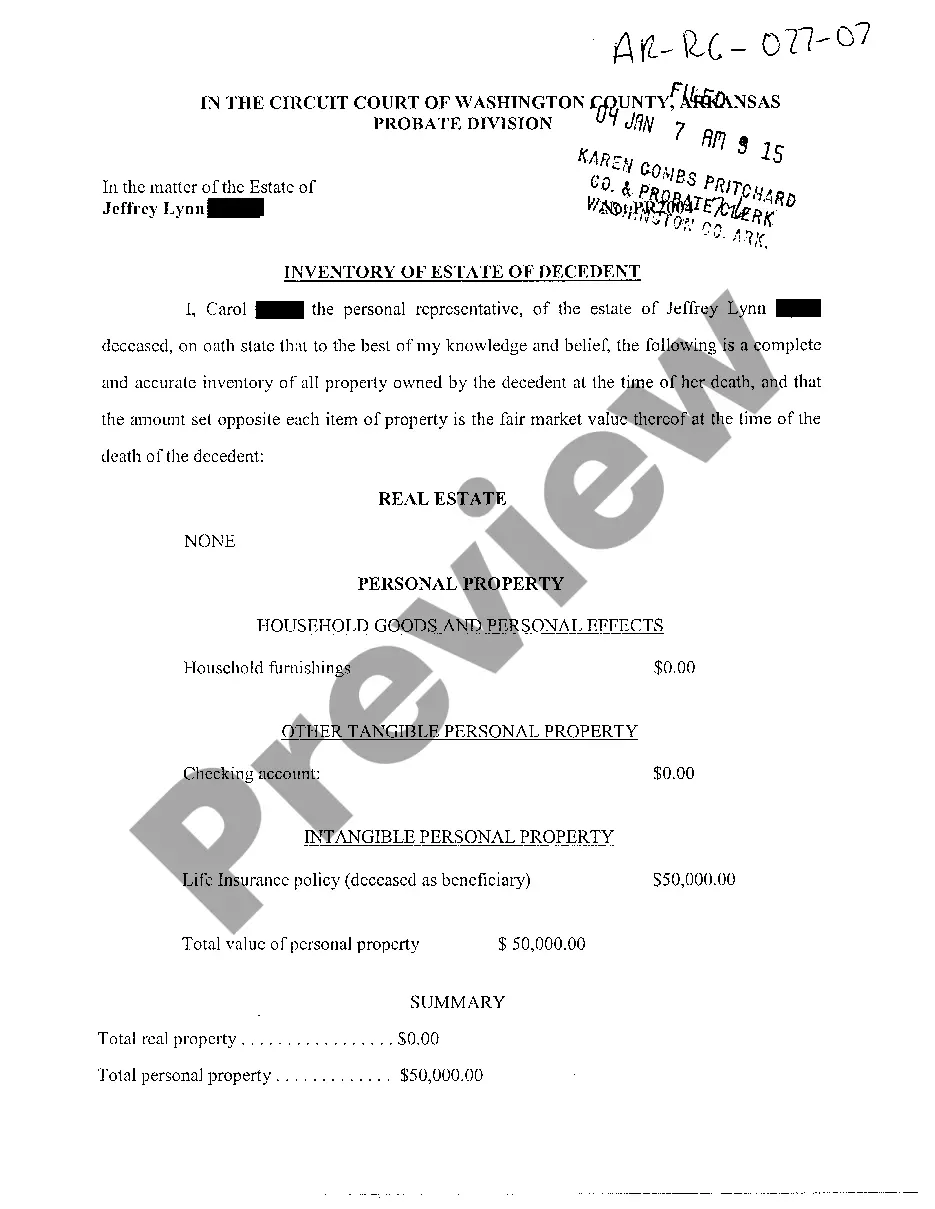

The Little Rock Arkansas Inventory of Estate of Decedent refers to the comprehensive list and documentation of assets, liabilities, and property owned by an individual who has passed away in Little Rock, Arkansas. This inventory serves as a vital component of the probate process, enabling the court to determine the total value and distribution of the decedent's estate among beneficiaries and creditors. The inventory is typically prepared by the estate's personal representative, executor or administrator, who diligently gathers information and identifies each item of value associated with the decedent. Keywords: Little Rock Arkansas, Inventory of Estate, Decedent, assets, liabilities, property, probate process, beneficiaries, creditors, personal representative, executor, administrator. Different Types of Little Rock Arkansas Inventory of Estate of Decedent: 1. Real Estate Inventory: This category of the inventory encompasses the decedent's owned land, residential or commercial properties, vacant lots, or any other form of real estate assets located in Little Rock, Arkansas. The inventory will include detailed descriptions of each property, its estimated value, and any outstanding mortgage or liens. 2. Financial Assets Inventory: This section of the inventory covers the decedent's financial holdings such as bank accounts, investment portfolios, retirement accounts, stocks, bonds, mutual funds, or any other form of liquid assets. Each financial asset will be listed with its corresponding value and documented proof such as bank statements, stock certificates, or account statements. 3. Personal Property Inventory: Within this category, all tangible personal belongings owned by the decedent are accounted for. It includes but is not limited to vehicles, jewelry, artwork, antiques, furniture, electronics, collectibles, clothing, and household items. Each item will be described with relevant details and assigned an estimated value. 4. Business Assets Inventory: If the decedent owned a business or had an interest in any business entities in Little Rock, Arkansas, this inventory will outline the details. It will include records of partnerships, sole proprietorship, limited liability companies (LCS), corporations, or any other business structures. The inventory will account for the value of the business, intellectual property, contracts, equipment, and other relevant assets associated with the business. 5. Debts and Liabilities Inventory: This section outlines the decedent's outstanding debts, loans, mortgages, credit card balances, taxes owed, or any other liabilities. The inventory will include details of creditors, outstanding balances, and the necessary documentation supporting these obligations. 6. Other Assets and Miscellaneous Inventory: This category covers any other assets that may not fall under the above-mentioned classifications. It could include royalty rights, patents, trademarks, copyrights, life insurance policies, pending lawsuits, or any other unique assets owned by the decedent. Preparing a comprehensive Little Rock Arkansas Inventory of Estate of Decedent is crucial in order to accurately assess the value of the estate and ensure fair distribution among beneficiaries and settlement of outstanding debts. It provides transparency and legal documentation for the probate process, safeguarding the rights and interests of all parties involved.

Little Rock Arkansas Inventory of Estate of Decedent

Description

How to fill out Little Rock Arkansas Inventory Of Estate Of Decedent?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no law background to draft such papers cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform offers a massive library with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you need the Little Rock Arkansas Inventory of Estate of Decedent or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Little Rock Arkansas Inventory of Estate of Decedent quickly employing our trustworthy platform. In case you are already an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, in case you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Little Rock Arkansas Inventory of Estate of Decedent:

- Ensure the form you have chosen is good for your location considering that the rules of one state or county do not work for another state or county.

- Review the form and read a brief description (if available) of scenarios the paper can be used for.

- If the form you chosen doesn’t suit your needs, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Choose the payment method and proceed to download the Little Rock Arkansas Inventory of Estate of Decedent as soon as the payment is completed.

You’re good to go! Now you can go ahead and print the form or fill it out online. In case you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.