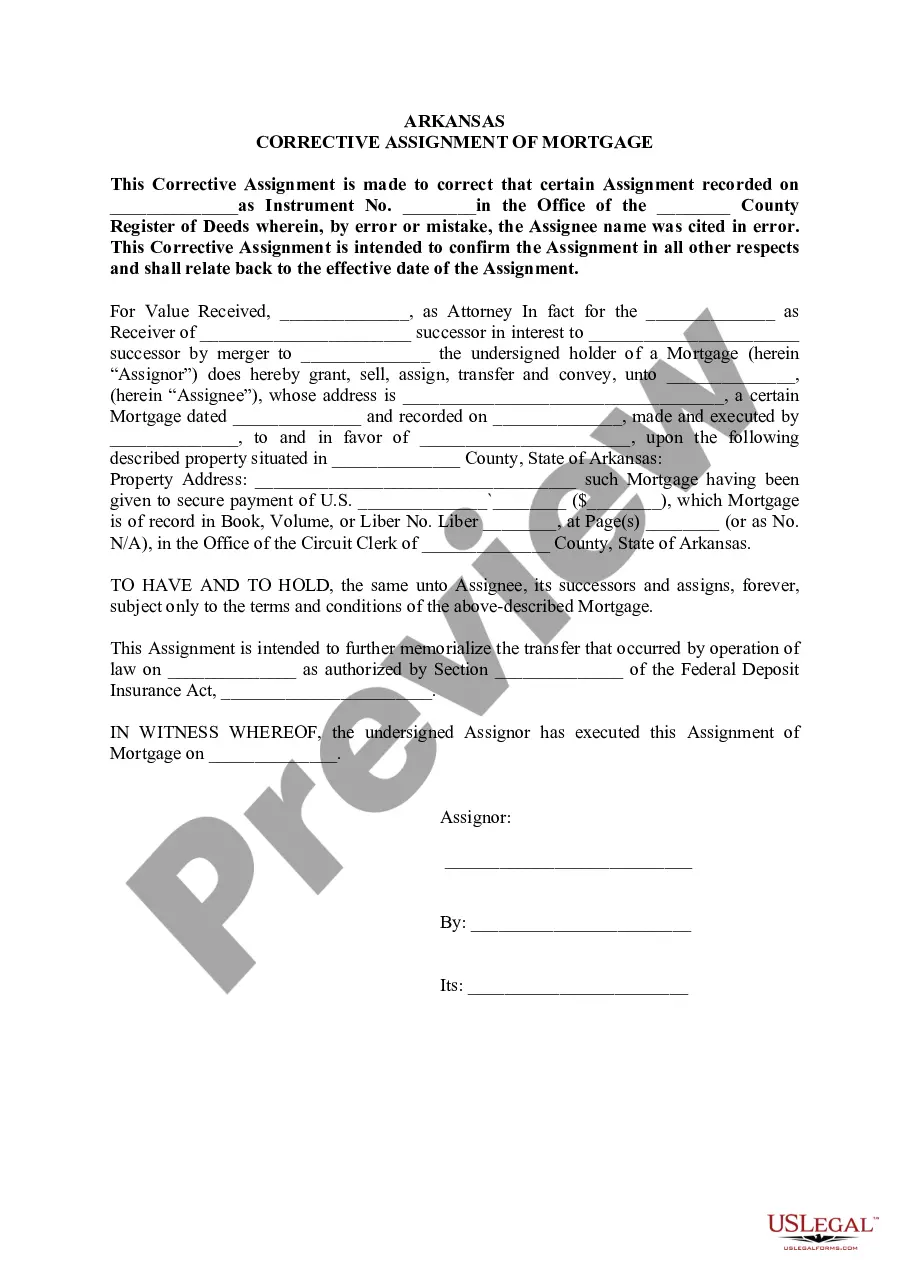

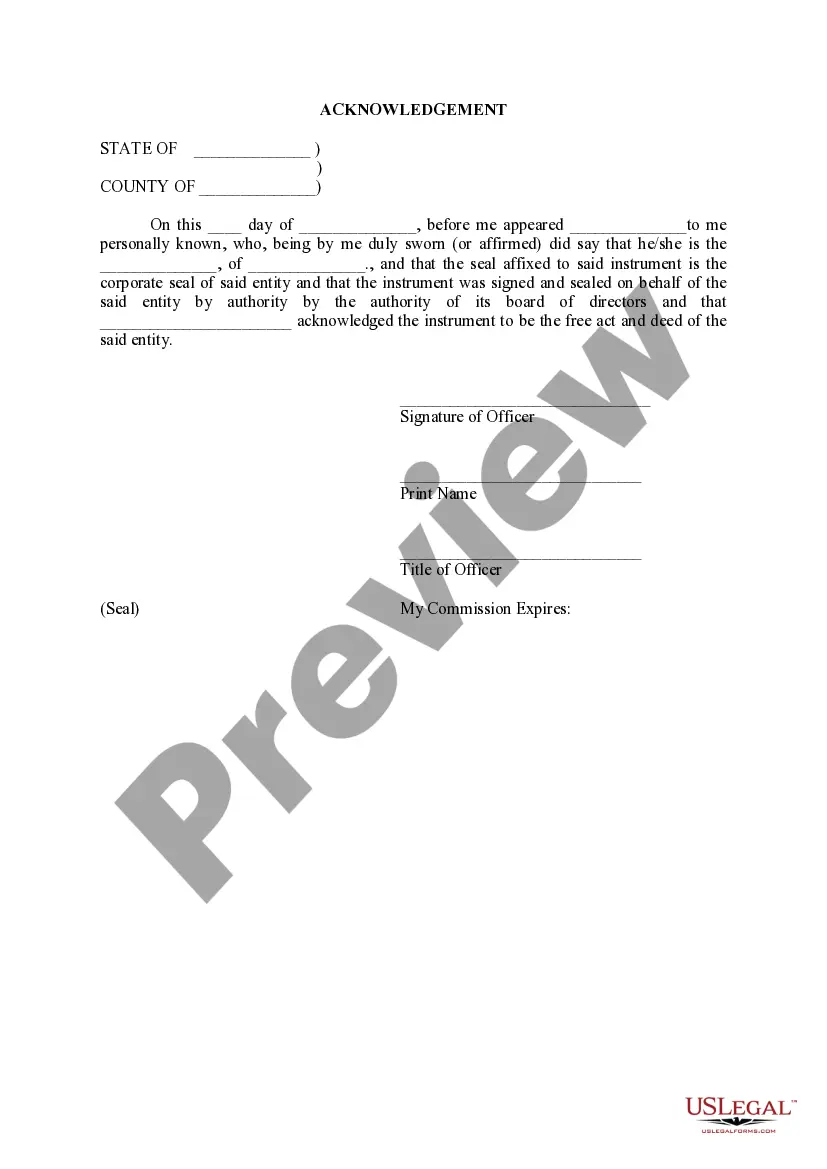

Little Rock Arkansas Corrective Assignment of Mortgage is a legal document that corrects any errors or omissions in the original mortgage assignment. This document is commonly used to ensure the accuracy and validity of a mortgage assignment, and it helps to protect the rights and interests of all parties involved. In Little Rock, Arkansas, there are various types of Corrective Assignment of Mortgage that can be employed depending on the specific circumstances. Some of these types include: 1. Corrective Assignment of Mortgage — This type is utilized when there are minor errors or discrepancies in the original mortgage assignment. It rectifies any inaccuracies in the assignment document, such as misspelled names, incorrect property descriptions, or erroneous recording details. 2. Corrective Assignment of Mortgage Due to a Change in Ownership — In the event of a change in ownership, whether due to the sale of the mortgaged property or transfer of the mortgage to a new lender, this corrective assignment is necessary. It ensures that the new owner or lender is correctly recorded as the mortgage holder and protects their legal rights. 3. Corrective Assignment of Mortgage for Loan Modification — If a borrower's loan is modified, such as through refinancing, loan extension, or alteration of repayment terms, this type of corrective assignment is required. It reflects the revised mortgage terms and conditions, protecting the rights and obligations of both the borrower and the lender. 4. Corrective Assignment of Mortgage for Lien Priority — When there is a dispute over lien priority, meaning multiple parties claim to have a superior right to the property's proceeds in case of foreclosure, a corrective assignment can be used to clarify and establish the correct order. It protects the interests of the mortgage holder and ensures the satisfaction of outstanding debts. In Little Rock, Arkansas, the Corrective Assignment of Mortgage should be filed with the county recorder or the registrar of deeds to ensure that it becomes part of the public record. It is essential to consult with a qualified attorney or a real estate professional to prepare and execute this document accurately, as any mistakes or omissions could lead to legal complications or challenges to the mortgage assignment's validity. Keywords: Little Rock Arkansas, Corrective Assignment of Mortgage, legal document, errors, omissions, accuracy, validity, protect rights, interests, minor errors, discrepancies, misspelled names, property descriptions, recording details, change in ownership, sale of property, transfer of mortgage, new lender, new owner, loan modification, refinancing, repayment terms, modified terms, mortgage holder, rights and obligations, lien priority, dispute, foreclosure, multiple parties, superior right, county recorder, registrar of deeds, public record, legal complications, mortgage assignment.

Little Rock Arkansas Corrective Assignment Of Mortgage

Description

How to fill out Little Rock Arkansas Corrective Assignment Of Mortgage?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal solutions that, as a rule, are very costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Little Rock Arkansas Corrective Assignment Of Mortgage or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally easy if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Little Rock Arkansas Corrective Assignment Of Mortgage adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Little Rock Arkansas Corrective Assignment Of Mortgage is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!