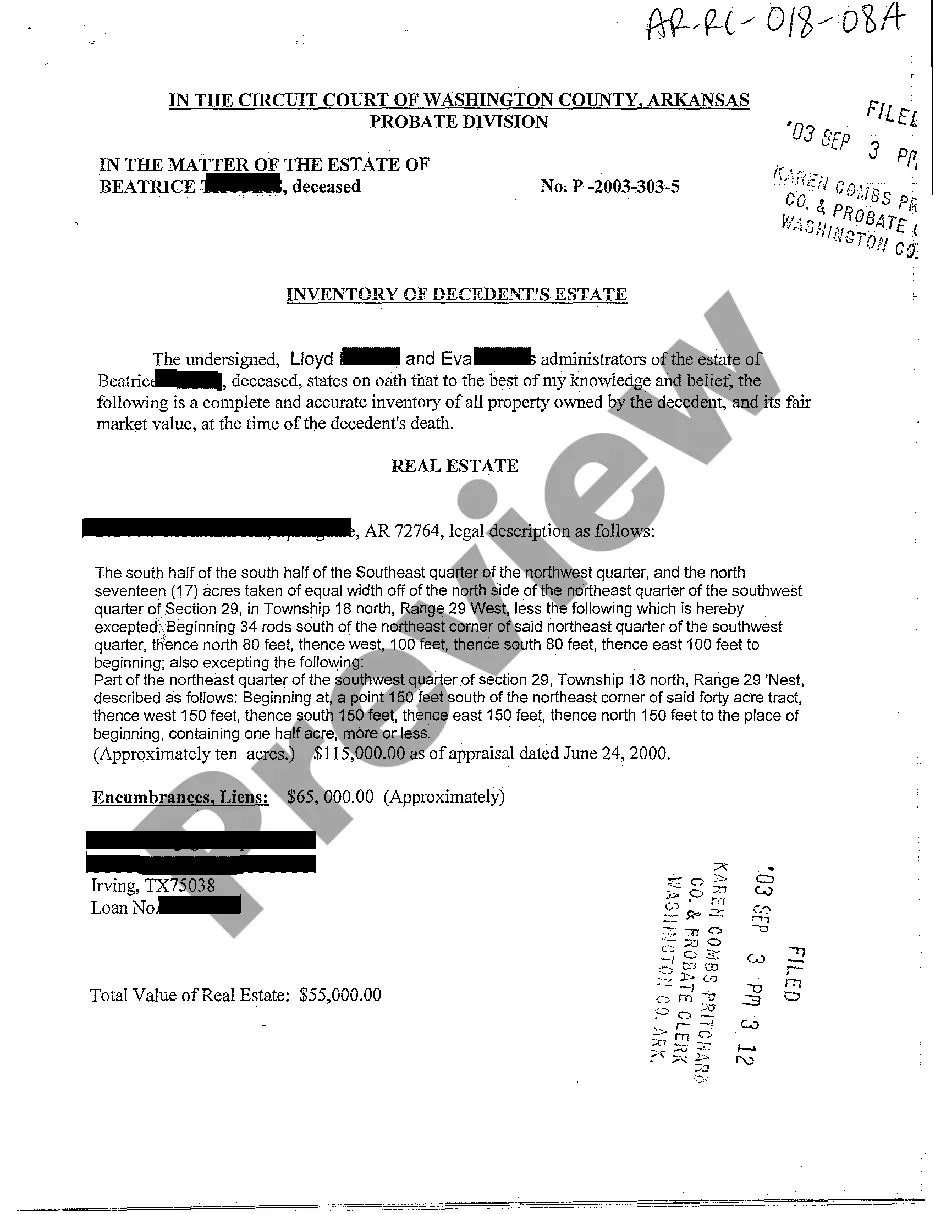

Little Rock Arkansas Inventory of Decedent's Estate is a crucial legal document used in the probate process to assess and account for the assets and possessions left behind by a deceased individual in Little Rock, Arkansas. This detailed inventory aims to ensure a fair and accurate distribution of the decedent's estate among the rightful beneficiaries and creditors. The inventory provides a comprehensive list of all the assets, liabilities, and monetary value associated with the estate. Keywords: Little Rock Arkansas, Inventory of Decedent's Estate, probate process, assets, possessions, deceased individual, distribution, beneficiaries, creditors, comprehensive list, liabilities, monetary value. Different types of Little Rock Arkansas Inventory of Decedent's Estate may include: 1. Real Estate Inventory: This type of inventory focuses on capturing all the real property owned by the decedent, such as houses, land, commercial buildings, rental properties, etc. Each property is described in detail, including its location, legal description, fair market value, and any existing mortgages or liens. 2. Personal Property Inventory: This inventory encompasses all the tangible assets owned by the decedent, excluding real estate. It comprises items like furniture, vehicles, jewelry, artwork, electronics, household items, collectibles, and other personal possessions. Each item is listed with its description, current condition, value, and any specific bequests or instructions related to it. 3. Financial Inventory: This type of inventory deals with the decedent's financial assets, including bank accounts, investments, stocks, mutual funds, retirement accounts, life insurance policies, and any other financial instruments. It provides details about the financial institution, account numbers, current balances or values, and any beneficiaries designated. 4. Business or Partnership Inventory: In cases where the decedent owned a business or had interests in partnerships, this inventory focuses on documenting those assets and their respective values. It includes details of business entities, ownership percentages, company assets, outstanding loans or debts, and any other relevant business-related information. 5. Debts and Liabilities Inventory: This inventory highlights all the debts, liabilities, and obligations of the decedent. It covers outstanding mortgages, loans, credit card debts, taxes owed, utility bills, personal loans, judgments, and any other liabilities that need to be settled using the estate's assets. Note: It's important to consult with an estate attorney or a probate professional to obtain accurate and up-to-date information regarding the specific requirements and forms needed for creating an inventory of a decedent's estate in Little Rock, Arkansas, as regulations and procedures may vary.

Little Rock Arkansas Inventory of Decedent's Estate

Description

How to fill out Little Rock Arkansas Inventory Of Decedent's Estate?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney services that, usually, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Little Rock Arkansas Inventory of Decedent's Estate or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Little Rock Arkansas Inventory of Decedent's Estate adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Little Rock Arkansas Inventory of Decedent's Estate is suitable for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!