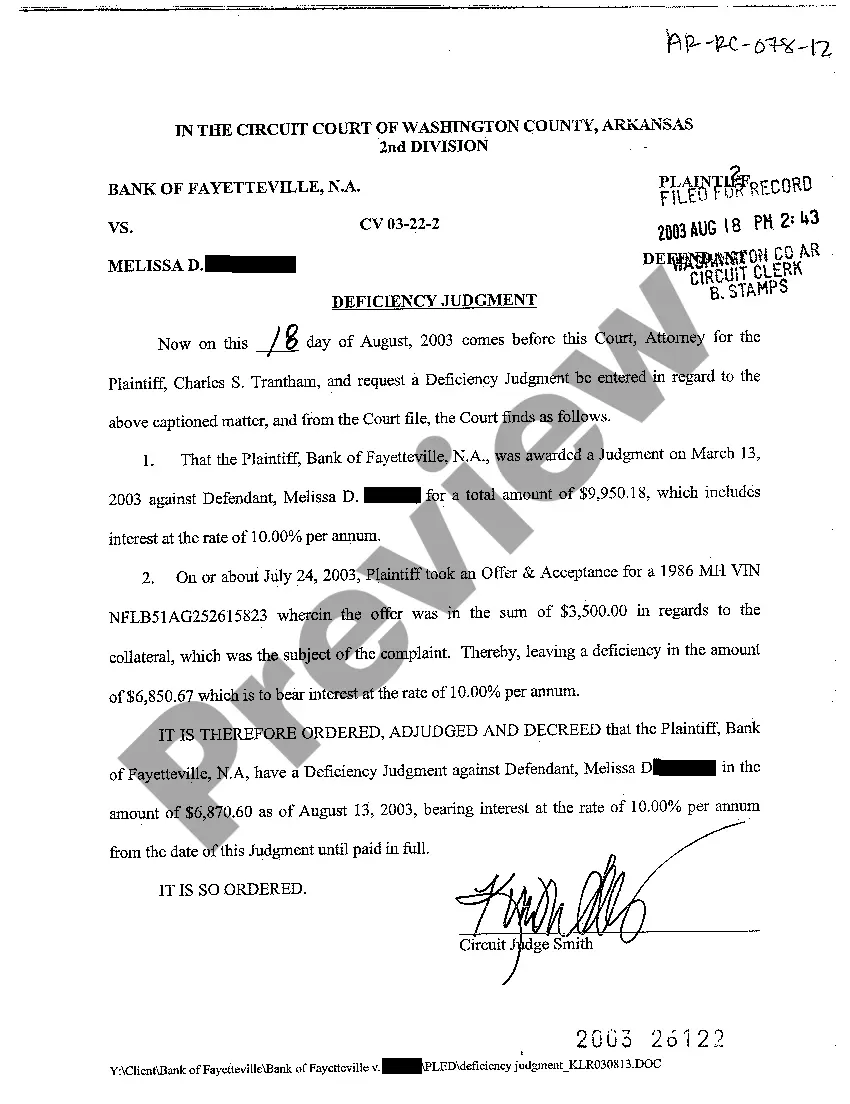

Little Rock Arkansas Deficiency Judgment on Complaint for Repletion is a legal process that occurs when a creditor obtains a judgment against a debtor for an outstanding balance or deficiency following the repossession and sale of the debtor's collateral to satisfy a debt. In simpler terms, it is a lawsuit filed by a creditor to recover the remaining balance owed on a loan after the debtor's property has been repossessed and sold. Keywords: Little Rock Arkansas, deficiency judgment, complaint, repletion, creditor, debtor, outstanding balance, collateral, lawsuit, loan. There are two types of Little Rock Arkansas Deficiency Judgment on Complaint for Repletion: 1. Monetary Judgment: In this type of judgment, the court determines the remaining balance or deficiency owed by the debtor after the sale of the repossessed collateral. The creditor is entitled to seek a monetary judgment for the amount owed, which includes the principal loan amount, interest, and any additional fees or costs associated with the repossession and sale. 2. Possession Judgment: In certain cases, the creditor may seek not only a monetary judgment but also the return of the repossessed property. If the court grants a possession judgment, the debtor is required to return the collateral to the creditor. If the debtor fails to comply with the possession judgment, additional legal action may be taken to enforce it, such as a writ of repletion or seizure of the debtor's assets. Little Rock Arkansas Deficiency Judgment on Complaints for Repletion can have significant consequences for both the creditor and the debtor. Creditors seek these judgments to recover the remaining balance owed on a loan, while debtors may face wage garnishment, bank account levies, or liens on real property if they fail to satisfy the deficiency. It is important for debtors in Little Rock Arkansas to be aware of their rights and seek legal counsel in these situations. Understanding the legal process and potential outcomes is crucial for both parties involved, as it may impact their financial stability and future creditworthiness.

Little Rock Arkansas Deficiency Judgment on Complaint for Replevin

Description

How to fill out Little Rock Arkansas Deficiency Judgment On Complaint For Replevin?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person with no legal education to create such paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Little Rock Arkansas Deficiency Judgment on Complaint for Replevin or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Little Rock Arkansas Deficiency Judgment on Complaint for Replevin quickly employing our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps prior to downloading the Little Rock Arkansas Deficiency Judgment on Complaint for Replevin:

- Ensure the template you have found is specific to your location considering that the regulations of one state or county do not work for another state or county.

- Review the document and read a short description (if provided) of cases the paper can be used for.

- If the form you selected doesn’t meet your needs, you can start again and look for the suitable document.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or create one from scratch.

- Select the payment method and proceed to download the Little Rock Arkansas Deficiency Judgment on Complaint for Replevin as soon as the payment is done.

You’re all set! Now you can proceed to print the document or complete it online. In case you have any problems locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.