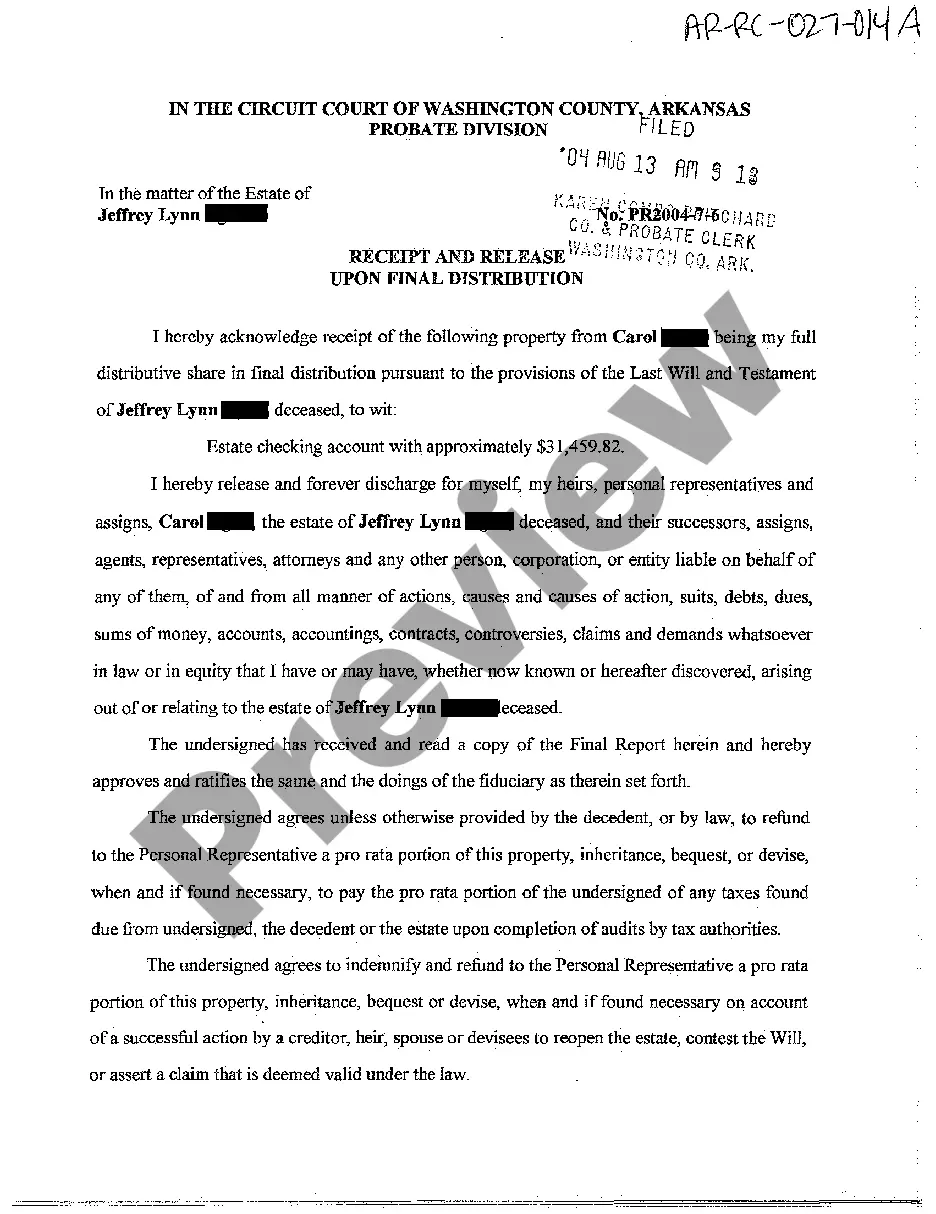

Little Rock Arkansas Payment and Release Upon Final Distribution refers to a legal document or process that involves the completion of financial transactions and the release of obligations between parties involved in a project or business venture in Little Rock, Arkansas. It typically signifies the last stage of a transaction or project where all financial matters are finalized and any remaining payments are made. Here is a detailed description of what this process entails: Payment and Release Upon Final Distribution is a crucial step in ensuring that all financial obligations are met, and parties involved can conclude a project or transaction in Little Rock, Arkansas. This process involves the distribution of funds, assets, or properties to the appropriate parties and the release of any outstanding liabilities or claims. In essence, this process guarantees that all parties have fulfilled their financial commitments, and all outstanding payments are settled before officially concluding an agreement, formalizing a partnership, or finalizing a construction project, among other endeavors. There may be different types of Payment and Release Upon Final Distribution contracts or agreements in Little Rock, Arkansas, depending on the nature of the project or transaction. Some common examples include: 1. Real Estate Payment and Release Upon Final Distribution: This type of agreement usually applies to real estate transactions, where the final transfer of property ownership occurs once all payments have been made and all parties have been released from any remaining obligations or claims. 2. Construction Payment and Release Upon Final Distribution: In construction projects, this agreement ensures that subcontractors, suppliers, and other involved parties receive their final payments upon project completion, allowing for the release of any claims or liens against the property. 3. Partnership/Investment Payment and Release Upon Final Distribution: This type of agreement applies to partnerships or investment ventures, determining the final distribution of profits, assets, or investments among partners or investors. It ensures that all financial matters are settled and releases all parties from any further obligations or claims. 4. Legal Settlement Payment and Release Upon Final Distribution: In legal settlements, this agreement ensures that all agreed-upon payments are made, releasing all parties involved from any further claims or liabilities related to the dispute or lawsuit. It is important to consult with legal professionals or experts in Little Rock, Arkansas, to draft and execute any Payment and Release Upon Final Distribution agreement accurately. These documents safeguard the interests of all parties involved and help to ensure a smooth and satisfactory conclusion to a project or transaction.

Little Rock Arkansas Payment and Release Upon Final Distribution refers to a legal document or process that involves the completion of financial transactions and the release of obligations between parties involved in a project or business venture in Little Rock, Arkansas. It typically signifies the last stage of a transaction or project where all financial matters are finalized and any remaining payments are made. Here is a detailed description of what this process entails: Payment and Release Upon Final Distribution is a crucial step in ensuring that all financial obligations are met, and parties involved can conclude a project or transaction in Little Rock, Arkansas. This process involves the distribution of funds, assets, or properties to the appropriate parties and the release of any outstanding liabilities or claims. In essence, this process guarantees that all parties have fulfilled their financial commitments, and all outstanding payments are settled before officially concluding an agreement, formalizing a partnership, or finalizing a construction project, among other endeavors. There may be different types of Payment and Release Upon Final Distribution contracts or agreements in Little Rock, Arkansas, depending on the nature of the project or transaction. Some common examples include: 1. Real Estate Payment and Release Upon Final Distribution: This type of agreement usually applies to real estate transactions, where the final transfer of property ownership occurs once all payments have been made and all parties have been released from any remaining obligations or claims. 2. Construction Payment and Release Upon Final Distribution: In construction projects, this agreement ensures that subcontractors, suppliers, and other involved parties receive their final payments upon project completion, allowing for the release of any claims or liens against the property. 3. Partnership/Investment Payment and Release Upon Final Distribution: This type of agreement applies to partnerships or investment ventures, determining the final distribution of profits, assets, or investments among partners or investors. It ensures that all financial matters are settled and releases all parties from any further obligations or claims. 4. Legal Settlement Payment and Release Upon Final Distribution: In legal settlements, this agreement ensures that all agreed-upon payments are made, releasing all parties involved from any further claims or liabilities related to the dispute or lawsuit. It is important to consult with legal professionals or experts in Little Rock, Arkansas, to draft and execute any Payment and Release Upon Final Distribution agreement accurately. These documents safeguard the interests of all parties involved and help to ensure a smooth and satisfactory conclusion to a project or transaction.