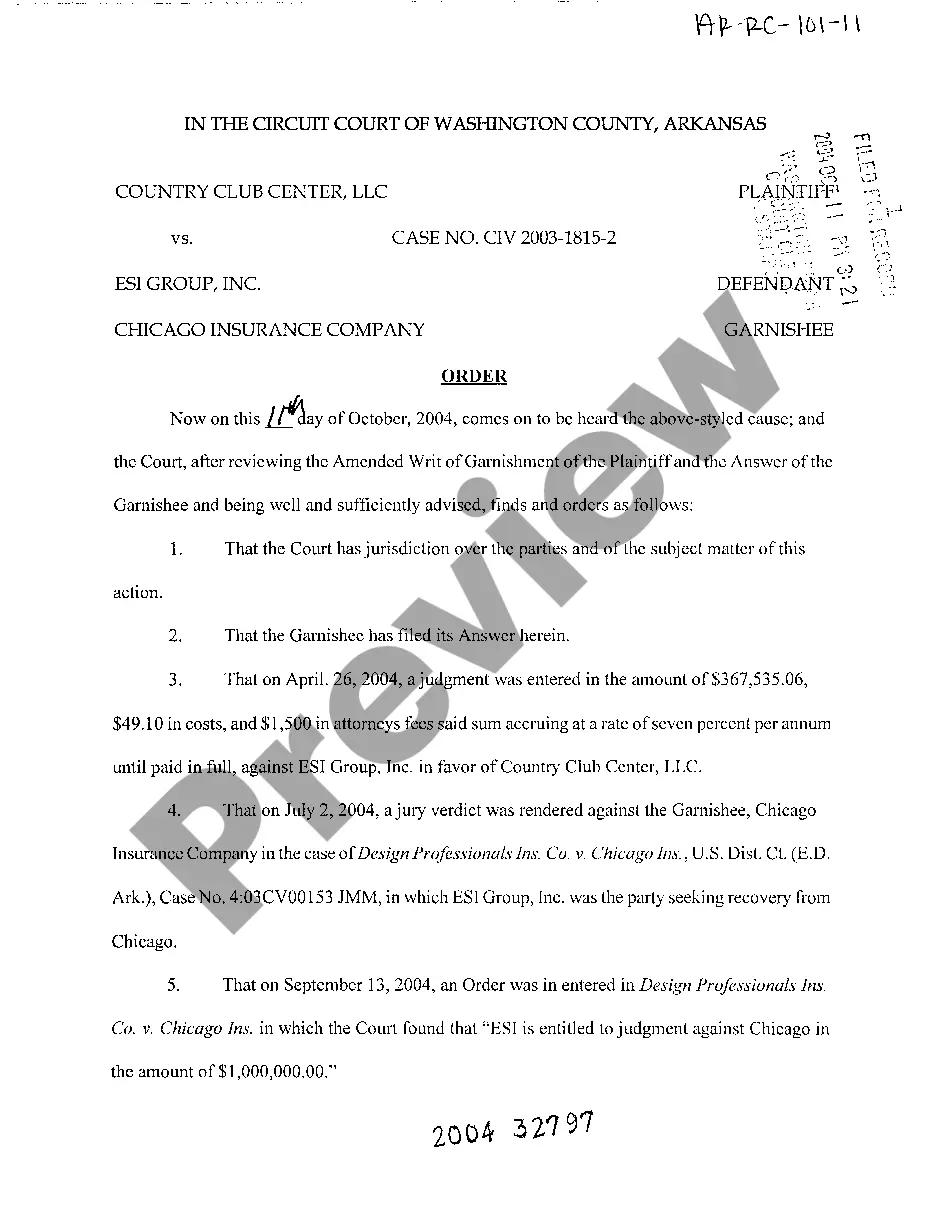

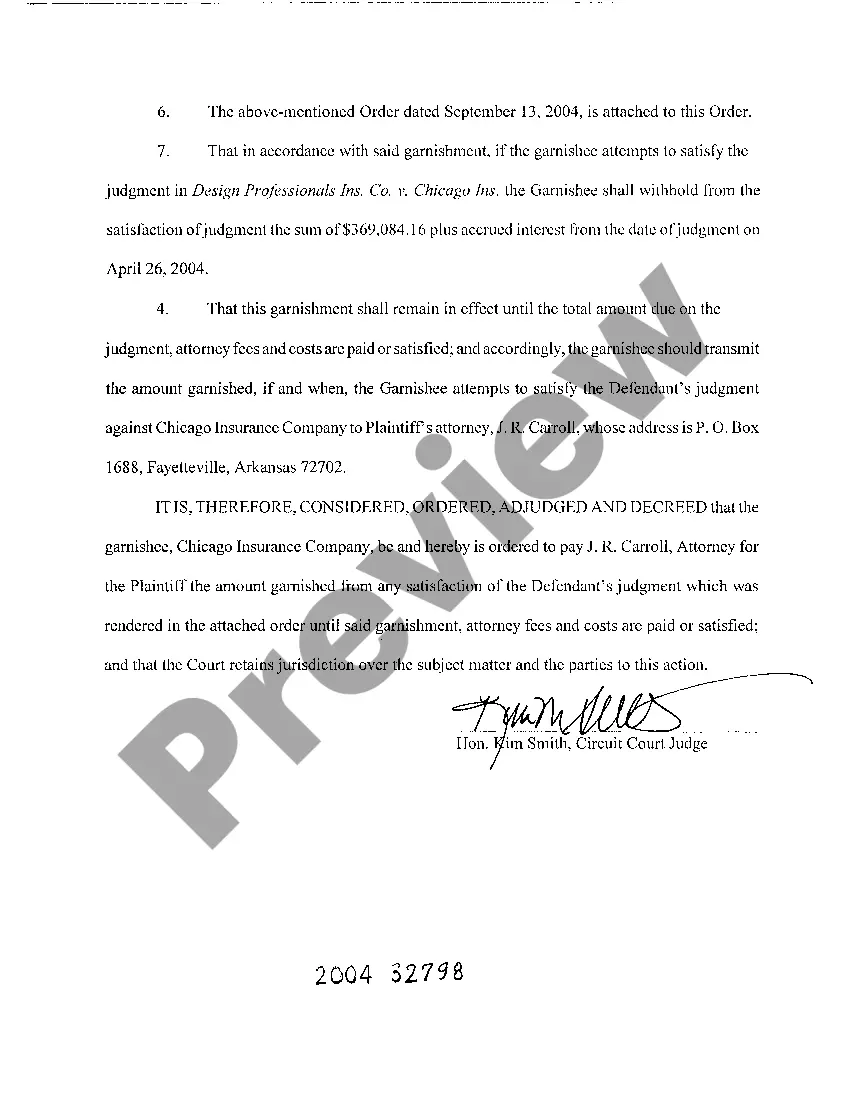

Little Rock Arkansas Order on the Amended Writ of Garnishment: A Comprehensive Guide In Little Rock, Arkansas, an Order on the Amended Writ of Garnishment is a legal document that plays a crucial role in the garnishment process. It outlines the necessary actions, procedures, and guidelines pertaining to the garnishment of wages or other assets of a debtor in order to satisfy a court-awarded judgment or debt. Keywords: Little Rock Arkansas, Order on the Amended Writ of Garnishment, garnishment process, legal document, wages, assets, debtor, court-awarded judgment, debt. Types of Little Rock Arkansas Orders on the Amended Writ of Garnishment: 1. Personal Property Garnishment Order: This type of order allows the creditor to garnish tangible personal property of the debtor, such as vehicles, equipment, or valuable possessions, to fulfill the outstanding debt. The order specifies the details, such as the items subject to garnishment, the process for enforcement, and the obligations of the garnishee. 2. Wage Garnishment Order: A wage garnishment order authorizes the creditor to garnish a portion of the debtor's wages or salary directly from their employer. This type of garnishment is commonly used to recover unpaid debts, child support, or spousal support. The order defines the percentage or amount to be garnished, the duration of the garnishment, and the responsibilities of both the employer and the debtor. 3. Bank Account Garnishment Order: When a debtor fails to pay a debt, a bank account garnishment order can be pursued. This order enables the creditor to freeze and garnish the funds held in the debtor's bank account to satisfy the outstanding debt. The order identifies the specific bank or financial institution, the account(s) subject to garnishment, and the limitations on exempt funds. 4. Property Lien Garnishment Order: In cases where the debtor possesses real estate or other valuable properties, a property lien garnishment order can be issued. This order allows the creditor to place a lien on the debtor's property, preventing them from selling or transferring ownership until the debt is settled. The order specifies the nature of the property, the lien's duration, and the garnishment enforcement process. 5. Non-Wage Garnishment Order: This type of order encompasses other forms of garnishment, such as the seizure of tax refunds, lottery winnings, or commissions due to the debtor. Usually, non-wage garnishment orders are utilized when the debtor does not have a regular paycheck, as in the case of self-employed individuals or certain sources of income. The order provides instructions on how to garnish the specific assets in question and details the limitations and exemptions that apply. Overall, Little Rock Arkansas Orders on the Amended Writ of Garnishment are legal tools designed to ensure the fair collection of debts and enforce court-awarded judgments. By following these orders, creditors can lawfully recover outstanding debts, providing some recourse for individuals and entities who are owed money.

Little Rock Arkansas Order on the Amended Writ of Garnishment

Description

How to fill out Little Rock Arkansas Order On The Amended Writ Of Garnishment?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Little Rock Arkansas Order on the Amended Writ of Garnishment? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of specific state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Little Rock Arkansas Order on the Amended Writ of Garnishment conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is good for.

- Start the search over if the template isn’t good for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Little Rock Arkansas Order on the Amended Writ of Garnishment in any available format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online once and for all.