Little Rock Arkansas Bond is a form of debt security that is issued by the city of Little Rock, Arkansas to raise funds for various projects and initiatives. It is a financial instrument used to finance infrastructure improvements, public works projects, and other important initiatives within the city. Little Rock Arkansas Bond serves as a long-term financing mechanism for the city government to undertake capital-intensive projects while spreading the cost over several years. These bonds are typically issued for a fixed term and carry a predetermined interest rate, which is paid to the bondholders. The interest on the Little Rock Arkansas Bonds may be tax-exempt, making them an attractive investment option for individuals seeking to reduce their tax liability. These bonds are considered relatively low-risk investments due to the backing by the city government and their priority as obligations in the event of financial difficulties. Different types of Little Rock Arkansas Bonds include: 1. General Obligation Bonds: These are backed by the full faith, credit, and taxing power of the city of Little Rock. The funds raised through these bonds can be used for a wide range of projects such as schools, parks, public safety facilities, and road construction. 2. Revenue Bonds: These bonds are secured by the anticipated revenue from specific projects or initiatives. They are typically issued to finance revenue-generating projects like toll roads, water and sewer systems, or other infrastructure projects that have a predictable revenue stream. 3. Tax Increment Financing (TIF) Bonds: These bonds are issued to finance projects in specific areas designated as TIF districts within Little Rock. The bond repayments are generated through the increased property tax revenues resulting from the enhanced value of the TIF district. 4. Municipal Utility Improvement Bonds: These bonds are specifically issued to fund improvements in municipal utilities such as water treatment plants, electrical grids, or wastewater management systems. The bond repayments are usually supported through the revenue generated by the utilities. Little Rock Arkansas Bonds provide an opportunity for individuals, institutional investors, and funds to invest in the growth and development of Little Rock while earning a fixed income. These bonds can be purchased through licensed brokers or financial institutions, and their availability may be subject to market conditions and investor demand. Investing in Little Rock Arkansas Bonds not only supports the city's infrastructure and economic development but also provides investors with a safe and predictable income stream, potentially offering tax advantages. It is important for potential investors to carefully evaluate the terms and conditions of the bonds, consider their risk appetite, and consult with financial advisors before making any investment decisions.

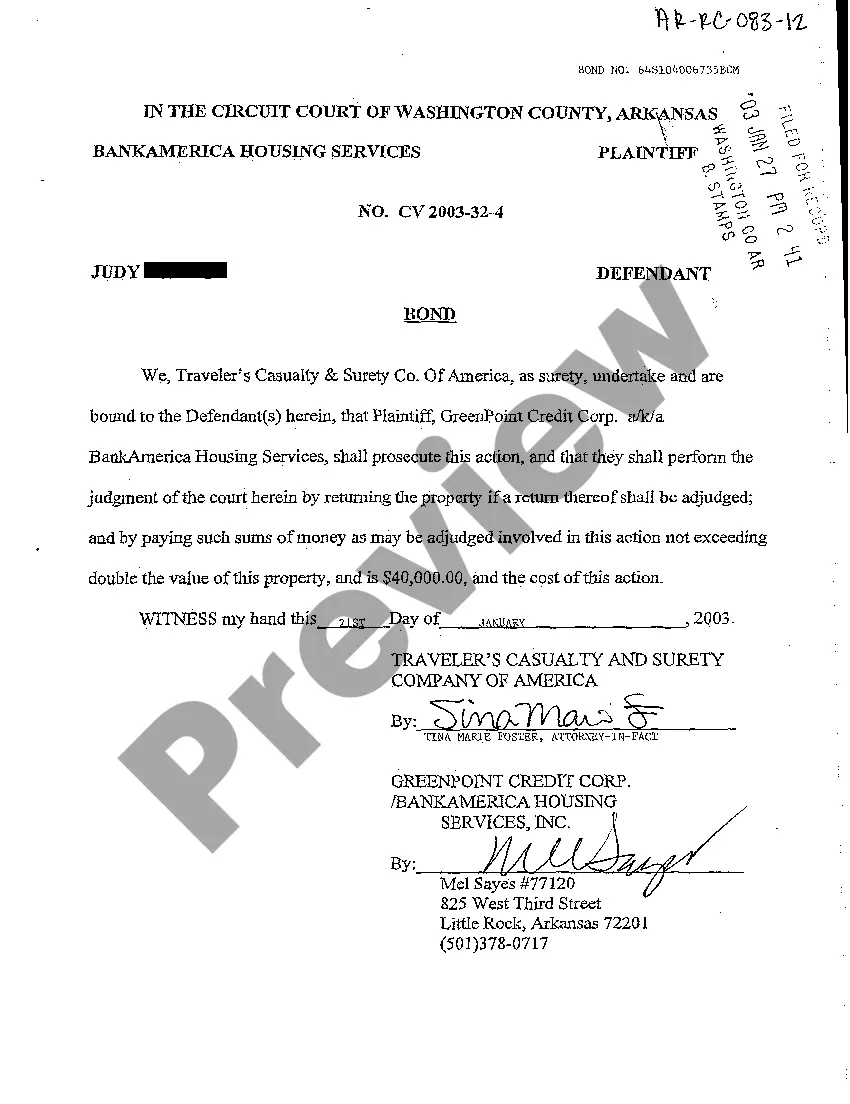

Little Rock Arkansas Bond

Description

How to fill out Little Rock Arkansas Bond?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any law education to draft this sort of paperwork cfrom the ground up, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our platform provides a massive collection with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you require the Little Rock Arkansas Bond or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Little Rock Arkansas Bond in minutes using our reliable platform. In case you are already an existing customer, you can proceed to log in to your account to download the needed form.

However, if you are a novice to our library, make sure to follow these steps before obtaining the Little Rock Arkansas Bond:

- Ensure the form you have chosen is suitable for your area because the rules of one state or area do not work for another state or area.

- Preview the form and go through a quick outline (if available) of cases the paper can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and search for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Select the payment method and proceed to download the Little Rock Arkansas Bond once the payment is completed.

You’re good to go! Now you can proceed to print out the form or fill it out online. If you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.