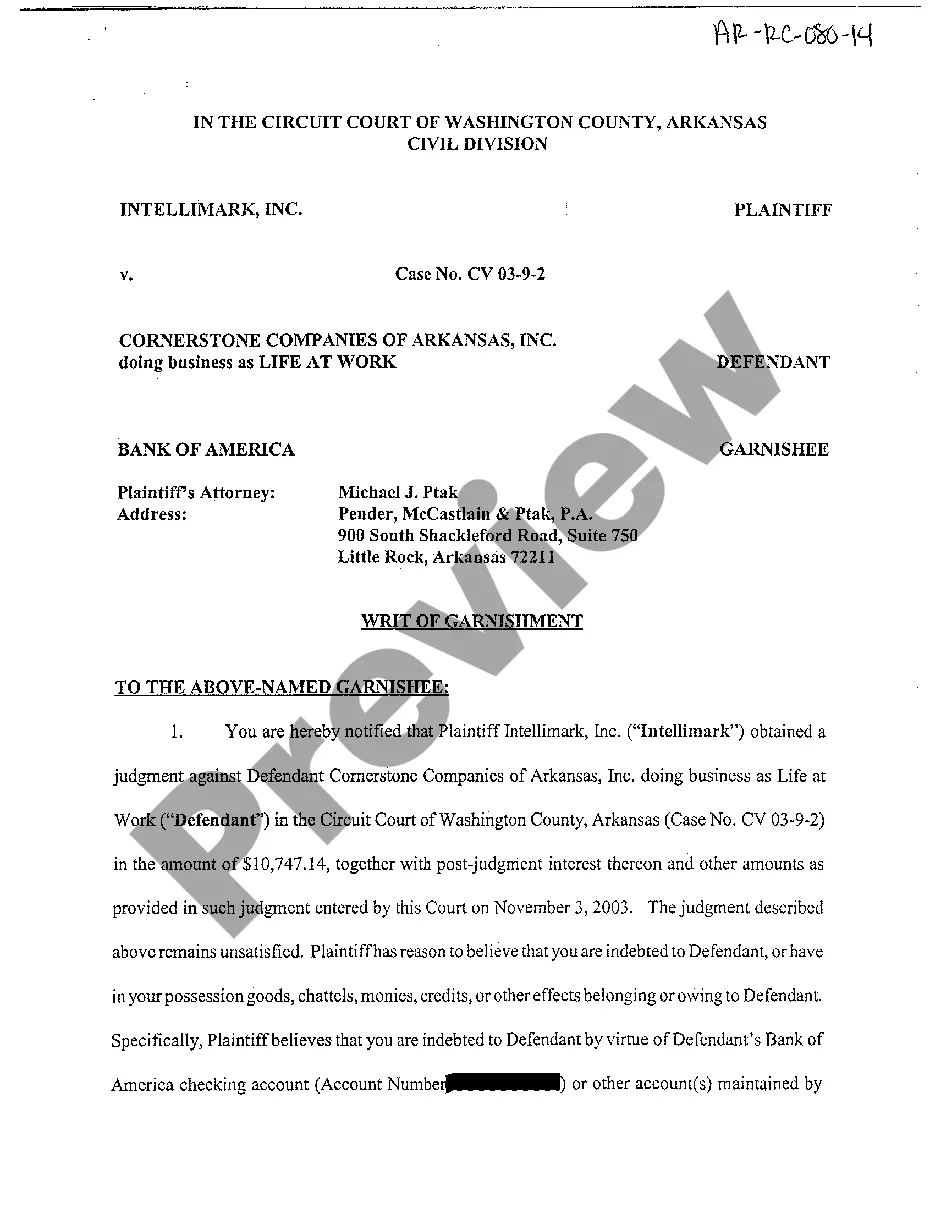

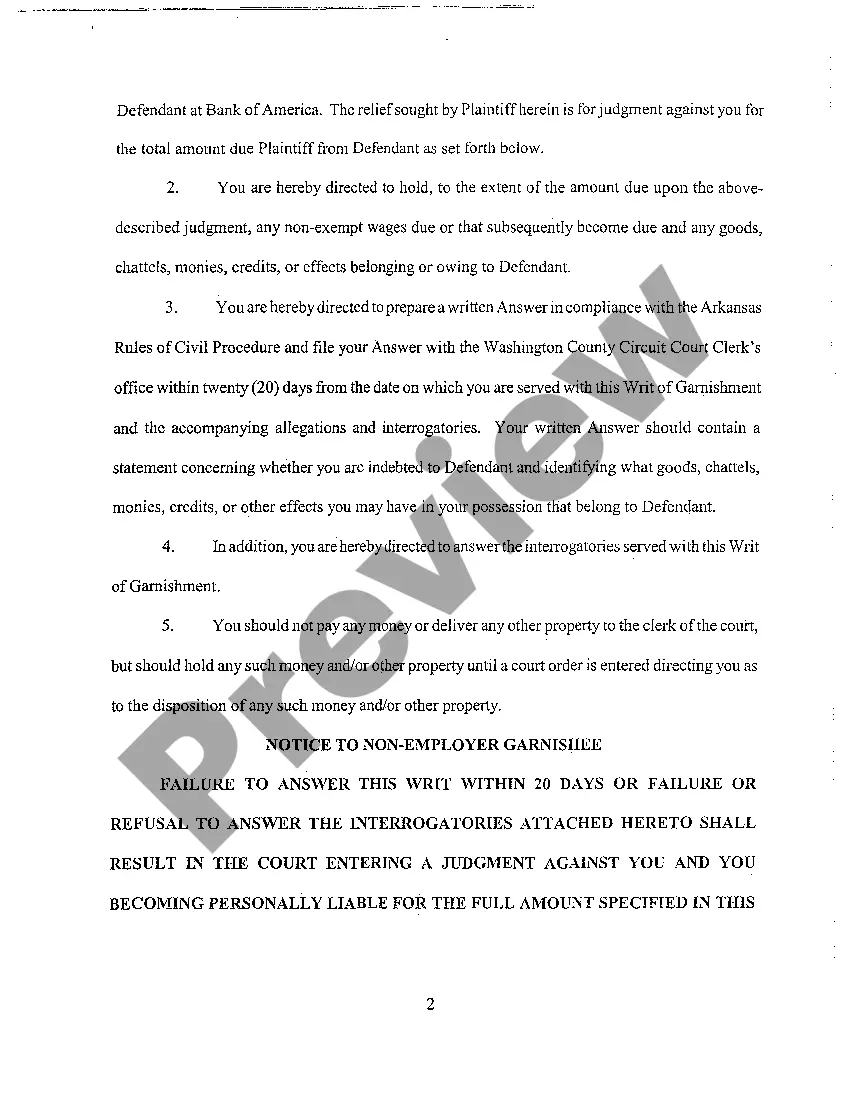

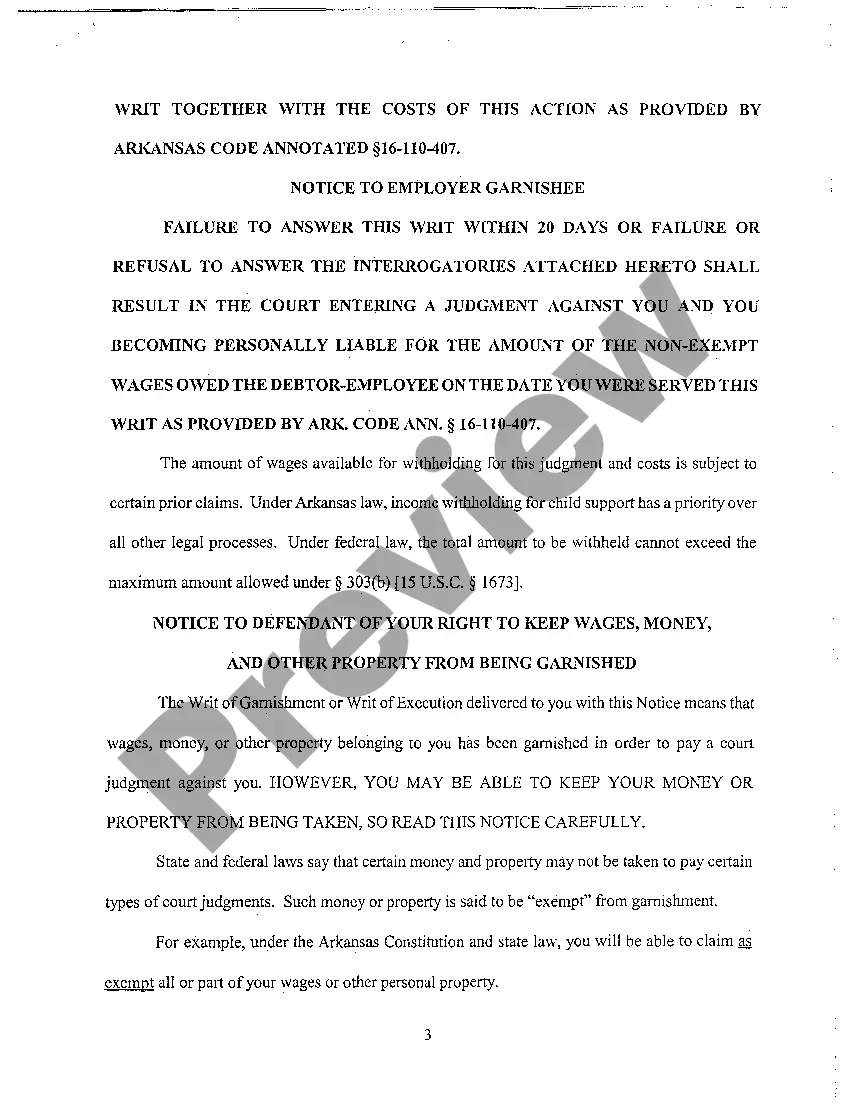

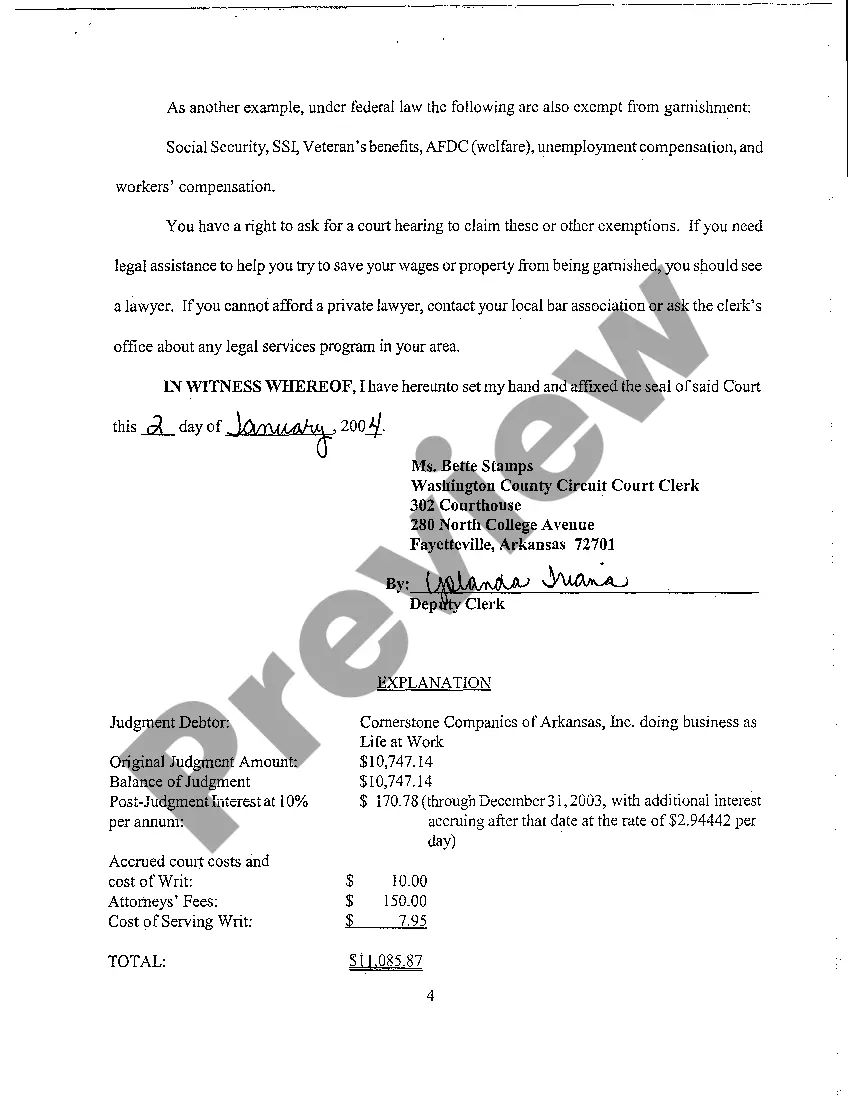

Little Rock Arkansas Writ of Garnishment is a legal procedure through which a creditor can collect a debt owed to them by garnishing a portion of the debtor's wages, bank accounts, or other assets. A writ of garnishment is typically obtained after the creditor has obtained a judgment against the debtor but has been unable to collect the debt voluntarily. In Little Rock, Arkansas, there are several types of writs of garnishment that can be used depending on the specific circumstances of the debt and the assets to be garnished. These include: 1. Wage Garnishment: This type of garnishment allows a creditor to deduct a portion of the debtor's wages directly from their employer. The amount that can be garnished is typically limited to a certain percentage of the debtor's disposable income. 2. Bank Account Garnishment: With a bank account garnishment, a creditor can seize funds from the debtor's bank account to satisfy the debt. In Little Rock, Arkansas, there are specific rules and procedures that must be followed to garnish a debtor's bank account, including notifying the bank of the garnishment. 3. Property/Asset Garnishment: In some cases, a creditor may seek to garnish a specific asset or property owned by the debtor. This could include vehicles, real estate, or other valuable items to satisfy the debt owed. It's important to note that there are legal limits and procedures that must be followed when pursuing a writ of garnishment in Little Rock, Arkansas. The creditor must obtain a court order, file the necessary paperwork, and serve the appropriate notice to the debtor before any collection actions can be taken. Additionally, exemptions may exist for certain types of income or property, such as Social Security benefits or primary residences. Overall, the Little Rock Arkansas Writ of Garnishment is a legal tool that creditors can use to collect outstanding debts. It provides a way to legally garnish a debtor's wages, bank accounts, or assets to satisfy the debt owed. However, it's important for both creditors and debtors to understand the specific rules and procedures involved in order to protect their rights and interests.

Arkansas Garnishment Exemption Form

Description

How to fill out Little Rock Arkansas Writ Of Garnishment?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for legal services that, as a rule, are extremely costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to legal counsel. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Little Rock Arkansas Writ of Garnishment or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Little Rock Arkansas Writ of Garnishment adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Little Rock Arkansas Writ of Garnishment would work for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!