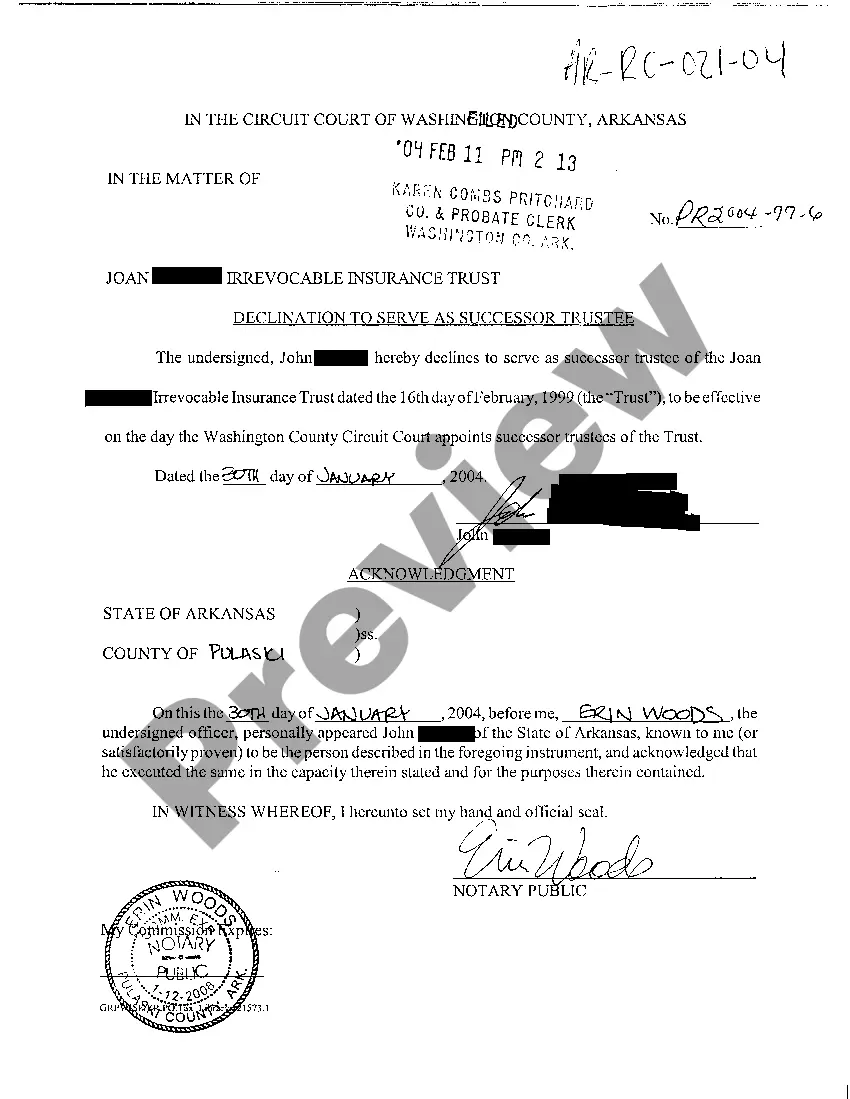

Little Rock Arkansas Declination To Serve As Successor Trustee refers to a legal process by which an individual in Little Rock, Arkansas refuses to take on the role of a successor trustee in a trust agreement. A trustee is appointed to manage and distribute the assets of a trust upon the death or incapacity of the original trustee. However, there may be instances where the individual chosen as the successor trustee is unable or unwilling to fulfill the responsibilities associated with this role, leading to a declination. There are different types of Little Rock Arkansas Declination To Serve As Successor Trustee, including: 1. Little Rock Arkansas Declination to Serve as Successor Trustee due to incapacity: This occurs when the designated successor trustee is deemed mentally or physically incapable of effectively managing the trust assets. In such cases, they may formally decline the role. 2. Little Rock Arkansas Declination to Serve as Successor Trustee due to conflict of interest: A potential successor trustee may have conflicts of interest that could compromise their ability to make unbiased decisions in the best interest of the trust beneficiaries. In such situations, the individual may choose to decline the role. 3. Little Rock Arkansas Declination to Serve as Successor Trustee due to lack of knowledge or expertise: Managing a trust requires a certain level of understanding of legal and financial matters. If a potential successor trustee feels inadequately equipped to handle the complexities involved, they may decline the position. 4. Little Rock Arkansas Declination to Serve as Successor Trustee for personal reasons: Sometimes potential successor trustees may have personal constraints or commitments that prevent them from dedicating the time and effort required to fulfill their duties effectively. They may choose to decline the role to avoid any potential complications. In Little Rock, Arkansas, the process for a declination to serve as a successor trustee involves submitting a formal declination document to the relevant court or granter of the trust. The document should outline the reasons for the declination and be filed within the specified timeframe mentioned in the trust agreement or state laws. It is crucial to consult with a qualified attorney in Little Rock, Arkansas when considering a declination to serve as a successor trustee. The attorney can provide guidance on the legal implications, potential alternatives, and assist in the proper execution of the declination process in accordance with state laws and the terms of the trust agreement.

Little Rock Arkansas Declination To Serve As Successor Trustee

Description

How to fill out Little Rock Arkansas Declination To Serve As Successor Trustee?

If you are in search of a legitimate form template, it’s challenging to discover a more suitable place than the US Legal Forms website – likely the most extensive collections online.

Here you can locate an immense variety of form samples for business and personal objectives by categories and states, or keywords.

Utilizing our premium search functionality, locating the most current Little Rock Arkansas Declination To Serve As Successor Trustee is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and download it to your device. Edit. Fill in, modify, print, and sign the acquired Little Rock Arkansas Declination To Serve As Successor Trustee.

- Additionally, the validity of each document is validated by a team of experienced lawyers who routinely review the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Little Rock Arkansas Declination To Serve As Successor Trustee is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have accessed the sample you desire. Review its details and utilize the Preview feature (if available) to inspect its content. If it doesn’t meet your requirements, use the Search box at the top of the screen to find the necessary document.

- Confirm your selection. Click the Buy now button. Then, choose the desired pricing option and provide your details to register for an account.

Form popularity

FAQ

When writing a letter to a trustee, be clear and respectful in your communication. Begin with a greeting, state the purpose of your letter, and provide relevant details. If you are referencing the Little Rock Arkansas Declination To Serve As Successor Trustee in your writing, clarify how it impacts current arrangements or decisions. USLegalForms can assist you in drafting this kind of letter by providing helpful templates and examples.

An example trustee resignation letter should clearly state the intention to resign, the reason for the resignation, and include a date for the effective resignation. It’s important to communicate this formally to ensure all involved parties are aware. If you’re dealing with a Little Rock Arkansas Declination To Serve As Successor Trustee, having a well-crafted resignation letter on hand can help make the transition smoother. USLegalForms provides templates that can guide you through writing an effective resignation letter.

To assign a successor trustee, you typically need to include this information in your trust document or will. Specify the name and details of the successor trustee, ensuring that they accept the responsibilities outlined. If you find yourself facing a Little Rock Arkansas Declination To Serve As Successor Trustee situation, you can efficiently navigate the nuances with resources from USLegalForms. This platform offers templates that simplify the process of assigning a successor trustee.

An independent trustee is a neutral party who administers a trust without bias towards the beneficiaries. Their role is crucial as they provide objective oversight, ensuring the trust operates smoothly. In situations involving the Little Rock Arkansas Declination To Serve As Successor Trustee, an independent trustee can offer impartial assistance and relieve the burden from family members. This can enhance transparency and trust among all parties involved.

A trustee in a will in the UK plays a vital role in managing the deceased's estate according to the will's instructions. This person ensures that the assets are distributed to the beneficiaries as specified. In cases like the Little Rock Arkansas Declination To Serve As Successor Trustee, you may need to understand how this role transitions when a trustee steps down. The responsibility of a trustee is substantial, as it involves overseeing funds and properties until obligations are fulfilled.

A successor trustee is appointed to take over for the original trustee when needed, while a co-trustee shares duties and responsibilities from the outset. This means that a successor trustee steps in at a specific point, whereas co-trustees actively manage the trust together. Understanding these differences can guide decisions in managing your trust effectively and may involve the Little Rock Arkansas Declination To Serve As Successor Trustee form.

A successor trustee takes on the role of trustee after the original trustee can no longer serve, such as due to death or incapacity. While both roles involve managing the trust, the successor trustee steps in at a specific time, ensuring continuity in trust administration. Understanding this distinction can help in navigating the Little Rock Arkansas Declination To Serve As Successor Trustee.

trustee is a type of trustee who shares the responsibilities of managing the trust with another trustee. This arrangement allows for shared decisionmaking and oversight. However, it's important to note that having cotrustees may complicate certain decisions, emphasizing the importance of a clear Little Rock Arkansas Declination To Serve As Successor Trustee.

A successor trustee is usually appointed through the trust document itself, which outlines the process and criteria for selection. Often, the person creating the trust will designate a successor while considering their capabilities and reliability. In Little Rock, Arkansas, following the guidelines in the Little Rock Arkansas Declination To Serve As Successor Trustee can simplify this crucial appointment.

To remove yourself from being a trustee, you generally need to follow the procedures outlined in the trust document. This process may involve resigning in writing and potentially obtaining court approval, depending on the circumstances. When managing your responsibilities, it's wise to refer to the Little Rock Arkansas Declination To Serve As Successor Trustee for guidance and clarity.