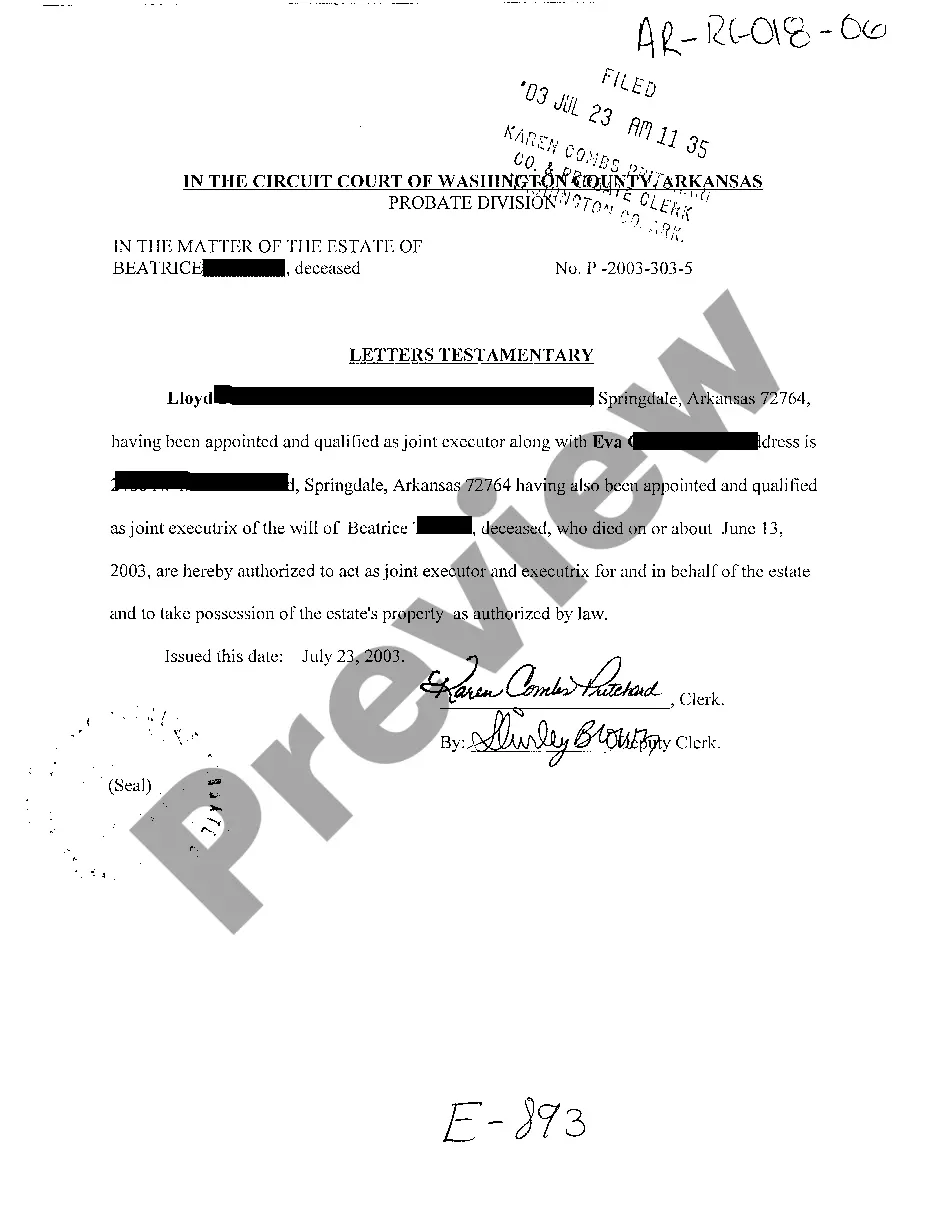

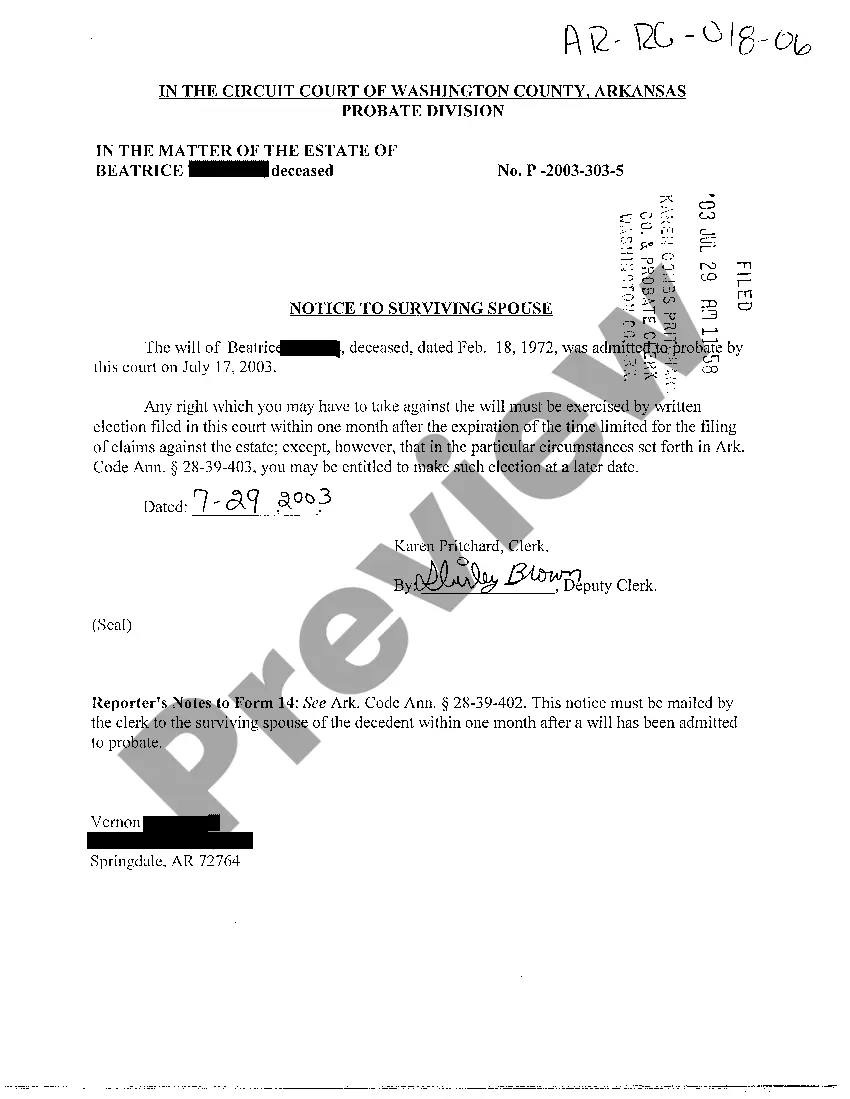

The Little Rock Arkansas Notice to Surviving Spouse is a legal document that serves to inform the surviving spouse about their rights and entitlements after the death of their spouse in Little Rock, Arkansas. This notice is particularly crucial when it comes to estate planning and probate proceedings. It ensures that the surviving spouse is informed about their legal obligations and the steps they need to take in order to protect their interests. Keywords: Little Rock Arkansas, notice to surviving spouse, legal document, rights, entitlements, death, estate planning, probate proceedings, legal obligations, protect interests. Different types of Little Rock Arkansas Notice to Surviving Spouse may include: 1. Little Rock Arkansas Notice of Surviving Spouse's Rights: This type of notice specifically focuses on informing the surviving spouse about their legal rights in matters such as property ownership, inheritance, and financial matters after the death of their spouse. 2. Little Rock Arkansas Notice of Deadline for Claiming Spousal Benefits: In certain cases, there might be specific deadlines for the surviving spouse to claim certain benefits, such as life insurance policies, retirement accounts, or social security benefits. This notice serves to notify the surviving spouse about these deadlines and the importance of timely action to secure their rights. 3. Little Rock Arkansas Notice of Probate Proceedings: This notice is typically issued by the court or the executor of the deceased spouse's estate. It provides information about the probate process, including important dates, hearings, and the responsibilities of the surviving spouse in the administration of the deceased spouse's estate. 4. Little Rock Arkansas Notice to Surviving Spouse Regarding Debts: In some cases, the surviving spouse may have responsibilities towards the debts or liabilities left behind by their deceased spouse. This notice informs the surviving spouse about their rights and obligations in relation to these debts, helping them understand their legal position. 5. Little Rock Arkansas Notice of Final Distribution to Surviving Spouse: Once the probate process is completed, this notice serves to inform the surviving spouse about the final distribution of assets from the deceased spouse's estate. It provides details about what the surviving spouse is entitled to, such as property, funds, or other assets. These various types of notices to surviving spouse in Little Rock, Arkansas help ensure that the surviving spouse is well-informed about their legal rights, obligations, and entitlements while dealing with the aftermath of their spouse's death. It is crucial for the surviving spouse to seek legal advice and assistance to fully understand and navigate through these complex matters.

Little Rock Arkansas Notice To Surviving Spouse

Description

How to fill out Little Rock Arkansas Notice To Surviving Spouse?

If you are looking for an authentic document, it’s challenging to find a more user-friendly platform than the US Legal Forms site – one of the most exhaustive online collections.

Here you can discover numerous document models for business and personal needs, categorized by categories and states, or keywords.

With our superior search capability, locating the latest Little Rock Arkansas Notice To Surviving Spouse is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the form. Choose the format and download it to your device.

- Additionally, the pertinence of each document is verified by a team of professional lawyers who routinely assess the templates on our site and refresh them in accordance with the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to obtain the Little Rock Arkansas Notice To Surviving Spouse is to Log In to your account and click the Download button.

- If this is your initial time using US Legal Forms, simply adhere to the directions outlined below.

- Ensure you have located the form you desire. Review its description and utilize the Preview feature (if accessible) to inspect its content. If it does not satisfy your needs, use the Search option located at the top of the screen to find the required file.

- Verify your choice. Select the Buy now button. Following that, choose your preferred payment plan and furnish details to register for an account.

Form popularity

FAQ

In Arkansas, when a husband dies, the wife is entitled to a portion of the estate, which may include property and other assets. If there is no will, the laws of intestacy will dictate the distribution, usually favoring the spouse. To fully comprehend your rights and entitlements, consult a Little Rock Arkansas Notice To Surviving Spouse, which can help clarify your situation.

When a homeowner dies in Arkansas, the fate of the house hinges on several factors, including ownership type and whether a will exists. If the home is jointly owned, the surviving owner may take full ownership. For detailed guidance regarding property rights, consider reviewing a Little Rock Arkansas Notice To Surviving Spouse, which outlines the necessary steps.

While many assets may transfer to a surviving spouse, not everything automatically belongs to them after death. The distribution of assets often depends on whether the deceased had a will or not. For a clear understanding of what may go to the spouse, you should refer to a Little Rock Arkansas Notice To Surviving Spouse to guide you through the process.

In Little Rock, Arkansas, a surviving spouse is typically the person legally married to the deceased at the time of death. To qualify, the couple must have been married and not legally separated. This definition helps ensure that the rights of the surviving spouse are recognized when dealing with estate matters, including receiving a Little Rock Arkansas Notice To Surviving Spouse.

In Arkansas, the maximum time for probate can vary, but it generally lasts about six months to one year. Complicated estates may take longer due to factors like asset valuation and disputes among heirs. Timely filing of necessary documents can help streamline the process. For a smoother experience with your Little Rock Arkansas Notice To Surviving Spouse, USLegalForms offers tools and templates to help expedite probate matters.

Not all wills require probate in Arkansas, but it is typically necessary for most estates. If the estate contains significant assets, probate ensures that the deceased's wishes are honored and debts are settled properly. However, smaller estates may qualify for simplified procedures. For specific guidance regarding the Little Rock Arkansas Notice To Surviving Spouse, consider consulting USLegalForms to help clarify the probate requirements.

If you don't file probate in Arkansas, the estate may remain in limbo, creating potential complications for the surviving spouse. Without probating the will, assets may not be distributed according to the deceased's wishes, which can lead to disputes among heirs. Moreover, certain debts of the estate may go unpaid, impacting your financial security. Using resources like USLegalForms can help you navigate the Little Rock Arkansas Notice To Surviving Spouse and facilitate the probate process effectively.

To initiate the probate process in Arkansas, you must file a petition with the local probate court. Gathering essential documents, such as the death certificate and a list of assets, is a critical first step. A Little Rock Arkansas Notice To Surviving Spouse can offer templates and directions for completing these initial filings correctly.

Probating an estate without a will, known as intestate succession, involves identifying heirs based on Arkansas law. The estate will be distributed according to statutory guidelines, and a Little Rock Arkansas Notice To Surviving Spouse can illuminate the necessary steps to follow. It can also aid in understanding how to designate an administrator for the estate.

In Arkansas, surviving spouses are entitled to a significant portion of the deceased spouse’s estate, even if there is a will. The Little Rock Arkansas Notice To Surviving Spouse provides important information regarding rights and entitlements. Moreover, these laws ensure that a surviving spouse retains necessary financial support after the loss of their partner.