Little Rock, Arkansas Allegations and Interrogatories for Garnishment After Judgment: When faced with a judgment that requires a debtor's income to be garnished, the legal process in Little Rock, Arkansas follows a specific set of procedures. The Allegations and Interrogatories for Garnishment After Judgment forms play a crucial role in this process, providing a platform for both the creditor and the debtor to present their claims and defenses. These forms are designed to ensure that all relevant information is presented and considered in a fair and transparent manner. Typically, the garnishment after judgment process begins with the creditor filing a Petition for Writ of Garnishment with the court, seeking to collect the outstanding debt from the debtor's wages, bank accounts, or property. The Allegations form is primarily used by the creditor to state the basis of their claim, detailing important information such as the amount owed, the original judgment, and any additional costs or interest incurred. This form also allows the creditor to outline the specific income sources they are targeting for garnishment, such as the debtor's employment or other financial accounts. On the other hand, the Interrogatories for Garnishment After Judgment form serves as a tool for the debtor to present their defenses and provide necessary information. This form enables the debtor to provide detailed responses to specific questions posed by the creditor. It allows the debtor to disclose any exemptions they believe should be considered, supporting documentation for financial hardship claims, or proving that the garnished funds are exempt under state or federal law. It is important to note that in Little Rock, Arkansas, there are no specific variations or types of Allegations and Interrogatories for Garnishment After Judgment that differ from the standard forms used throughout the state. However, the content and nature of the allegations and interrogatories may vary depending on the specific circumstances of the case, the amount owed, and the debtor's financial situation. To navigate through this process effectively, it is recommended that debtors seek legal advice or assistance to properly fill out the Allegations and Interrogatories for Garnishment After Judgment forms. This will help ensure that all relevant information is included, any applicable exemptions are properly claimed, and the debtor's rights and interests are adequately protected. In conclusion, the Allegations and Interrogatories for Garnishment After Judgment forms in Little Rock, Arkansas are essential components of the garnishment process. They provide a platform for both the creditor and debtor to present their claims and defenses, ensuring a fair and transparent resolution to outstanding debts. By following the proper procedures and seeking legal advice, debtors can navigate this process successfully and protect their rights.

Little Rock Arkansas Allegations and Interrogatories for Garnishment After Judgment

State:

Arkansas

City:

Little Rock

Control #:

AR-RC-079-16

Format:

PDF

Instant download

This form is available by subscription

Description

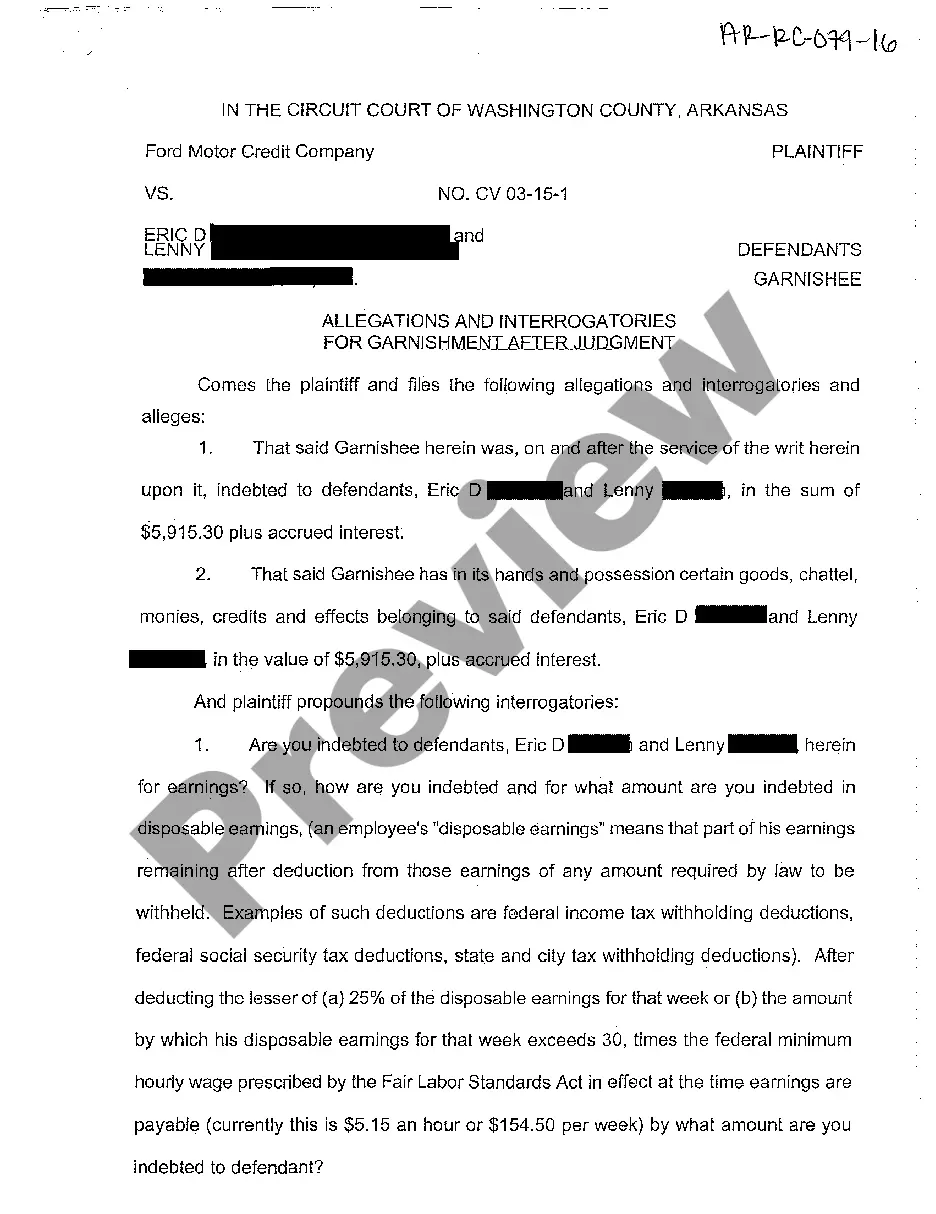

A16 Allegations and Interrogatories for Garnishment After Judgment

Little Rock, Arkansas Allegations and Interrogatories for Garnishment After Judgment: When faced with a judgment that requires a debtor's income to be garnished, the legal process in Little Rock, Arkansas follows a specific set of procedures. The Allegations and Interrogatories for Garnishment After Judgment forms play a crucial role in this process, providing a platform for both the creditor and the debtor to present their claims and defenses. These forms are designed to ensure that all relevant information is presented and considered in a fair and transparent manner. Typically, the garnishment after judgment process begins with the creditor filing a Petition for Writ of Garnishment with the court, seeking to collect the outstanding debt from the debtor's wages, bank accounts, or property. The Allegations form is primarily used by the creditor to state the basis of their claim, detailing important information such as the amount owed, the original judgment, and any additional costs or interest incurred. This form also allows the creditor to outline the specific income sources they are targeting for garnishment, such as the debtor's employment or other financial accounts. On the other hand, the Interrogatories for Garnishment After Judgment form serves as a tool for the debtor to present their defenses and provide necessary information. This form enables the debtor to provide detailed responses to specific questions posed by the creditor. It allows the debtor to disclose any exemptions they believe should be considered, supporting documentation for financial hardship claims, or proving that the garnished funds are exempt under state or federal law. It is important to note that in Little Rock, Arkansas, there are no specific variations or types of Allegations and Interrogatories for Garnishment After Judgment that differ from the standard forms used throughout the state. However, the content and nature of the allegations and interrogatories may vary depending on the specific circumstances of the case, the amount owed, and the debtor's financial situation. To navigate through this process effectively, it is recommended that debtors seek legal advice or assistance to properly fill out the Allegations and Interrogatories for Garnishment After Judgment forms. This will help ensure that all relevant information is included, any applicable exemptions are properly claimed, and the debtor's rights and interests are adequately protected. In conclusion, the Allegations and Interrogatories for Garnishment After Judgment forms in Little Rock, Arkansas are essential components of the garnishment process. They provide a platform for both the creditor and debtor to present their claims and defenses, ensuring a fair and transparent resolution to outstanding debts. By following the proper procedures and seeking legal advice, debtors can navigate this process successfully and protect their rights.

Free preview

How to fill out Little Rock Arkansas Allegations And Interrogatories For Garnishment After Judgment?

If you’ve already used our service before, log in to your account and download the Little Rock Arkansas Allegations and Interrogatories for Garnishment After Judgment on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Little Rock Arkansas Allegations and Interrogatories for Garnishment After Judgment. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!