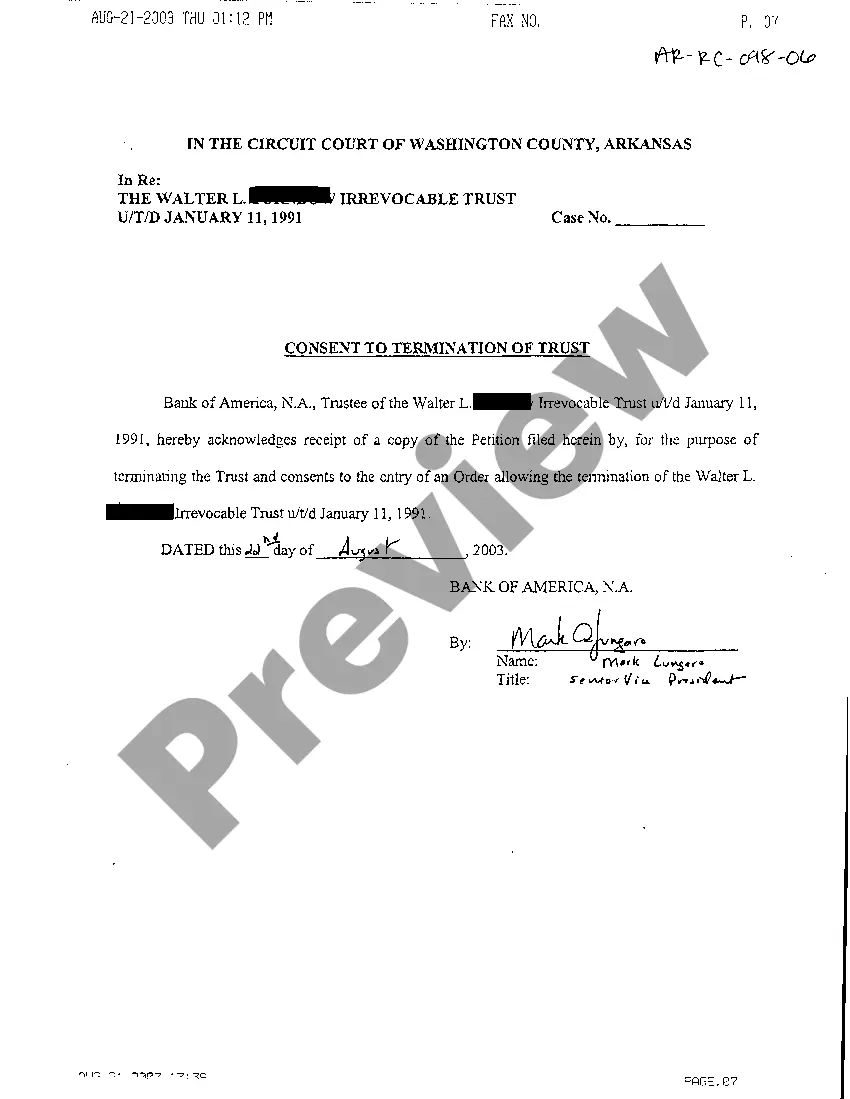

Little Rock Arkansas Consent to Termination of Trust is a legal document used in the state of Arkansas to dissolve a trust agreement. This consent form is typically signed by all beneficiaries and trustees involved in the trust to indicate their agreement to terminate the trust before its intended duration. Keywords: Little Rock Arkansas, Consent to Termination of Trust, legal document, Arkansas, dissolve, trust agreement, beneficiaries, trustees, terminate, intended duration. Types of Little Rock Arkansas Consent to Termination of Trust: 1. Revocable Trust Termination: This form of consent is used when the trust is revocable, meaning that it can be altered, modified, or terminated during the settler's lifetime. The beneficiaries and trustees agree to terminate the trust per the settler's wishes. 2. Irrevocable Trust Termination: This type of consent is required when the trust is irrevocable, meaning that it cannot be modified or terminated without the consent of all beneficiaries and trustees involved. The consent form ensures that all parties are in agreement about the termination of the trust. 3. Minor Beneficiary Trust Termination: In cases where a trust is specifically designed for a minor beneficiary, their legal guardian or parent may need to provide consent on behalf of the minor via a separate consent form. This ensures that the termination is done in the best interest of the minor and in compliance with applicable laws. 4. Charitable Trust Termination: If a trust is established for charitable purposes, this specific consent form is utilized. It requires the agreement of all involved parties, including trustees and representatives of the charitable organization, in order to lawfully terminate the trust. 5. Testamentary Trust Termination: A testamentary trust is created through a will and comes into effect after the settler's death. In such cases, the consent to termination may require the approval of beneficiaries, executors, and trustees named in the will. The Little Rock Arkansas Consent to Termination of Trust is a crucial legal document that facilitates the proper termination of a trust agreement. It ensures all parties involved are in agreement and comply with applicable laws in Arkansas.

Little Rock Arkansas Consent to Termination of Trust is a legal document used in the state of Arkansas to dissolve a trust agreement. This consent form is typically signed by all beneficiaries and trustees involved in the trust to indicate their agreement to terminate the trust before its intended duration. Keywords: Little Rock Arkansas, Consent to Termination of Trust, legal document, Arkansas, dissolve, trust agreement, beneficiaries, trustees, terminate, intended duration. Types of Little Rock Arkansas Consent to Termination of Trust: 1. Revocable Trust Termination: This form of consent is used when the trust is revocable, meaning that it can be altered, modified, or terminated during the settler's lifetime. The beneficiaries and trustees agree to terminate the trust per the settler's wishes. 2. Irrevocable Trust Termination: This type of consent is required when the trust is irrevocable, meaning that it cannot be modified or terminated without the consent of all beneficiaries and trustees involved. The consent form ensures that all parties are in agreement about the termination of the trust. 3. Minor Beneficiary Trust Termination: In cases where a trust is specifically designed for a minor beneficiary, their legal guardian or parent may need to provide consent on behalf of the minor via a separate consent form. This ensures that the termination is done in the best interest of the minor and in compliance with applicable laws. 4. Charitable Trust Termination: If a trust is established for charitable purposes, this specific consent form is utilized. It requires the agreement of all involved parties, including trustees and representatives of the charitable organization, in order to lawfully terminate the trust. 5. Testamentary Trust Termination: A testamentary trust is created through a will and comes into effect after the settler's death. In such cases, the consent to termination may require the approval of beneficiaries, executors, and trustees named in the will. The Little Rock Arkansas Consent to Termination of Trust is a crucial legal document that facilitates the proper termination of a trust agreement. It ensures all parties involved are in agreement and comply with applicable laws in Arkansas.