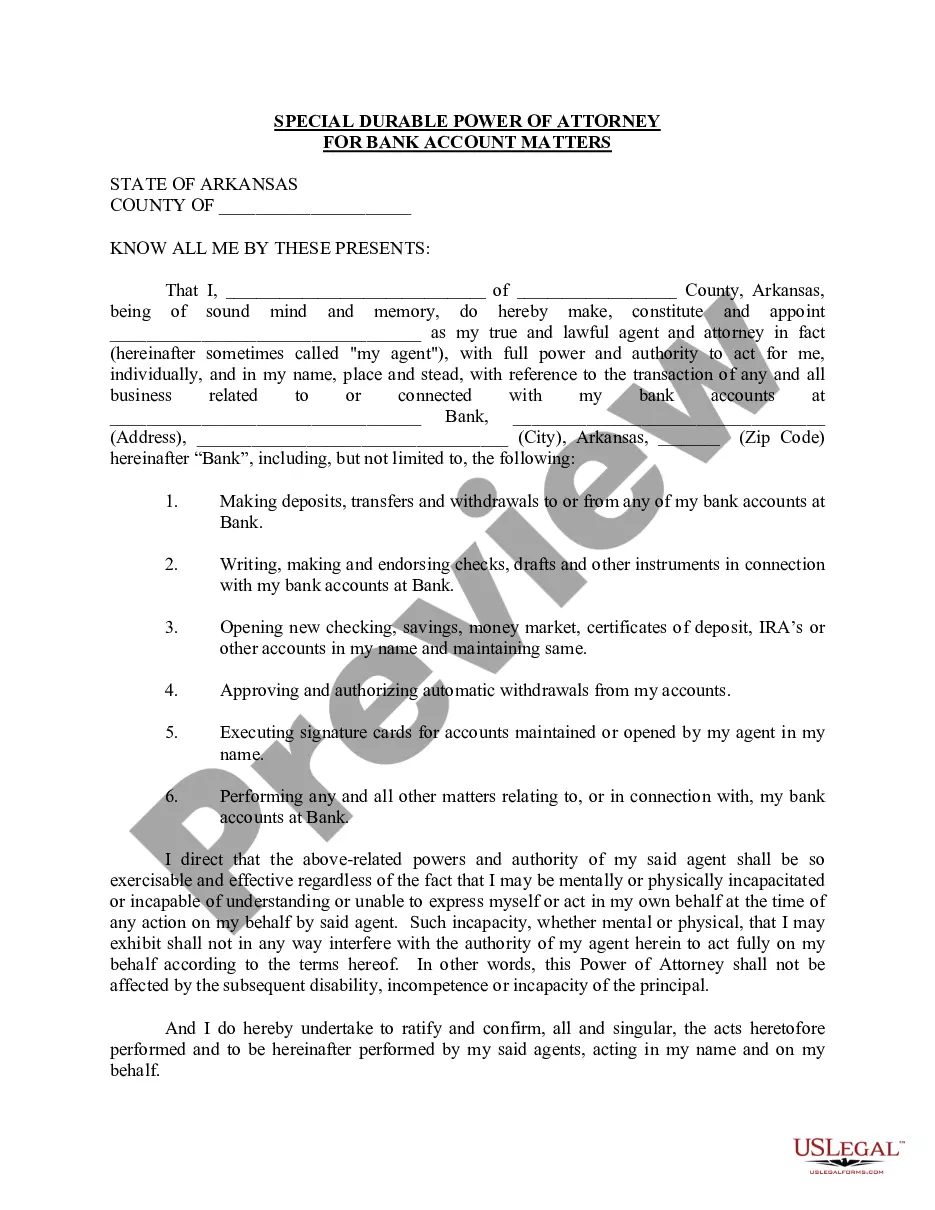

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

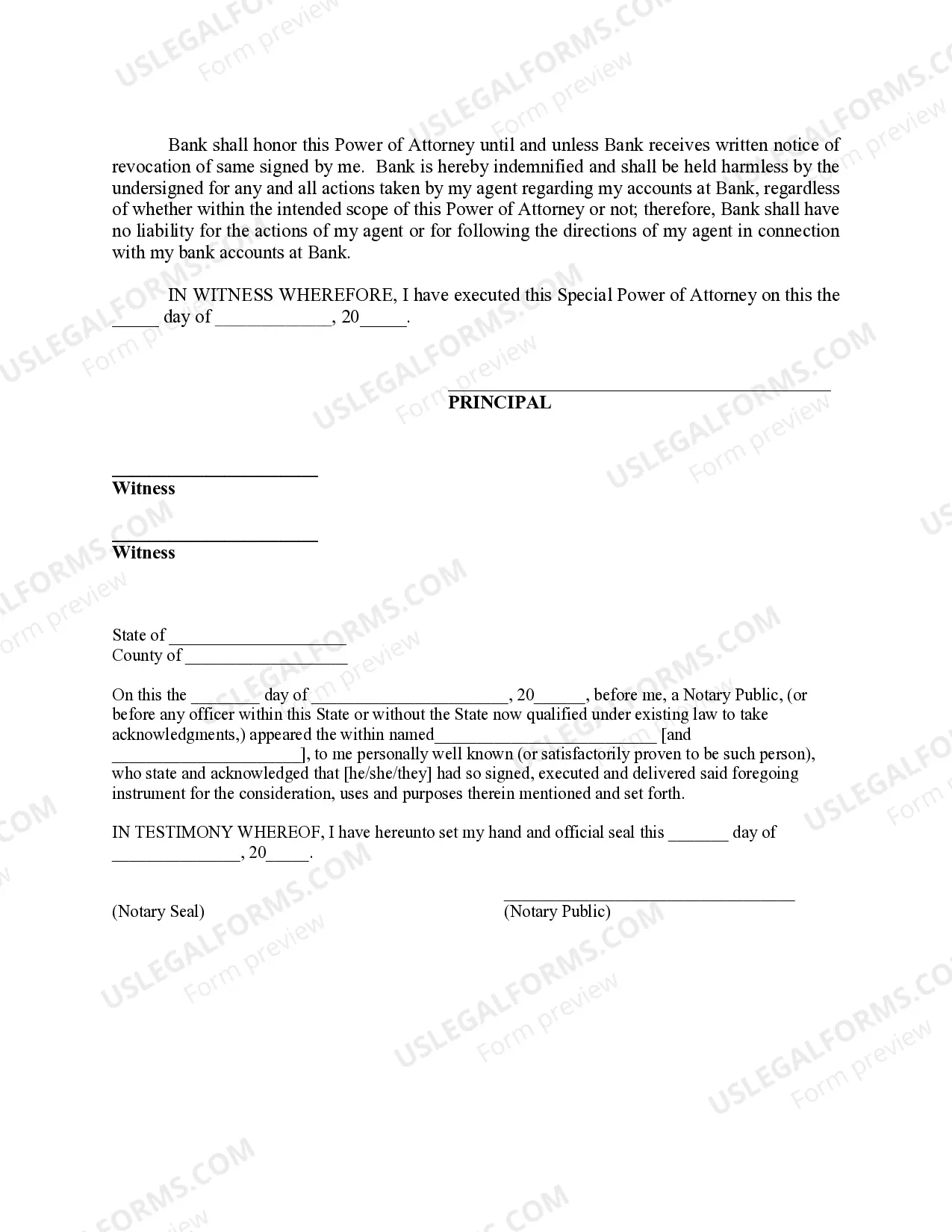

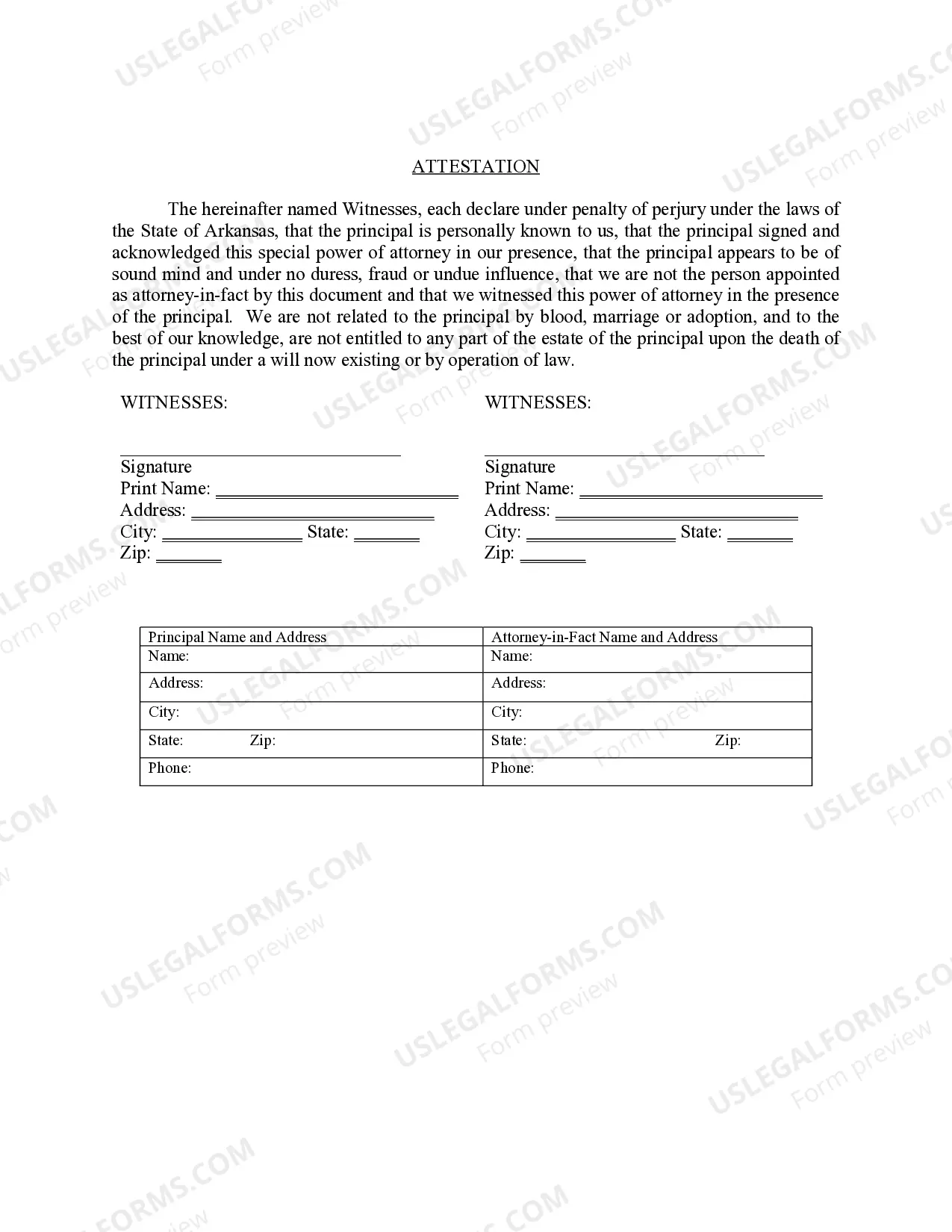

Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters allows an individual, referred to as the “principal,” to grant another person, known as the “agent” or “attorney-in-fact,” the authority to act on their behalf in matters related to bank accounts. This legal document is specifically designed to address the management and decision-making responsibilities regarding the principal's bank accounts, ensuring seamless financial dealings even in the event of incapacity or unavailability. The Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters grants the agent wide-ranging legal powers and duties, including but not limited to: 1. Account Management: The agent will have the authority to open, close, operate, and manage the principal's bank accounts in Little Rock, Arkansas, including checking, savings, money market, and certificate of deposit accounts. 2. Transactions and Payments: The agent can perform all necessary banking transactions on behalf of the principal, such as depositing funds, withdrawing cash, transferring funds between accounts, writing checks, and making payments to creditors. 3. Statements and Records: The agent is entitled to access and request bank statements, transaction records, and any other financial documentation pertaining to the principal's accounts. 4. Investment and Trading: If specifically authorized, the agent may have the power to make investment decisions on behalf of the principal, including buying or selling stocks, bonds, and other securities. 5. Banking Relationships: The agent can establish and maintain relationships with financial institutions, including opening new accounts, changing account signatories, and updating contact information. 6. Safety Deposit Boxes: If the principal owns a safe deposit box, the agent may access, manage, and control its contents. It's important to note that the Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters grants the agent durable powers, meaning their authority remains in effect even if the principal becomes incapacitated or mentally incompetent. However, the powers granted to the agent can be explicitly limited, and the principal may specify instructions, conditions, or restrictions in the document. While there may not be different types of Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters, variations could exist based on the specific needs and requirements of the principal. Some individuals may prefer to grant limited powers that restrict the agent's authority to certain accounts or transactions, while others may opt for broader powers encompassing multiple banking relationships. Creating a Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters should be done with careful consideration and consultation with legal professionals to ensure compliance with state laws and the unique circumstances of the principal.Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters allows an individual, referred to as the “principal,” to grant another person, known as the “agent” or “attorney-in-fact,” the authority to act on their behalf in matters related to bank accounts. This legal document is specifically designed to address the management and decision-making responsibilities regarding the principal's bank accounts, ensuring seamless financial dealings even in the event of incapacity or unavailability. The Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters grants the agent wide-ranging legal powers and duties, including but not limited to: 1. Account Management: The agent will have the authority to open, close, operate, and manage the principal's bank accounts in Little Rock, Arkansas, including checking, savings, money market, and certificate of deposit accounts. 2. Transactions and Payments: The agent can perform all necessary banking transactions on behalf of the principal, such as depositing funds, withdrawing cash, transferring funds between accounts, writing checks, and making payments to creditors. 3. Statements and Records: The agent is entitled to access and request bank statements, transaction records, and any other financial documentation pertaining to the principal's accounts. 4. Investment and Trading: If specifically authorized, the agent may have the power to make investment decisions on behalf of the principal, including buying or selling stocks, bonds, and other securities. 5. Banking Relationships: The agent can establish and maintain relationships with financial institutions, including opening new accounts, changing account signatories, and updating contact information. 6. Safety Deposit Boxes: If the principal owns a safe deposit box, the agent may access, manage, and control its contents. It's important to note that the Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters grants the agent durable powers, meaning their authority remains in effect even if the principal becomes incapacitated or mentally incompetent. However, the powers granted to the agent can be explicitly limited, and the principal may specify instructions, conditions, or restrictions in the document. While there may not be different types of Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters, variations could exist based on the specific needs and requirements of the principal. Some individuals may prefer to grant limited powers that restrict the agent's authority to certain accounts or transactions, while others may opt for broader powers encompassing multiple banking relationships. Creating a Little Rock Arkansas Special Durable Power of Attorney for Bank Account Matters should be done with careful consideration and consultation with legal professionals to ensure compliance with state laws and the unique circumstances of the principal.