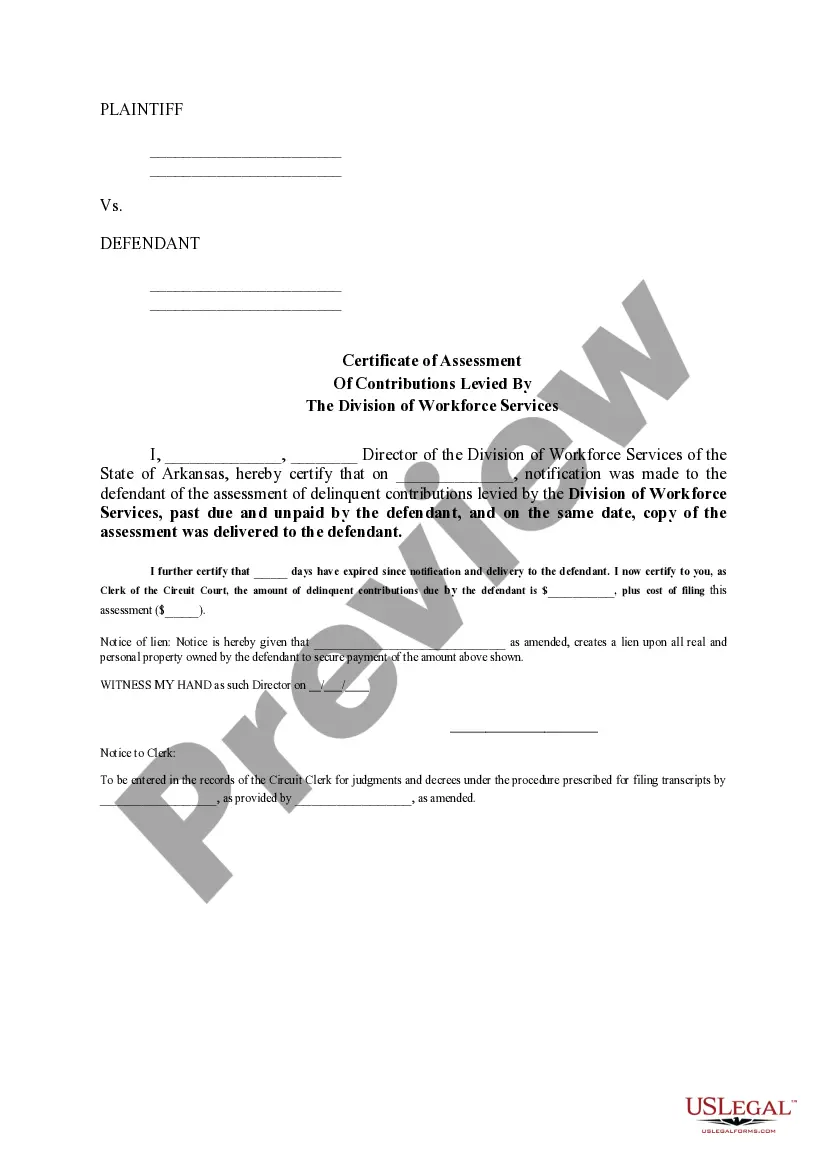

The Little Rock Arkansas Certificate of Assessment of Contributions Levied is a legal document issued by the city government of Little Rock, Arkansas. It serves as an official notification to property owners regarding their assessed contributions or taxes for specific purposes. This detailed description aims to provide an understanding of what this certificate entails, its purpose, and the different types associated with it. The primary objective of the Little Rock Arkansas Certificate of Assessment of Contributions Levied is to inform property owners about their tax obligations. These taxes are levied by the city government to finance various public services and improvements, such as road maintenance, parks and recreation facilities, public schools, emergency services, and administrative expenses. The certificate typically includes important information such as the property owner's name, address, and tax identification number. It also states the tax period or year to which the assessment applies. The certificate will specify the various types of contributions levied for specific purposes or funds. Each contribution will have a separate line item detailing the amount owed. Some common types of contributions that may be mentioned in the Little Rock Arkansas Certificate of Assessment of Contributions Levied include: 1. Property Tax: This refers to the general tax levied on the assessed value of real estate properties within Little Rock. Property taxes are a significant source of revenue for the city and are typically used to fund a wide range of public services. 2. Special Assessments: These are taxes imposed on properties within specific districts or zones to fund improvements or services in that area. Examples include special assessments for street lighting, sidewalk projects, sewer improvements, or neighborhood revitalization initiatives. 3. Occupation Tax: If the property is used for commercial or business purposes, an occupation tax may be levied. This tax is typically based on the type of business or profession and helps support the regulation and maintenance of the local business environment. 4. Sanitation Fee: This is a fee charged to cover the costs of garbage collection and disposal services provided by the city. It ensures the cleanliness and hygiene of the community. 5. School Taxes: A portion of the assessed contributions may go towards funding the local public school system. These taxes help provide resources for education programs, facilities, and teacher salaries. 6. Public Safety Tax: This tax is dedicated to funding public safety services, including police and fire departments. It ensures residents' safety and contributes to maintaining law and order within Little Rock. It is essential for property owners to carefully review the Little Rock Arkansas Certificate of Assessment of Contributions Levied to ensure accuracy and address any concerns. Payment deadlines and instructions for submitting payments are typically included. Failure to pay the assessed contributions within the specified timeframe may result in penalties or legal actions by the city government. Understanding the different types of contributions and their designated purposes enables property owners to better comprehend how their taxes contribute to the development and maintenance of Little Rock, Arkansas.

Little Rock Arkansas Amendment No. To The Declaration of Covenants Conditions

Description

How to fill out Little Rock Arkansas Amendment No. To The Declaration Of Covenants Conditions?

Take advantage of the US Legal Forms and get instant access to any form sample you require. Our beneficial platform with a large number of document templates makes it easy to find and obtain virtually any document sample you need. It is possible to download, complete, and certify the Little Rock Arkansas Certificate of Assessment Of Contributions Levied in just a few minutes instead of surfing the Net for hours looking for the right template.

Utilizing our catalog is a superb strategy to raise the safety of your form filing. Our professional lawyers regularly check all the records to make certain that the templates are appropriate for a particular region and compliant with new laws and polices.

How do you obtain the Little Rock Arkansas Certificate of Assessment Of Contributions Levied? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Additionally, you can find all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, stick to the instructions below:

- Open the page with the form you need. Ensure that it is the template you were hoping to find: verify its headline and description, and use the Preview option if it is available. Otherwise, use the Search field to look for the needed one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Export the file. Indicate the format to get the Little Rock Arkansas Certificate of Assessment Of Contributions Levied and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable template libraries on the internet. Our company is always happy to assist you in virtually any legal process, even if it is just downloading the Little Rock Arkansas Certificate of Assessment Of Contributions Levied.

Feel free to take advantage of our platform and make your document experience as efficient as possible!