Little Rock Arkansas Response to Amended Writ of Garnishment is a legal process that individuals or businesses in the state can go through when their wages or bank accounts are being targeted for debt collection. It involves submitting a formal response to an amended writ of garnishment, which is a court order issued by a creditor allowing them to collect a portion of the debtor's income or assets. In Little Rock Arkansas, there are different types of responses that can be made to an amended writ of garnishment depending on the specific circumstances: 1. Request for Hearing: This type of response can be filed if the debtor believes that the amended writ of garnishment is unjust or incorrect. By requesting a hearing, the debtor can present evidence and arguments to challenge or modify the garnishment order. 2. Claim of Exemption: Debtors who meet certain criteria may be eligible to claim exemptions from garnishment under Arkansas law. These exemptions can protect certain types of income or property from being seized. Responding with a claim of exemption requires providing evidence and documentation to support the exemption claim. 3. Financial Hardship: In some cases, debtors in Little Rock Arkansas can demonstrate that a garnishment would cause them extreme financial hardship. This response would entail submitting detailed financial information, such as income, expenses, and other obligations, to show that the garnishment would leave the debtor unable to meet their basic needs. 4. Negotiated Repayment Plan: Instead of disputing the amended writ of garnishment, debtors have the option to propose a negotiated repayment plan to the creditor. This response demonstrates the debtor's willingness to repay the debt in a manageable manner while avoiding the need for garnishment. When preparing a Little Rock Arkansas Response to Amended Writ of Garnishment, it is important to include all the necessary information, such as contact details, case number, and any supporting documentation. The response should be written clearly and concisely, addressing the specific issues raised in the amended writ of garnishment. By utilizing relevant keywords, such as "Little Rock Arkansas," "response to amended writ of garnishment," "garnishment exemptions," "financial hardship," and "negotiated repayment plan," one can create content that guides individuals or businesses in Little Rock Arkansas through the process of responding to an amended writ of garnishment effectively and in accordance with Arkansas law.

Little Rock Arkansas Response to Amended Writ of Garnishment

State:

Arkansas

City:

Little Rock

Control #:

AR-RC-101-10

Format:

PDF

Instant download

This form is available by subscription

Description

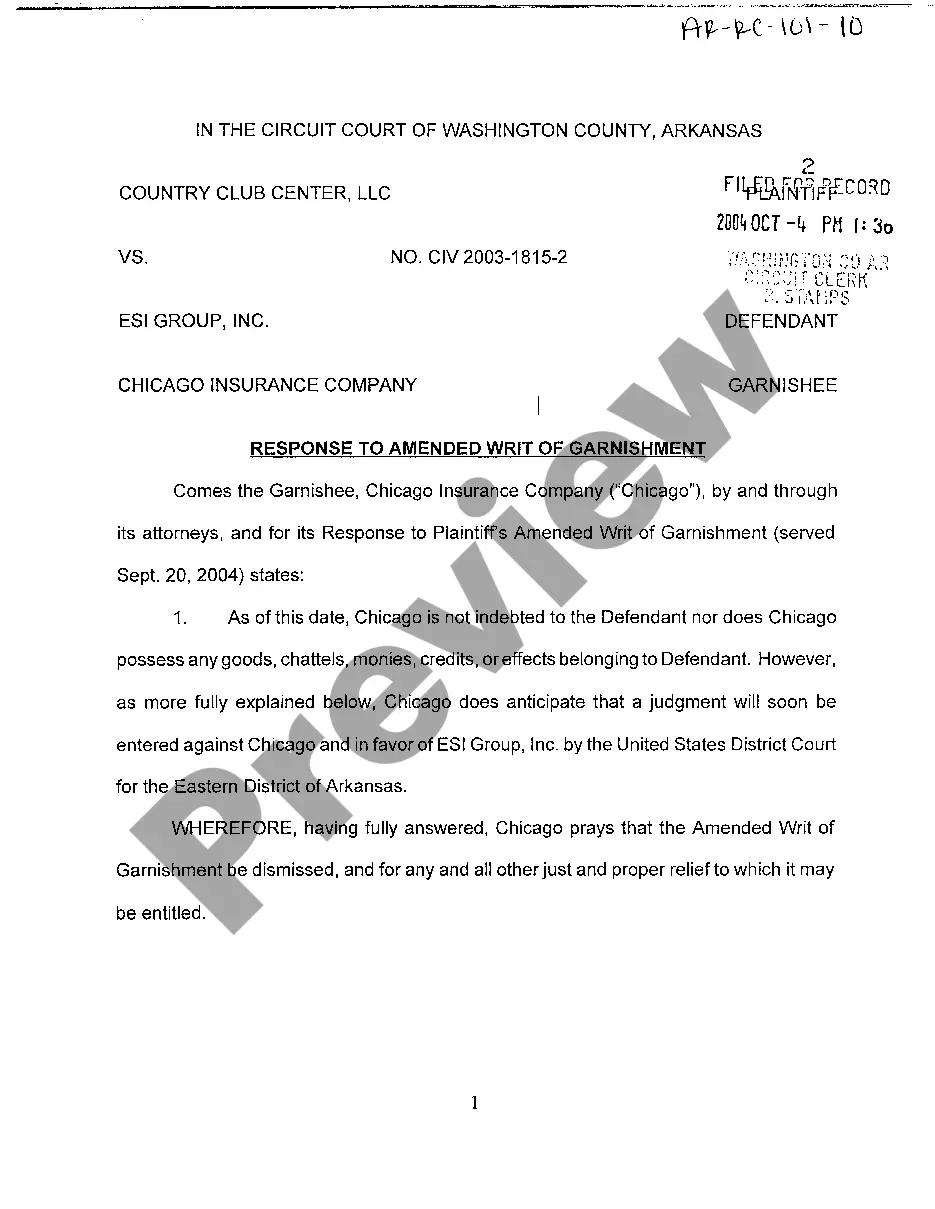

A10 Response to Amended Writ of Garnishment

Little Rock Arkansas Response to Amended Writ of Garnishment is a legal process that individuals or businesses in the state can go through when their wages or bank accounts are being targeted for debt collection. It involves submitting a formal response to an amended writ of garnishment, which is a court order issued by a creditor allowing them to collect a portion of the debtor's income or assets. In Little Rock Arkansas, there are different types of responses that can be made to an amended writ of garnishment depending on the specific circumstances: 1. Request for Hearing: This type of response can be filed if the debtor believes that the amended writ of garnishment is unjust or incorrect. By requesting a hearing, the debtor can present evidence and arguments to challenge or modify the garnishment order. 2. Claim of Exemption: Debtors who meet certain criteria may be eligible to claim exemptions from garnishment under Arkansas law. These exemptions can protect certain types of income or property from being seized. Responding with a claim of exemption requires providing evidence and documentation to support the exemption claim. 3. Financial Hardship: In some cases, debtors in Little Rock Arkansas can demonstrate that a garnishment would cause them extreme financial hardship. This response would entail submitting detailed financial information, such as income, expenses, and other obligations, to show that the garnishment would leave the debtor unable to meet their basic needs. 4. Negotiated Repayment Plan: Instead of disputing the amended writ of garnishment, debtors have the option to propose a negotiated repayment plan to the creditor. This response demonstrates the debtor's willingness to repay the debt in a manageable manner while avoiding the need for garnishment. When preparing a Little Rock Arkansas Response to Amended Writ of Garnishment, it is important to include all the necessary information, such as contact details, case number, and any supporting documentation. The response should be written clearly and concisely, addressing the specific issues raised in the amended writ of garnishment. By utilizing relevant keywords, such as "Little Rock Arkansas," "response to amended writ of garnishment," "garnishment exemptions," "financial hardship," and "negotiated repayment plan," one can create content that guides individuals or businesses in Little Rock Arkansas through the process of responding to an amended writ of garnishment effectively and in accordance with Arkansas law.

Free preview

How to fill out Little Rock Arkansas Response To Amended Writ Of Garnishment?

If you’ve already used our service before, log in to your account and save the Little Rock Arkansas Response to Amended Writ of Garnishment on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Little Rock Arkansas Response to Amended Writ of Garnishment. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!