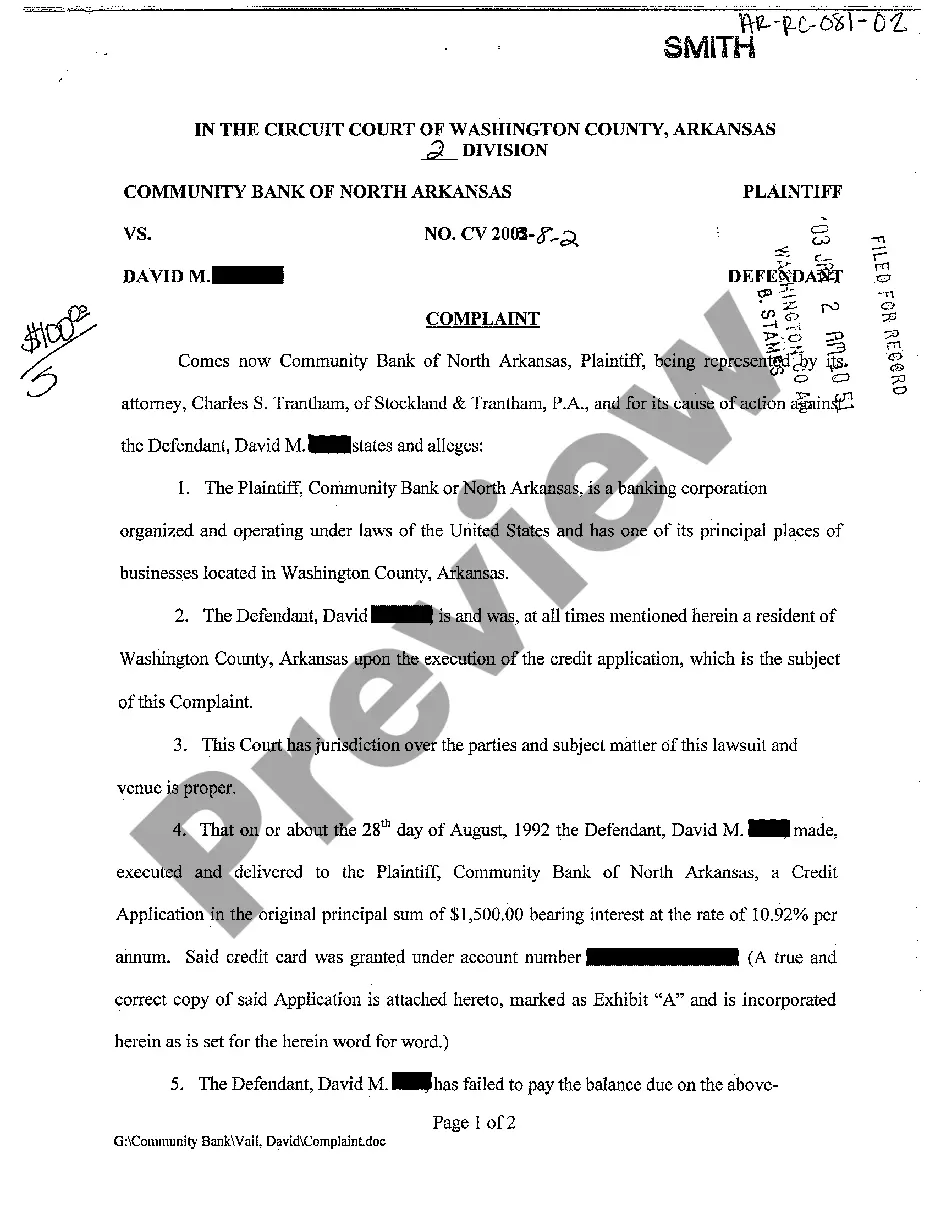

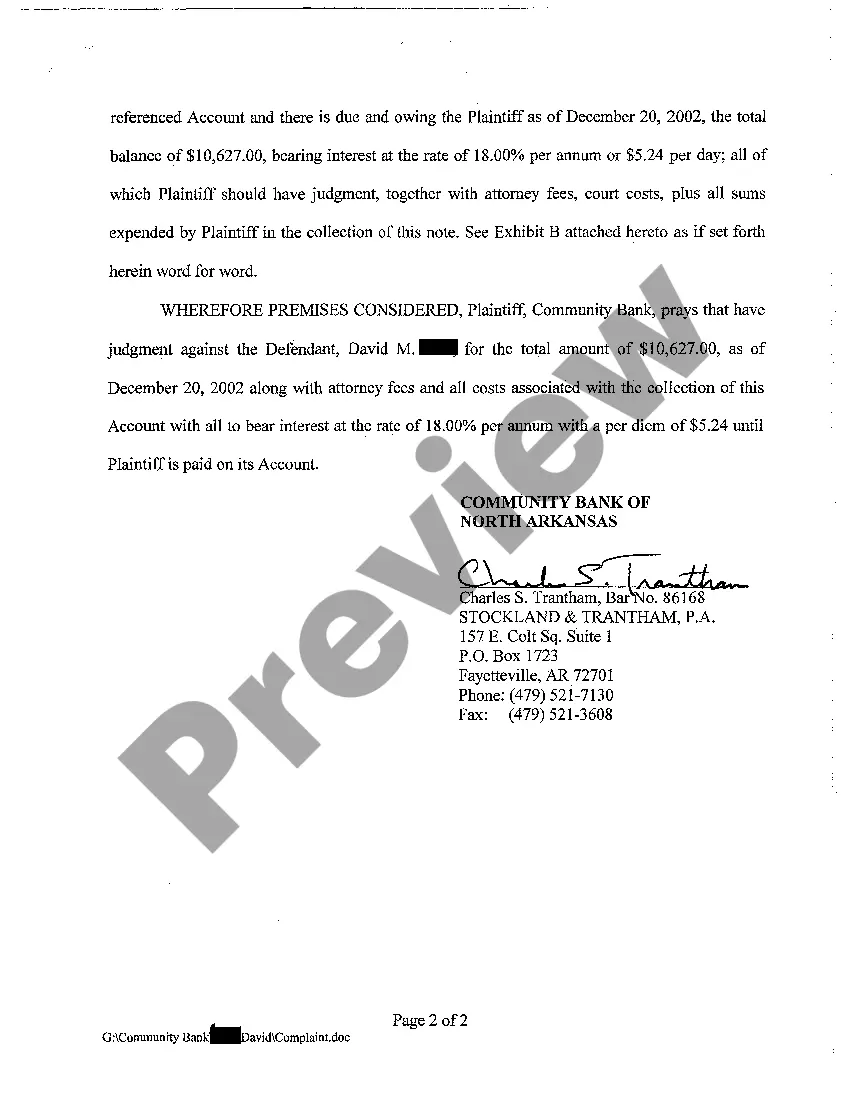

Little Rock Arkansas Complaint for Collection of Debt: A Comprehensive Guide Introduction: A Little Rock Arkansas Complaint for Collection of Debt is a legal document filed by a creditor seeking to recover unpaid debts from a debtor residing in Little Rock, Arkansas. This comprehensive guide aims to provide valuable information about this process, including types of complaints, procedures, and relevant keywords to enhance understanding. Types of Little Rock Arkansas Complaints for Collection of Debt: 1. Verified Complaint for Collection of Debt: A verified complaint is a formal written document filed with the court. It states the details of the debt, the amount owed, the creditor's contact information, and the debtor's information. This complaint is signed under oath by the creditor or a representative, validating its authenticity. 2. Summons and Complaint for Collection of Debt: This complaint is typically issued alongside a summons, which notifies the debtor about the legal proceedings initiated against them. It provides them a specified time frame to respond and either admit or contest the debt. 3. Affidavit of Debt Complaint: In this type of complaint, the creditor submits an affidavit stating the details of the debt, including the original amount owed, any interest or fees applied, and any previous attempts to collect the debt. This affidavit serves as evidence supporting the creditor's claim. Key Steps Involved in Filing a Little Rock Arkansas Complaint for Collection of Debt: 1. Research and Document Preparation: — Gather all relevant documents related to the debt, such as contracts, invoices, and communication records. — Organize and compile the necessary evidence supporting the debt claim. — Ensure compliance with the Fair Debt Collection Practices Act (FD CPA) regulations. 2. Drafting the Complaint: — Use proper legal language and format the complaint accurately. — Include details about the debt, such as the amount owed, interest, fees, and any prior attempts to collect. — Clearly state the creditor's details and contact information, providing sufficient evidence of the debt's validity. 3. Filing the Complaint: — Visit the appropriate Arkansas state court website to obtain the necessary forms for filing the complaint. — Pay the required filing fees specified by the court. — File the complaint with the court clerk, ensuring all necessary information is included. 4. Serving the Complaint: — Follow Arkansas state rules for serving the complaint, providing copies to the debtor through certified mail or personal service by a process server. — Keep records of the date and method of service for future reference. 5. Response and Debtor's Options: — After receiving the complaint, the debtor has a specific timeframe, typically 30 days, to respond. — The debtor may choose to— - Pay the debt in full. — Negotiate a settlement with the creditor. — Contest the debt in court, leading to litigation proceedings. 6. Collecting the Debt: — If the debtor fails to respond or contest the debt, the creditor may proceed to seek a default judgment. — If the court rules in favor of the creditor, they can take further legal actions to collect the debt, including wage garnishment or asset seizure. Conclusion: A Little Rock Arkansas Complaint for Collection of Debt is a legal tool that enables creditors to pursue unpaid debts through the court system. This guide has provided an overview of the different types of complaints, the necessary steps involved in filing, and an understanding of the debtor's options. Engaging in diligent research, adhering to legal requirements, and seeking professional guidance can greatly assist both creditors and debtors in navigating this complex process effectively.

Little Rock Arkansas Complaint for Collection of Debt

Description

How to fill out Little Rock Arkansas Complaint For Collection Of Debt?

If you are searching for a relevant form template, it’s difficult to choose a better place than the US Legal Forms site – one of the most considerable online libraries. Here you can get thousands of form samples for business and personal purposes by types and states, or keywords. With our advanced search option, discovering the most recent Little Rock Arkansas Complaint for Collection of Debt is as easy as 1-2-3. Moreover, the relevance of every file is proved by a group of expert lawyers that regularly check the templates on our website and revise them in accordance with the most recent state and county demands.

If you already know about our platform and have a registered account, all you need to get the Little Rock Arkansas Complaint for Collection of Debt is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the sample you want. Read its information and utilize the Preview function to explore its content. If it doesn’t suit your needs, use the Search option near the top of the screen to get the appropriate file.

- Confirm your choice. Click the Buy now button. Following that, choose the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the template. Choose the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the received Little Rock Arkansas Complaint for Collection of Debt.

Each template you save in your user profile does not have an expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to get an additional version for modifying or printing, you can return and save it once again at any moment.

Take advantage of the US Legal Forms extensive library to get access to the Little Rock Arkansas Complaint for Collection of Debt you were seeking and thousands of other professional and state-specific samples on a single platform!