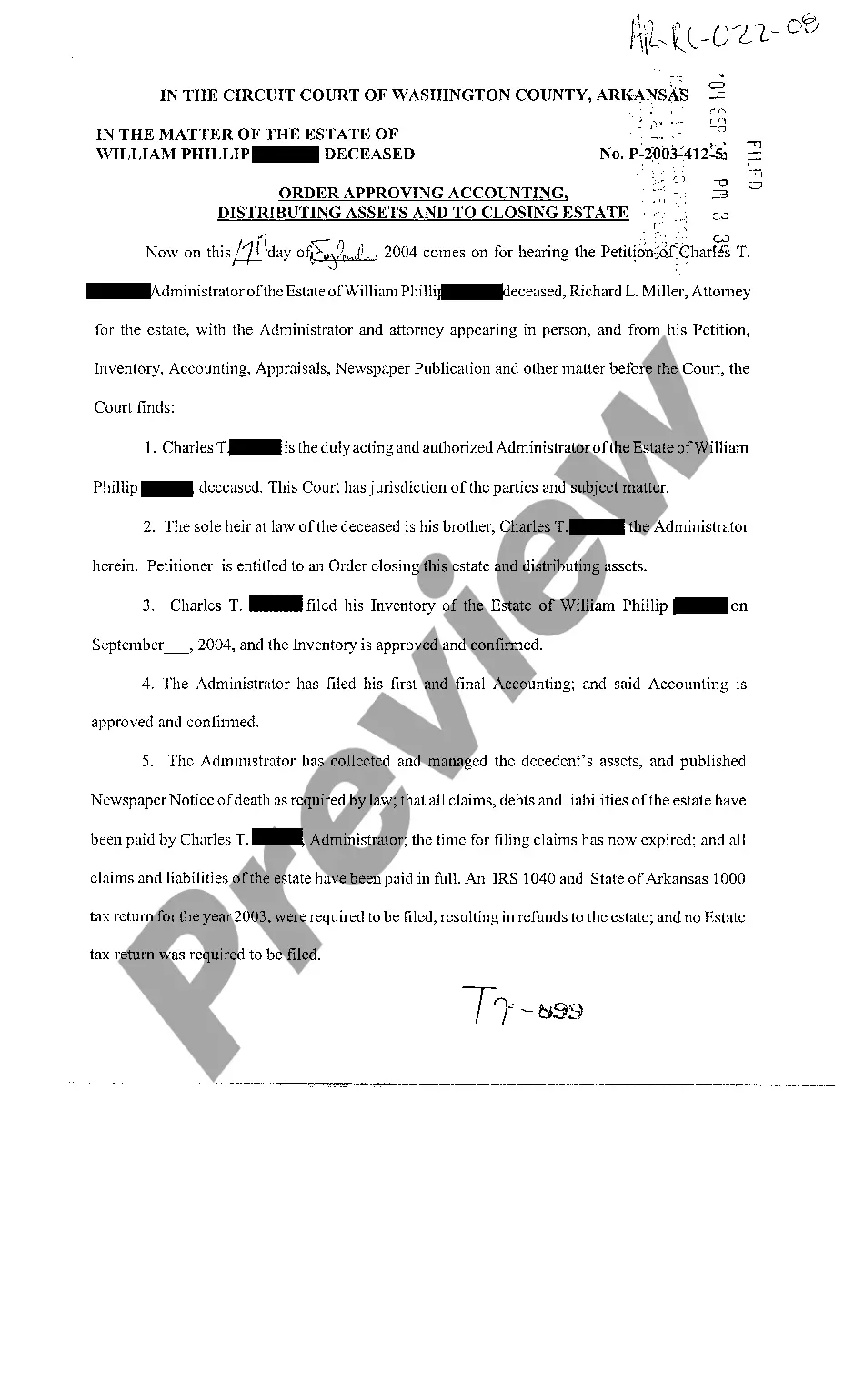

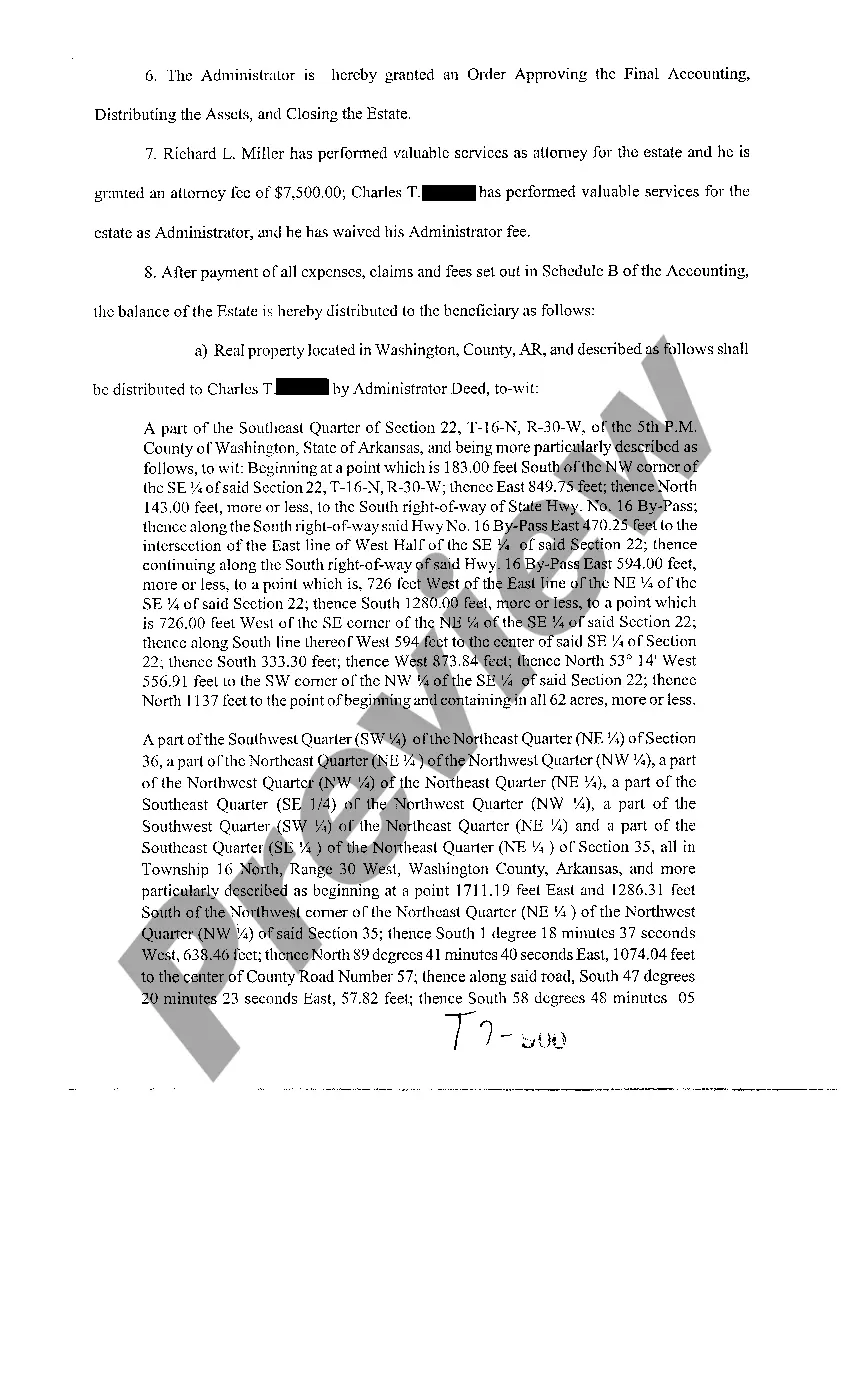

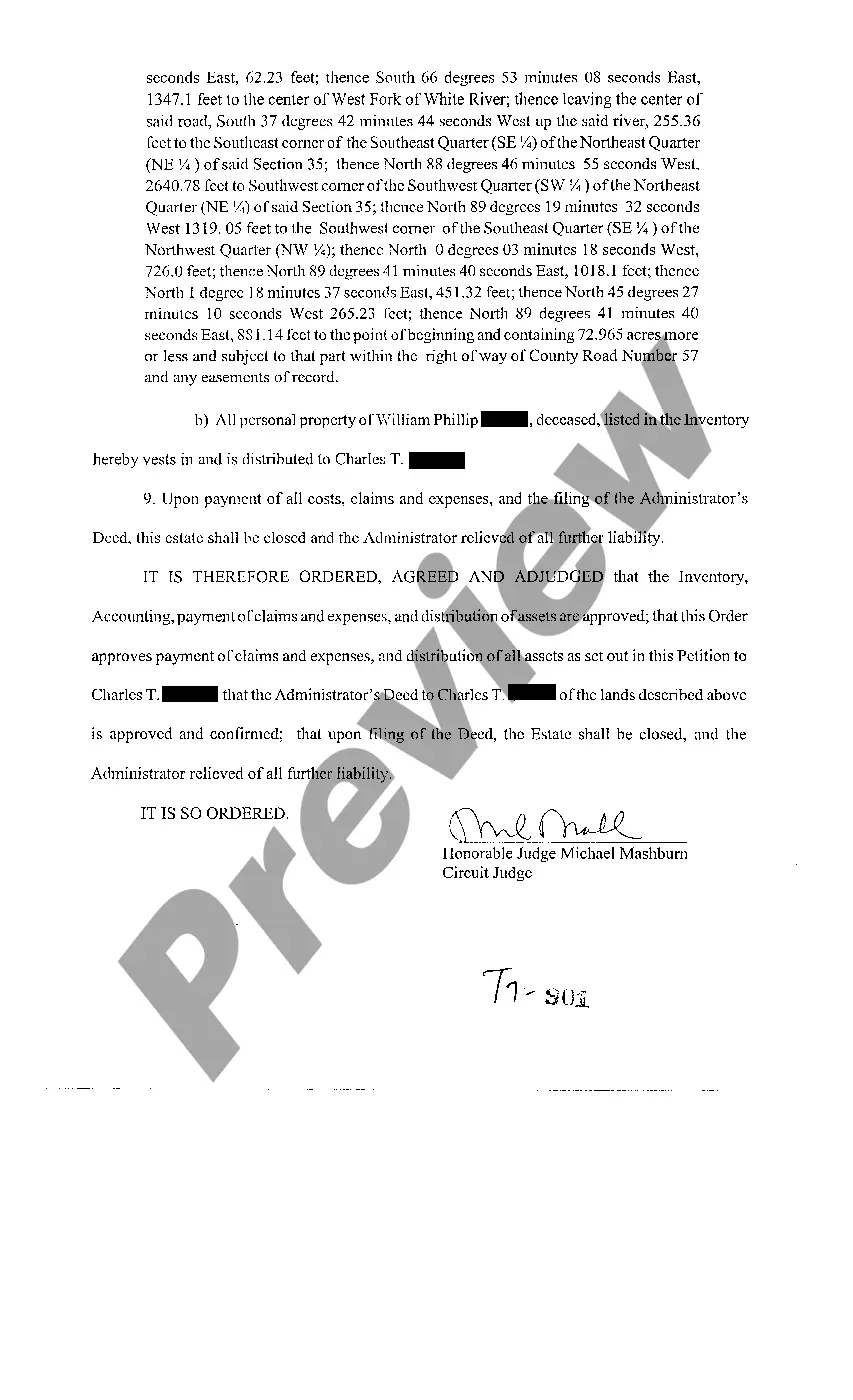

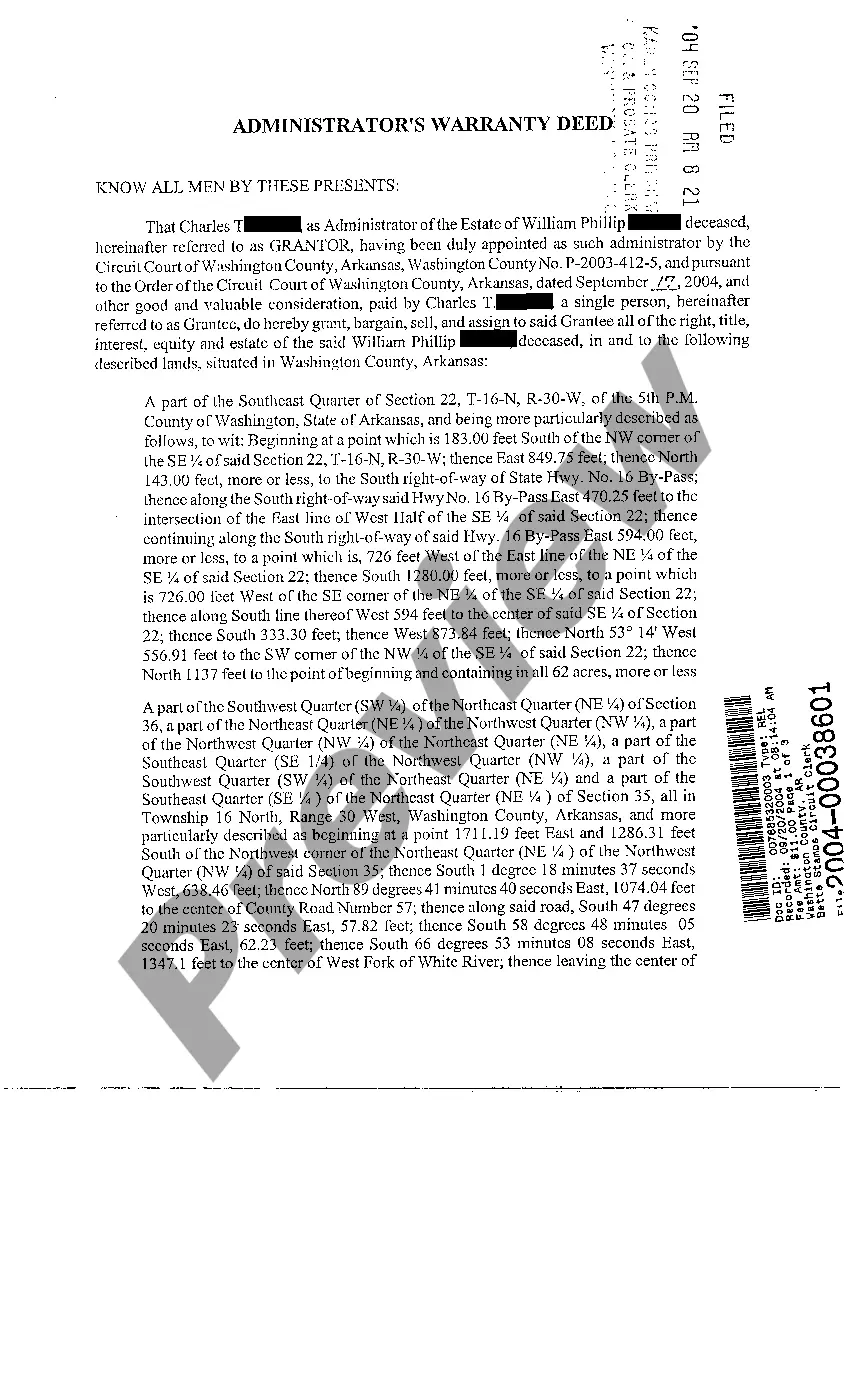

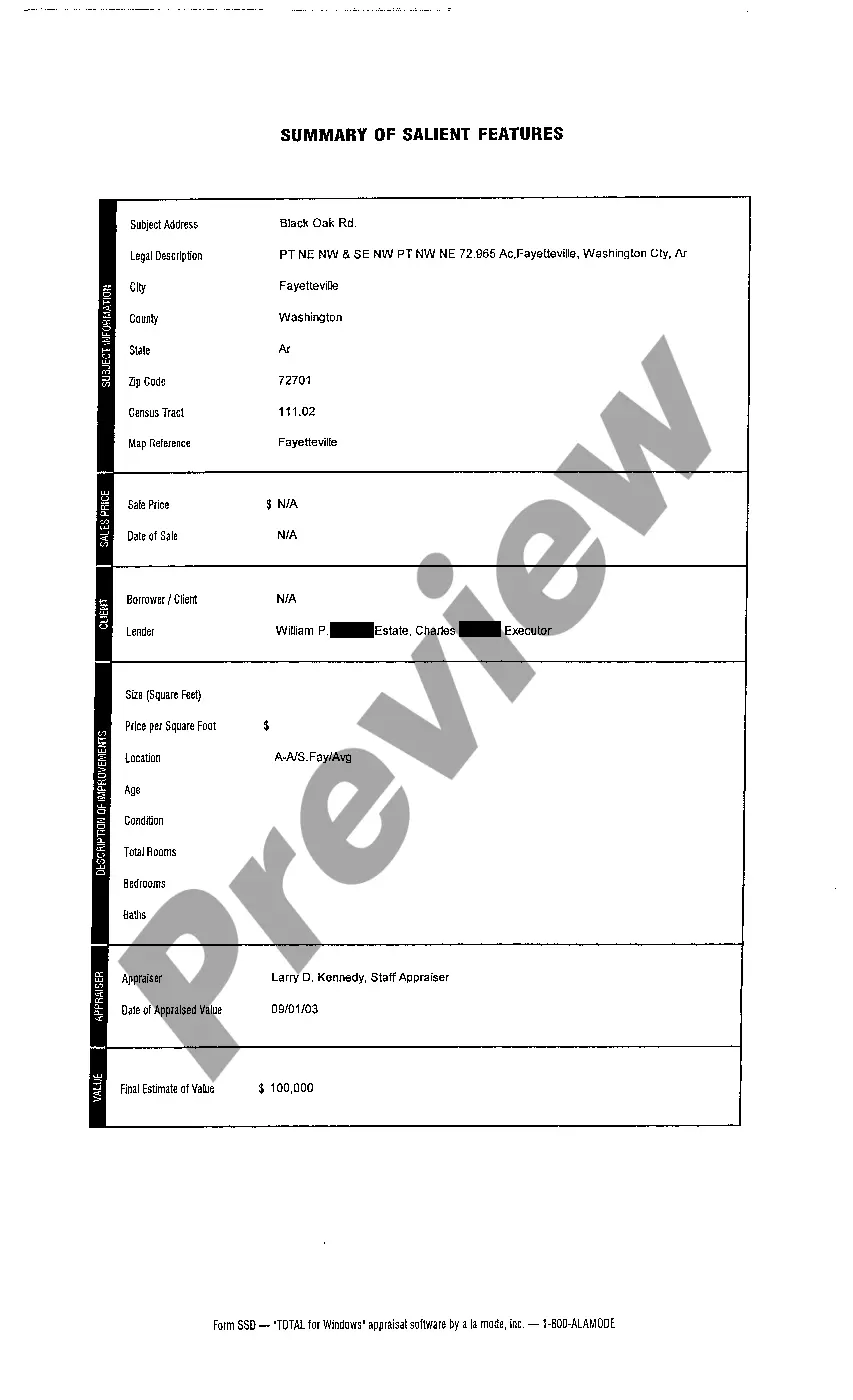

The Little Rock Arkansas Order Approving Accounting, Distributing Assets, and To Closing Estate is a legal process that occurs when an estate is ready to be settled and closed. This order is issued by the probate court to ensure that all financial matters related to the deceased person's estate are properly documented and resolved. In this process, the executor or personal representative of the estate presents a detailed report, referred to as an accounting, which provides an overview of all assets, debts, income, and expenses associated with the estate. This accounting is thoroughly reviewed by the court to ensure its accuracy and completeness. The purpose of the order is to provide transparency and accountability in the handling of estate affairs. It not only serves to protect the interests of beneficiaries and creditors but also ensures that all parties involved comply with the legal requirements and obligations. The specific steps involved in the Little Rock Arkansas Order Approving Accounting, Distributing Assets, and To Closing Estate process may vary depending on the complexity of the estate. However, some key aspects typically included are: 1. Filing the accounting: The executor is required to file the accounting with the probate court, providing a detailed breakdown of all financial transactions within the estate. 2. Notice to interested parties: The court typically requires the executor to provide notice to all interested parties, including beneficiaries, heirs, and creditors, informing them of the accounting filing. 3. Review by the court: The probate court carefully examines the accounting, ensuring that all assets and liabilities are accurately represented. The court may request additional information or clarification as necessary. 4. Confirmation hearing: Once the court is satisfied with the accuracy and completeness of the accounting, it schedules a confirmation hearing. At this hearing, interested parties have an opportunity to voice objections or concerns regarding the accounting. 5. Order approval: If the court determines that the accounting is in order, it will issue an Order Approving Accounting, confirming the accuracy of the presented financial report. 6. Asset distribution: After the Order Approving Accounting is granted, the executor is authorized to distribute the remaining estate assets to the beneficiaries in accordance with the terms outlined in the estate planning documents or state laws of intestacy if no will exists. 7. Closing the estate: Following the distribution of assets, all necessary tax returns, legal filings, and administrative tasks are completed, officially closing the estate. It is important to note that variations of the Little Rock Arkansas Order Approving Accounting, Distributing Assets, and To Closing Estate process may exist based on the specific circumstances of the estate. Consulting an experienced probate attorney is highly recommended ensuring compliance with local laws and regulations.

Little Rock Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate

Description

How to fill out Little Rock Arkansas Order Approving Accounting, Distributing Assets And To Closing Estate?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for attorney solutions that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Little Rock Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Little Rock Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Little Rock Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate is suitable for you, you can choose the subscription option and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!