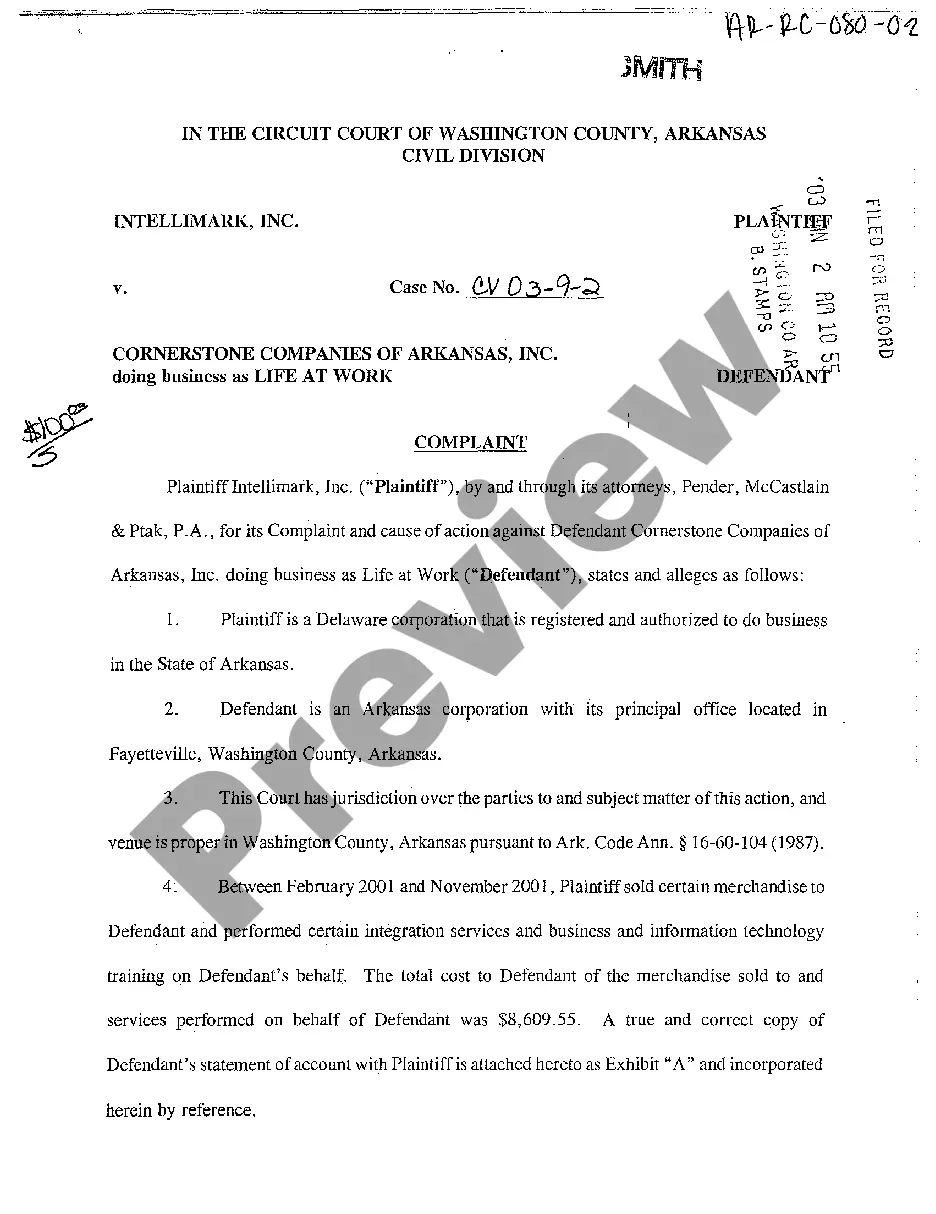

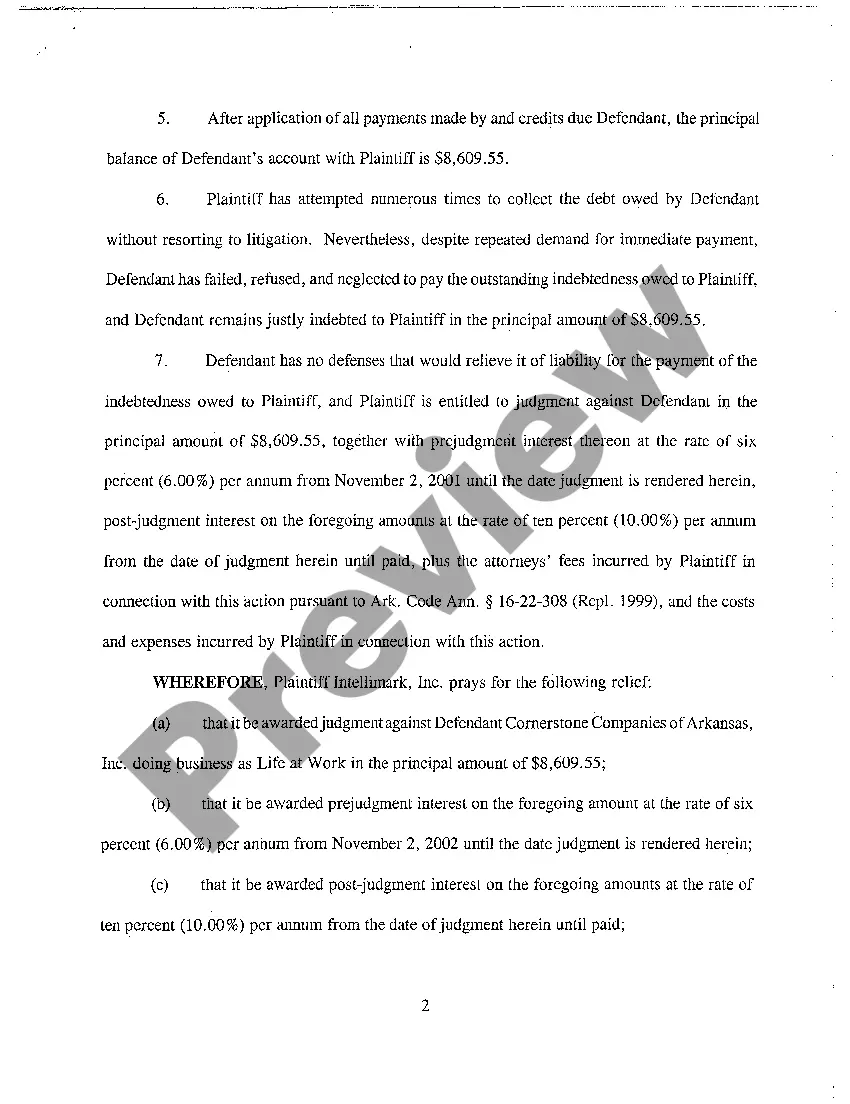

Title: Little Rock Arkansas Complaint for Collection of Debt: A Comprehensive Overview Introduction: In Little Rock, Arkansas, individuals or businesses, known as creditors, have the option to file a Complaint for Collection of Debt when seeking to recover unpaid debts from debtors residing within the jurisdiction. This legal process aims to ensure the fair collection of outstanding debts while adhering to the laws and regulations governing debt recovery in Little Rock. Types of Little Rock Arkansas Complaint for Collection of Debt: 1. Consumer Debt Collection Complaint: Consumer debt collection complaints primarily involve unpaid debts owed by individuals for personal purposes, such as credit card bills, medical expenses, or payday loans. These complaints typically follow specific legal procedures, governed by federal and state laws, including the Fair Debt Collection Practices Act (FD CPA) and the Arkansas Fair Debt Collection Practices Act. 2. Commercial Debt Collection Complaint: Commercial debt collection complaints deal with unpaid debts owed by businesses, which can include outstanding invoices, loans, or unpaid services rendered. The process of filing complaints for commercial debt collection may involve additional contractual agreement reviews and negotiations due to the complexity of business transactions. Key Steps in the Complaint for Collection of Debt Process: 1. Pre-computing: — Creditor conducts thorough documentation and verification of the debt, including gathering supporting evidence, such as invoices, statements, and contractual agreements. — Creditor may attempt to reach a resolution through negotiation, reminders, or demand letters before pursuing legal action. 2. Filing the Complaint: — Creditor files the Complaint for Collection of Debt in the appropriate Little Rock court, providing necessary information, including the debtor's details, the amount owed, and an itemized account of the debt. 3. Serving the Summons: — Once filed, the court issues a summons, officially notifying the debtor of the complaint and the legal actions taken against them. Proper service of the summons is crucial to ensure due process. 4. Defending or Settling the Claim: — Upon receiving the summons, the debtor has a limited timeframe to respond, during which they may choose to defend the claim, negotiate a settlement, or ignore the complaint, leading to a potential default judgment. 5. Litigation and Judgment: — If the debtor fails to respond within the specified timeframe, the court may issue a default judgment in favor of the creditor, enabling them to pursue further collection methods. — In cases where the debtor responds, a trial may occur to present evidence and arguments from both parties, leading to a judgment or potential settlement. Conclusion: Little Rock Arkansas Complaint for Collection of Debt encompasses the legal framework through which creditors seek to recover unpaid debts within this jurisdiction. Whether it relates to consumer or commercial debt, understanding the process and adhering to relevant laws is essential for both creditors and debtors engaged in debt collection disputes. Professional legal advice can help navigate this process effectively and ensure the fair and legal recovery of outstanding debts.

Little Rock Arkansas Complaint for Collection of Debt

Description

How to fill out Little Rock Arkansas Complaint For Collection Of Debt?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Little Rock Arkansas Complaint for Collection of Debt? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Little Rock Arkansas Complaint for Collection of Debt conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over if the template isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Little Rock Arkansas Complaint for Collection of Debt in any provided file format. You can return to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal papers online for good.