to ensure they understand the specific rules and requirements related to the redemption process. Compliance with these regulations and deadlines is crucial to successfully redeeming the property and retaining ownership.

Little Rock Arkansas Redemption Deed

Description

How to fill out Little Rock Arkansas Redemption Deed?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Little Rock Arkansas Redemption Deed becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Little Rock Arkansas Redemption Deed takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Little Rock Arkansas Redemption Deed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!