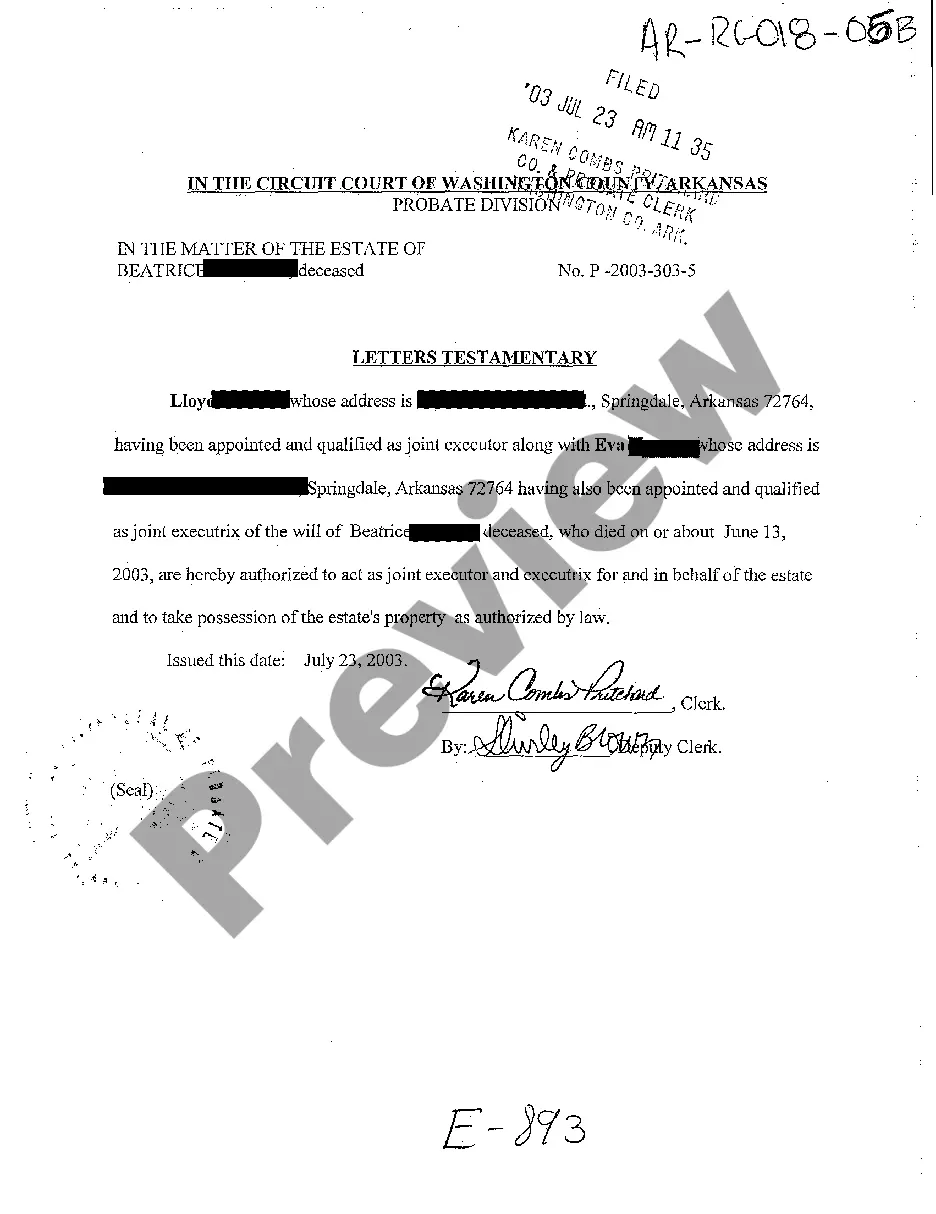

Little Rock, Arkansas Letters Testamentary: A Detailed Description and Types Letters Testamentary, a legal term used in probate proceedings, refer to a document issued by the court that authorizes an individual, known as an executor or personal representative, to act on behalf of a deceased person's estate. In Little Rock, Arkansas, Letters Testamentary are an essential part of the probate process, granting authority to the executor to administer and distribute the assets of the deceased in accordance with their will. When a person passes away, their estate often goes through probate to settle their affairs. During this process, the court appoints an executor, named in the deceased's will or chosen by the court if there is no will (intestate). Once appointed, the executor receives Letters Testamentary, which serve as legal proof of their authority and allow them to carry out their duties. The Letters Testamentary document typically includes relevant information such as the executor's name, the deceased person's name and date of death, the court granting the letters, and the specific powers and responsibilities authorized by the court. These powers encompass various tasks, including collection and management of assets, paying debts and taxes, locating beneficiaries, identifying potential heirs, and ultimately distributing the estate's assets in accordance with the will. In Little Rock, Arkansas, there are different types of Letters Testamentary, depending on the circumstances of the estate and the specific requirements of the court: 1. General Letters Testamentary: This type is issued when the deceased individual has left a valid will designating an executor to handle their estate's affairs. General Letters Testamentary give the executor full power to act on behalf of the estate. 2. Limited Letters Testamentary: If the court determines that only certain limited powers are necessary for the executor to fulfill their duties, they may issue Limited Letters Testamentary. This variant restricts the executor's authority to perform specific actions outlined by the court. 3. Ancillary Letters Testamentary: When the deceased person owned property or had assets in multiple states, Ancillary Letters Testamentary may be required. These letters are obtained in addition to the primary Letters Testamentary and enable the executor to handle matters specifically related to the out-of-state assets. Regardless of the type of Letters Testamentary granted, the executor holds a fiduciary duty to act in the best interest of the estate and the beneficiaries named in the will. They must follow the instructions provided in the will, comply with state probate laws, prepare an inventory of assets, address debts and taxes, and ensure the fair distribution of the estate as directed by the court. Obtaining Letters Testamentary is a crucial step in the probate process in Little Rock, Arkansas. It establishes the executor's authority, enabling them to carry out their responsibilities and fulfill their duties efficiently. Executors must consult with legal professionals to ensure they fully understand their rights, limitations, and obligations while administering the estate.

Little Rock Arkansas Letters Testamentary

Description

How to fill out Little Rock Arkansas Letters Testamentary?

We consistently aim to reduce or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek legal assistance that is typically quite expensive.

However, not every legal matter is similarly convoluted. Many of them can be handled by ourselves.

US Legal Forms is an online directory of current DIY legal templates covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button beside it. If you misplace the document, you can always redownload it in the My documents tab. The procedure is equally uncomplicated if you're unfamiliar with the site! You can set up your account within minutes. Ensure you verify if the Little Rock Arkansas Letters Testamentary complies with your state's and area's laws and regulations. Additionally, it's crucial that you review the form's outline (if accessible), and if you find any inconsistencies with what you initially sought, look for an alternative template. Once you've confirmed that the Little Rock Arkansas Letters Testamentary is appropriate for your situation, you can choose a subscription plan and process the payment. Then you can download the document in any format that is available. Over the past 24 years in the market, we have assisted millions by providing customizable and up-to-date legal forms. Make use of US Legal Forms now to conserve time and resources!

- Our library enables you to handle your matters independently without resorting to legal advice.

- We offer access to legal document formats that are not always readily available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Take advantage of US Legal Forms whenever you require to locate and download the Little Rock Arkansas Letters Testamentary or any other document with ease and security.

Form popularity

FAQ

Probate is typically triggered in Arkansas when a person passes away and leaves a will. Factors that may influence this process include the estate’s total value and the presence of debts. Little Rock Arkansas Letters Testamentary are issued to allow the executor to manage the estate legally. Being aware of these triggers can help streamline estate management for loved ones.

If a will is not probated in Arkansas, the deceased's estate may be treated as intestate, and state laws will dictate asset distribution. This scenario can lead to unintended results, such as assets going to relatives who may not be favored. In such situations, navigating the implications of Little Rock Arkansas Letters Testamentary becomes vital. Seeking legal advice can clarify your options.

Not every will requires probate in Arkansas. Small estates may qualify for simplified procedures or exemptions, avoiding standard probate processes. However, Little Rock Arkansas Letters Testamentary may be necessary for larger estates or if disputes arise. Knowing the specific requirements for your situation can guide your decisions effectively.

To avoid probate in Arkansas, consider establishing living trusts, joint ownership of property, or beneficiary designations for accounts. These options allow assets to transfer outside of probate, saving time and costs. Little Rock Arkansas Letters Testamentary often signify the beginning of a lengthy probate process, so planning ahead can simplify your estate management. Exploring these alternatives will provide peace of mind.

In Arkansas, the probate process involves a legal procedure for administering a deceased person's estate. Typically, this includes validating the will and distributing assets accordingly. Handling Little Rock Arkansas Letters Testamentary is crucial, as these letters give the executor authority to act on behalf of the estate. Understanding the rules can help you navigate the process smoothly.

The minimum estate value for probate in Arkansas is generally set at $100,000. This threshold applies to the total assets within the estate, excluding certain exempt assets. If your estate's value falls below this amount, you may not need to go through the formal probate process. For expert guidance on handling your estate, consider using resources related to Little Rock Arkansas Letters Testamentary.

Certain assets in Arkansas are exempt from probate, including life insurance policies with designated beneficiaries and retirement accounts like IRAs. Additionally, property held in joint tenancy passes directly to the surviving owner without going through probate. Understanding these exemptions can simplify estate management, making tools like Little Rock Arkansas Letters Testamentary quite valuable.

In Arkansas, the threshold for probate depends on the total value of the estate. If the estate's assets exceed $100,000, the probate process typically becomes necessary. It's essential to note that this includes real estate, personal property, and other assets. For assistance with navigating Arkansas probate, you can consider resources like Little Rock Arkansas Letters Testamentary.

To get letters of testamentary in Arkansas, initiate the process by filing the deceased's will with the local probate court. Afterward, submit a petition for letters testamentary, including necessary information about the estate and its assets. Once the court reviews and approves your submission, you will be issued the letters, authorizing you as the executor to handle the estate matters. Consider using USLegalForms for a streamlined approach to this legal requirement.

In Arkansas, there is no minimum value for an estate to go through probate; however, estates valued over $100,000 will likely require probate. Smaller estates may benefit from simplified processes or alternatives, depending on the assets involved. It is crucial to assess the estate's worth accurately. Consulting with a knowledgeable platform like USLegalForms can provide the guidance needed for your specific situation.