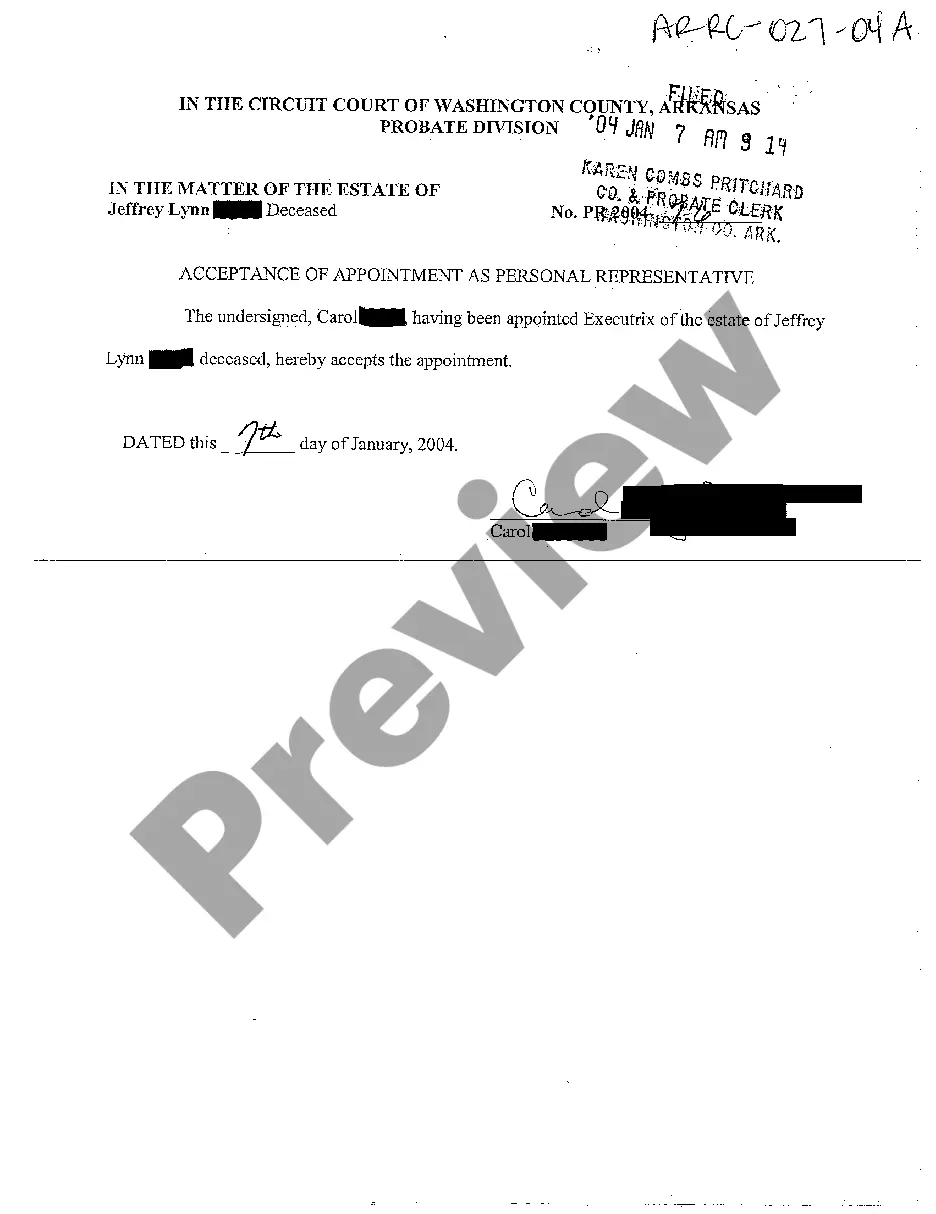

Little Rock, Arkansas Acceptance of Appointment as Personal Representative The Little Rock, Arkansas Acceptance of Appointment as Personal Representative refers to a legal document that formally acknowledges an individual's acceptance to act as the personal representative or executor of a deceased person's estate in the city of Little Rock, Arkansas. When someone passes away, their estate, including assets, debts, and property, needs to be managed and distributed as per their wishes or state laws. The personal representative plays a pivotal role in handling these tasks and ensuring that everything is carried out smoothly and in compliance with relevant legal requirements. The Acceptance of Appointment as Personal Representative is a crucial step in the probate process and signifies the individual's willingness to take on the responsibilities and duties associated with administering the estate. The document typically outlines the terms and conditions of the appointment, and by signing it, the personal representative agrees to fulfill their fiduciary obligations faithfully and ethically. There are several types of Little Rock, Arkansas Acceptance of Appointment as Personal Representative, depending on the circumstances: 1. Regular Acceptance of Appointment as Personal Representative: This is the most common type, usually used when the deceased person has left a valid will. The appointed personal representative accepts the position and agrees to administer the estate according to the terms outlined in the will, as well as following Arkansas probate laws. 2. Acceptance of Appointment as Personal Representative Without a Will: In cases where the decedent died intestate (without a will), the court appoints a personal representative based on Arkansas intestacy laws. This type of acceptance involves accepting the responsibilities without specific instructions from a will and distributing the estate according to state laws. 3. Limited Acceptance of Appointment as Personal Representative: Sometimes, a personal representative may possess limitations in their ability to fulfill the entire range of duties. In such cases, they can accept the appointment with restrictions or limitations, outlined in the Limited Acceptance of Appointment as Personal Representative document. This might occur when the personal representative has conflicts of interest or other commitments that prevent them from carrying out certain tasks. Regardless of the type of Little Rock, Arkansas Acceptance of Appointment as Personal Representative, it is crucial that the individual understands the responsibilities involved. The personal representative has numerous duties, including inventorying assets, paying debts and taxes, managing estate investments, distributing assets to beneficiaries, and handling any legal disputes that may arise during the probate process. They must act in the best interest of the estate and its beneficiaries, demonstrating honesty, diligence, and accountability. In conclusion, the Little Rock, Arkansas Acceptance of Appointment as Personal Representative is a significant legal document that formalizes an individual's agreement to undertake the role of a personal representative in managing and distributing a deceased person's estate. Whether it is a regular acceptance, acceptance without a will, or a limited acceptance, the personal representative should thoroughly comprehend the responsibilities entailed and carry out their duties diligently to ensure the proper administration of the estate.

Little Rock, Arkansas Acceptance of Appointment as Personal Representative The Little Rock, Arkansas Acceptance of Appointment as Personal Representative refers to a legal document that formally acknowledges an individual's acceptance to act as the personal representative or executor of a deceased person's estate in the city of Little Rock, Arkansas. When someone passes away, their estate, including assets, debts, and property, needs to be managed and distributed as per their wishes or state laws. The personal representative plays a pivotal role in handling these tasks and ensuring that everything is carried out smoothly and in compliance with relevant legal requirements. The Acceptance of Appointment as Personal Representative is a crucial step in the probate process and signifies the individual's willingness to take on the responsibilities and duties associated with administering the estate. The document typically outlines the terms and conditions of the appointment, and by signing it, the personal representative agrees to fulfill their fiduciary obligations faithfully and ethically. There are several types of Little Rock, Arkansas Acceptance of Appointment as Personal Representative, depending on the circumstances: 1. Regular Acceptance of Appointment as Personal Representative: This is the most common type, usually used when the deceased person has left a valid will. The appointed personal representative accepts the position and agrees to administer the estate according to the terms outlined in the will, as well as following Arkansas probate laws. 2. Acceptance of Appointment as Personal Representative Without a Will: In cases where the decedent died intestate (without a will), the court appoints a personal representative based on Arkansas intestacy laws. This type of acceptance involves accepting the responsibilities without specific instructions from a will and distributing the estate according to state laws. 3. Limited Acceptance of Appointment as Personal Representative: Sometimes, a personal representative may possess limitations in their ability to fulfill the entire range of duties. In such cases, they can accept the appointment with restrictions or limitations, outlined in the Limited Acceptance of Appointment as Personal Representative document. This might occur when the personal representative has conflicts of interest or other commitments that prevent them from carrying out certain tasks. Regardless of the type of Little Rock, Arkansas Acceptance of Appointment as Personal Representative, it is crucial that the individual understands the responsibilities involved. The personal representative has numerous duties, including inventorying assets, paying debts and taxes, managing estate investments, distributing assets to beneficiaries, and handling any legal disputes that may arise during the probate process. They must act in the best interest of the estate and its beneficiaries, demonstrating honesty, diligence, and accountability. In conclusion, the Little Rock, Arkansas Acceptance of Appointment as Personal Representative is a significant legal document that formalizes an individual's agreement to undertake the role of a personal representative in managing and distributing a deceased person's estate. Whether it is a regular acceptance, acceptance without a will, or a limited acceptance, the personal representative should thoroughly comprehend the responsibilities entailed and carry out their duties diligently to ensure the proper administration of the estate.